After the accounts of a partnership have been drawn up and the books closed off, it is discovered that for the years ended 31st March, 2023 and 2024

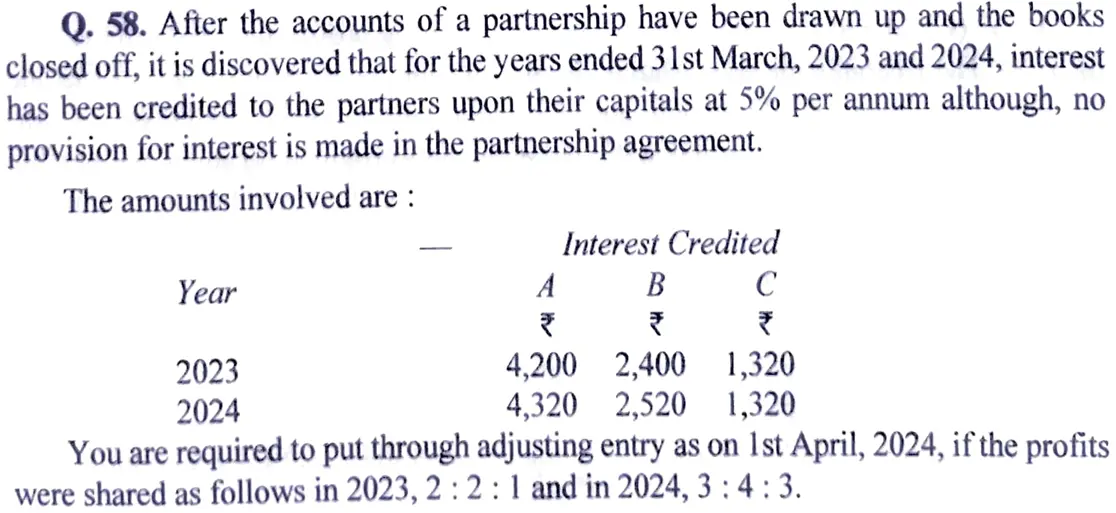

After the accounts of a partnership have been drawn up and the books closed off, it is discovered that for the years ended 31st March, 2023 and 2024, interest has been credited to the partners upon their capitals at 5% per annum although, no provision for interest is made in the partnership agreement.

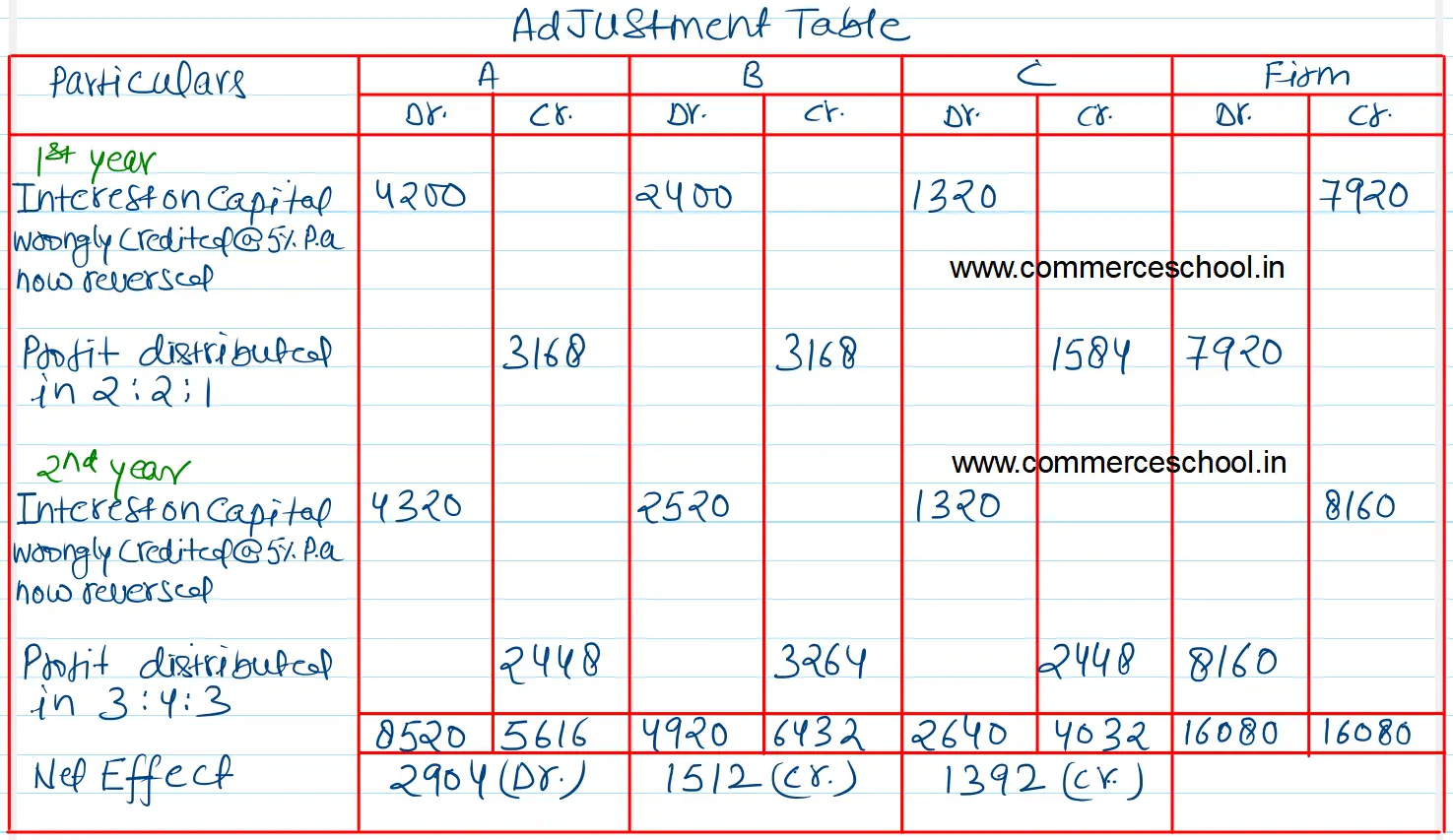

The amounts involved are: Interest Credited

You are required to put through adjusting entry as on 1st April, 2024, if the profits were shared as follows in 2023, 2 : 2 : 1 and in 2024, 3 : 4 : 3.

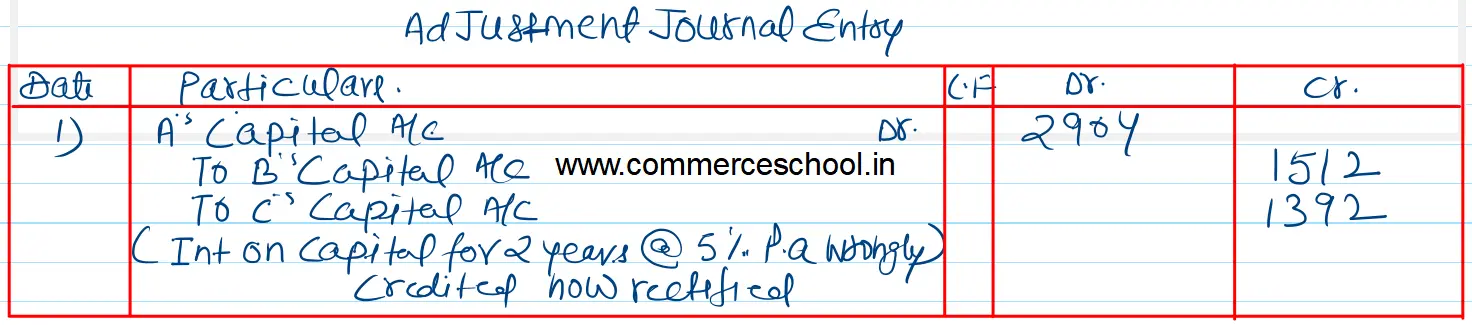

A’s Capital a/c Dr. 2,904

To B’s Capital A/c 1,512

| Year | A | B | C |

| 2023 | 4,200 | 2,400 | 1,320 |

| 2024 | 4,320 | 2,520 | 1,320 |

Anurag Pathak Answered question