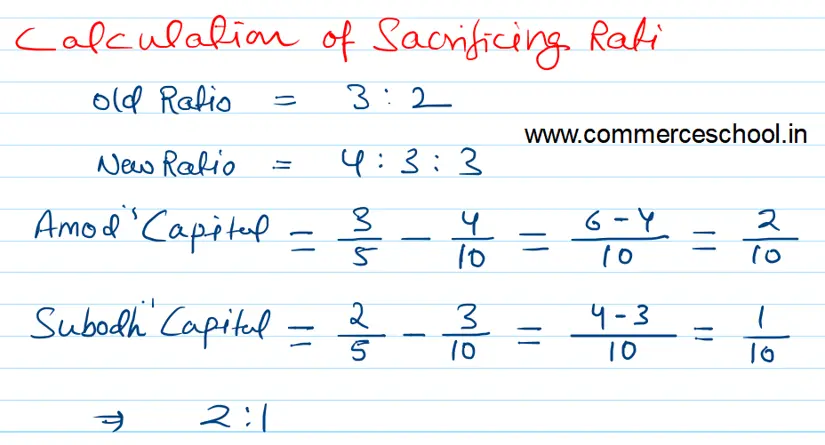

Amod and Subodh are partners sharing profits in the ratio of 3 : 2. They admit Pramod as a new partner from 1st April, 2023. They have decided to share future profits in the ratio of 4 : 3 : 3. The Balance Sheet as at 31st March, 2023 is given below:

Amod and Subodh are partners sharing profits in the ratio of 3 : 2. They admit Pramod as a new partner from 1st April 2023. They have decided to share future profits in the ratio of 4 : 3 : 3. The Balance Sheet as at 31st March 2023 is given below:

| Liabilities | ₹ | Assets | ₹ | |

| Amod’s Capital

Subodh’s Capital Workmen Compensation Reserve Investment Fluctuation Reserve Employee’s Provident Fund Pramod’s Loan |

3,52,000 5,08,000 40,000 20,000 68,000 6,00,000 |

Goodwill

Land and Building Investment (Market Value ₹ 90,000) Debtors Stock Bank Balance Advertisement Suspense A/c |

2,00,000

|

68,000 1,20,00 1,00,000 1,80,000 6,00,000 5,00,000 20,000 |

| 15,88,000 | 15,88,000 |

Terms of Pramod’s admission are as follows:

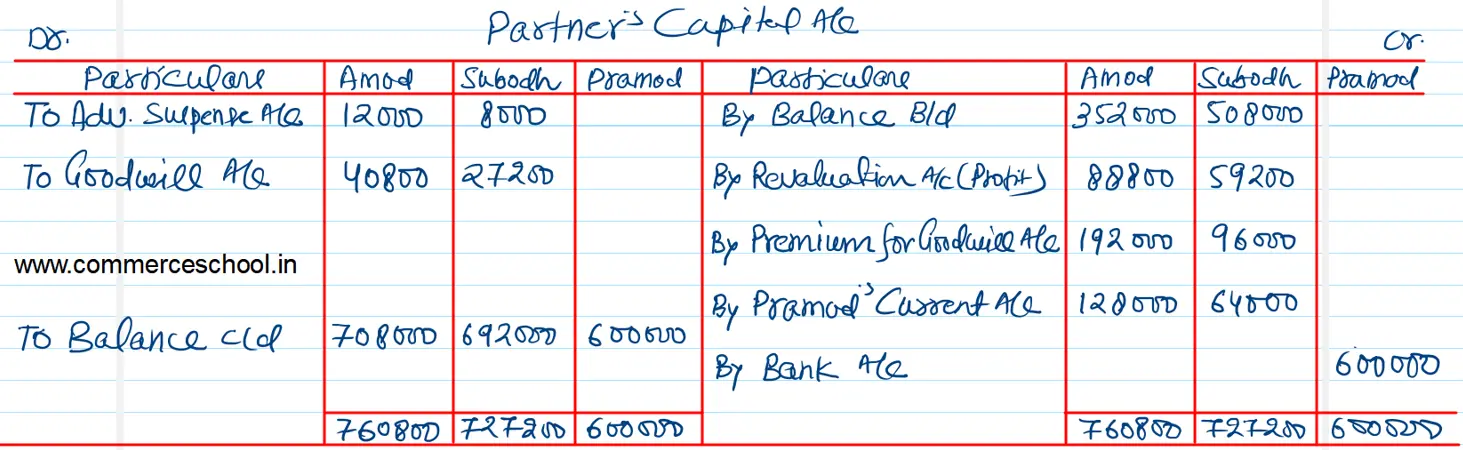

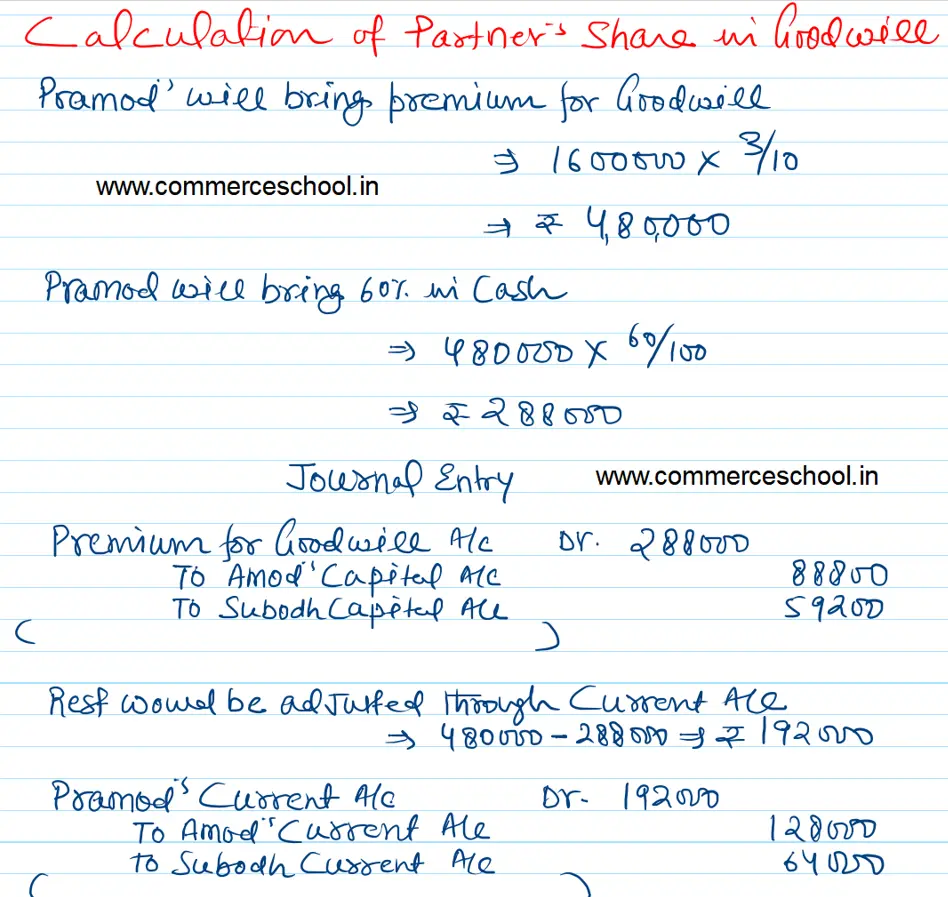

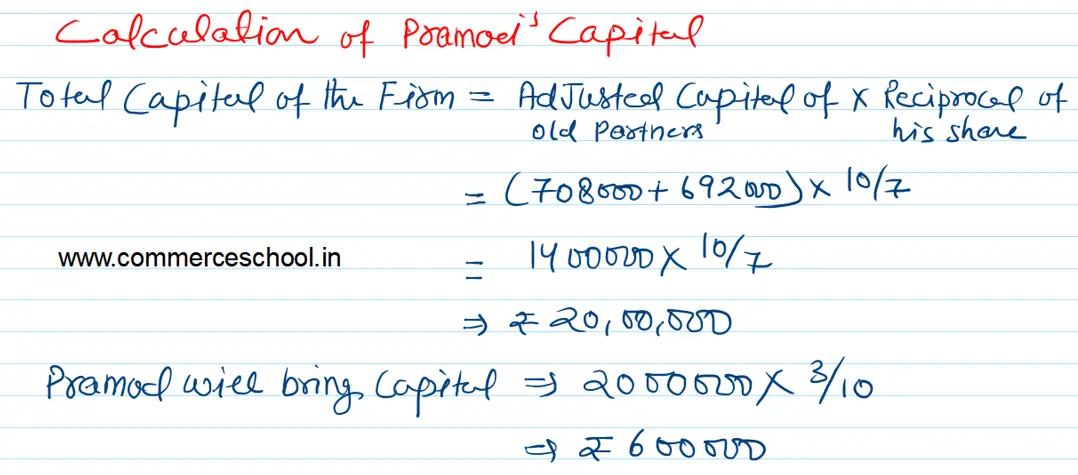

(i) Pramod contributes proportionate capital and 60% of his share of goodwill in cash.

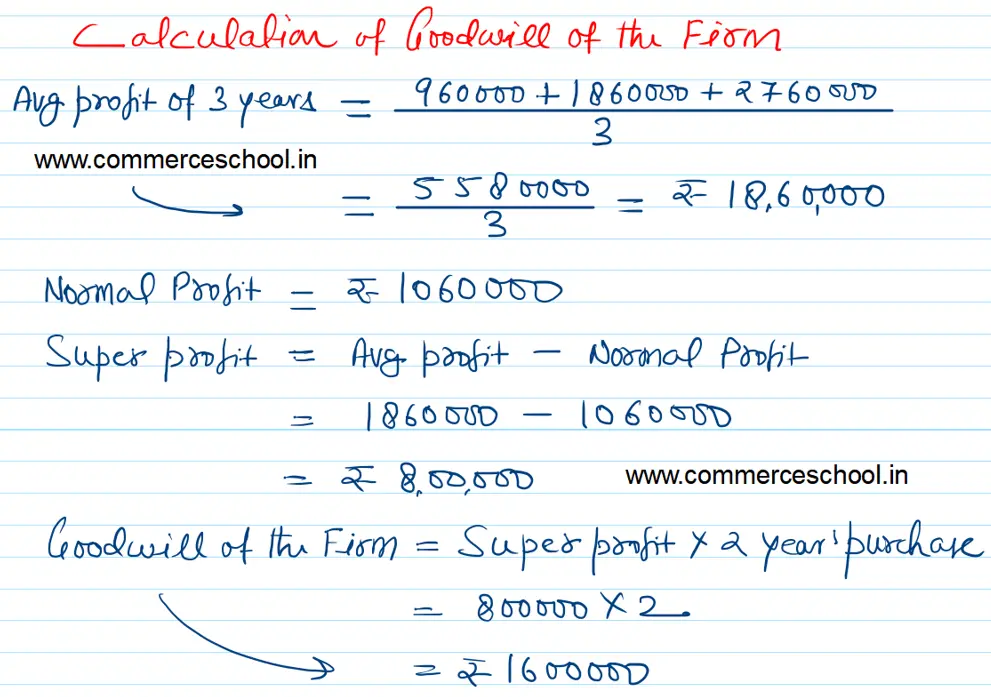

(ii) Goodwill is to be valued at 2 year’s purchase of super profit of last three completed years. Profits for three years ended 31st March, were:

2021 – ₹ 9,60,000; 2022 – ₹ 18,60,000; 2023 – ₹ 27,60,000.

Normal Profit is ₹ 10,60,000 with same amount of capital invested in similar industry.

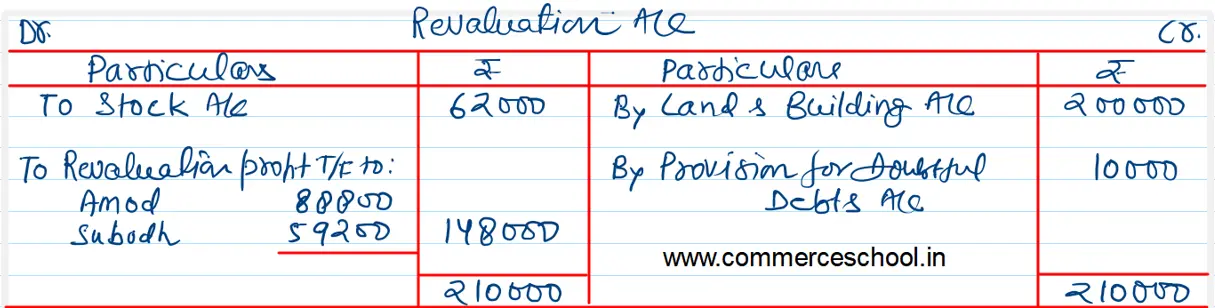

(iii) Land and Building was found undervalued by ₹ 2,00,000.

(iv) Stock was found overvalued by ₹ 62,000.

(v) Provision for Doubtful Debts is to be made equal to 5% of the debtors.

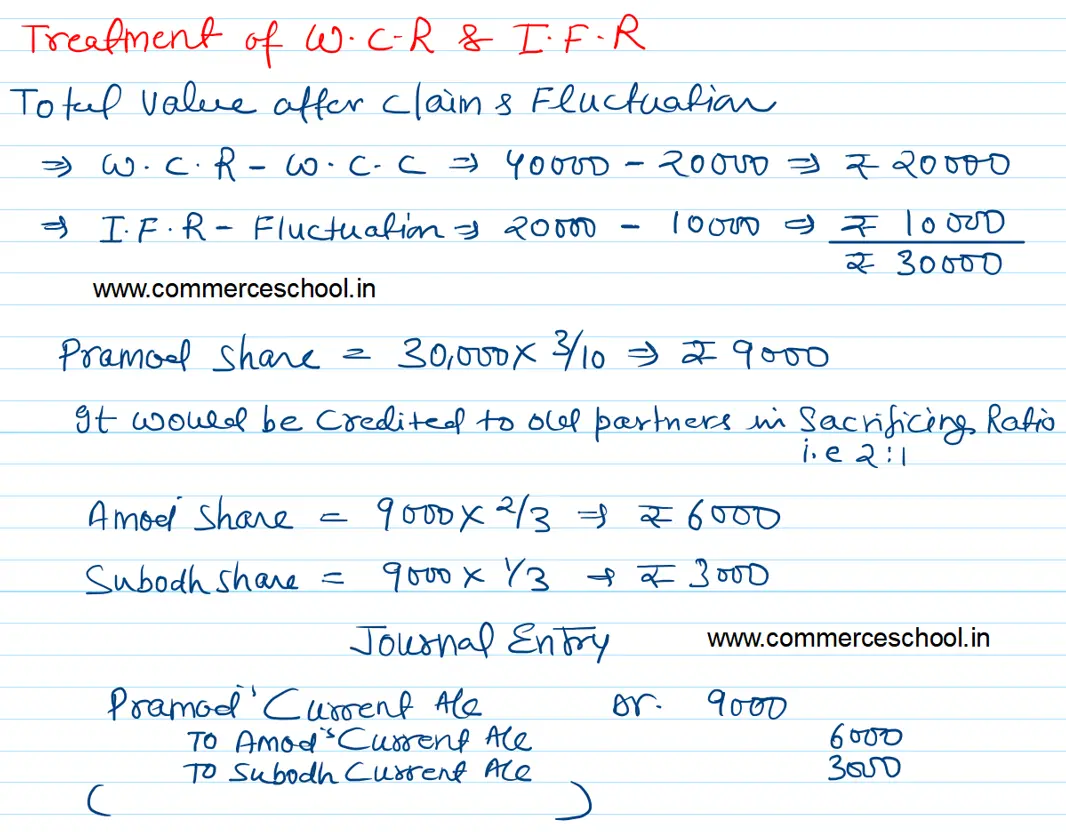

(vi) Claim on account of Workmen Compensation is ₹ 20,000.

(vii) Workmen Compensation Reserve and Investment Fluctuation Reserve are to exist in the books of the new firm after adjusting Workmen Compensation Claim and difference between the book value and market value of investment. This adjustment is to be made through partner’s current accounts.

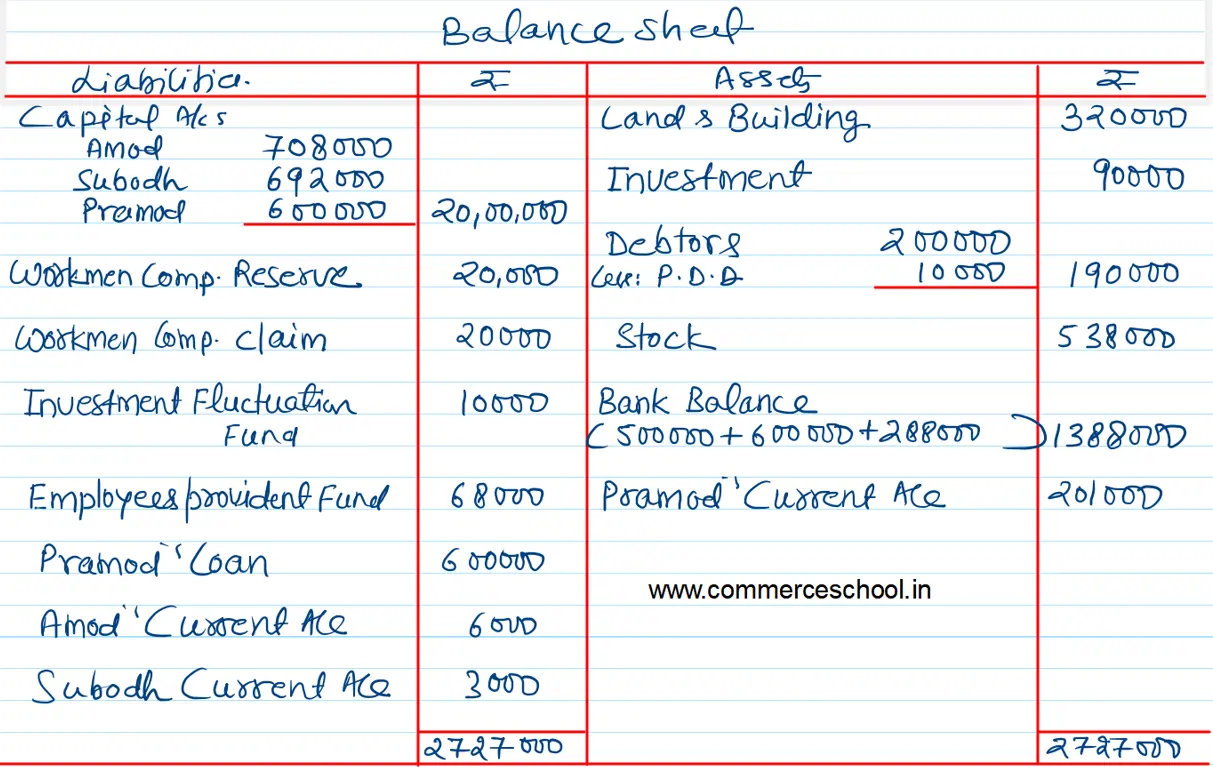

Prepare Revaluation Account, Partner’s Capital Accounts, and Balance Sheet of the reconstituted firm.