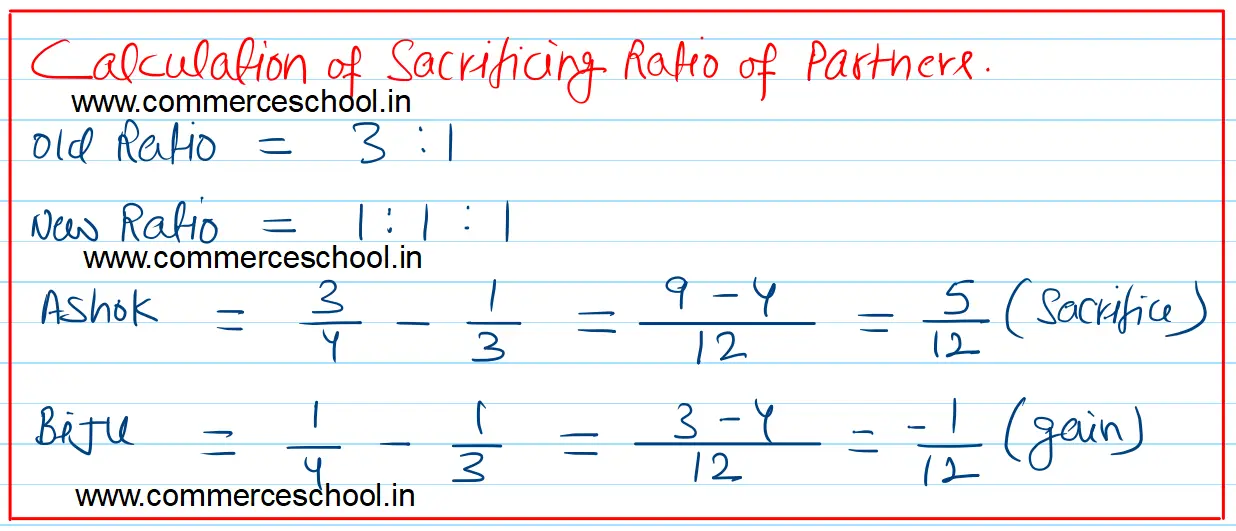

Ashok and Biju were partners sharing profits and losses in the ratio of 3 : 1 respectively. The following was their balance sheet as at 31st March, 2024

Ashok and Biju were partners sharing profits and losses in the ratio of 3 : 1 respectively. The following was their balance sheet as at 31st March, 2024:

| Liabilities | ₹ | Assets | ₹ |

|

Creditors Bank Overdraft Ashok’s Capital Biju’s Capital |

1,20,000 1,50,000 1,50,000 1,00,000 |

Sundry Debtors Stock Furniture Machinery |

2,00,000 2,20,000 40,000 60,000 |

| 5,20,000 | 5,20,000 |

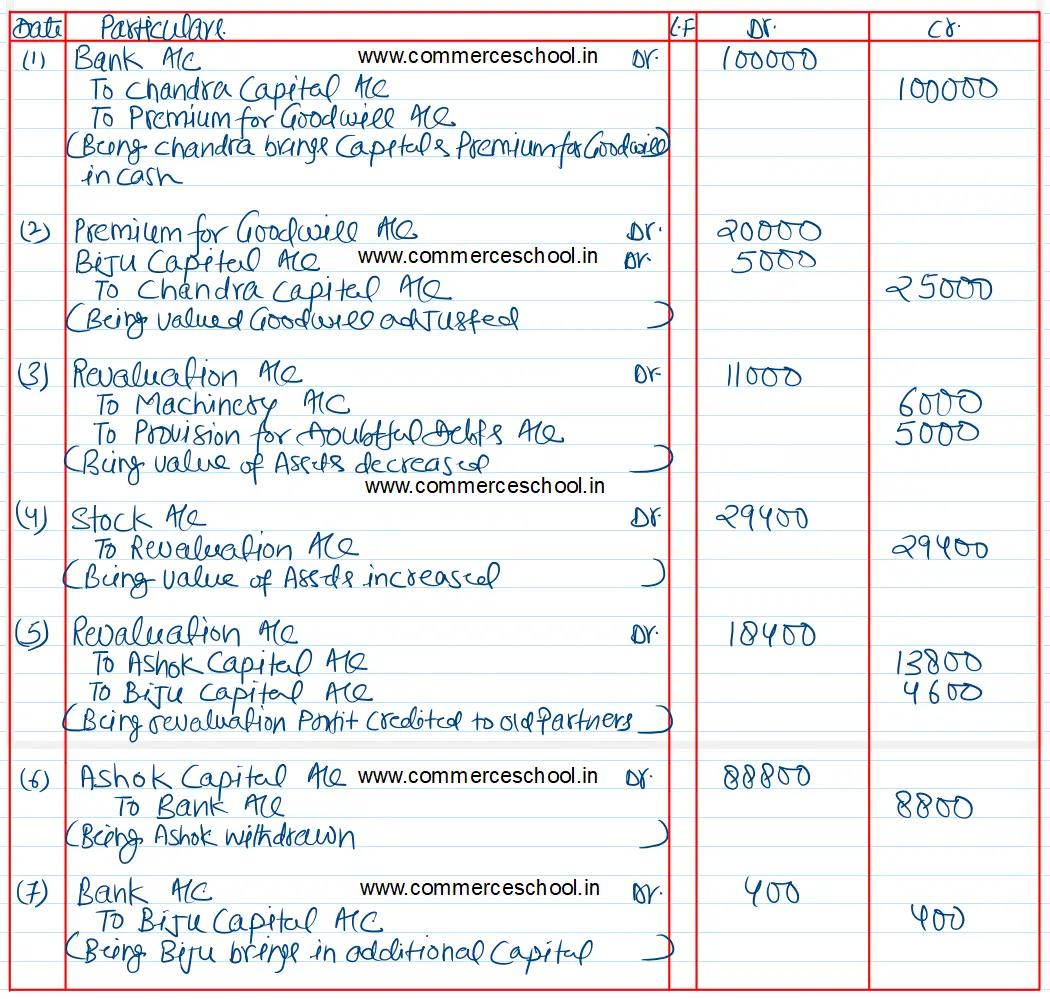

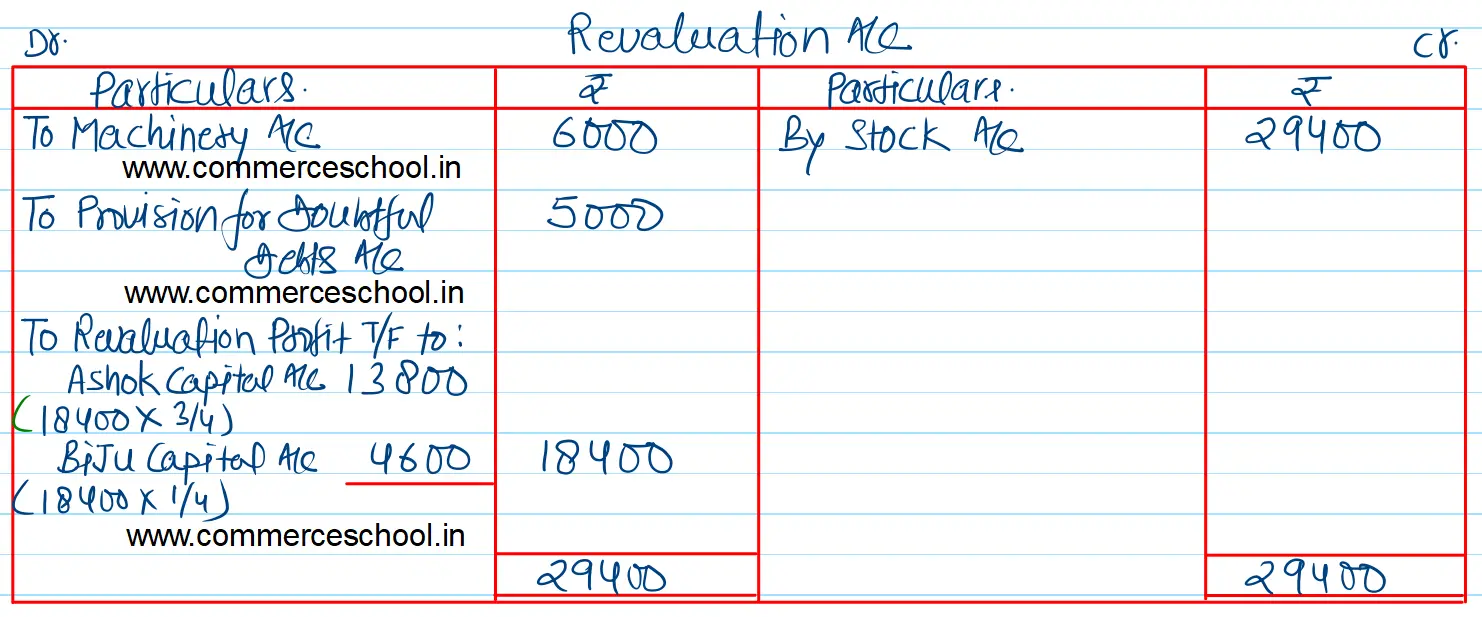

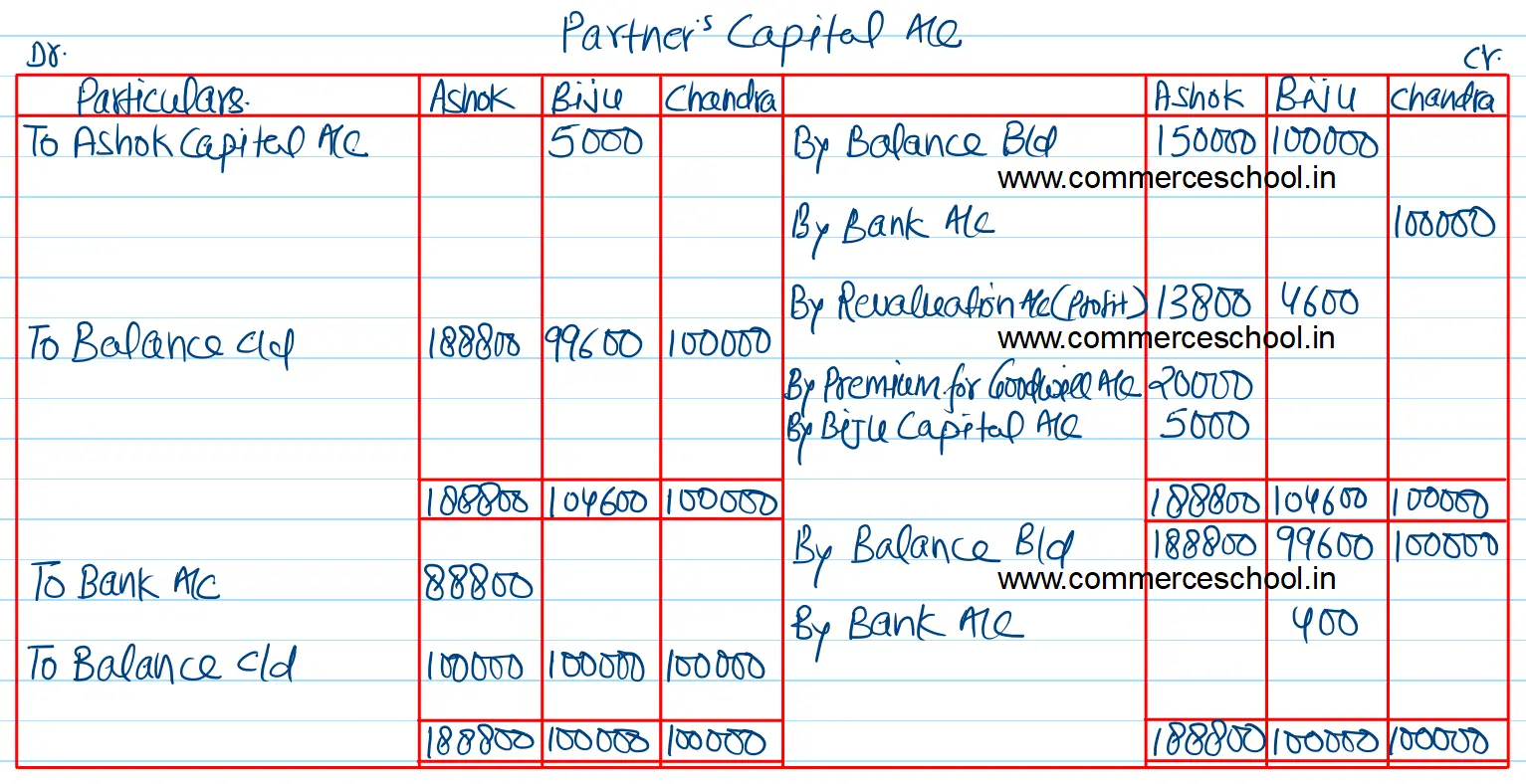

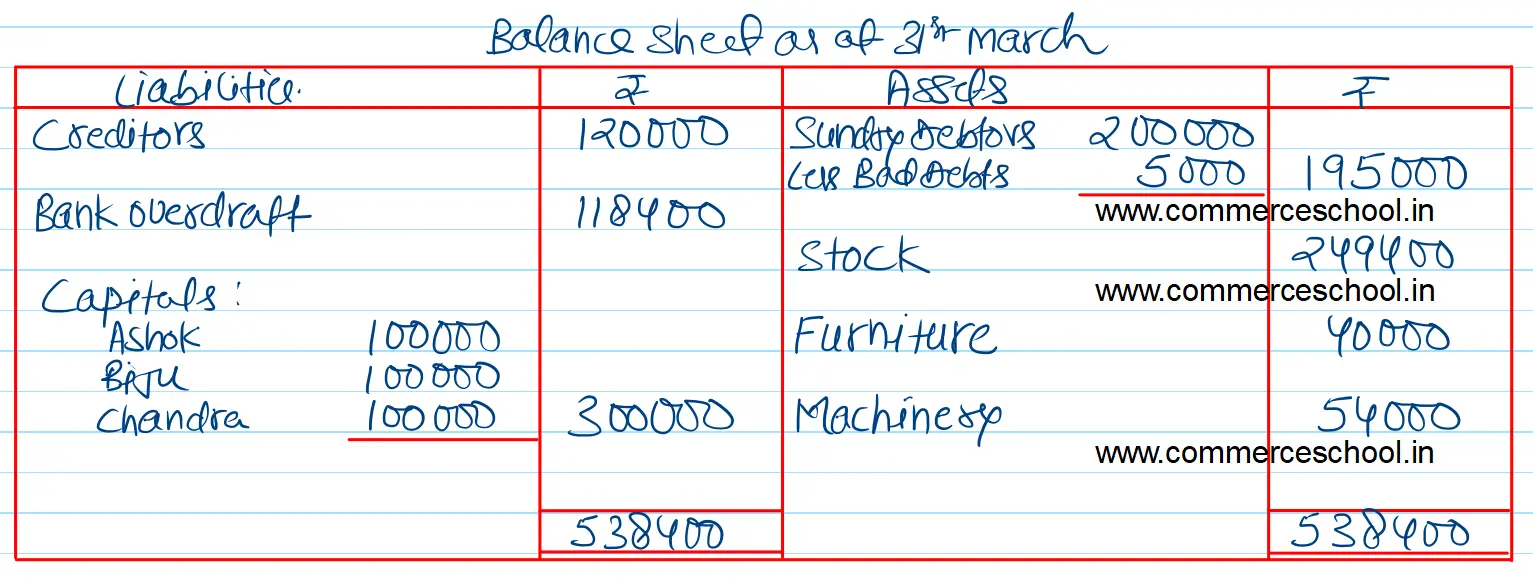

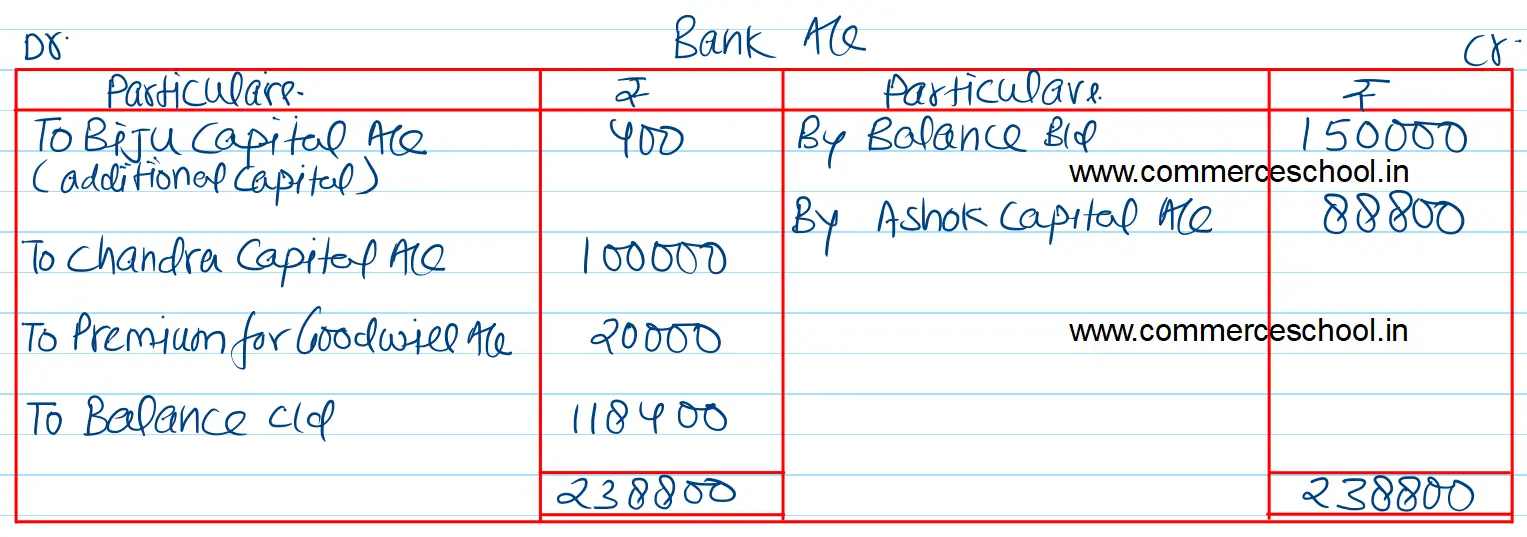

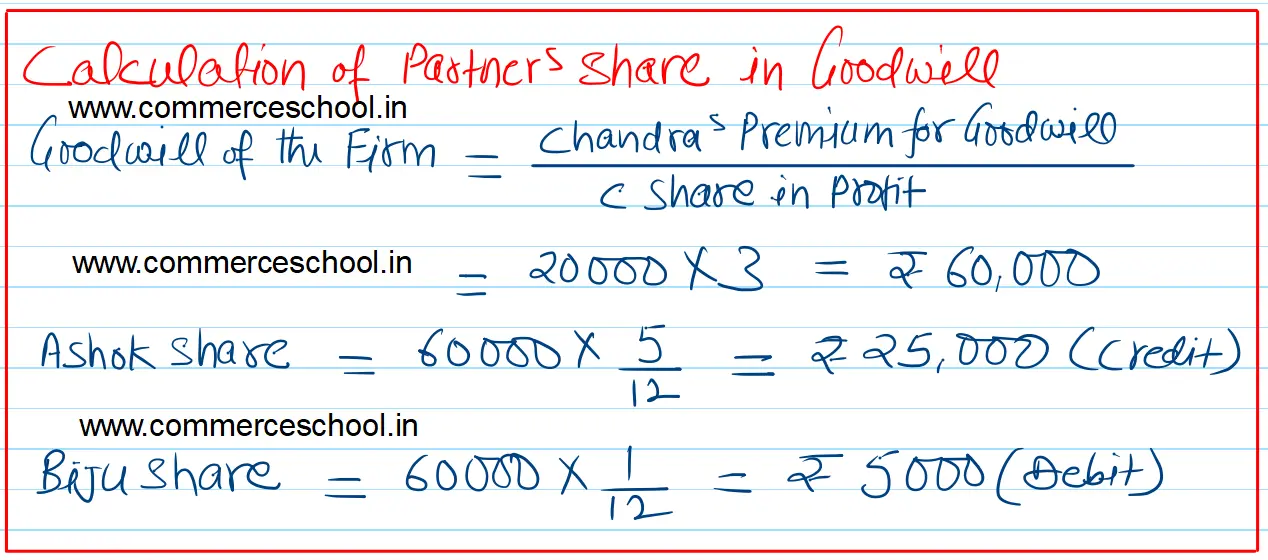

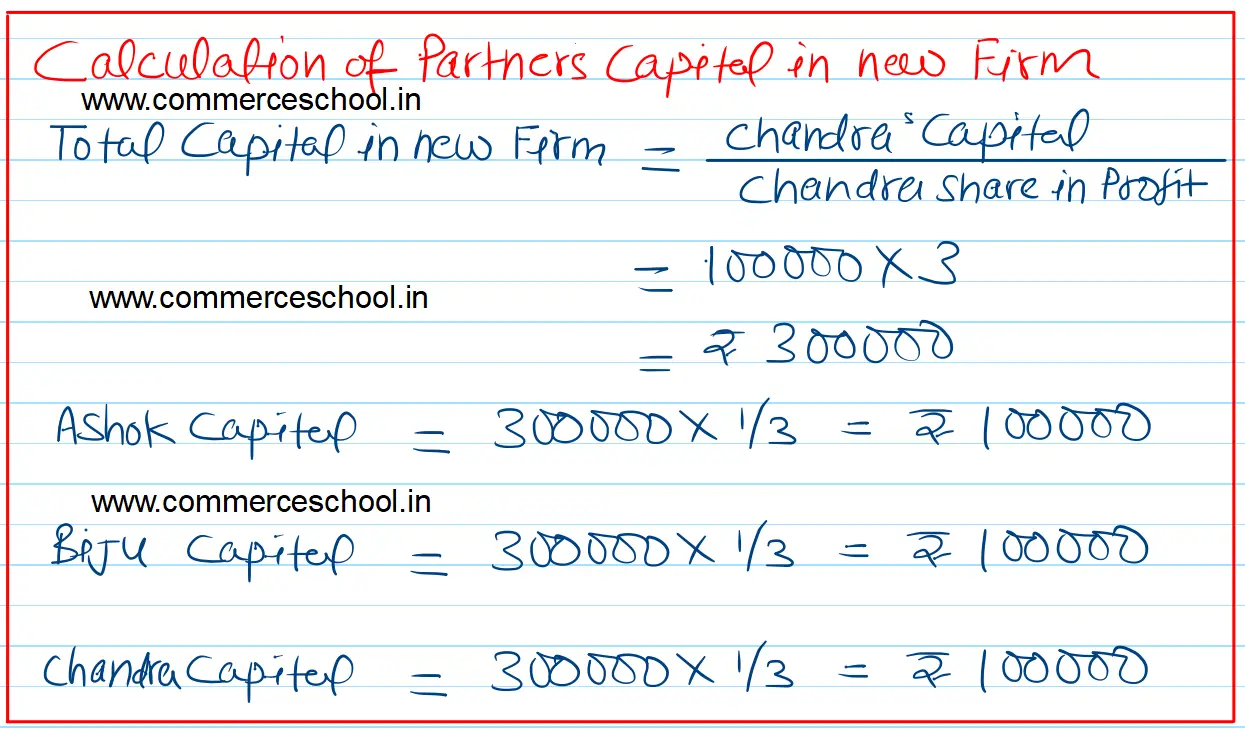

On 1st April, 2024, Chandra was admitted to the firm on the following terms: (I) Chandra would provide ₹ 1,00,000 as a capital and pay ₹ 20,000 as goodwill for his one-third share in future profits. (ii) Ashok, Biju and Chandra would share profits equally. (iii) Machinery would be reduced by 10% and ₹ 5,000 would be provided for bad debts. Stock would be valued at ₹ 2,49,400. (iv) Capital accounts of old partners would be adjusted in the profit sharing ratio on the basis of Chandra’s Capital by bringing in or taking out cash. Pass necessary journal entries and prepare partner’s capital accounts and balance sheet of the new firm. [Ans. Gain on Revaluation ₹ 18,400; Final Capitals ₹ 1,00,000 each; Ashok withdraws ₹ 88,800 and Biju brings in ₹ 400; Bank overdraft balance ₹ 1,18,400; Balance Sheet Total ₹ 5,38,400.]