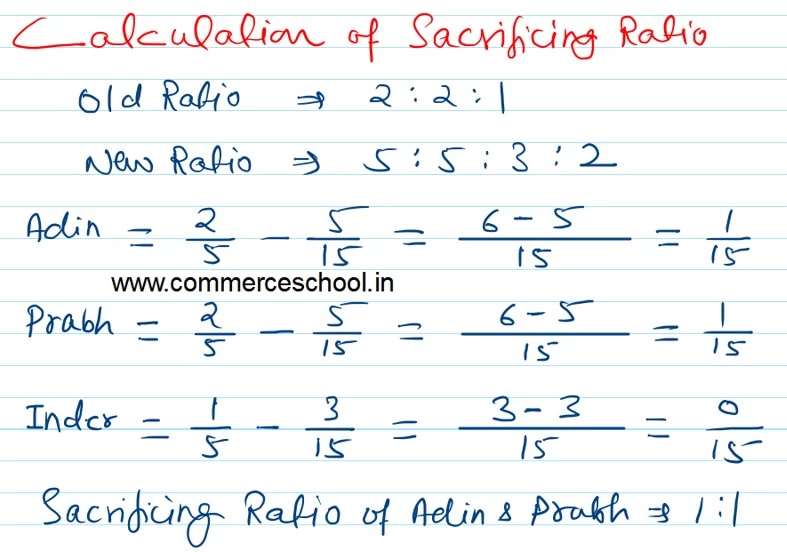

Adin, Prabh and Inder are partners sharing profits and losses in the ratio of 2 : 2 : 1 respectively. Their Balance Sheet as at 31st March, 2023 is as given below:

Adin, Prabh and Inder are partners sharing profits and losses in the ratio of 2 : 2 : 1 respectively. Their Balance Sheet as at 31st March, 2023 is as given below:

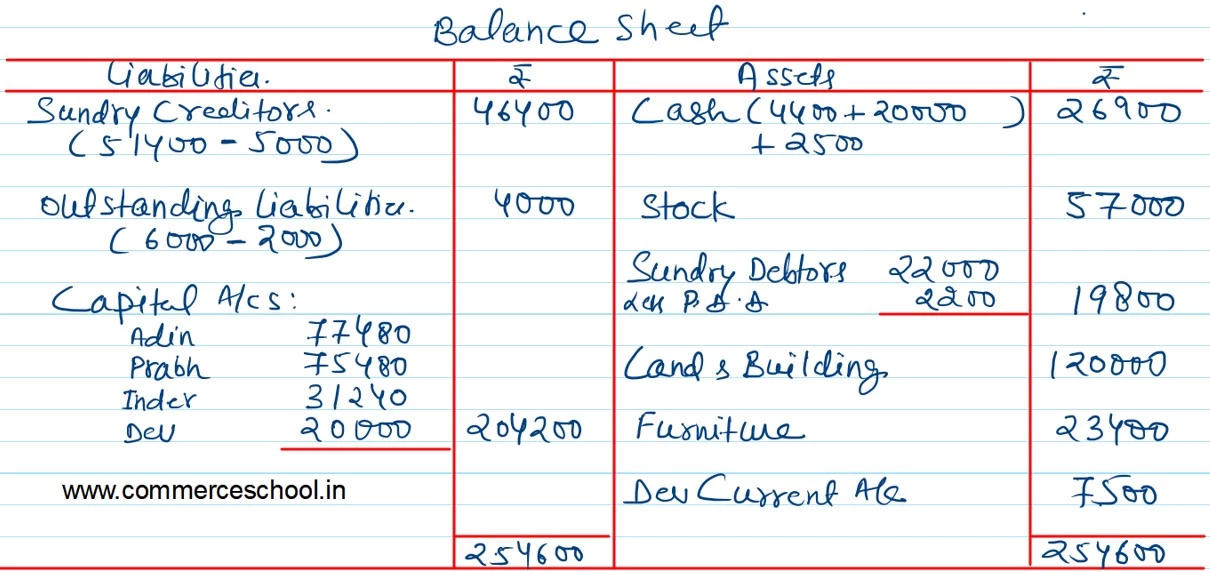

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors

Outstanding Liabilities General Reserve Capital A/cs: Adin Prabh Inder |

51,400 6,000 26,000 48,000 48,000 20,000 |

Cash

Stock Sundry Debtors Land and Building Furniture |

4,400 47,000 22,000 1,00,000 26,000 |

| 1,99,400 | 1,99,400 |

The partners admit Dev as a partner with effect from 1st April, 2023, on the following terms:

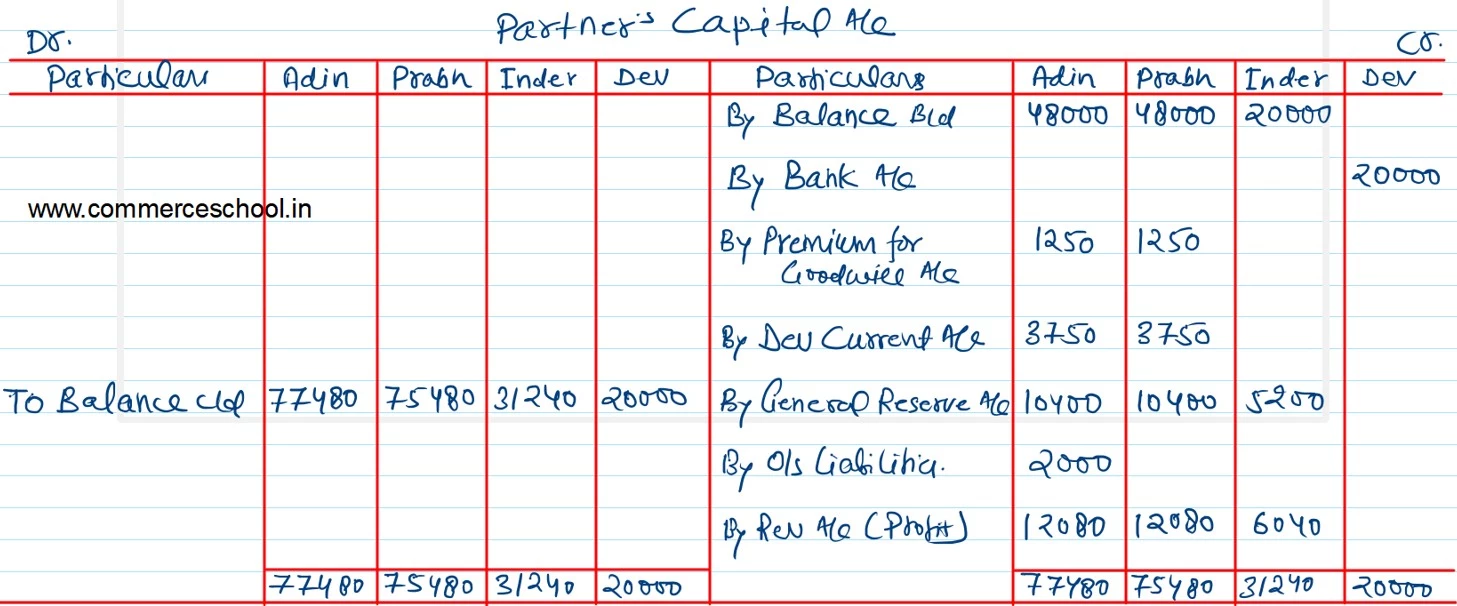

(i) Dev will bring ₹ 20,000 as Capital and ₹ 10,000 as his share of Goodwill.

(ii) Dev could bring only ₹ 2,500 as Goodwill in cash.

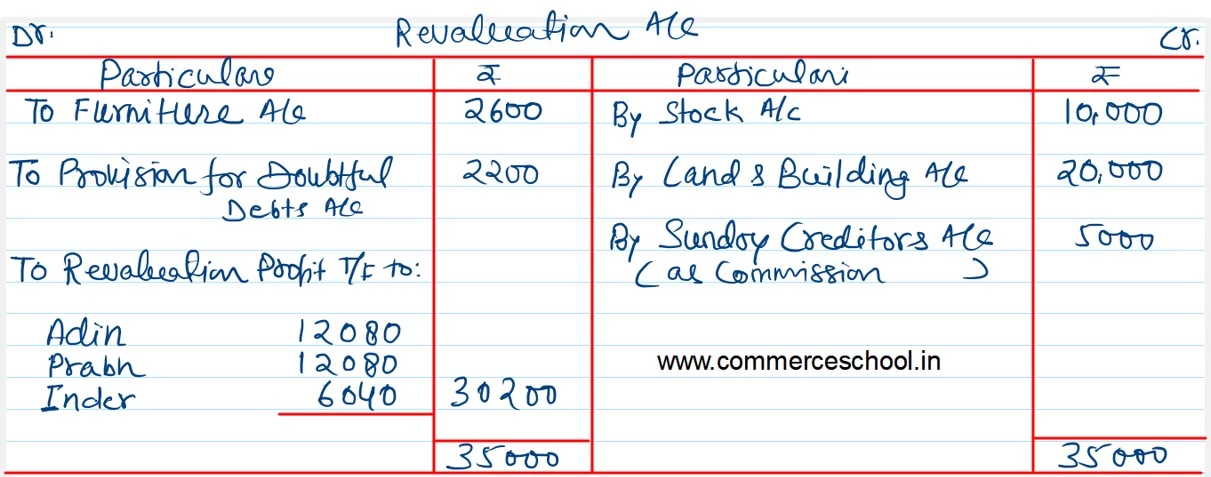

(iii) Value of Stock should be increased by ₹ 10,000. Furniture should be reduced by 10% and value of Land and Building should be enhanced by 20%.

(iv) Provision for Doubtful Debts should be made at 10% of Sundry Debtors.

(v) Outstanding Liabilities includes ₹ 2,000 due to Raman which has been paid by Adin privately. Necessary entry is to be passed to reimburse Adin before admitting the new partner.

(vi) The new profit sharing ratio for Adin, Prabh, Inder and Dev is 5 : 5 : 3 : 2.

(vii) Sundry Creditors include ₹ 5,000 received as commission from Amin.

Pass the necessary Journal entries to incorporate the above changes. Also, prepare the Capital Accounts of Partners and Balance Sheet of the new firm.