Amit and Kartik are partners sharing profits and losses equally. They decided to admit Saurabh for an equal share in the profits. For this purpose, the goodwill of the firm was to be valued at four years’ purchase of super profits

Amit and Kartik are partners sharing profits and losses equally. They decided to admit Saurabh for an equal share in the profits. For this purpose, the goodwill of the firm was to be valued at four years’ purchase of super profits.

The Balance Sheet of the firm on Saurabh’s admission was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Capital A/cs: Amit Kartik | 90,000 50,000 | Fixed Assets (Tangible) | 75,000 |

| Creditors | 5,000 | Furniture | 15,000 |

| General Reserve | 20,000 | Stock | 30,000 |

| Bills Payable | 25,000 | Debtors | 20,000 |

| Cash | 50,000 | ||

| 1,90,000 | 1,90,000 |

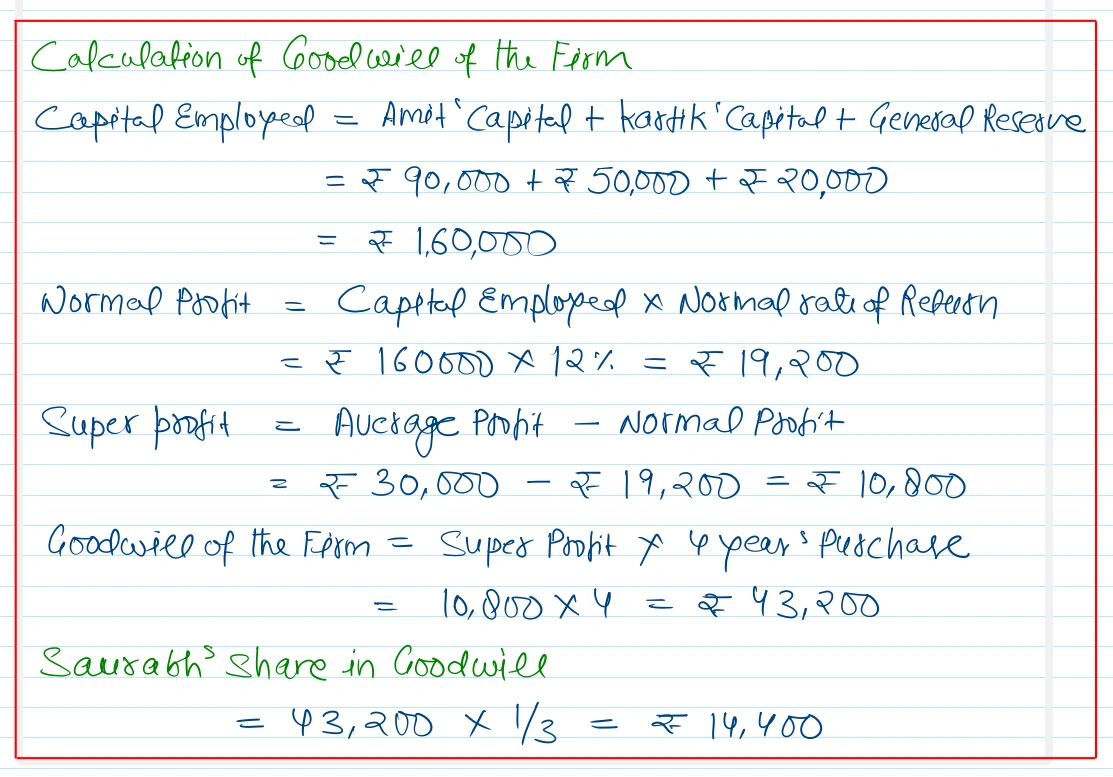

The normal rate of return is 12% p.a. Average profit of the firm for the last four years was ₹ 30,000. Calculate Saurabh’s share of goodwill.

[Ans.: Capital Employed – ₹ 1,60,000 (Capital + Reserve), Normal Profit – ₹ 19,200; Average Profit – ₹ 30,000; Firm’s Goodwill – ₹ 43,200; Saurabh’s Share of Goodwill – ₹ 14,400.]

Anurag Pathak Changed status to publish