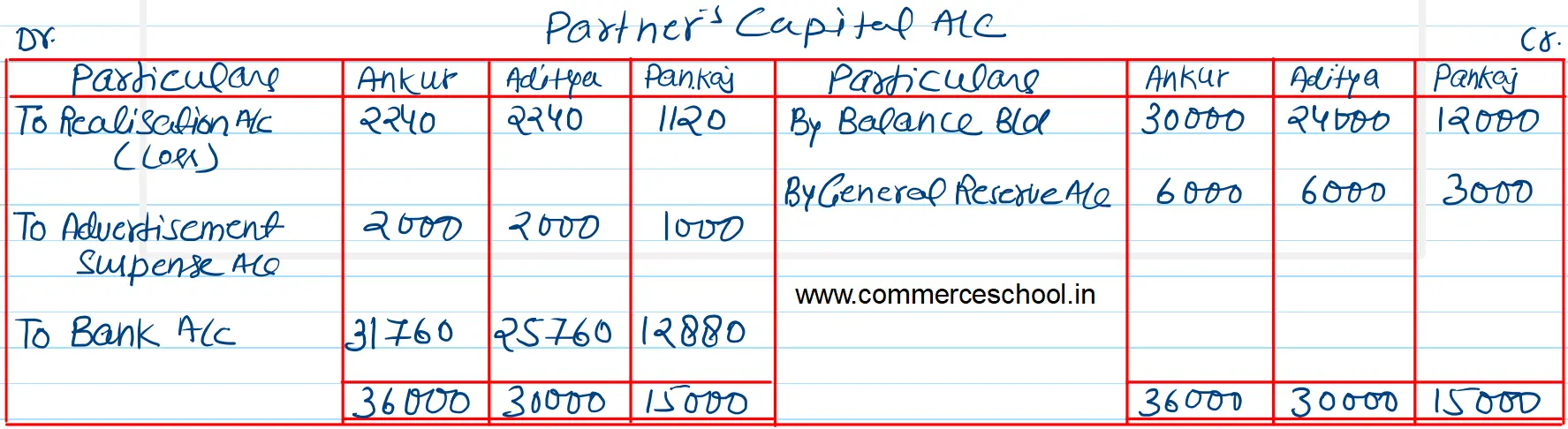

Ankur Aditya and Pankaj were partners sharing profits and losses in the ratio of 2 : 2 : 1. On 1st April, 2022, their Balance Sheet was as follows:

Ankur Aditya and Pankaj were partners sharing profits and losses in the ratio of 2 : 2 : 1. On 1st April, 2022, their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ | |

|

Capital A/cs: Ankur Aditya Pankaj Reserve Creditors |

30,000 24,000 12,000 15,000 24,000 |

Cash at Bank Debtors Less: PDD Stock Furniture Building Advertisement Suspense |

16,000 4,00 |

24,400

15,600 12,000 4,000 44,000 5,000 |

| 1,05,000 | 1,05,000 |

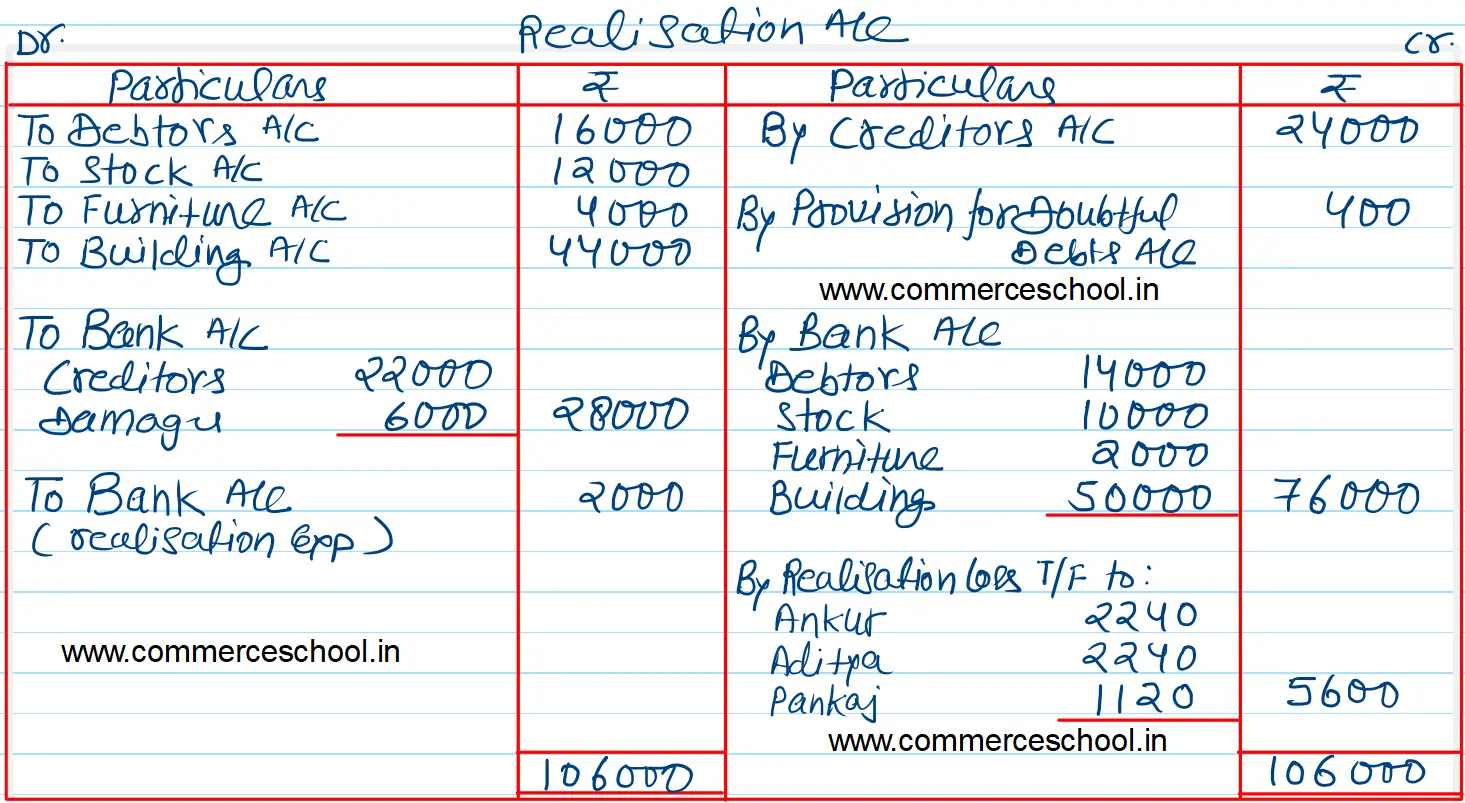

The firm was dissolved on that date. The assets realised were as follows:

| Debtors | ₹ 14,000 |

| Stock | ₹ 10,000 |

| Furniture | ₹ 2,000 |

| Building | ₹ 50,000 |

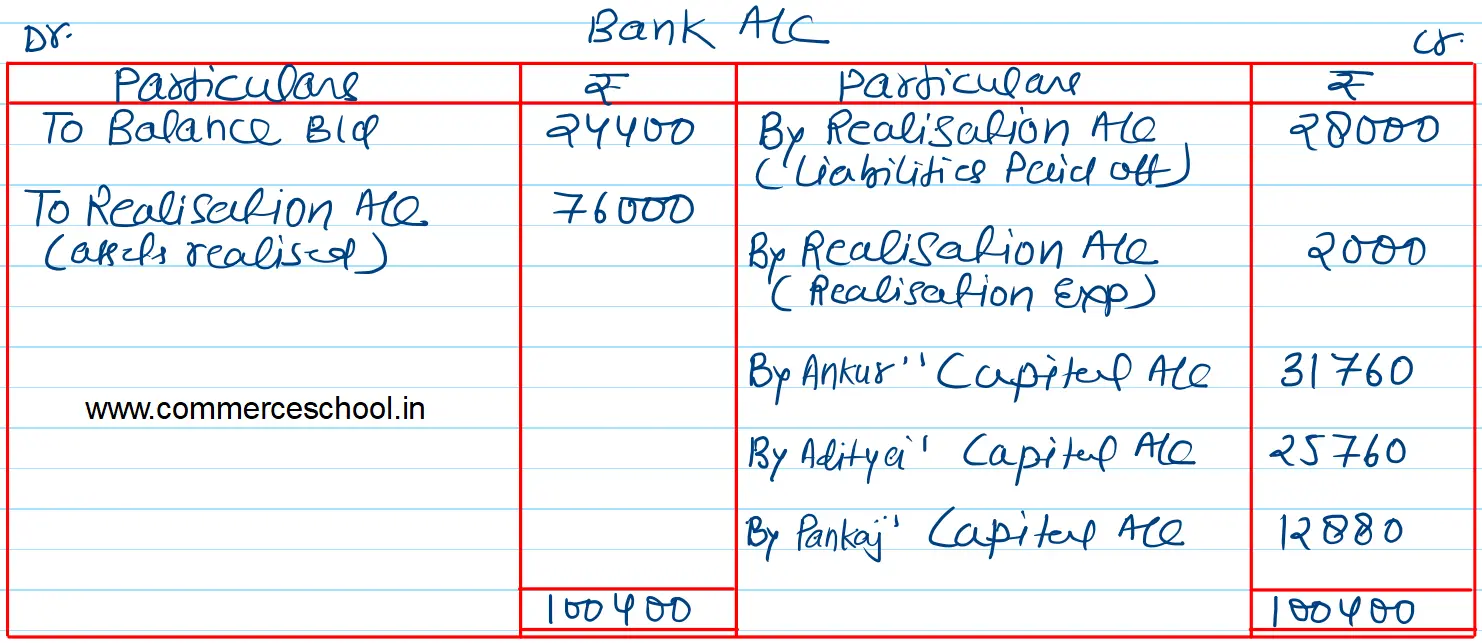

Creditors were settled for ₹ 22,000. It was noticed that a liability of ₹ 6,000 for damages existed which had to be paid. Realisation Expenses amounted to ₹ 2,000.

Prepare Realisation Account, Partner’s Capital Account and Bank Account to close the books of the firm.

Anurag Pathak Answered question