Aditi, Bobby and Krish were partners in a firm sharing profits and losses in the ratio of 5 : 3 : 2. Their capitals were ₹ 5,00,000, ₹ 4,00,000 and ₹ 2,00,000 respectively

Aditi, Bobby and Krish were partners in a firm sharing profits and losses in the ratio of 5 : 3 : 2. Their capitals were ₹ 5,00,000, ₹ 4,00,000 and ₹ 2,00,000 respectively. The partnership deed provided for the following:

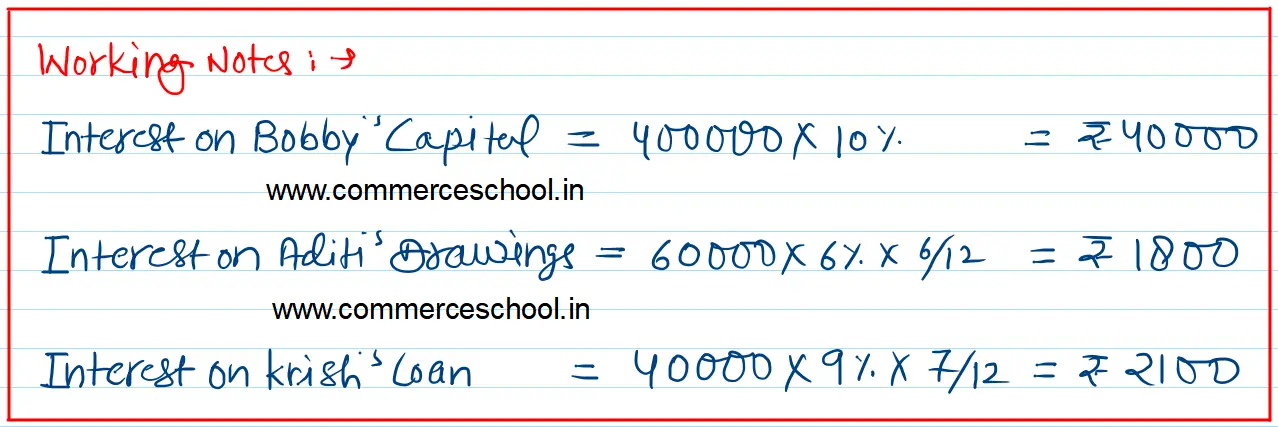

(a) Interest on capital @ 10% per annum.

(b) Interest on drawings @ 6% per annum.

(c) Interest on partner’s loan to the firm @ 9% per annum.

During the year, Aditi had withdrawn ₹ 60,000 and Bobby ₹ 50,000. On 1st September 2021, Krish had given a loan of ₹ 40,000 to the firm.

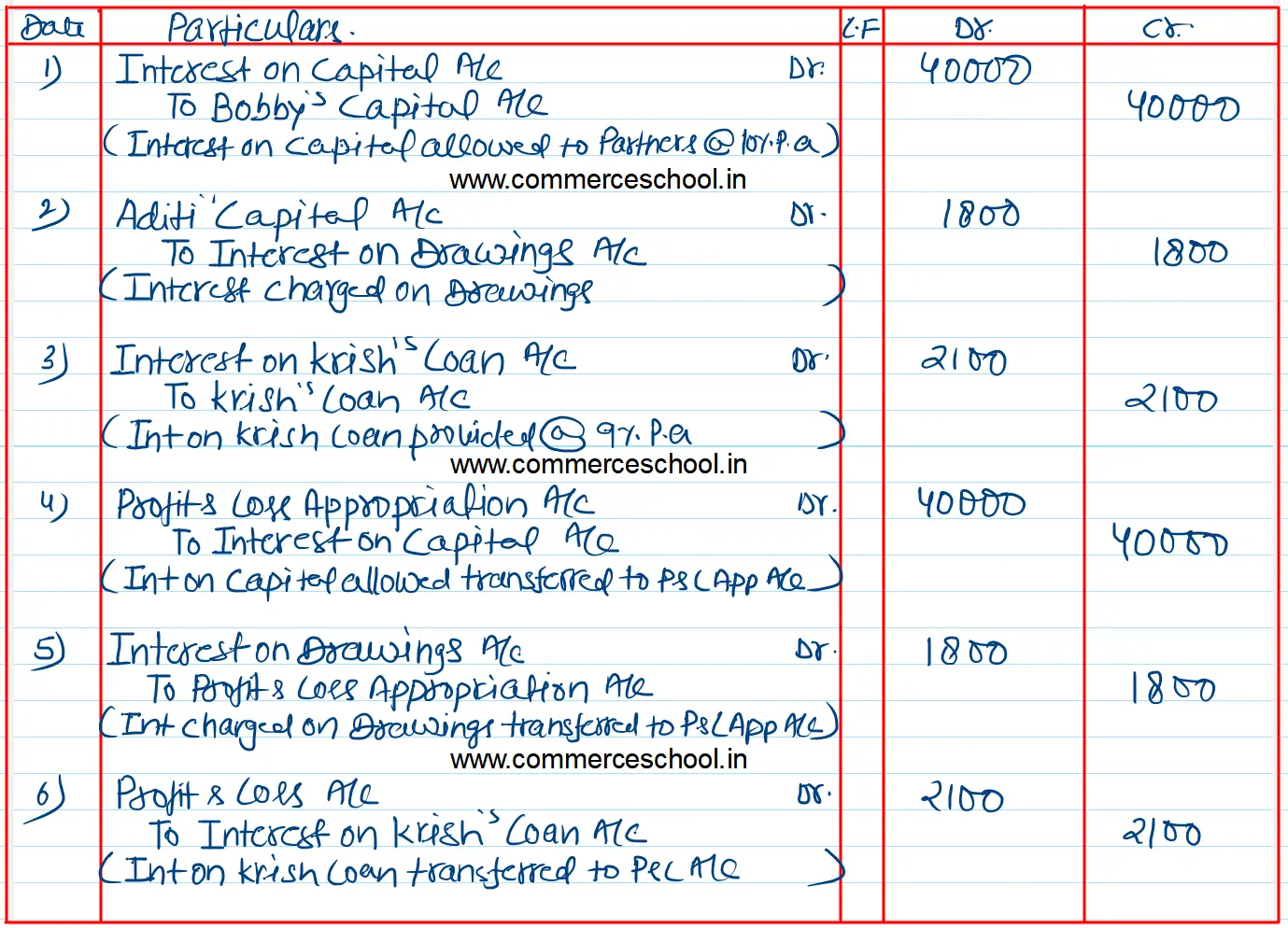

Pass necessary Journal entries in the books of the firm for the following transactions for the year ended 31st March 2022:

(i) Allowing interest on Bobby’s capital.

(ii) Charging interest on Aditi’s drawings.

(iii) Providing interest on Krish’s Loan to the firm.

Also pass transfer entries in the Profit & Loss Account/Profit & Loss Appropriation Account, as the case may be.