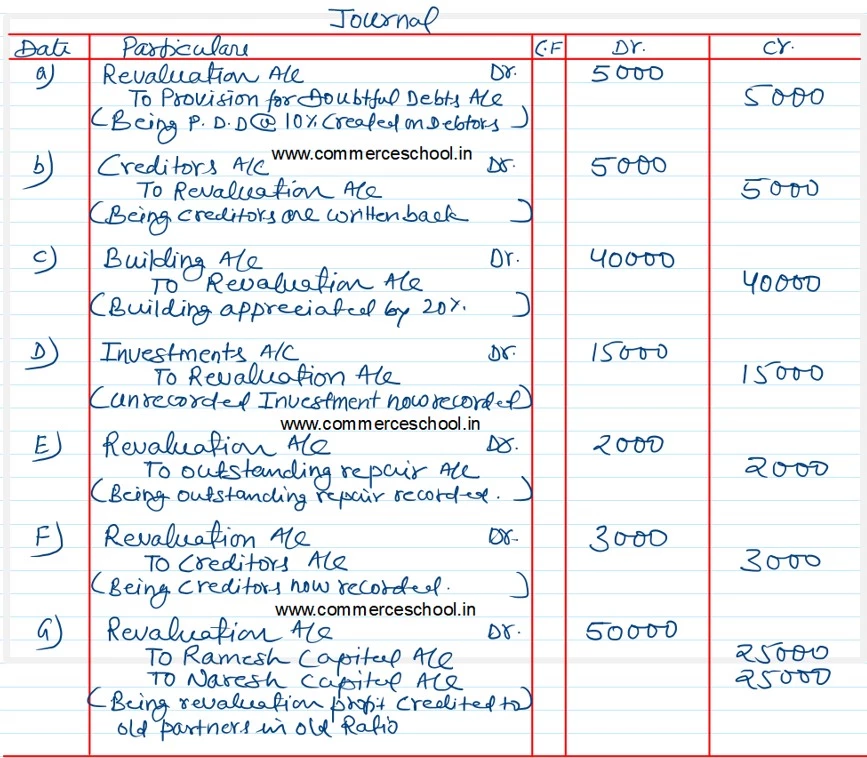

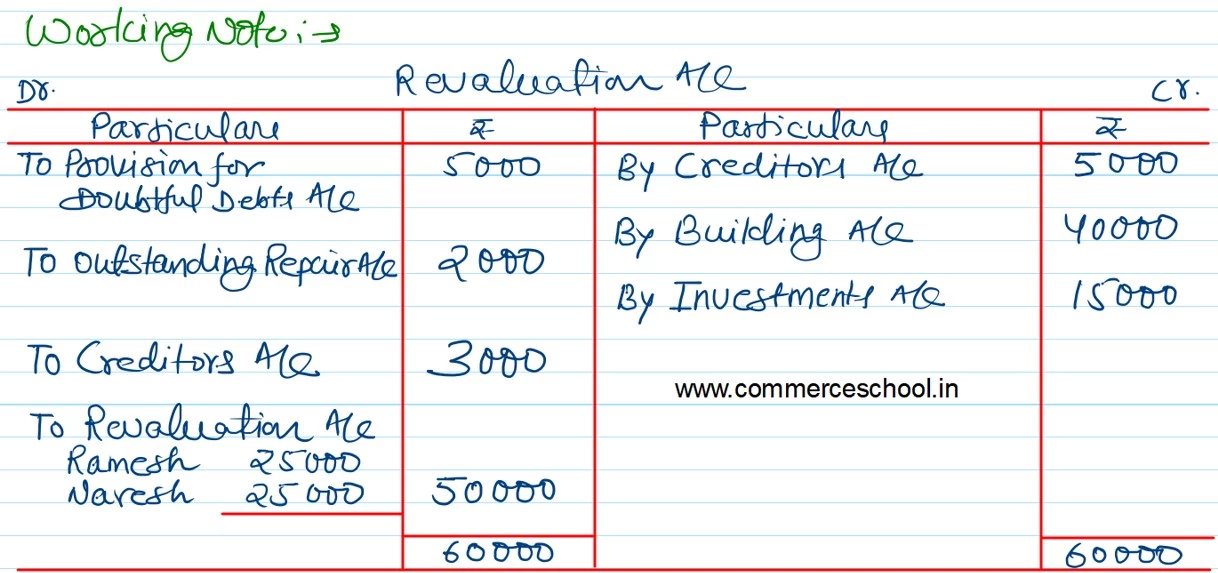

At the time of admission of a partner Suresh, assets and liabilities of Ramesh and Naresh were revalued as follows: a) A Provision for Doubtful Debts @ 10% was made on Sundry Debtors (Sundry Debtors ₹ 50,000). b) Creditors were written back by ₹ 5,000. c) Building was appreciated by 20% (Books value of Building ₹ 2,00,000). d) Unrecorded Investments were valued at ₹ 15,000. e) A provision of ₹ 2,000 was made for an Outstanding Bill for repairs. f) Unrecorded Liability towards suppliers was ₹ 3,000. Pass necessary Journal entries.

At the time of admission of a partner Suresh, assets and liabilities of Ramesh and Naresh were revalued as follows:

a) A Provision for Doubtful Debts @ 10% was made on Sundry Debtors (Sundry Debtors ₹ 50,000).

b) Creditors were written back by ₹ 5,000.

c) Building was appreciated by 20% (Books value of Building ₹ 2,00,000).

d) Unrecorded Investments were valued at ₹ 15,000.

e) A provision of ₹ 2,000 was made for an Outstanding Bill for repairs.

f) Unrecorded Liability towards suppliers was ₹ 3,000.

Pass necessary Journal entries.

Anurag Pathak Changed status to publish