Arnab, Ragini and Dhrupad are partners sharing profits in the ratio of 3 : 1 : 1. Last year, conflicts arose due to certain issues of disagreements and on 31st March, 2023, they decided to dissolved the firm. On that date their Balance sheet was as under:

Arnab, Ragini and Dhrupad are partners sharing profits in the ratio of 3 : 1 : 1. Last year, conflicts arose due to certain issues of disagreements and on 31st March, 2023, they decided to dissolve the firm. On that date their Balance sheet was as under:

| Liabilities | ₹ | Assets | ₹ | |

| Creditors

Arnab’s Brother’s Loan Dhrupad’s Loan Investment Fluctuation Reserve Capital A/cs: Arnab Ragini Dhrupad |

60,000

95,000 1,00,000 50,000 2,75,000 2,00,000 1,70,000 |

Bank

Debtors Stock Investments Building Profit & Loss Account |

1,70,000 20,00 |

50,000

1,50,000 1,50,000 2,50,000 3,00,000 50,000 |

| 9,50,000 | 9,50,000 |

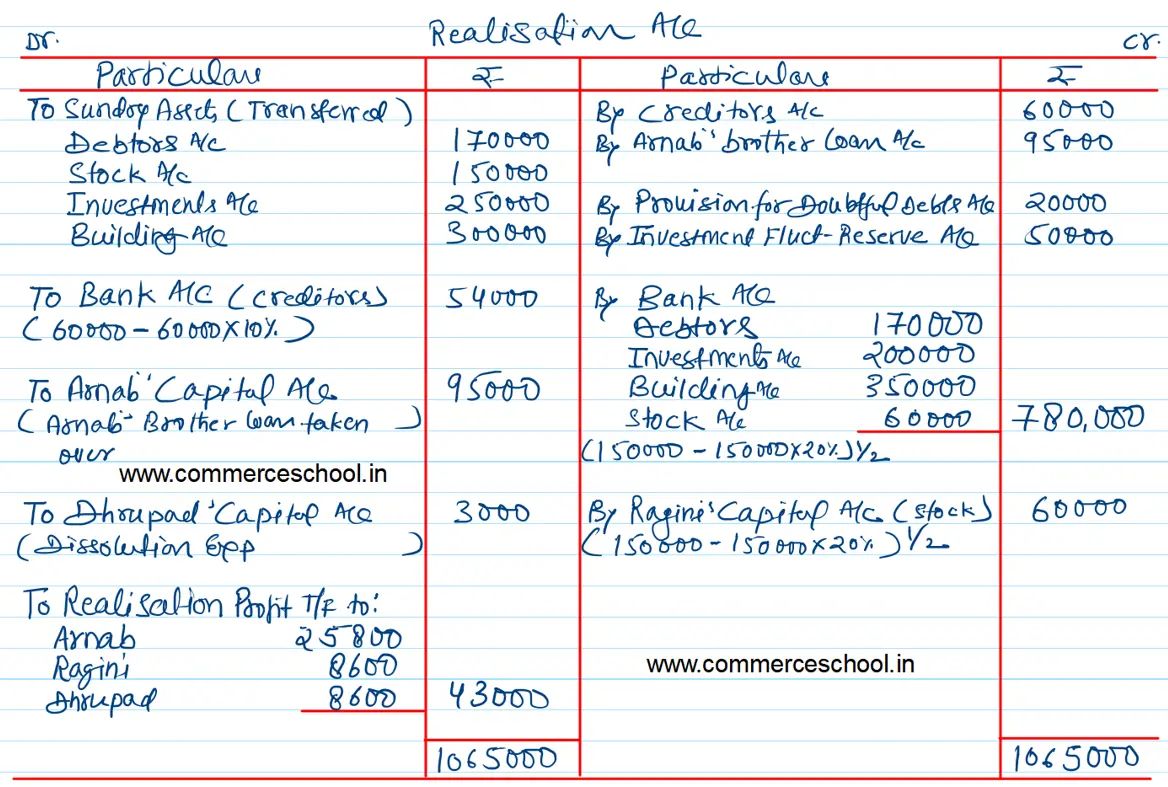

The Assets were realised and the liabilities were paid as under:

(i) Arnab agreed to pay his brother’s loan.

(ii) Investments realised 20% less.

(iii) Creditors were paid at 10% less.

(iv) Building was auctioned for ₹ 3,55,000. Commission on auction was ₹ 5,000.

(v) 50% of the stock was taken over by Ragini at market price which was 20% less than the book value and the remaining was sold at market price.

(vi) Dissolution expenses were ₹ 8,000; ₹ 3,000 were to be borne by the firm and the balance by Dhrupad. The expenses were paid by him.

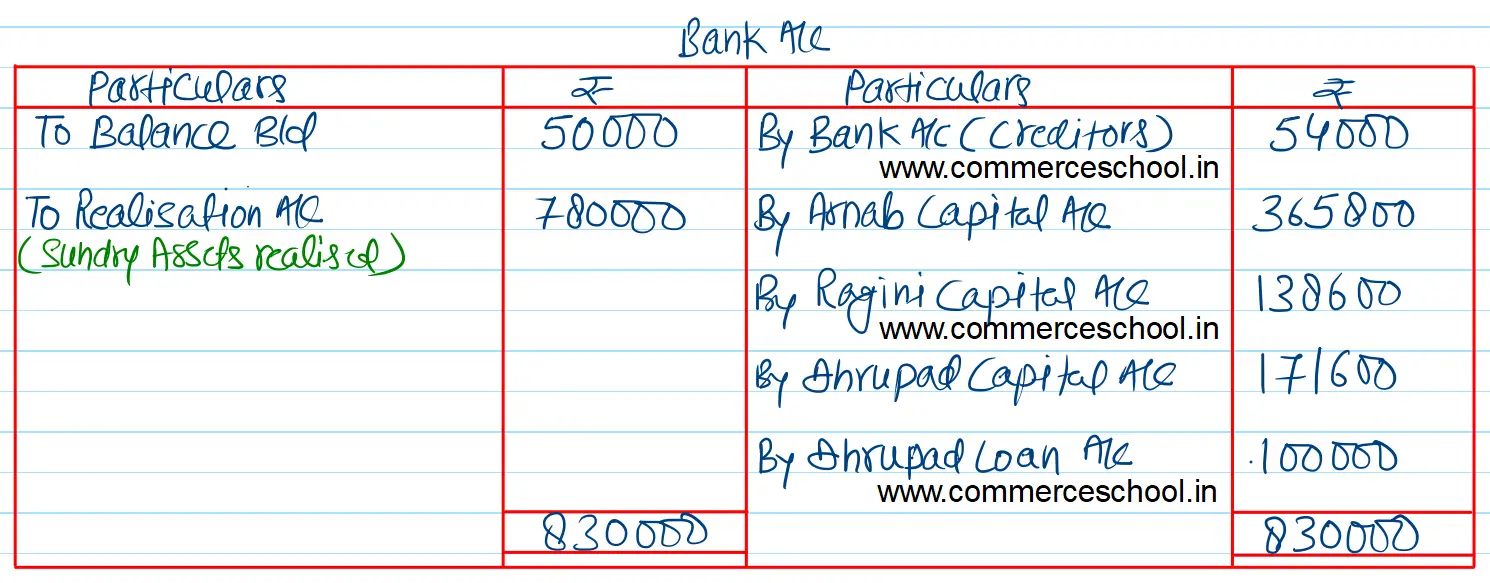

Prepare Realisation Account and Parnter’s Capital Accounts.

[Ans.: Loss on Realisation – ₹ 1,27,000; Final Payments: Arnal – ₹ 2,63,800; Ragini – ₹ 1,04,600 and Dhrupad – ₹ 1,37,600.]