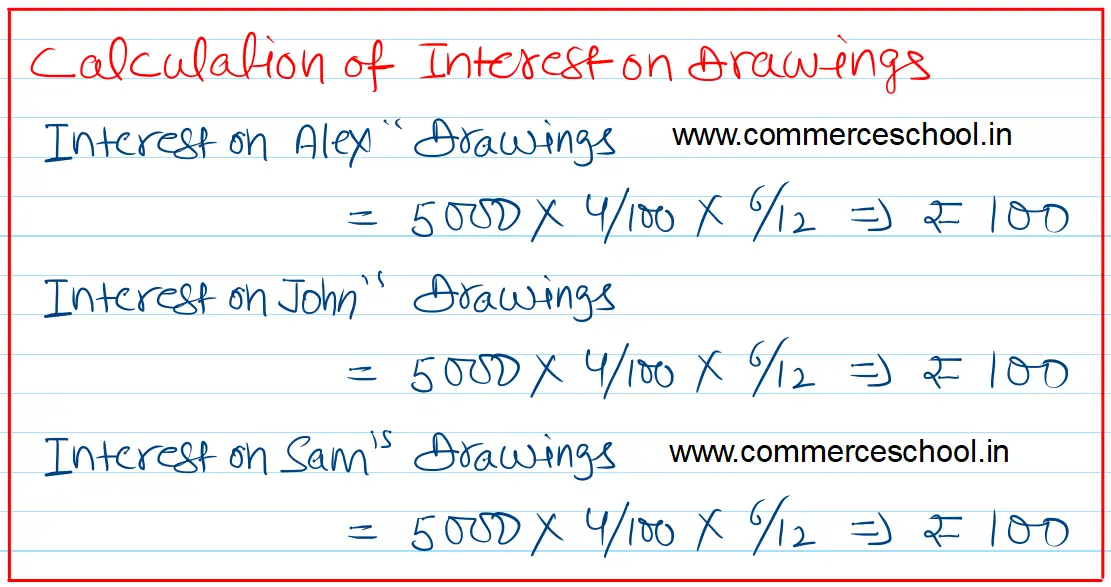

Alex, John and Sam are partners in a firm. Their capital accounts on 1st April, 2021, stood at ₹ 1,00,000, ₹ 80,000 and ₹ 60,000 respectively

Alex, John and Sam are partners in a firm. Their capital accounts on 1st April, 2021, stood at ₹ 1,00,000, ₹ 80,000 and ₹ 60,000 respectively.

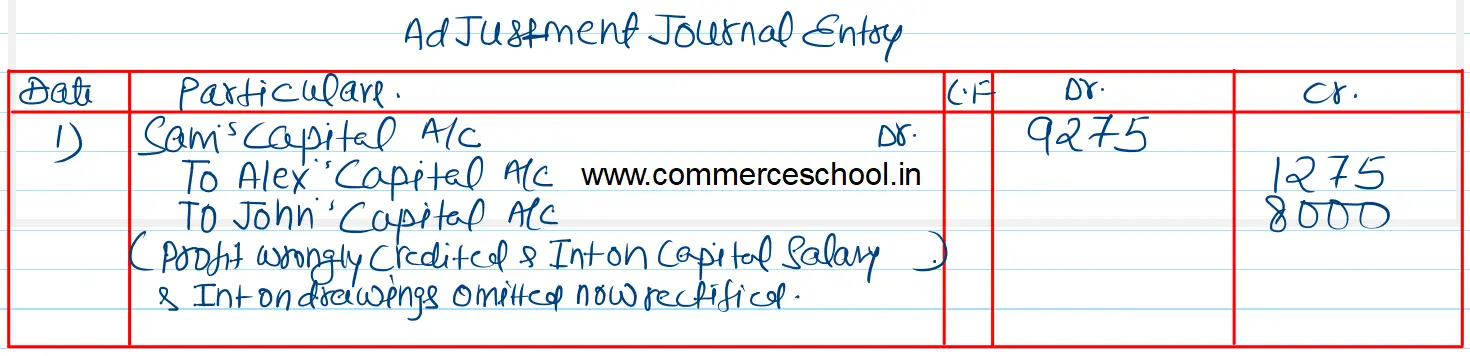

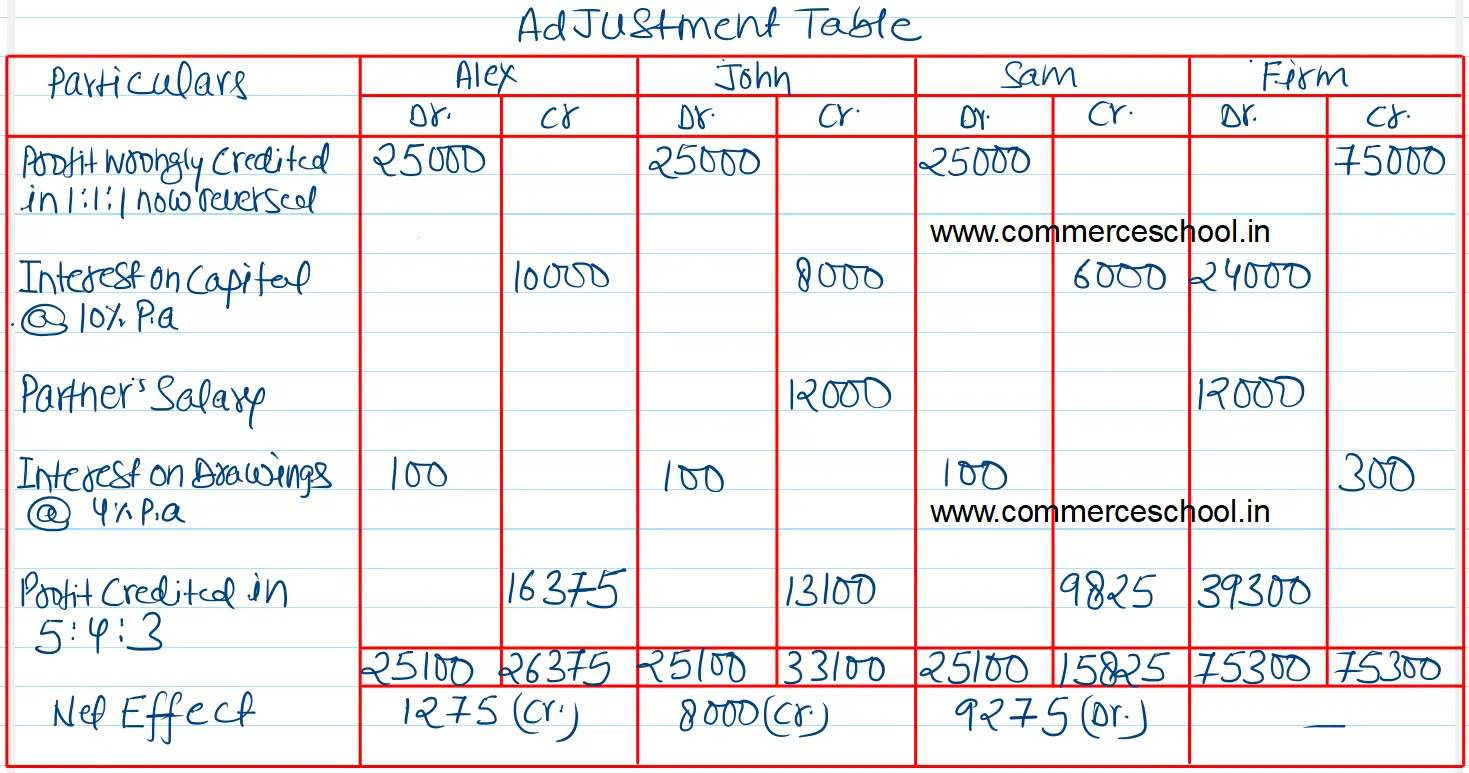

Each partner withdrew ₹ 5,000 during the financial year 2021 – 22.

As per the provisions of their partnership deed:

(a) John was entitled to a salary of ₹ 1,000 per month.

(b) Interest on capital was to be allowed @ 10% per annum.

(c) Interest on drawings was to be charged @ 4% per annum.

(d) Profits and losses were to be shared in the ratio of their capitals.

The net profit of ₹ 75,000 for the year ended 31st March, 2022, was divided equally amongst the partners without providing for the terms of the deed.

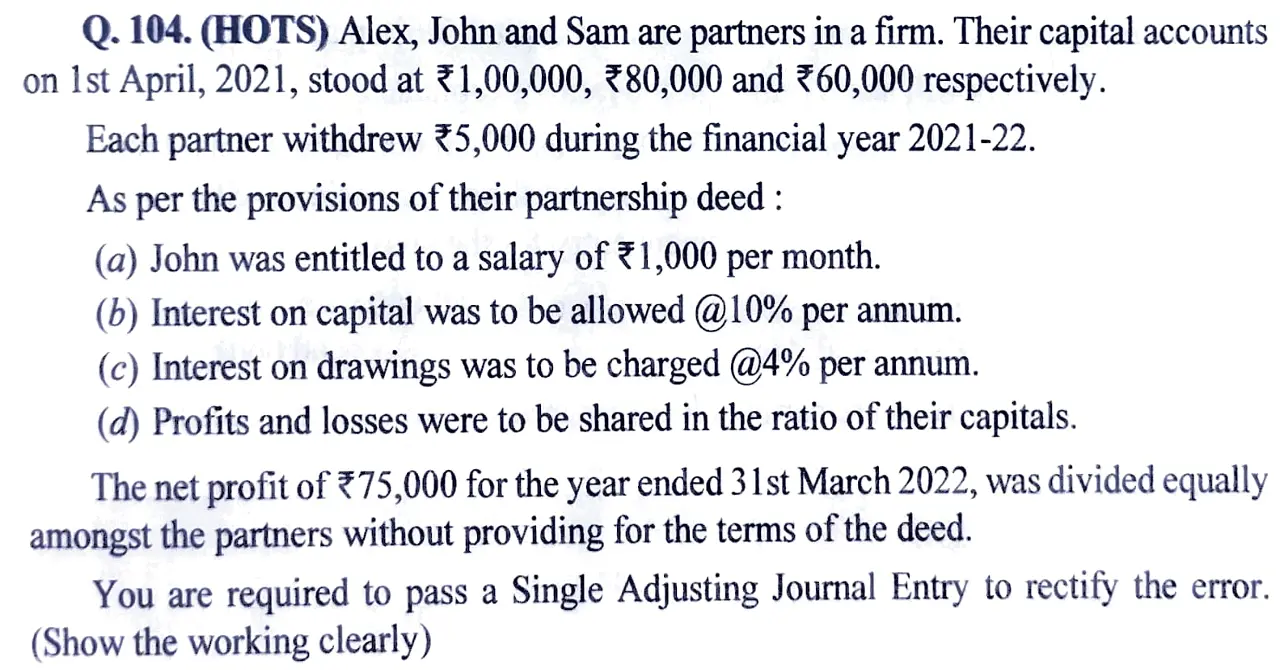

You are required to pass a Single Adjusting Journal Entry to rectify the error. (Show the working clearly)