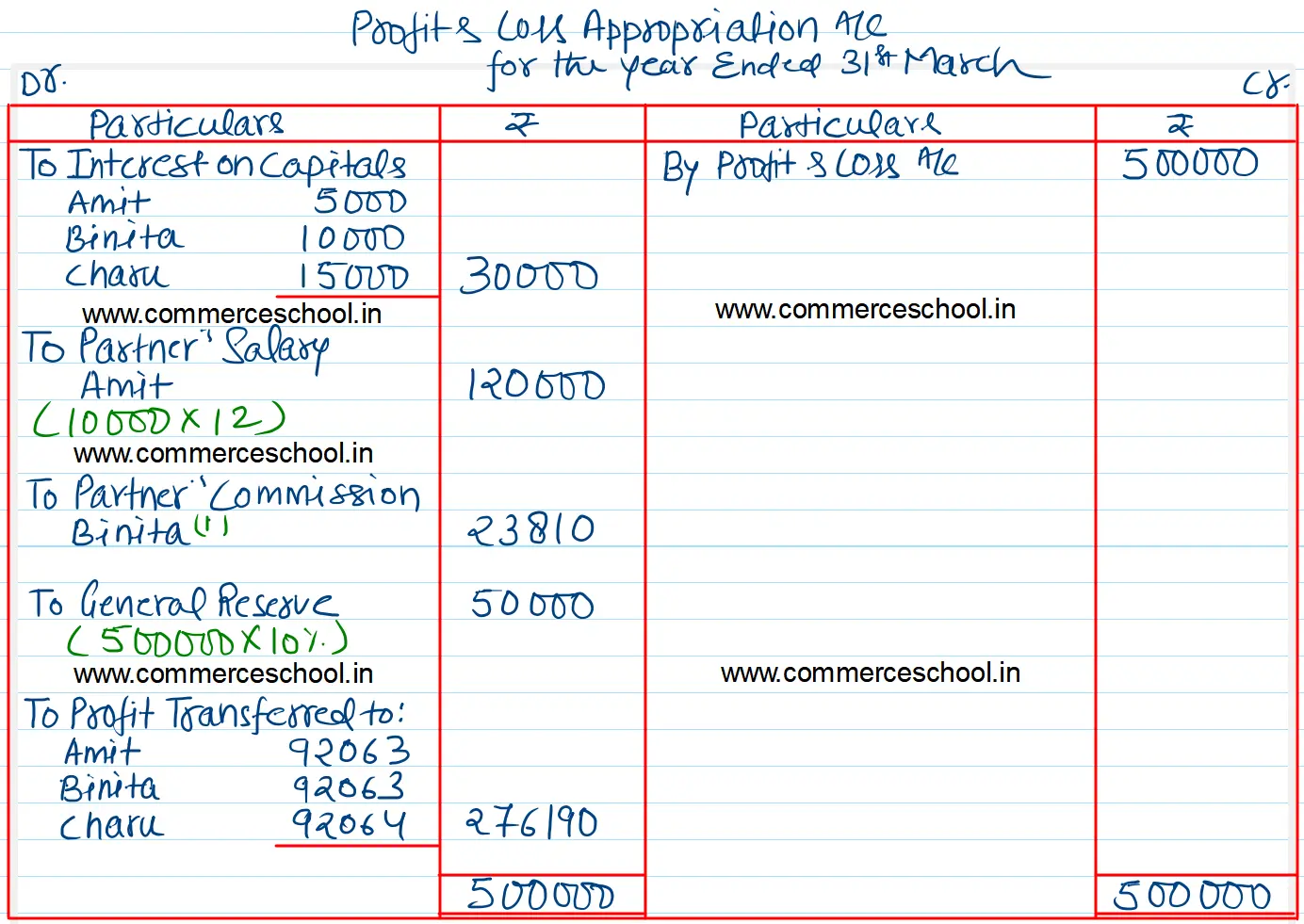

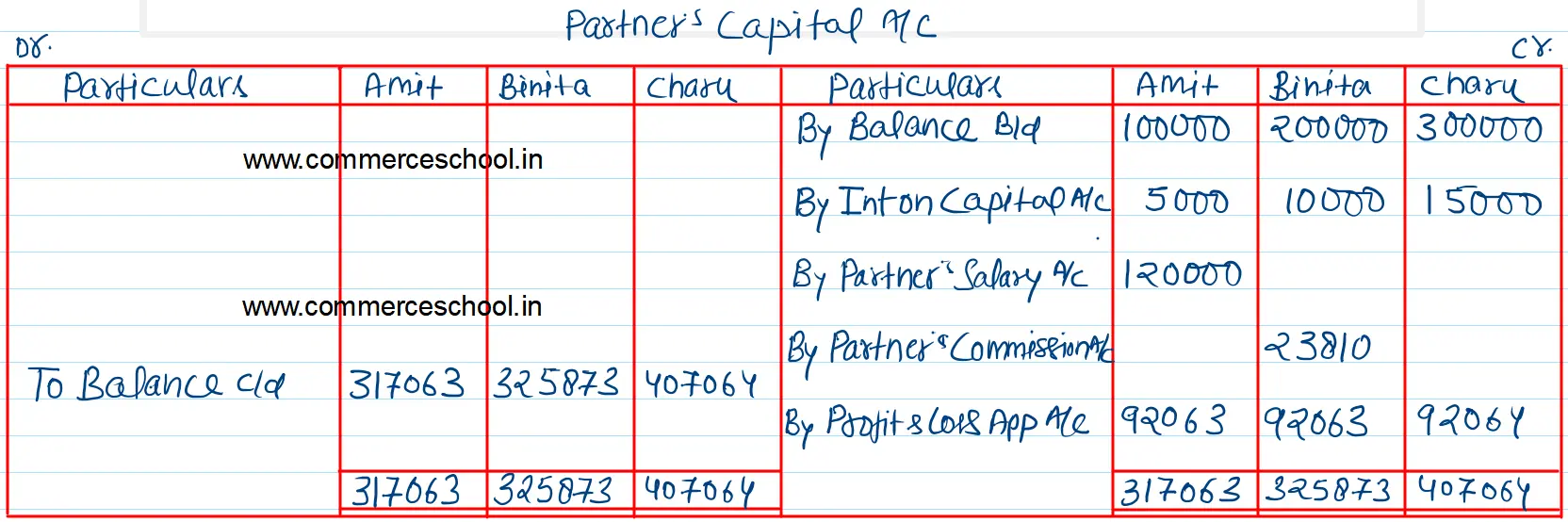

Amit, Binita, and Charu are the three partners. On 1st April 2022, their capitals stood as: Amit ₹ 1,00,000, Binita ₹ 2,00,000, and Charu ₹ 3,00,000. It was decided that:

Amit, Binita, and Charu are the three partners. On 1st April 2022, their capitals stood as: Amit ₹ 1,00,000, Binita ₹ 2,00,000, and Charu ₹ 3,00,000. It was decided that:

(a) they would receive interest on Capitals @ 5% p.a.,

(b) Amit would get a salary of ₹ 10,000 per month,

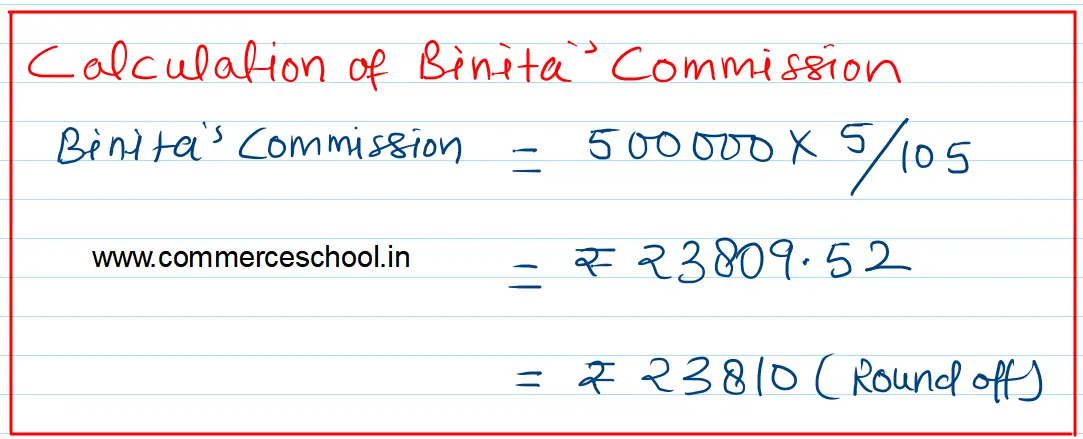

(c) Binita would receive commission @ 5% of net profit after deduction of commission, and

(d) 10% of the net profit would be transferred to the General Reserve.

Before the above items were taken into account, profit for the year ended 31st March 2023 was ₹ 5,00,000.

Prepare the Profit and Loss Appropriation Account and the Capital Accounts of the Partners.

[Ans: Divisible Profit – ₹ 2,76,190; Commission (Binita) – ₹ 23,810; General Reserve – ₹ 50,000; Share of Profit: Amit – ₹ 92,063; Binita – ₹ 92,063, Charu – ₹ 92,064; Closing Balances of Capital A/cs: Amit – ₹ 3,17,063; Binita – ₹ 3,25,873; Charu – ₹ 4,07,064.]