Ashish and Akash are partners in a firm sharing profits in the ratio of 3 : 2. Their Balance Sheet as at 31st March, 2023 was as under:

Ashish and Akash are partners in a firm sharing profits in the ratio of 3 : 2. Their Balance Sheet as at 31st March, 2023 was as under:

| Liabilities | ₹ | Assets | ₹ | |

| Capital A/cs:

Ashish Akash General Reserve Bank Loan Creditors |

35,000 30,000 10,000 9,000 36,000 |

Machinery

Furniture Investments Stock Debtors Cash |

19,000

|

33,000 15,000 20,000 23,000 17,000 12,000 |

| 1,20,000 | 1,20,000 |

On 1st April, 2023, they admitted Namrata into partnership for 1/4th share in the profit on the following terms:

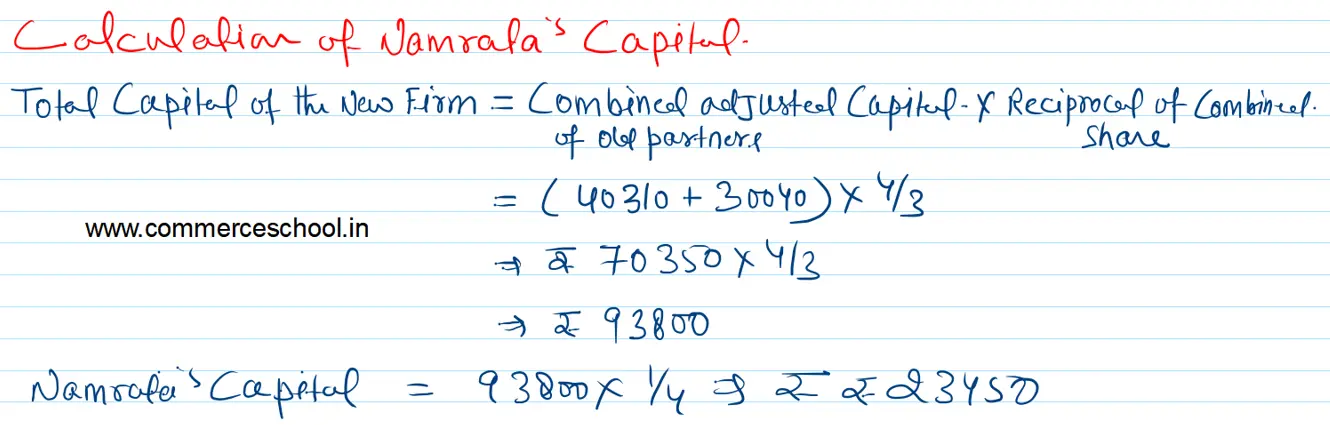

(i) Namrata brings Capital proportionate to her share. She bring ₹ 7,000 in cash as her share of Goodwill.

(ii) All debtors are good.

(iii) Reduce Stock by 5% and Furniture by 10%.

(iv) An outstanding bill for repairs ₹ 1,000 will be brought in books.

(v) Half of the investments were to be taken by Ashish and Akash in their profit sharing ratio at book value.

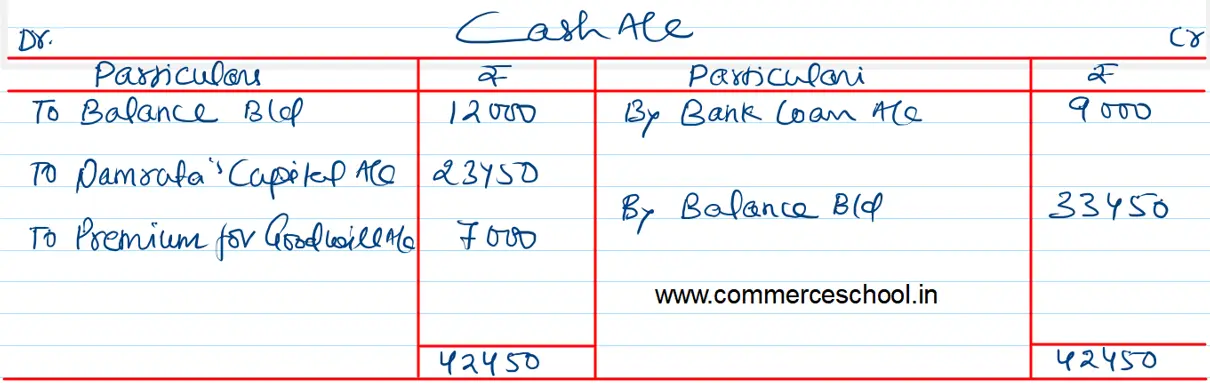

(vi) Bank Loan is paid.

(vii) Partners agreed to share future profits in the ratio of 3 : 3 : 2.

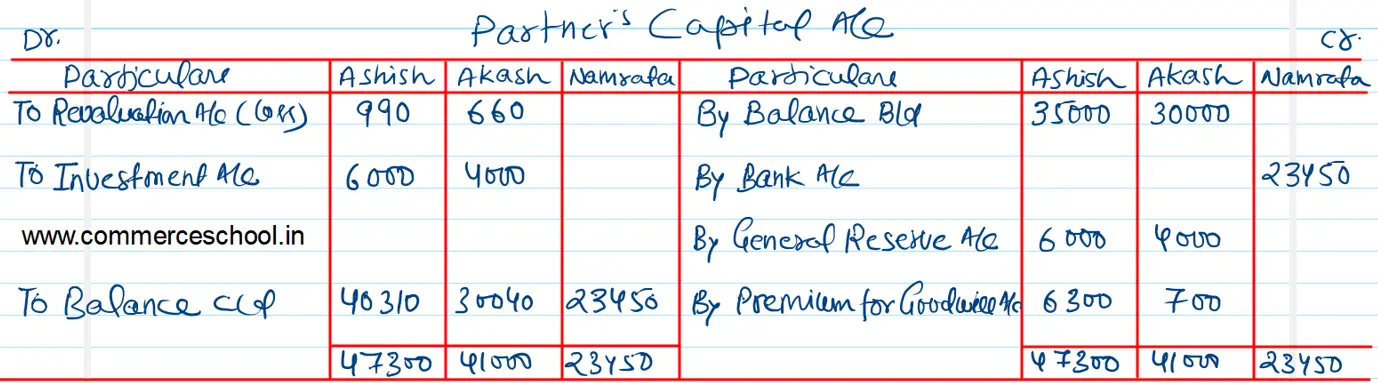

Prepare Revaluation Account, Partner’s Capital Accounts and Balance Sheet of the new firm.

Journal

Journal

| Particulars | Dr. | Cr. |

| Cash A/c Dr. | 30,450 | |

| To Namrata’s Capital A/c To Premium for Goodwill A/c (Being Namrata bring her amount of capital and share of goodwill) | 23,450 7,000 |

| Particulars | Dr. | Cr. |

| Premium for Goodwill A/c Dr. | 7,000 | |

| To Ashish’s Capital A/c To Akash’s Capital A/c (Being premium for goodwill transferred to Partner’s capital A/cs in their sacrificing ratio, i.e., 9 : 1) | 6,300 700 |