Arsh and Daksh are partners in a firm with profit sharing ratio as follows: 1/2 to Arsh, 1/3 to Daksh and 1/6 carried to a Reserve. They admit Sachi as a partner on 1st April, 2023. The Balance Sheet of the firm as at 31st March, was as follows:

Arsh and Daksh are partners in a firm with profit sharing ratio as follows: 1/2 to Arsh, 1/3 to Daksh and 1/6 carried to a Reserve. They admit Sachi as a partner on 1st April, 2023. The Balance Sheet of the firm as at 31st March, was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Capital A/cs:

Arsh Daksh General Reserve Workmen Compensation Reserve Employee’s Provident Fund Creditors |

50,000 40,000 30,000 5,000 5,000 20,000 |

Building

Machinery Stock Debtors Cash at Bank Goodwill Advertisement Expenditure |

50,000 30,000 18,000 22,000 5,000 20,000 5,000 |

| 1,50,000 | 1,50,000 |

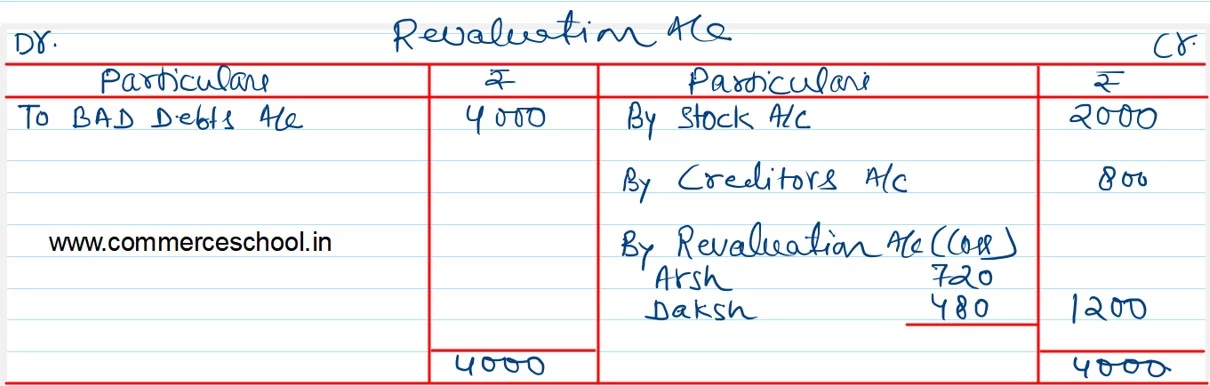

Following adjustments are required on the admission of Sachi:

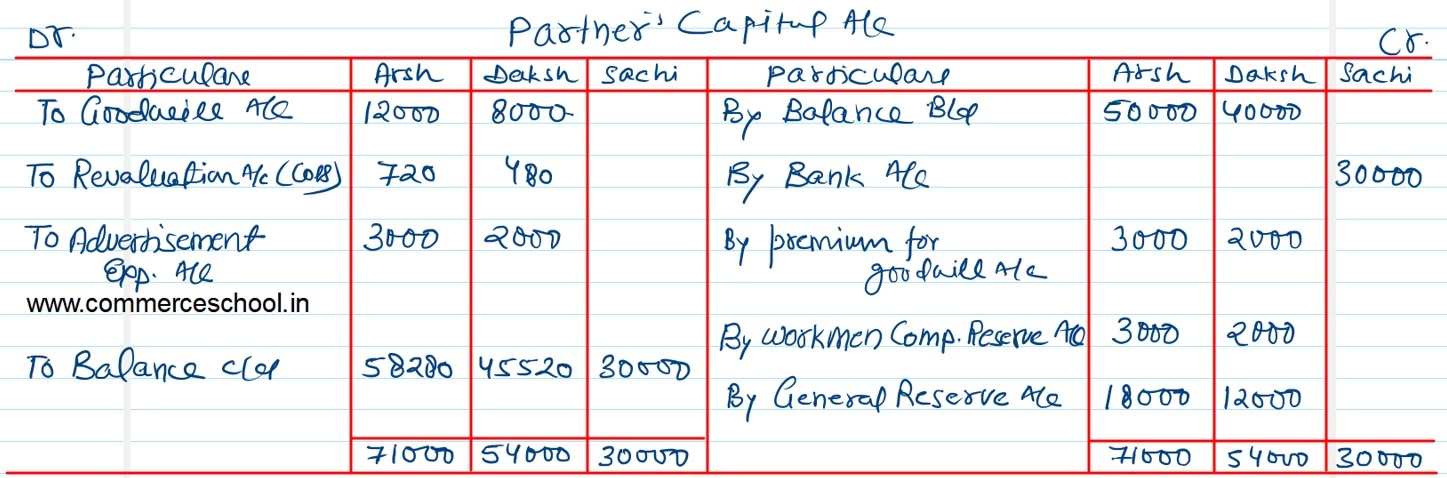

(i) Sachi brings ₹ 30,000 for 1/5th share in the firm.

(ii) Goodwill of the firm was valued at ₹ 25,000 and Sachi brings her share of goodwill in cash.

(iii) Stock is undervalued by 10%.

(iv) Creditors include ₹ 800 which is not to be paid, therefore, has to be written back.

(v) For Debtors, the following debts proved bad or doubtful –

(a) ₹ 2,000 due from Amit, bad to the full extent.

(b) ₹ 4,000 due from Bhushan – insolvent, estate expected to pay on 50%.

Prepare Revaluation Account, Partner’s Capital Accounts and Balance Sheet of the new firm.