Ashish and Kanav were partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March, 2018 their Balance Sheet was as follows:

Ashish and Kanav were partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March, 2018 their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Trade Creditors

Employee’s Provident Fund Mrs. Ashish’s Loan Kanav’s Loan Workmen’s Compensation Fund Investment Fluctuation Reserve Capitals: Ashish Kanav |

42,000 60,000 9,000 35,000 20,000 4,000 1,20,000 80,000 |

Bank

Stock Debtors Furniture Plant Investments Profit & Loss A/c |

35,000 24,000 19,000 40,000 2,10,000 32,000 10,000 |

| 3,70,000 | 3,70,000 |

On the above date they decided to dissolve the firm.

(a) Ashish agreed to take over furniture at ₹ 38,000 and pay Mrs. Ashish’s Loan.

(b) Debtors realised ₹ 18,500 and plant realised 10% more.

(c) Kanav took over 40% of the stock at 20% less than book value. Remaining stock was sold at a gain of 10%.

(d) Trade creditors took over investments in full settlement.

(e) Kanav agreed to take over the responsibility of completing dissolution at an agreed remuneration of ₹ 12,000 and to bear realisation expenses. Actual expenses of realisation amounted to ₹ 8,000.

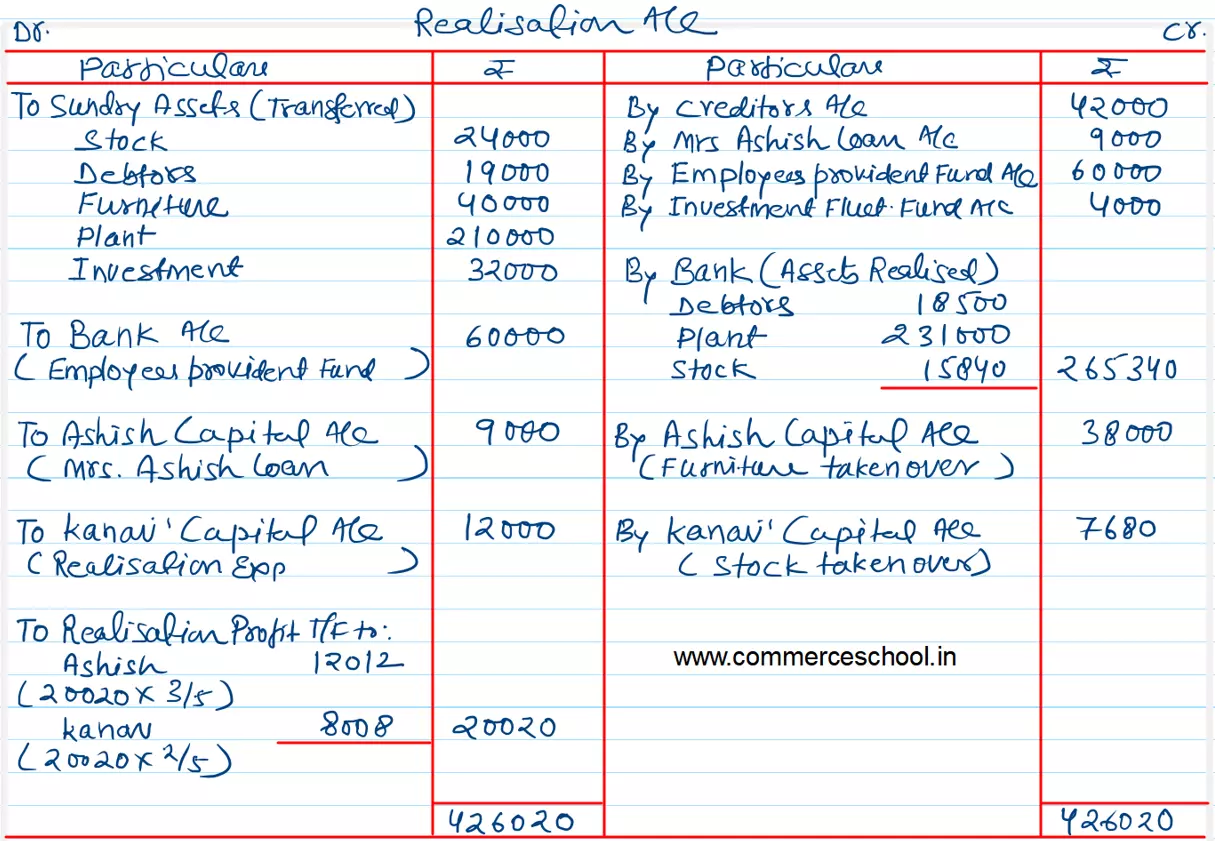

Prepare Realisation Account.

[Ans.: Gain (profit) on Realisaiton – ₹ 20,020.]