Amit, Balan and Chander were partners in a firm sharing profits in the proportion of 1/2, 1/3 and 1/6 respectively. Chander retired on 1st April, 2014. The Balance Sheet of the firm on the date of Chander’s retirement was as follows:

Amit, Balan and Chander were partners in a firm sharing profits in the proportion of 1/2, 1/3 and 1/6 respectively. Chander retired on 1st April, 2014. The Balance Sheet of the firm on the date of Chander’s retirement was as follows:

| Liabilities | ₹ | Assets | ₹ | |

| Sundry Creditors

Employee’s Provident Fund General Reserve Capital A/cs: Amit Balan Chander |

12,600 3,000 9,000 40,000 36,500 20,000 |

Bank

Debtors Stock Investments Patents Machinery |

30,000

|

4,100 29,000 25,000 10,000 5,000 48,000 |

| 1,21,100 | 1,21,100 |

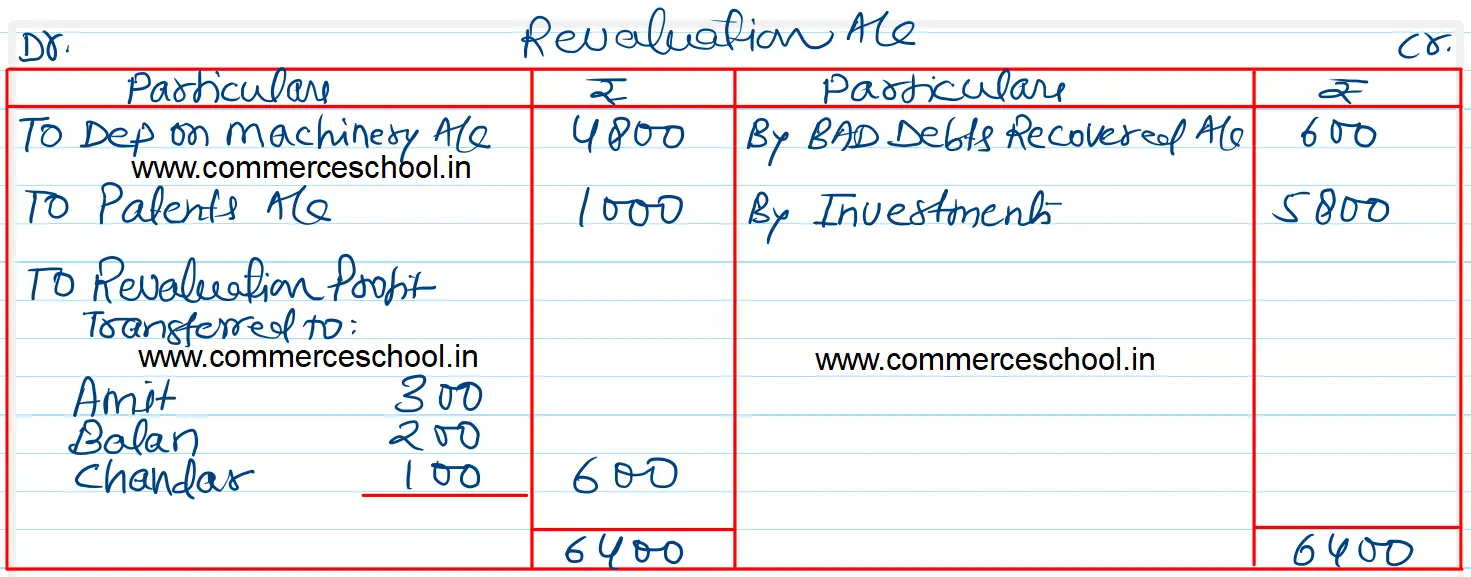

It was agreed that:

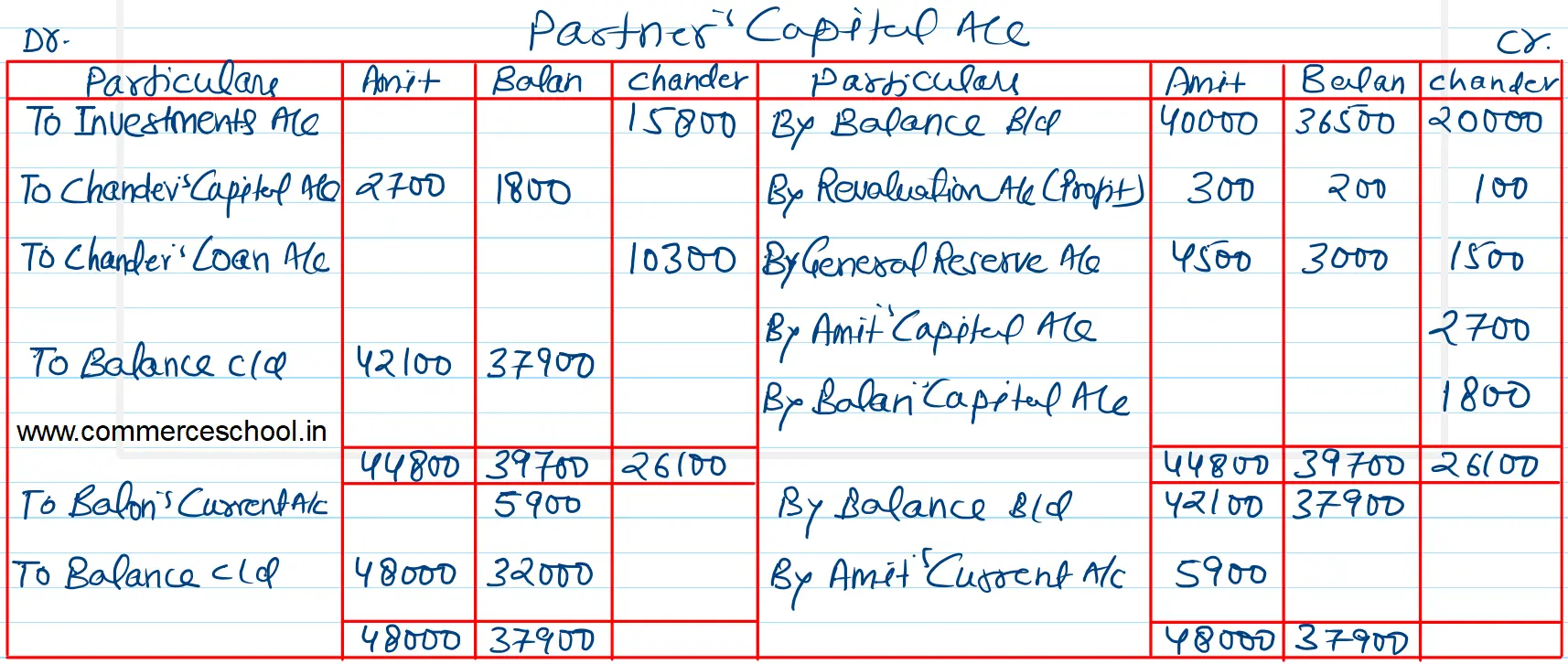

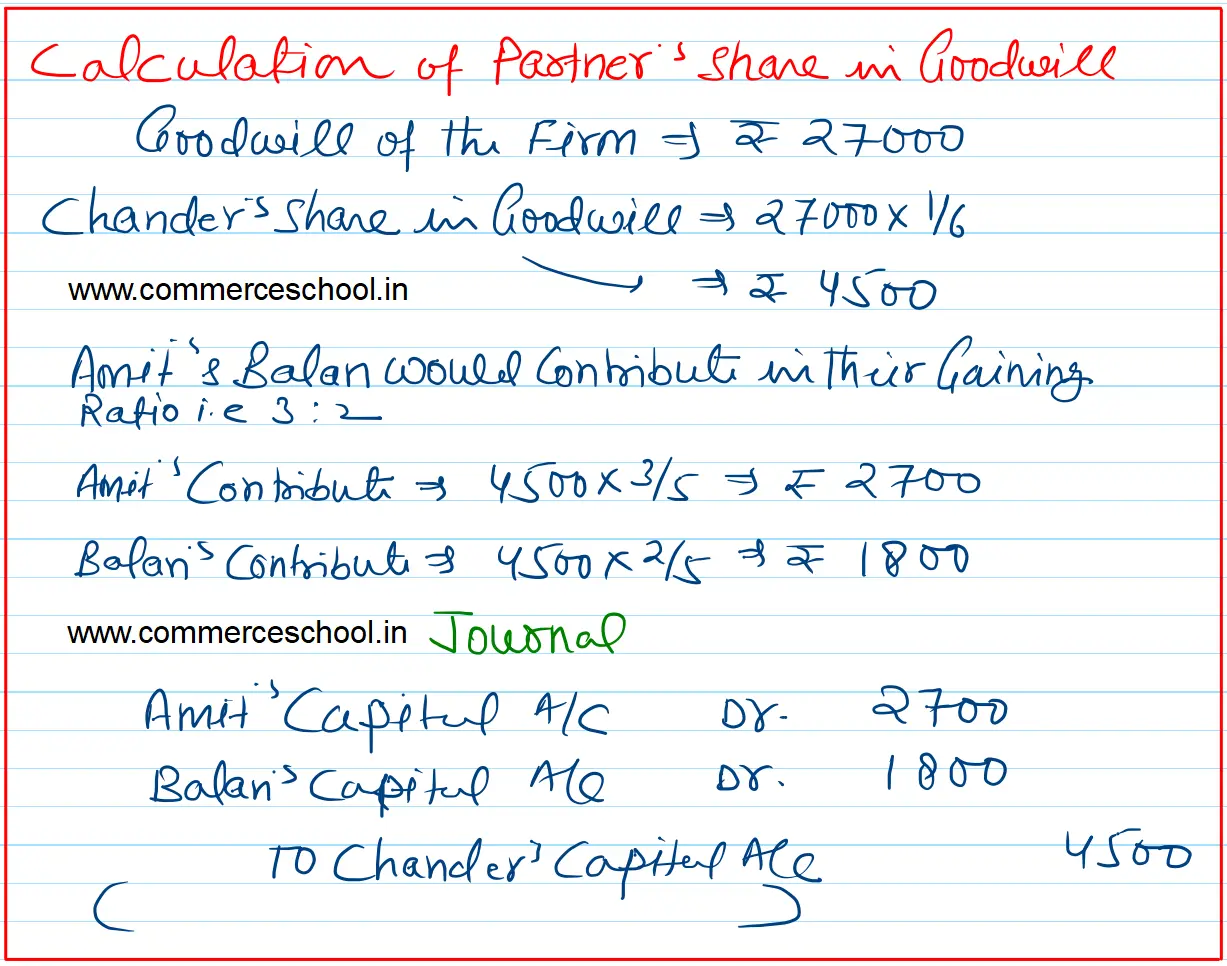

i) Goodwill will be valued at ₹ 27,000.

ii) Depreciation of 10% was to be provided on Machinery

iii) Patents were to be reduced by 20%.

iv) An old photocopier previously written off was sold for ₹ 600.

v) Chander took over investments for ₹ 15,800.

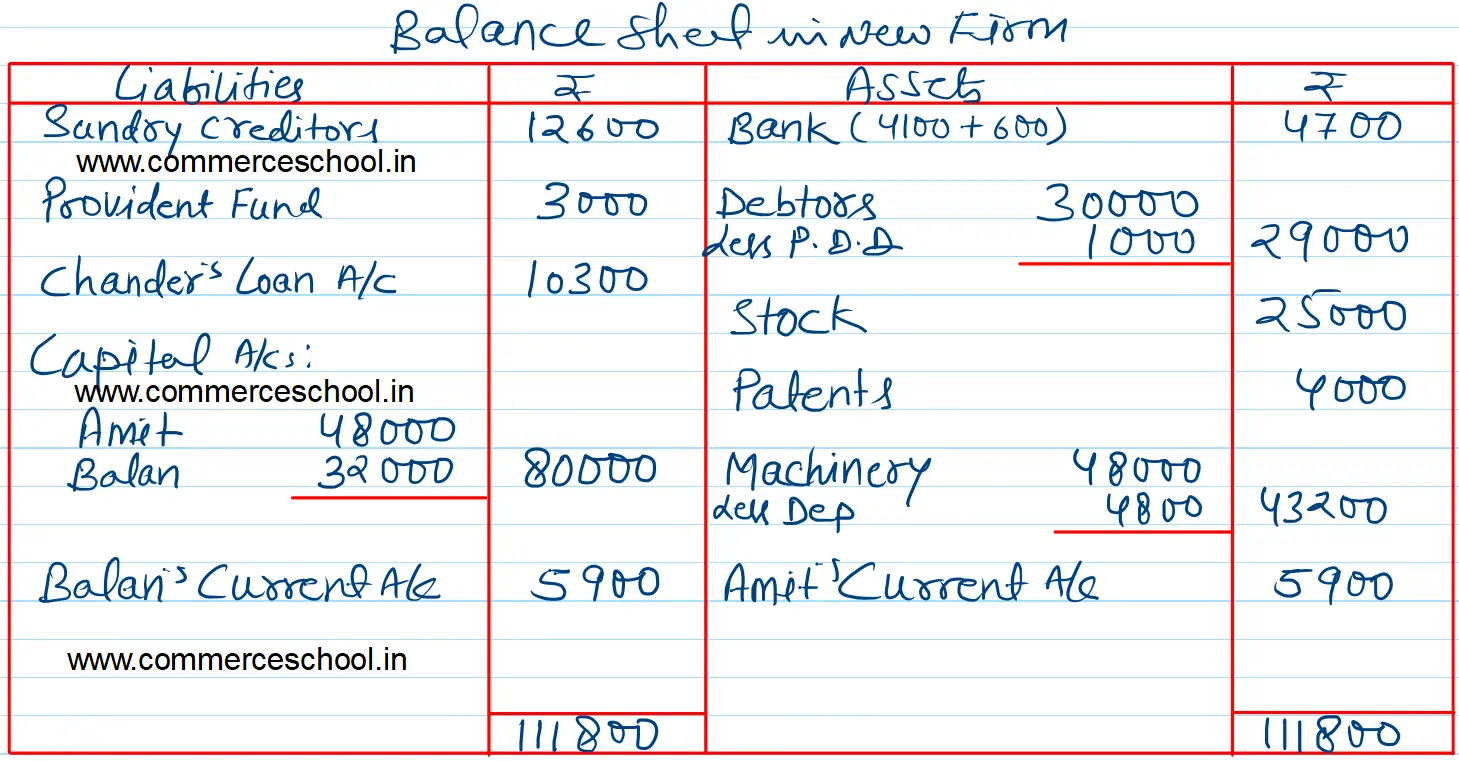

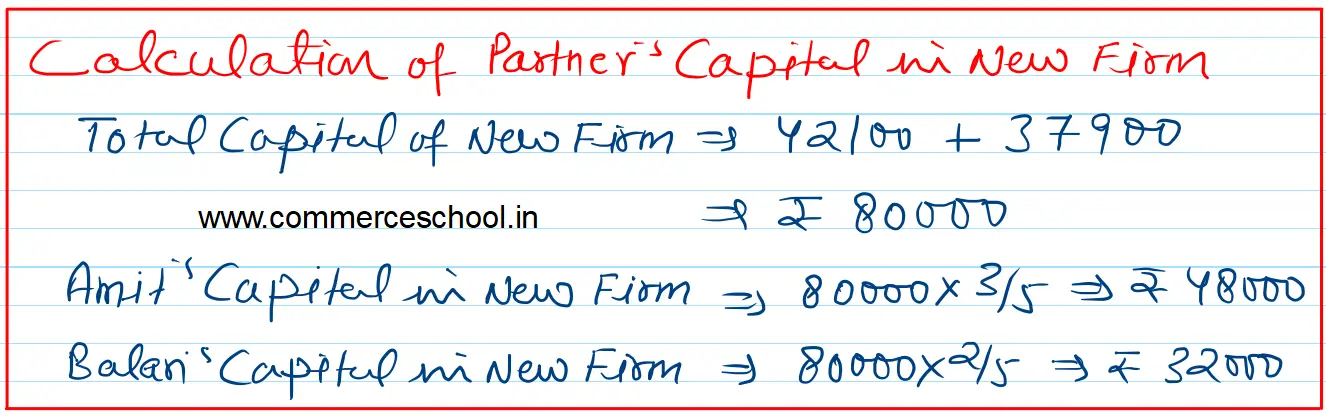

vi) Amit and Balan decided to adjust their capitals in proportion of their profit sharing ratio by opening current accounts.

Prepare Revaluation Account and Partner’s Capital Accounts on Chander’s retirement.

[Ans.: Gain (Profit) on Revaluation – ₹ 600; Chander’s Loan A/c – ₹ 10,300; Partner’s Capital Accounts: Amit – ₹ 48,000; Balan – ₹ 32,000. Current Accounts: Amit – ₹ 5,900 (Dr.); Balan – ₹ 5,900 (Cr.).]