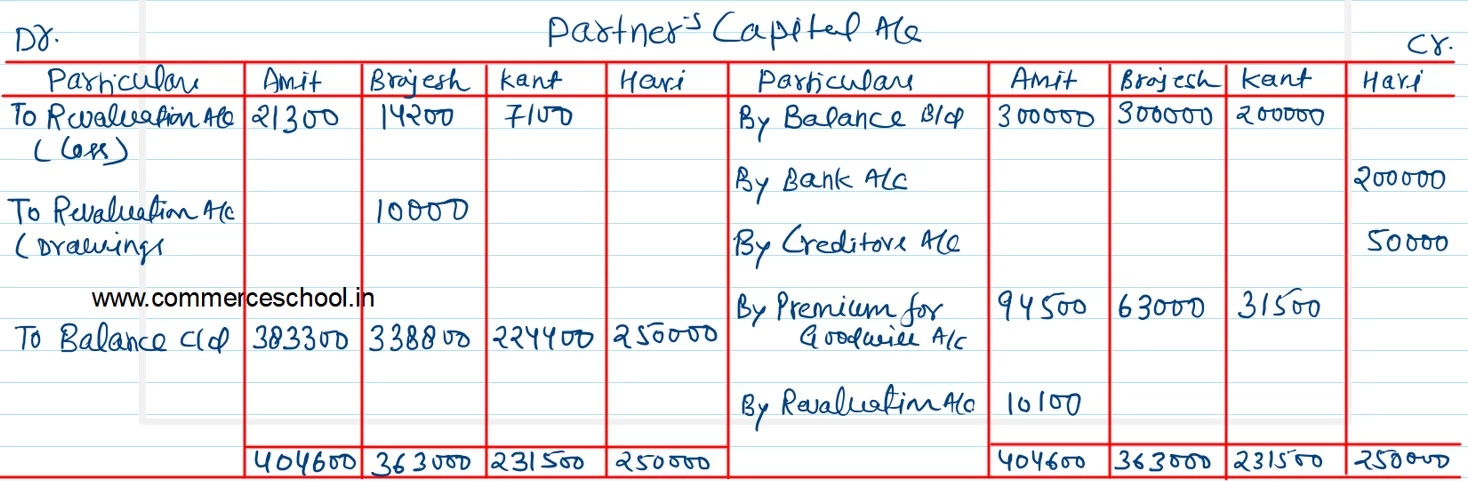

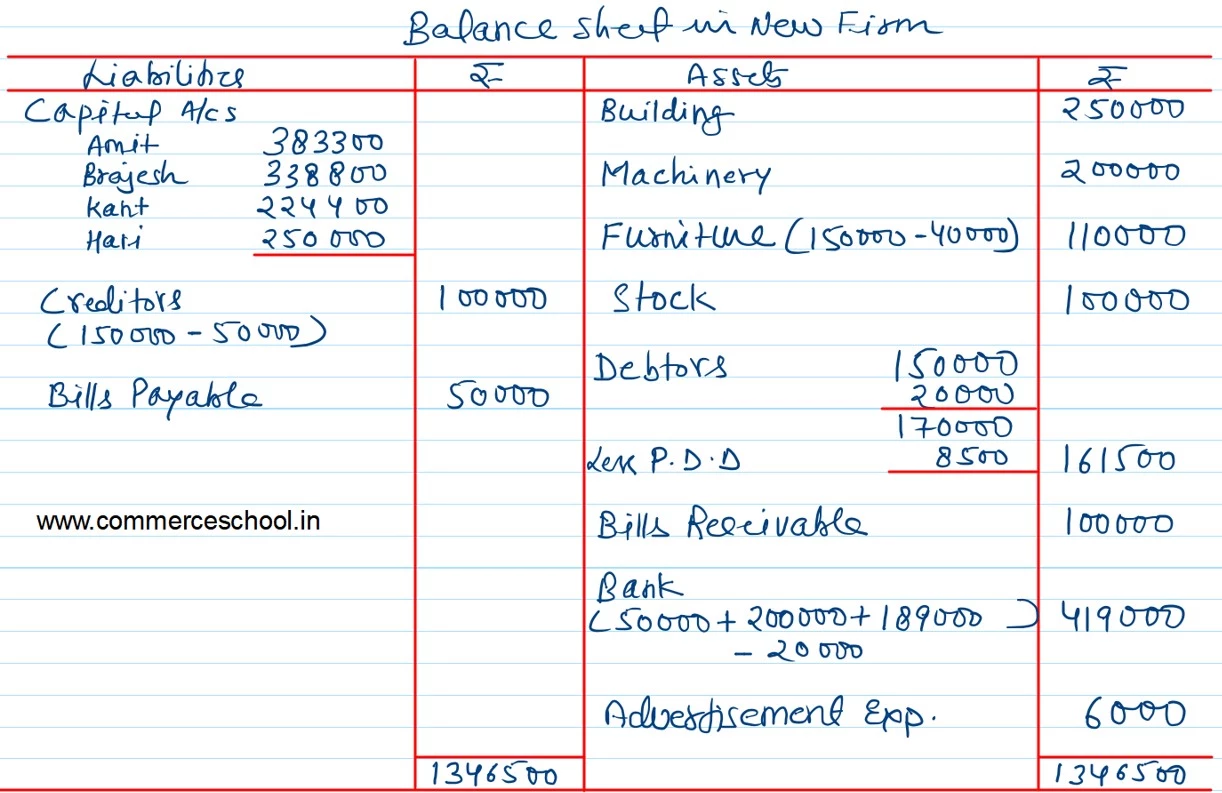

Amit, Brajesh and Kant are partners sharing profits and losses in the ratio of 3 : 2 : 1. Hari is admitted as a new partner on 1st April, 2023 for 1/4th share and is to pay ₹ 2,50,000 as capital. Following is the Balance Sheet of the firm as at 31st March, 2023.

Amit, Brajesh and Kant are partners sharing profits and losses in the ratio of 3 : 2 : 1. Hari is admitted as a new partner on 1st April, 2023 for 1/4th share and is to pay ₹ 2,50,000 as capital. Following is the Balance Sheet of the firm as at 31st March, 2023.

| Liabilities | ₹ | Assets | ₹ |

| Capital A/cs:

Amit Brajesh Kant Creditors Bills Payable |

3,00,000 3,00,000 2,00,000 1,50,000 50,000 |

Building

Machinery Furniture Stock Debtors Bills Receivable Bank |

2,50,000 2,00,000 1,50,000 1,00,000 1,50,000 1,00,000 50,000 |

| 10,00,000 | 10,00,000 |

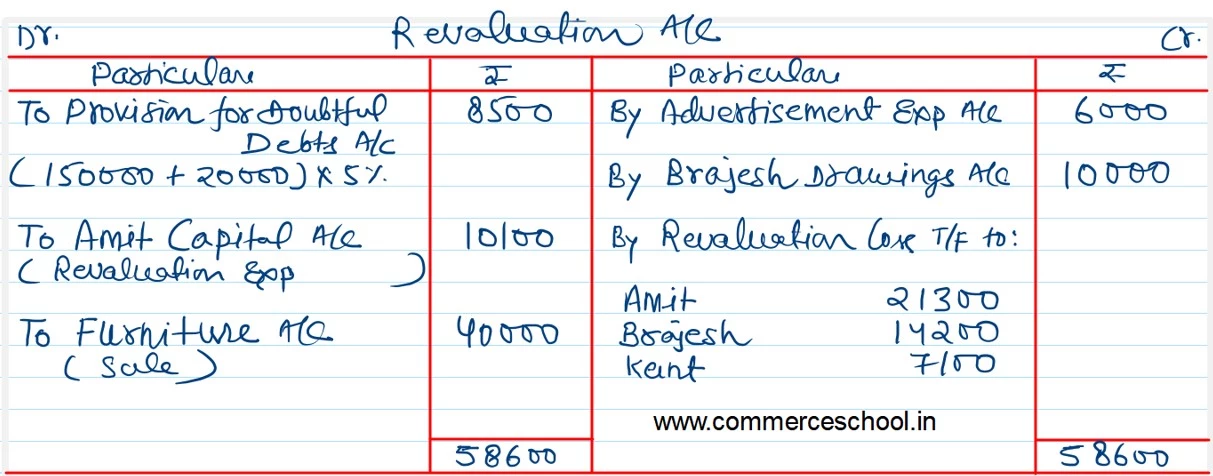

Following are the required adjustments on Hari’s admission:

(i) Out of the creditors, a sum of ₹ 50,000 is owing to Hari. This amount shall be adjusted as a part of his capital.

(ii) Bills of ₹ 80,000 were discounted with the bank, out of which, a bill of ₹ 20,000 was dishonoured on 31st March, 2023, but entry has not been passed for dishonour, Due dates of the other discounted bills fall in April, 2023.

(iii) Advertisement Expenditure includes ₹ 6,000 which is for the next accounting period.

(iv) Miscellaneous Expenses debited in the profit & Loss Account includes ₹ 10,000 paid for Brajesh’s personal life insurance policy.

(v) Provision for Doubtful Debts @ 5% is to be created against Debtors.

(vi) Expenses on revaluation amounting to ₹ 10,100 is paid by Amit.

(vii) During the year, part of the furniture was sold for ₹ 25,000. The book value of the furniture sold was ₹ 40,000 and the written down value on the date of sale is ₹ 35,000. The proceeds was wrongly credited to Sales Account.

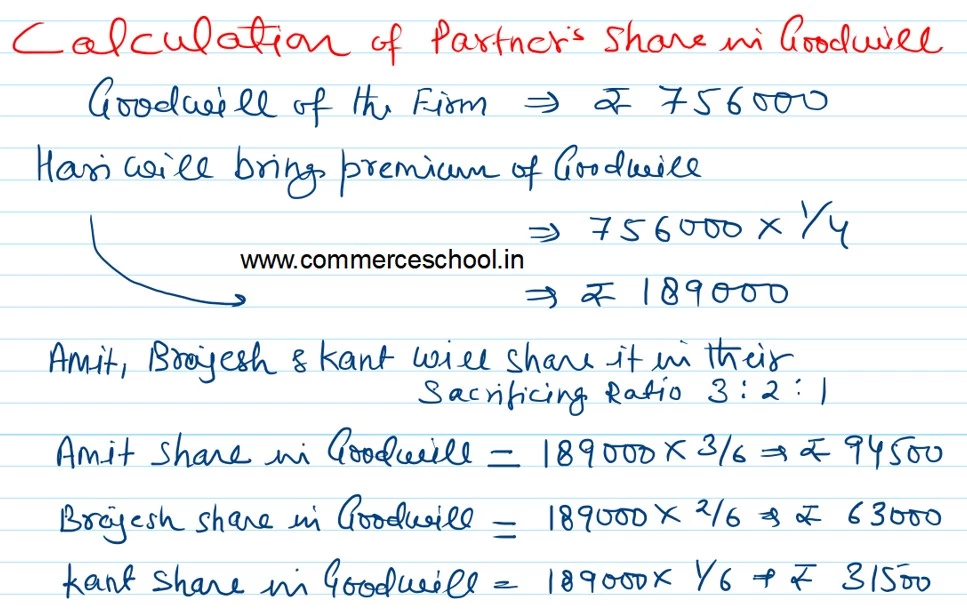

(viii) Value of the goodwill is ₹ 7,56,000 and Hari brings his share by cheque.

Prepare the Revaluation Account, Partner’s Capital Accounts and the Balance Sheet after Hari’s admission.