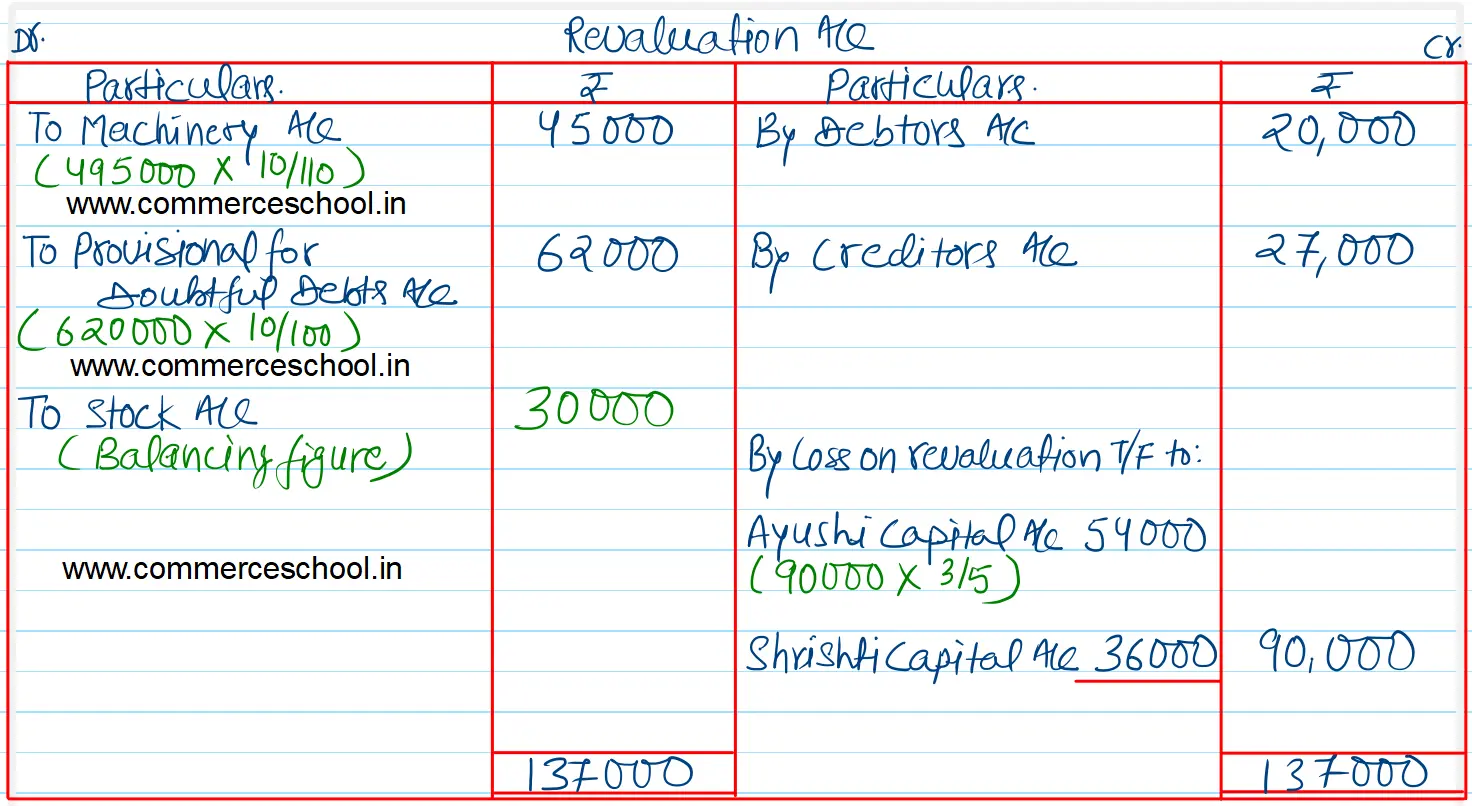

Ayushi and Shrishti are partners sharing profits in 3 : 2. Their Balance Sheet showed Stock at ₹ 3,10,000; Machinery at ₹ 4,95,000; Debtors at ₹ 6,00,000; Creditors at ₹ 3,47,000. They admit Tina as a partner and new profit sharing ratio is agreed at 4 : 3 : 2

Ayushi and Shrishti are partners sharing profits in 3 : 2. Their Balance Sheet showed Stock at ₹ 3,10,000; Machinery at ₹ 4,95,000; Debtors at ₹ 6,00,000; Creditors at ₹ 3,47,000. They admit Tina as a partner and new profit sharing ratio is agreed at 4 : 3 : 2. Following terms were agreed:

(i) Machinery is overvalued by 10%.

(ii) Unrecorded debtors of ₹ 20,000 be brought into books and provision for doubtful debts be created at 10%.

(iii) Creditors of ₹ 27,000 are not likely to be paid.

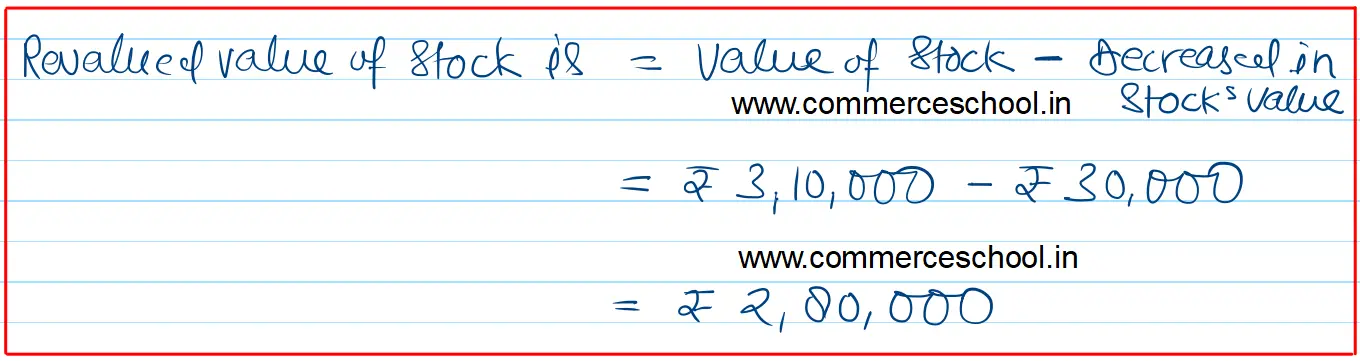

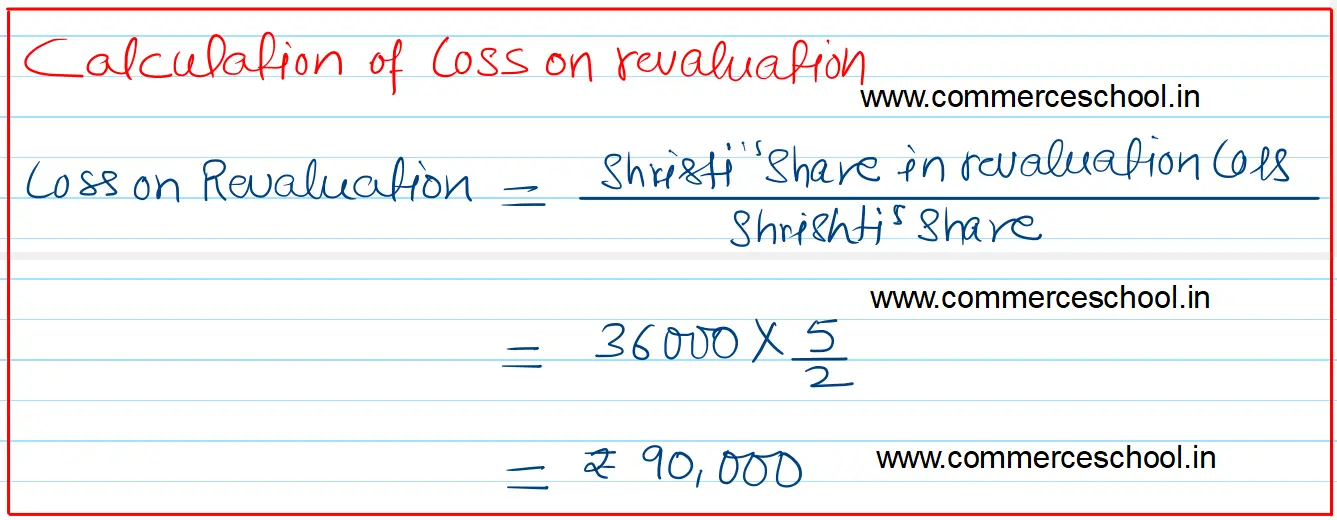

Shrishti’s share in loss on revaluation amounted to ₹ 36,000. You are required to calculate the revalued value of stock.

[Ans. Revalued value of stock ₹ 2,80,000.]

Anurag Pathak Answered question