Ashu and Harish are partners sharing profit and losses as 3 : 2. They decided to dissolve the firm on 31st March 2023. Their Balance sheet on the above date was:

Ashu and Harish are partners sharing profit and losses as 3 : 2. They decided to dissolve the firm on 31st March 2023. Their Balance sheet on the above date was:

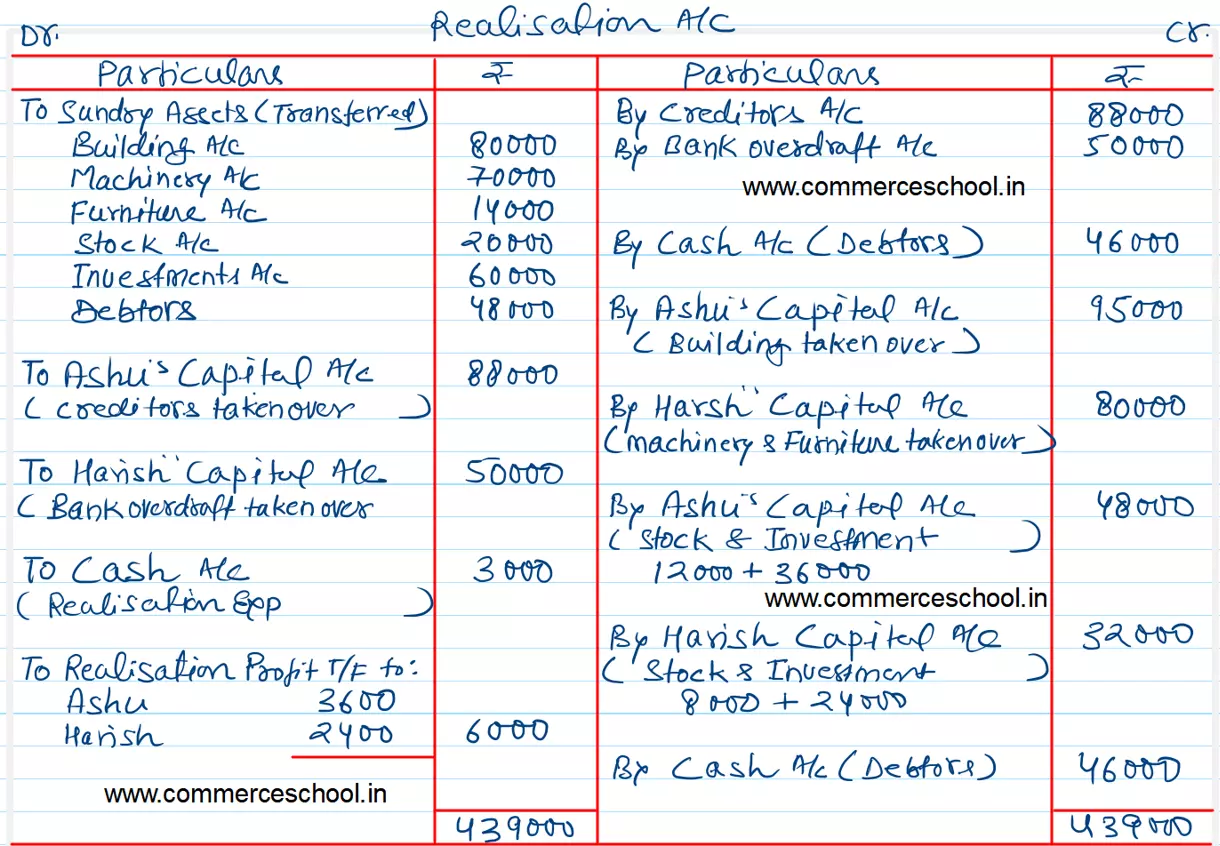

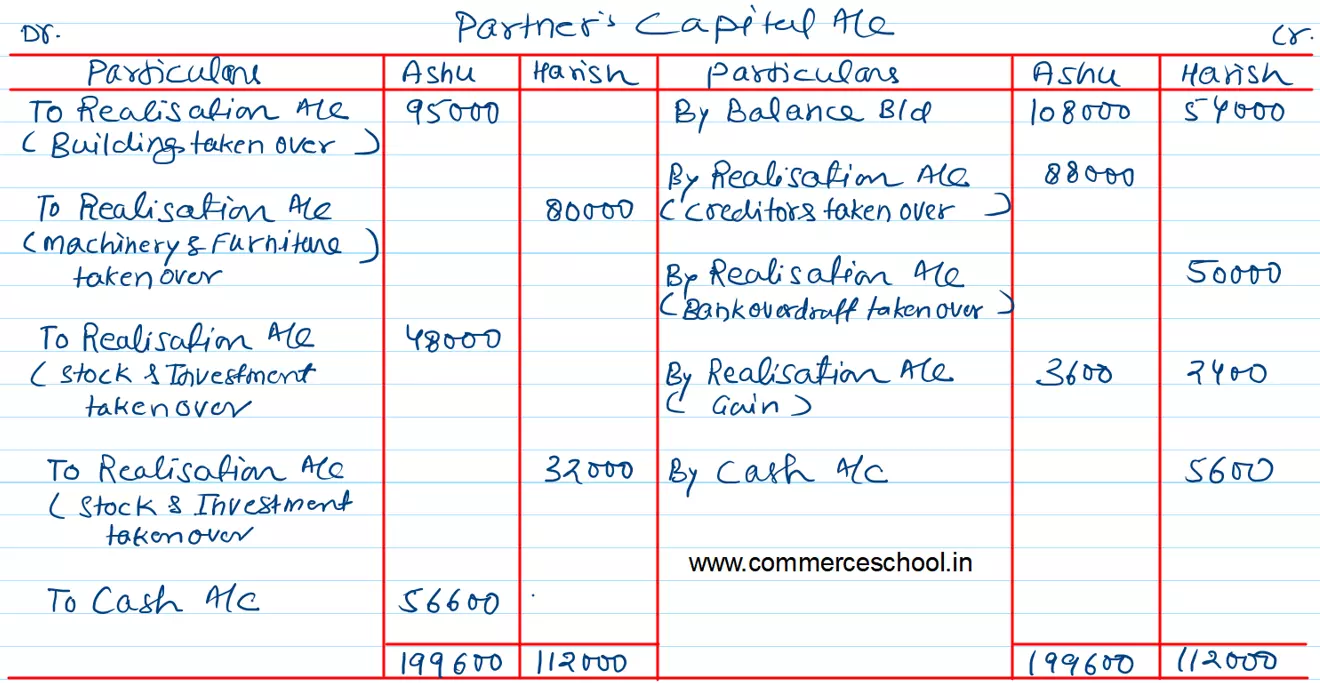

| Liabilities | ₹ | Assets | ₹ |

| Capital A/cs:

Ashu Harish Creditors Bank Overdraft |

1,08,000 54,000 88,000 50,000 |

Building

Machinery Furniture Stock Investments Debtors Cash in Hand |

80,000 70,000 14,000 20,000 60,000 48,000 8,000 |

| 3,00,000 | 3,00,000 |

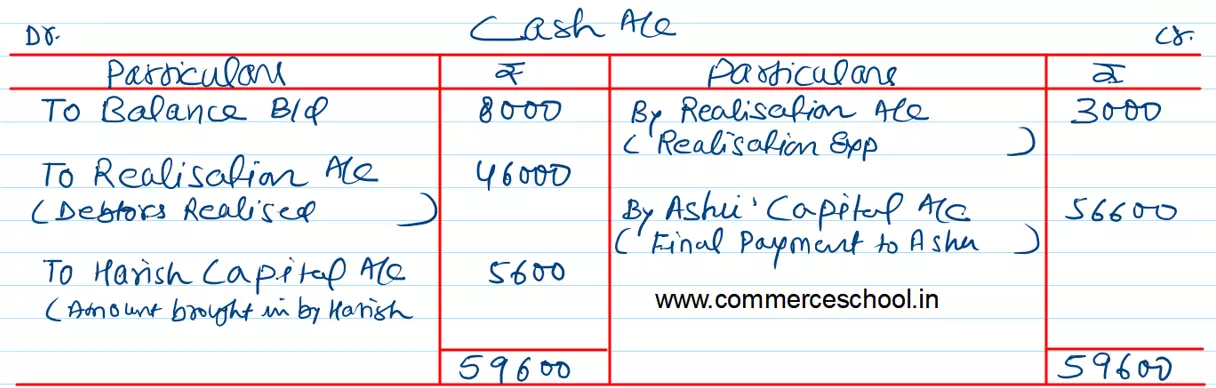

Ashu is to take over the building at ₹ 95,000 and Machinery and Furniture is taken over by Harish at value of ₹ 80,000. Ashu agreed to pay Creditor and Harish agreed to meet Bank Overdraft. Stock and Investments are taken by both partner in profit sharing ratio. Debtors realised for ₹ 46,000, expenses of realisation amounted to ₹ 3,000. prepare necessary Ledger Accounts.

[Ans.: Gain (profit) on Realisation – ₹ 6,000; Final Payments: Ashu – ₹ 56,600, Amount brought in by Harish – ₹ 5,600; Total of Cash Account – ₹ 59,600.]