Ajay, Bijay, and Chandan are partners in a firm with capitals of ₹ 1,50,000; ₹ 1,20,000, and ₹ 90,000 respectively. Their Partnership Deed provides as follows:

TS Grewal Class 12 (2023-24) Edition ISC Board

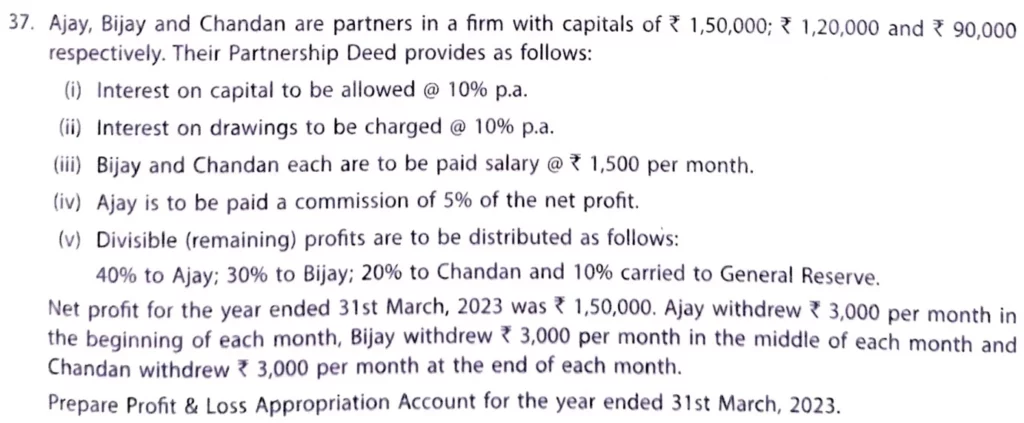

Question no. 37

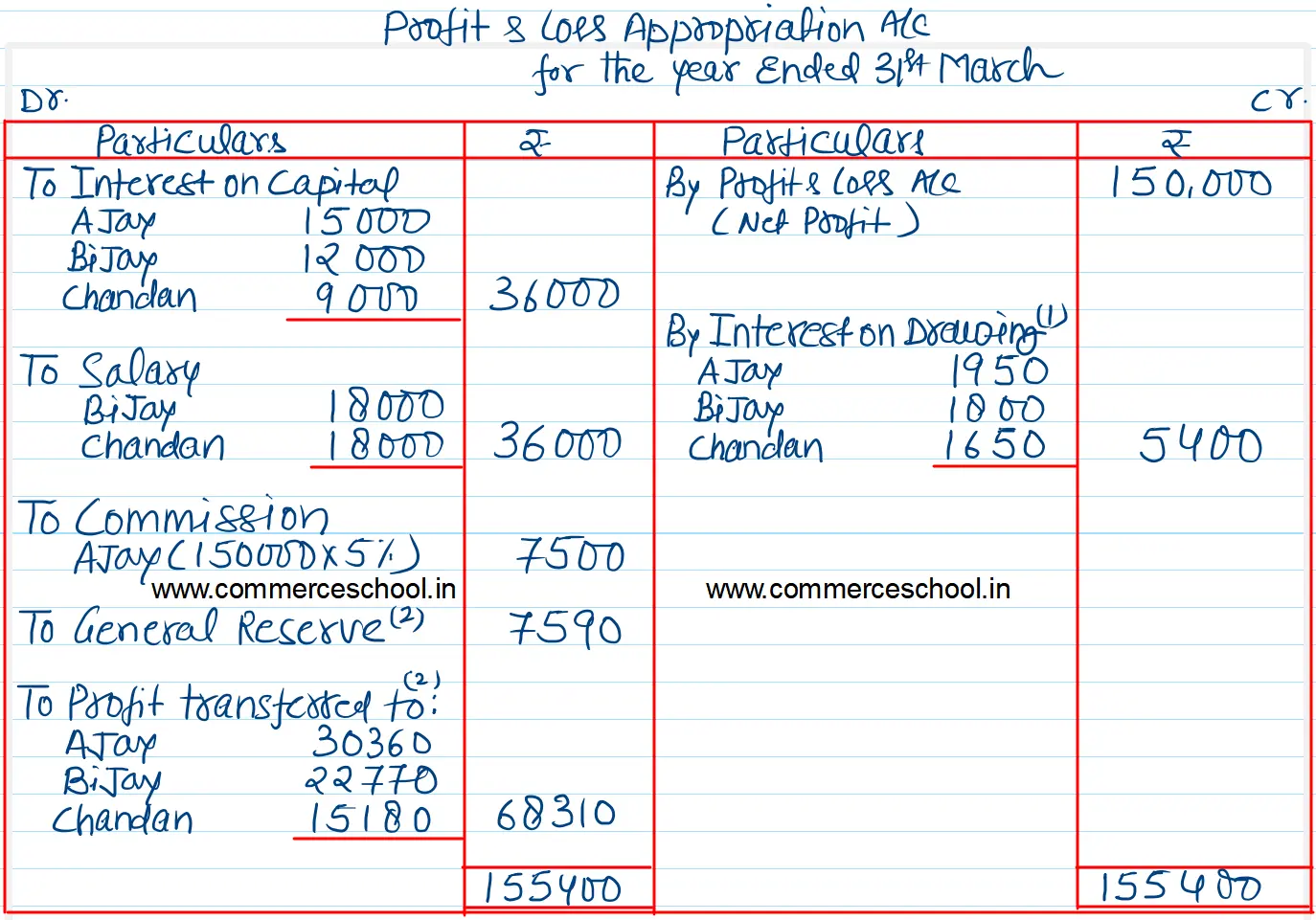

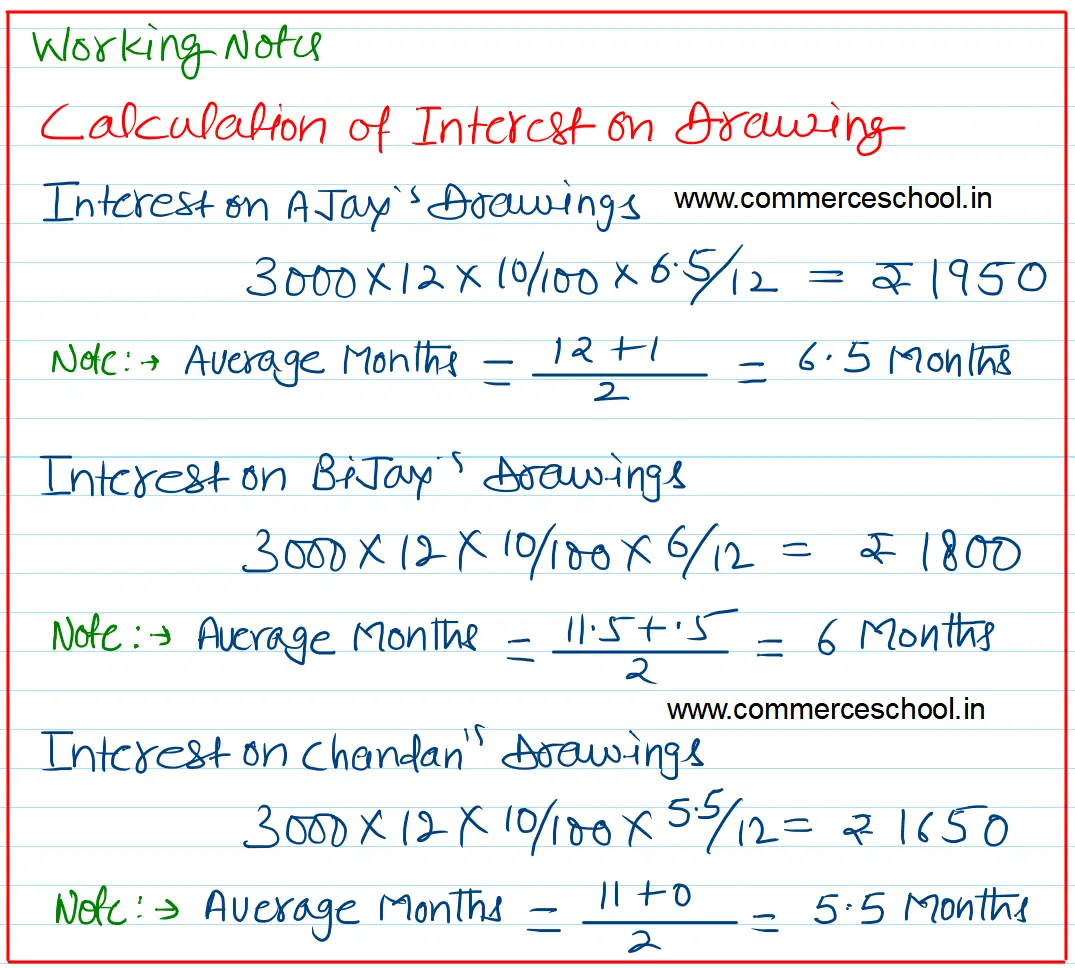

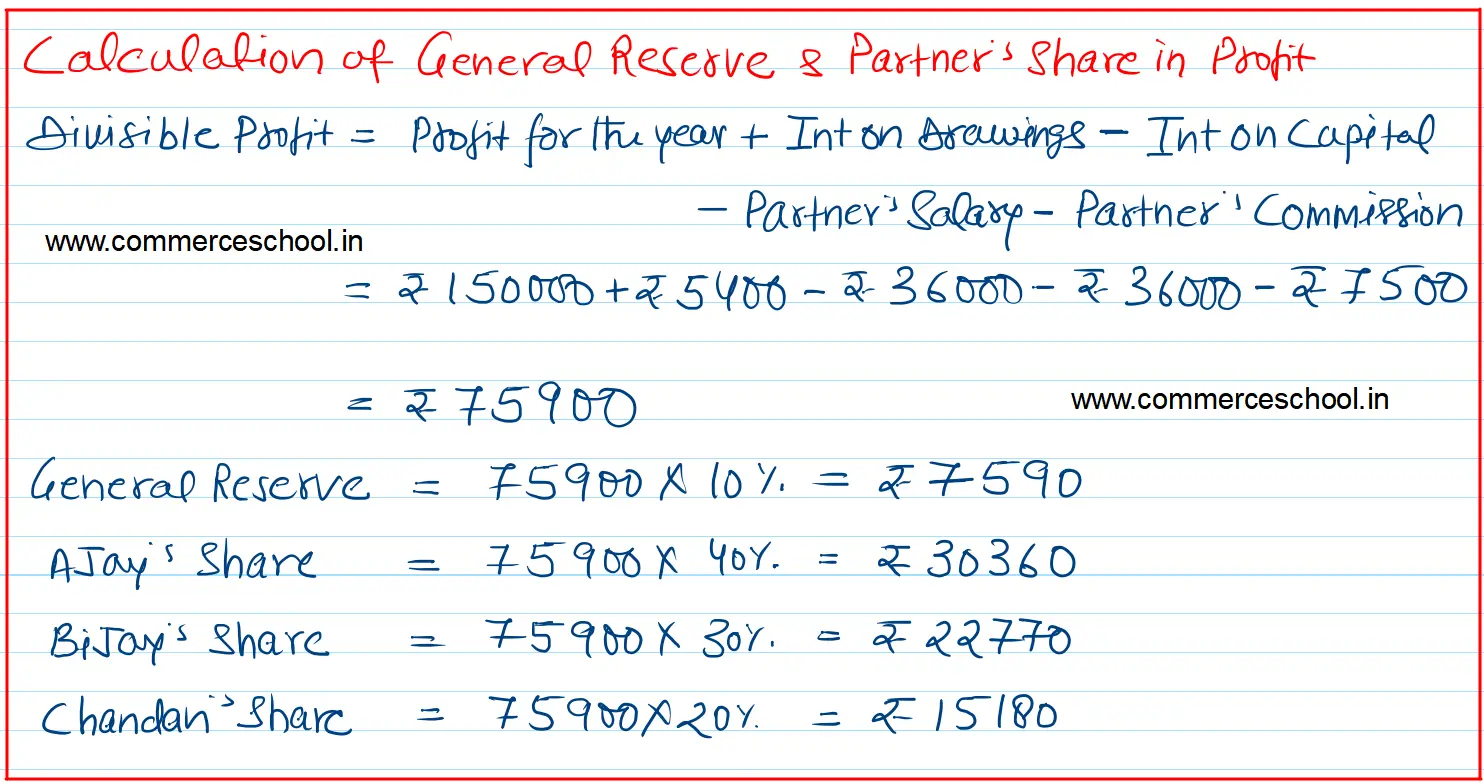

Ajay, Bijay, and Chandan are partners in a firm with capitals of ₹ 1,50,000; ₹ 1,20,000, and ₹ 90,000 respectively. Their Partnership Deed provides as follows: (i) Interest on Capital to be allowed @ 10% p.a. (ii) Interest on drawings to be charged @ 10% p.a. (iii) Bijay and Chandan each are to be paid a salary @ ₹ 1,500 per month. (iv) Ajay is to be paid a commission of 5% of the net profit. (v) Divisible (remaining) profits are to be distributed as follows: 40% to Ajay; 30% to Bijay; 20% to Chandan and 10% carried to General Reserve. Net Profit for the year ended 31st March 2023 was ₹ 1,50,000. Ajay withdrew ₹ 3,000 per month in the beginning of each month, Bijay withdrew ₹ 3,000 per month in the middle of each month and Chandan withdrew ₹ 3,000 per month at the end of each month. Prepare Profit and Loss Appropriation Account for the year ended 31st March 2023.

TS Grewal Class 12 (2024-25) Edition ISC Board

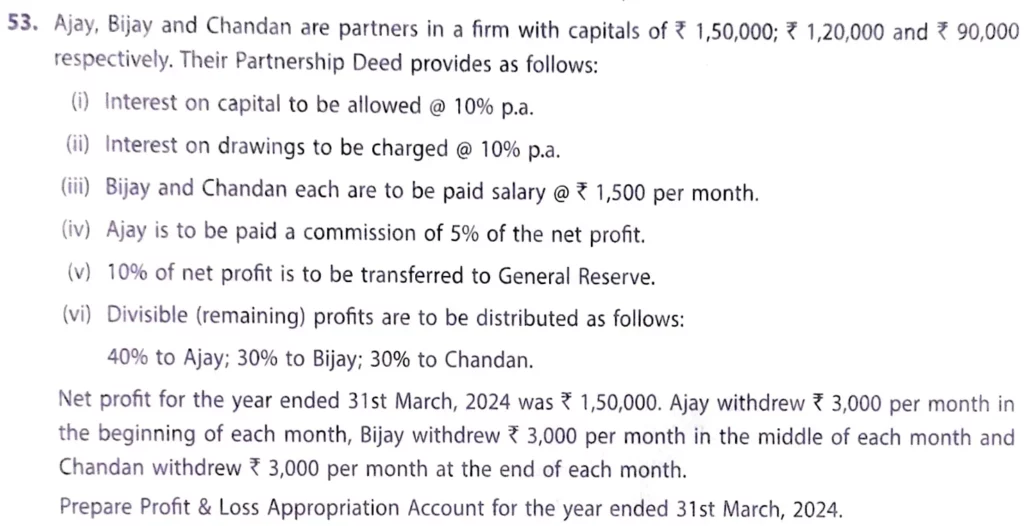

Question no. 53

Ajay, Bijay, and Chandan are partners in a firm with capitals of ₹ 1,50,000; ₹ 1,20,000, and ₹ 90,000 respectively. Their Partnership Deed provides as follows:

(i) Interest on Capital to be allowed @ 10% p.a.

(ii) Interest on drawings to be charged @ 10% p.a.

(iii) Bijay and Chandan each are to be paid a salary @ ₹ 1,500 per month.

(iv) Ajay is to be paid a commission of 5% of the net profit.

(v) 10% of the net profit is to be transferred to general reserve.

(v) Divisible (remaining) profits are to be distributed as follows: 40% to Ajay; 30% to Bijay; 30% to Chandan.

Net Profit for the year ended 31st March 2024 was ₹ 1,50,000. Ajay withdrew ₹ 3,000 per month in the beginning of each month, Bijay withdrew ₹ 3,000 per month in the middle of each month and Chandan withdrew ₹ 3,000 per month at the end of each month.

Prepare Profit and Loss Appropriation Account for the year ended 31st March 2024.

Solution:-

TS Grewal Class 12 (2023-24) Edition ISC Board

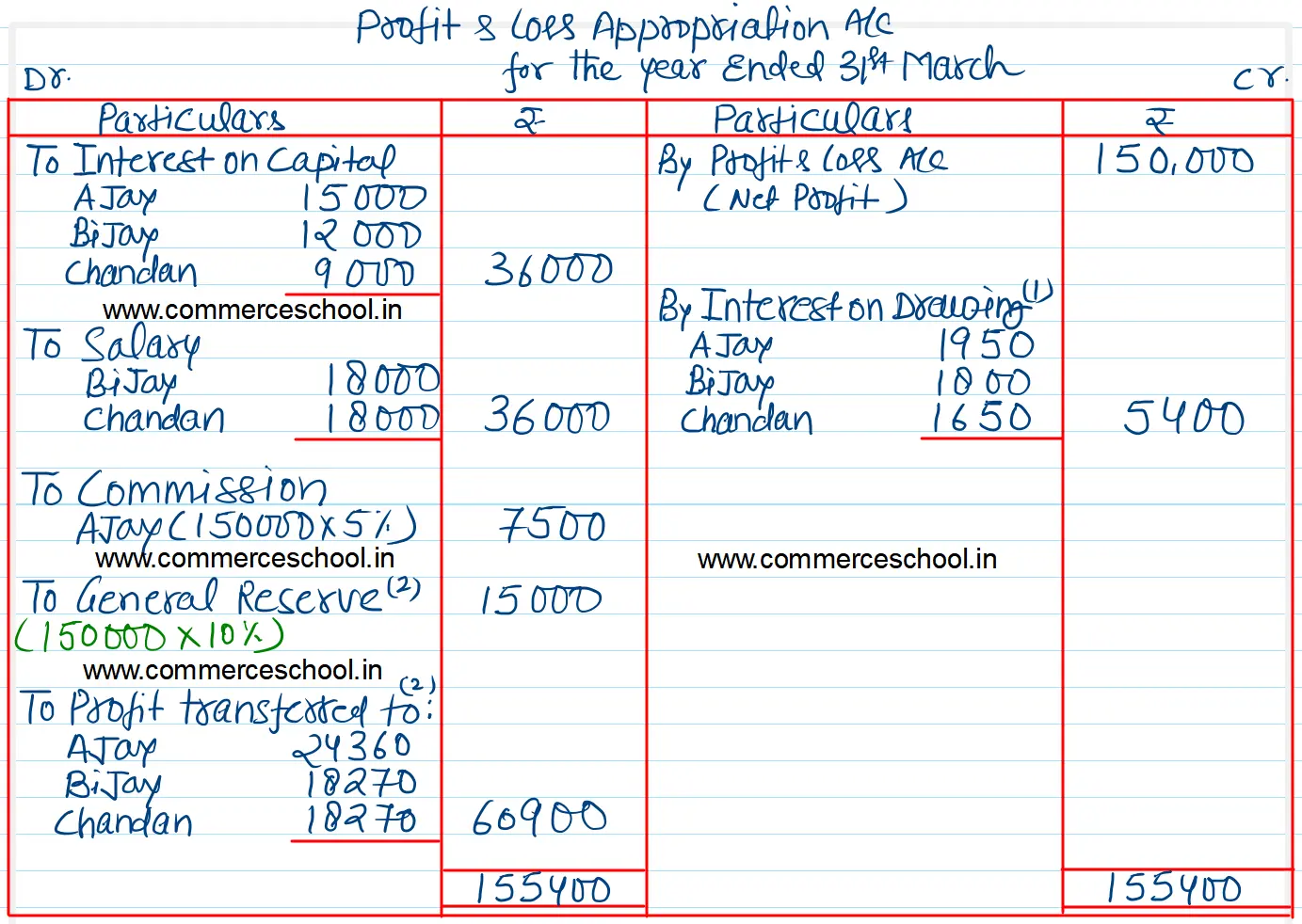

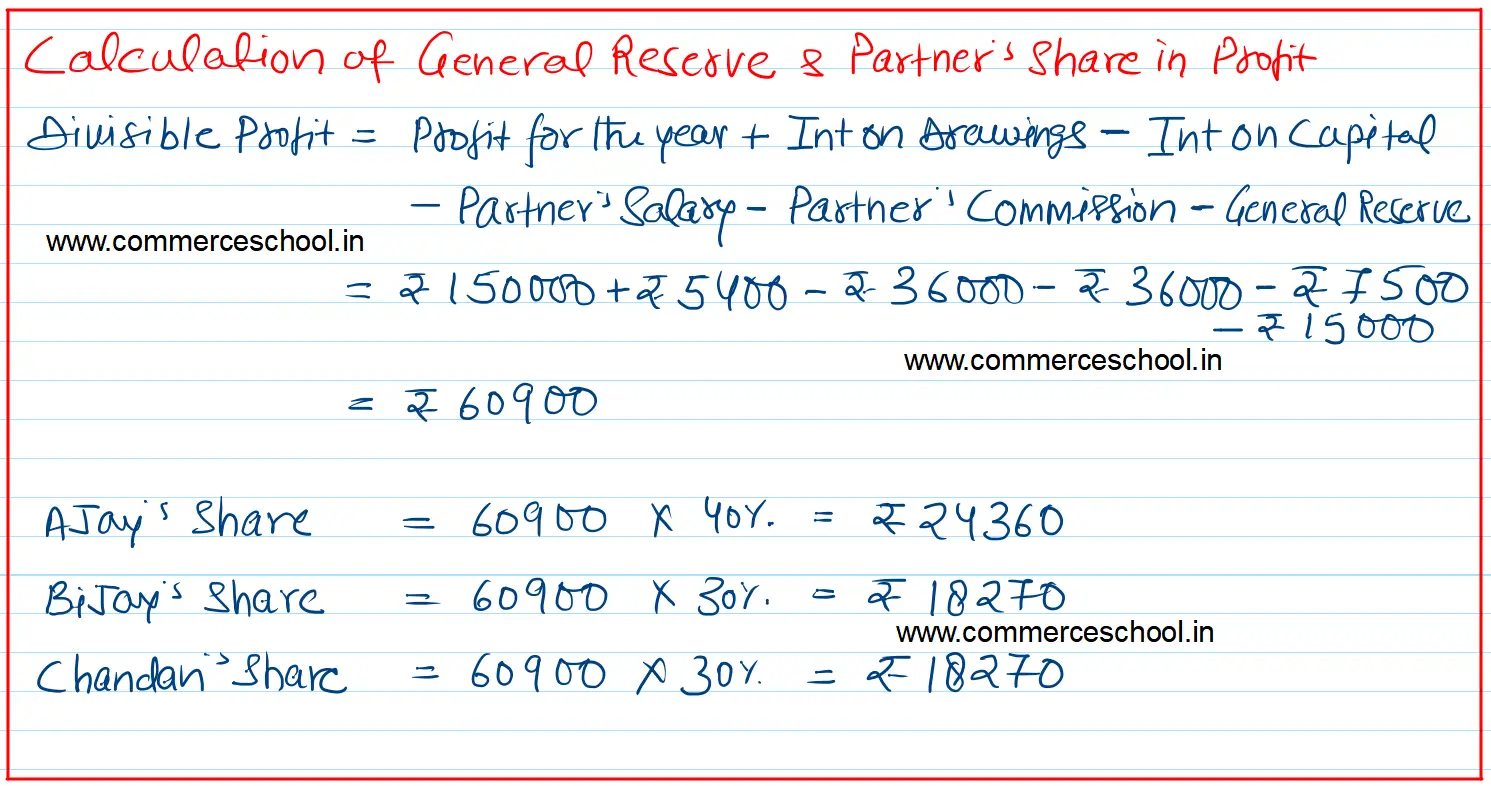

Question No. 37 Answer

TS Grewal Class 12 (2024-25) Edition ISC Board

Question No. 53 Answer