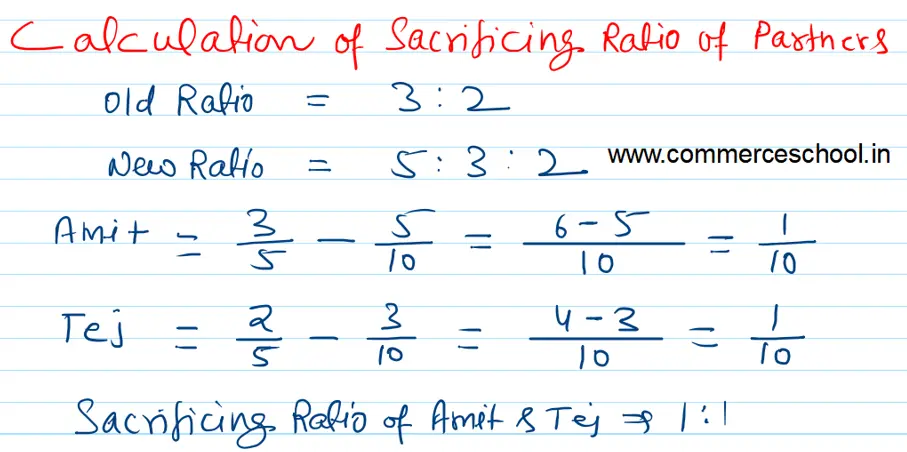

Amit and Tej are partners sharing profits and losses in the ratio of 3 : 2. Their Balance Sheet as at 1st April, 2023 was as under:

Amit and Tej are partners sharing profits and losses in the ratio of 3 : 2. Their Balance Sheet as at 1st April, 2023 was as under:

| Liabilities | ₹ | Assets | ₹ |

| Capital A/cs:

Amit Tej Reserve Workmen Compensation Reserve Creditors Outstanding Expenses |

29,000 15,000 5,000 5,000 30,000 2,500 |

Building

Machinery Furniture Stock Debtors Cash |

45,000 9,000 5,000 15,000 9,000 3,500 |

| 86,500 | 86,500 |

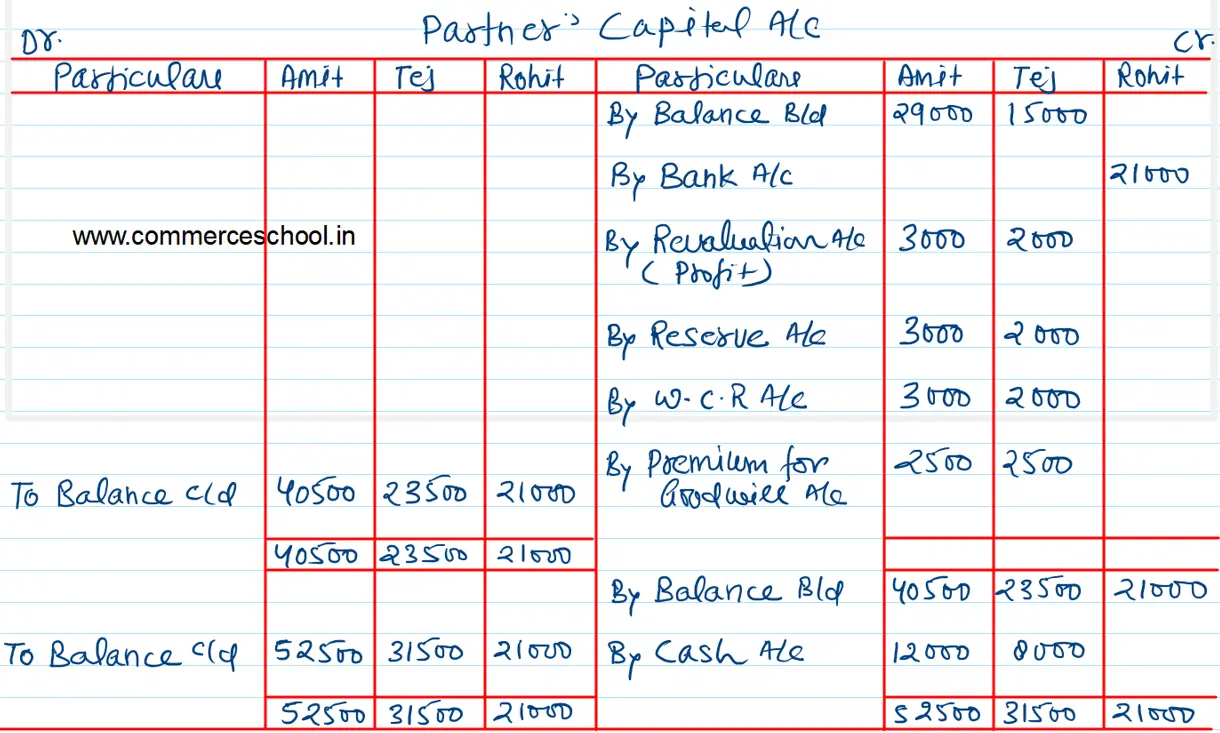

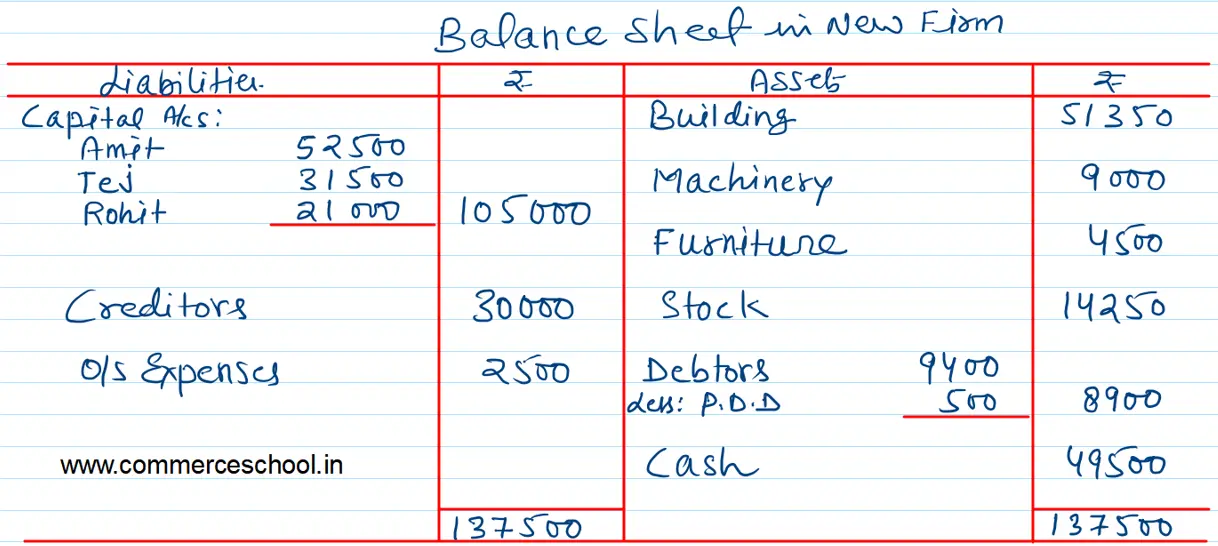

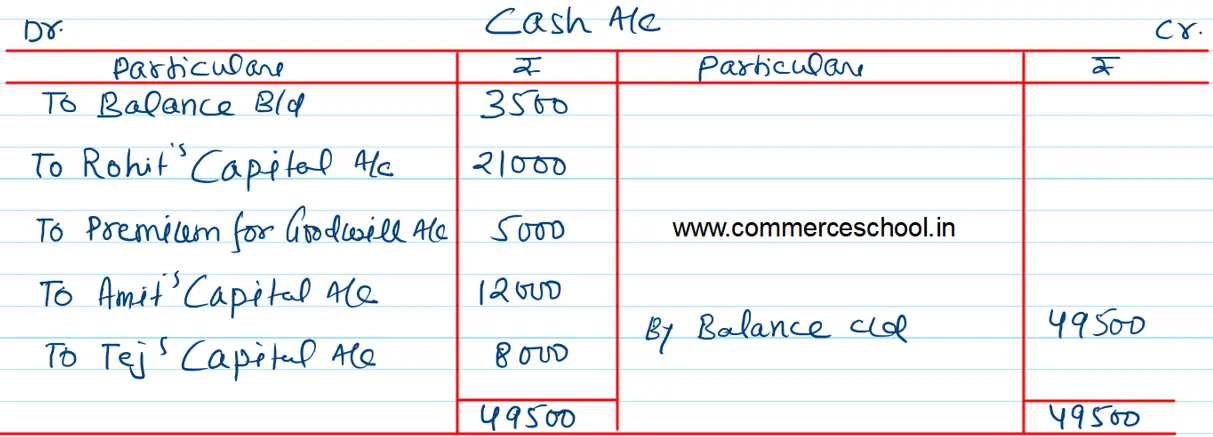

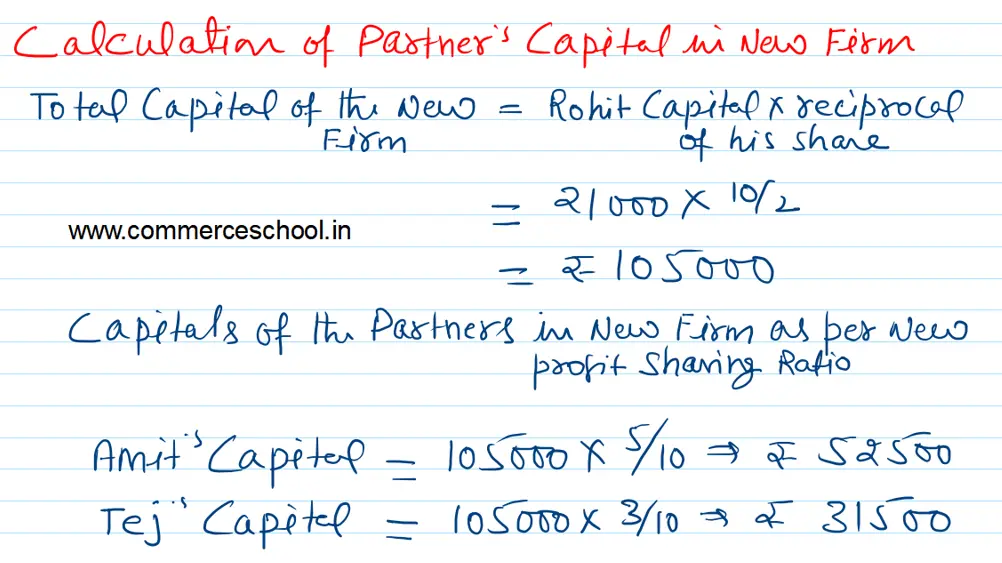

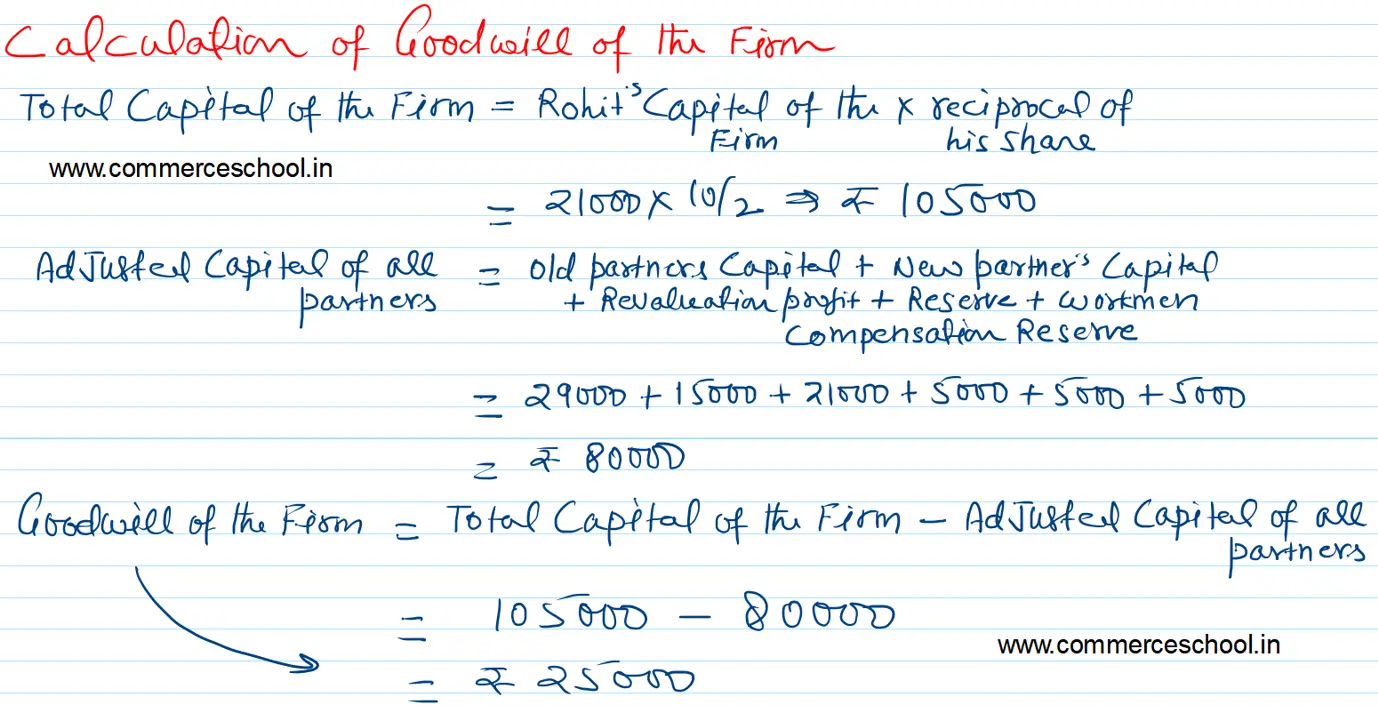

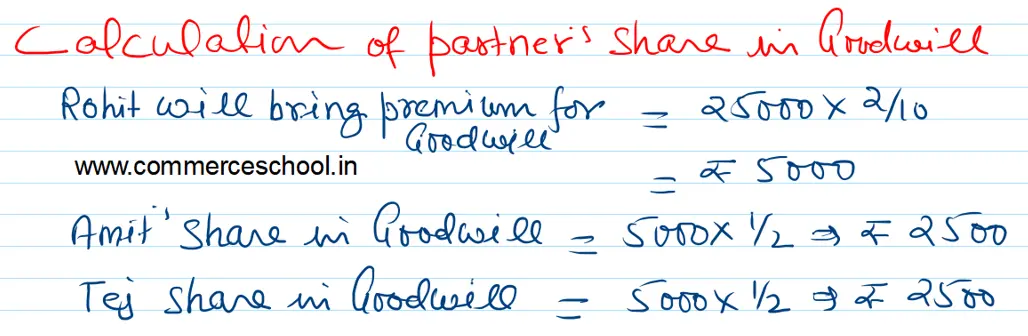

Rohit is admitted as a new partner introducing a Capital of ₹ 21,000. Capitals of the partners are to be adjusted in new profit sharing ratio, which is 5 : 3 : 2 taking Rohit’s Capital as base, Rohit is to bring premium for Goodwill. Goodwill amount being calculated on the basis of Rohit’s share in the profits and capital contributed by him.

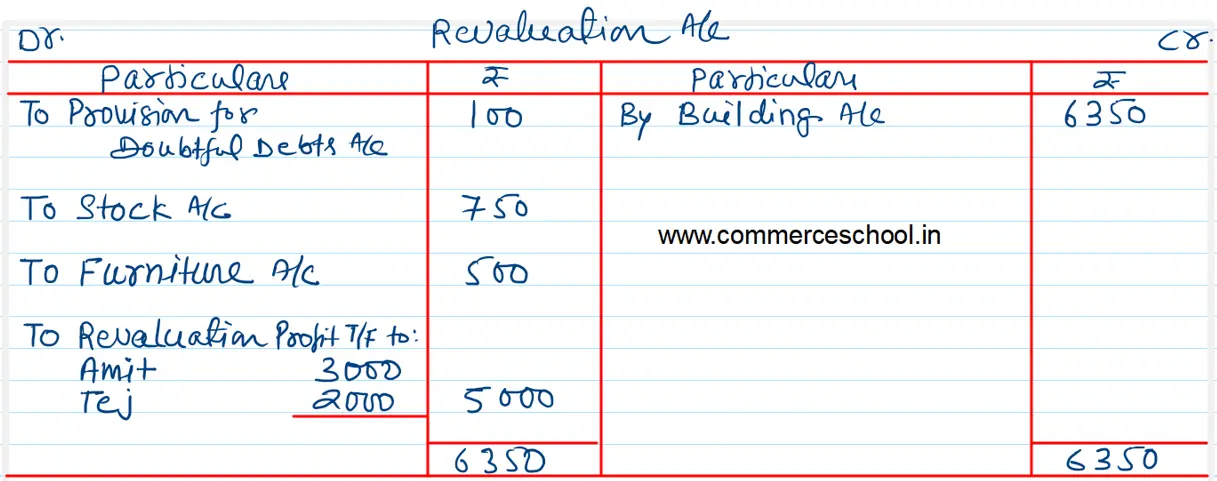

Following revaluations are made:

(i) Provision for Doubtful Debts is to be raised to ₹ 5,00.

(ii) Stock to be depreciated by 5% and Furniture to be depreciated by 10%.

(iii) Building is revalued at ₹ 51,350.

Prepare necessary Ledger Accounts and Balance sheet of the new firm.