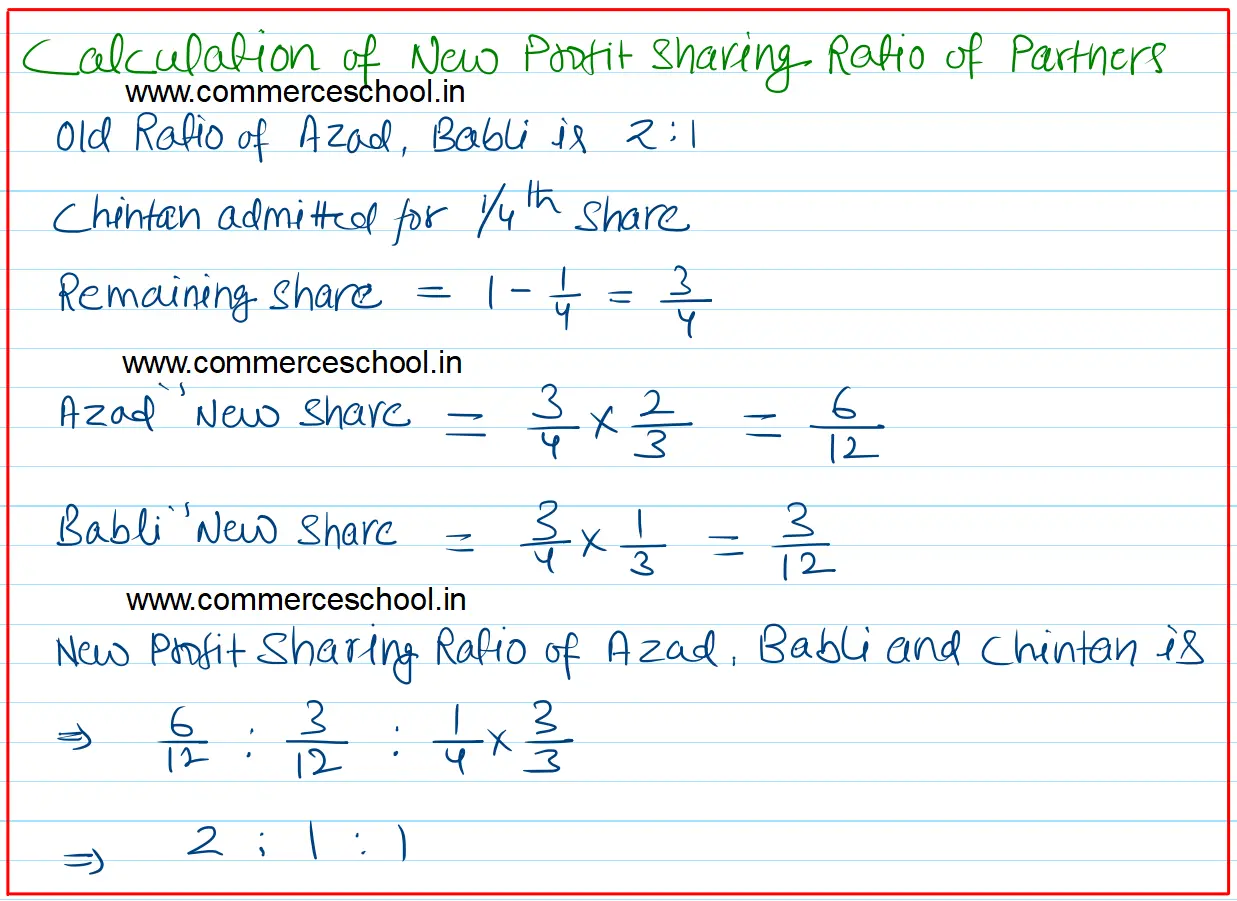

Azad and Babli are partners in a firm sharing profits and losses in the ratio of 2 : 1. Chintan is admitted into the firm with 1/4 share in profits

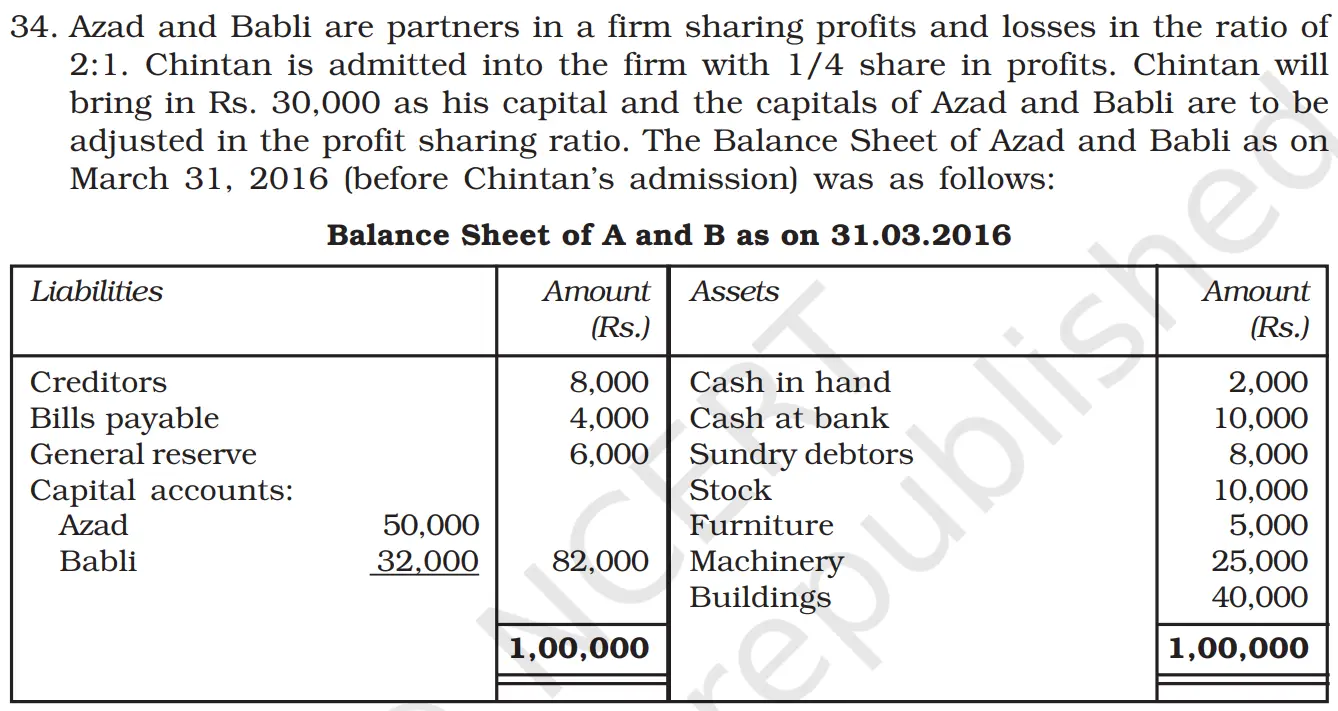

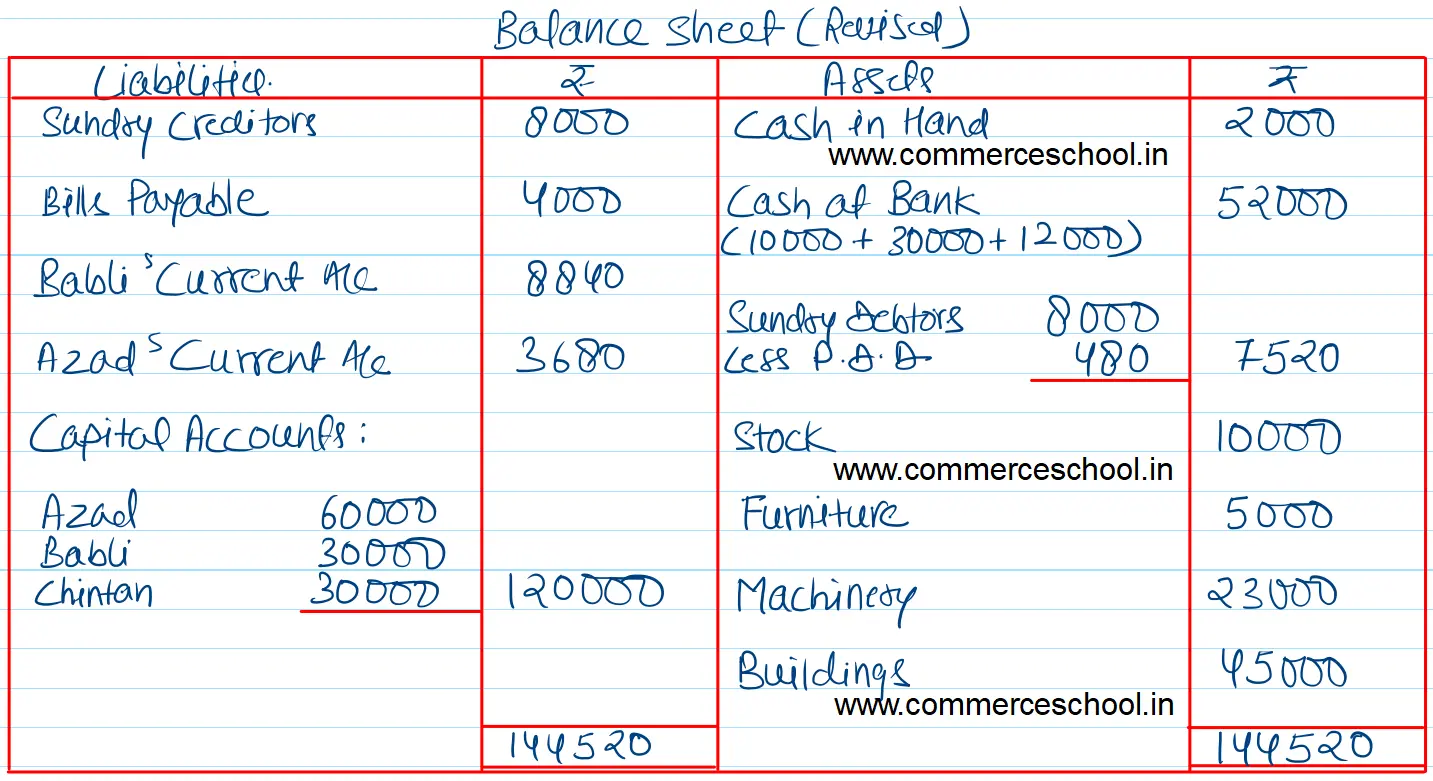

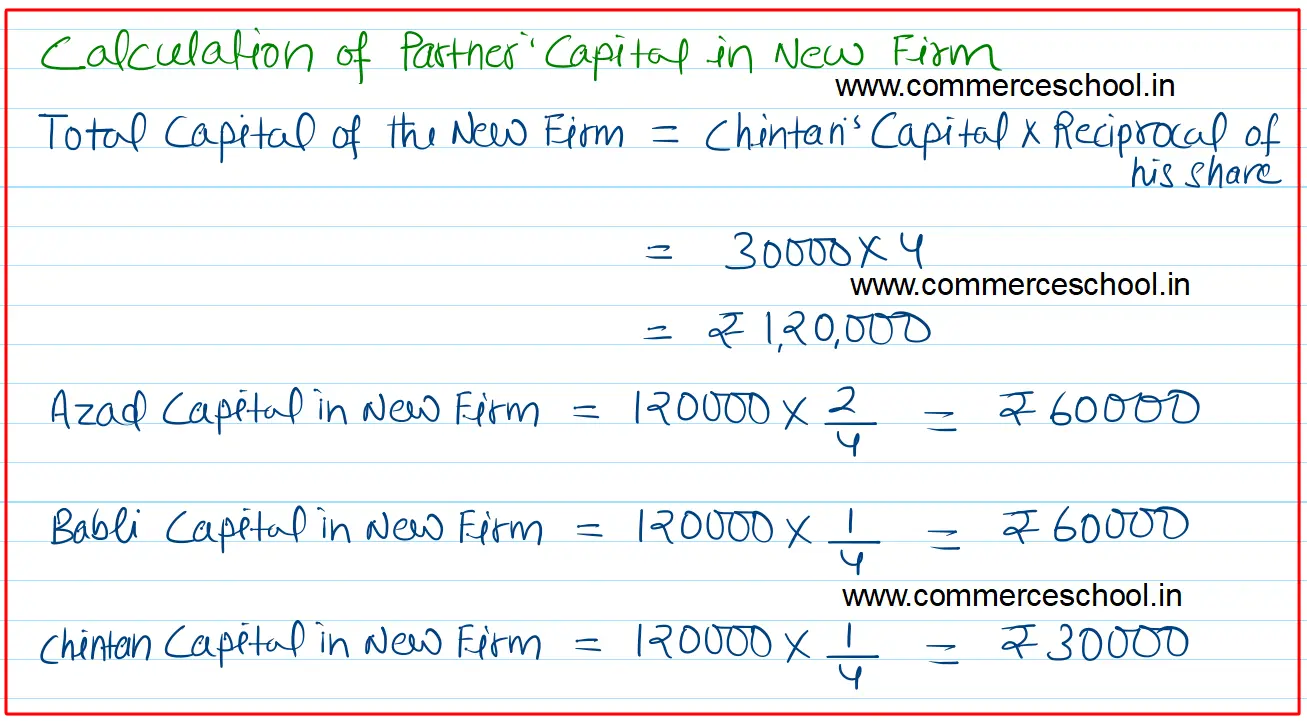

Azad and Babli are partners in a firm sharing profits and losses in the ratio of 2 : 1. Chintan is admitted into the firm with 1/4 share in profits. Chintan will bring in Rs. 30,000 as his capital and the capitals of Azad and Babli are to be adjusted in the profit sharing ratio. The Balance Sheet of Azad and Babli as on March 31, 2016 (before Chintan’s admission) was as follows:

Balance Sheet of A and B as on 31.03.2016

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 8,000 | Cash in Hand | 2,000 |

| Bills Payable | 4,000 | Cash at Bank | 10,000 |

| General Reserve | 6,000 | Sundry Debtors | 8,000 |

|

Capital Accounts: Azad Babli |

50,000 32,000 |

Stock | 10,000 |

| Furniture | 5,000 | ||

| Machinery | 25,000 | ||

| Buildings | 40,000 | ||

| 1,00,000 | 1,00,000 |

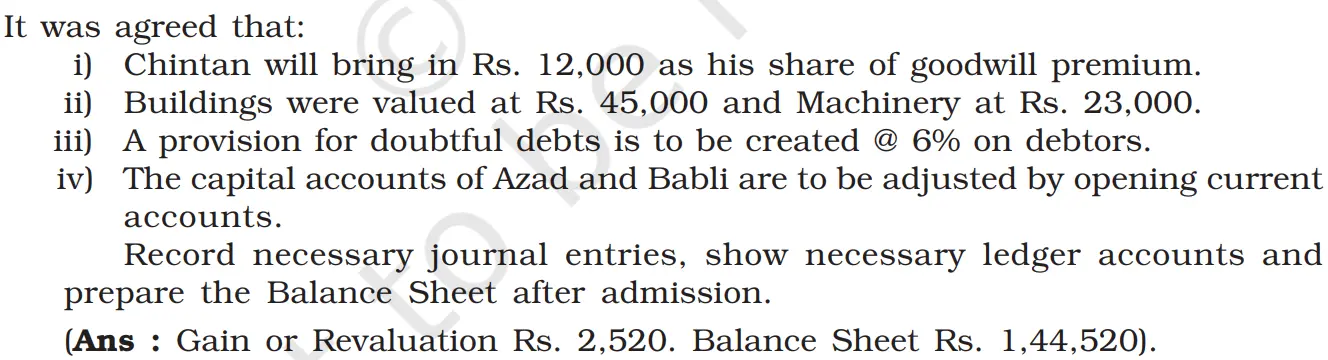

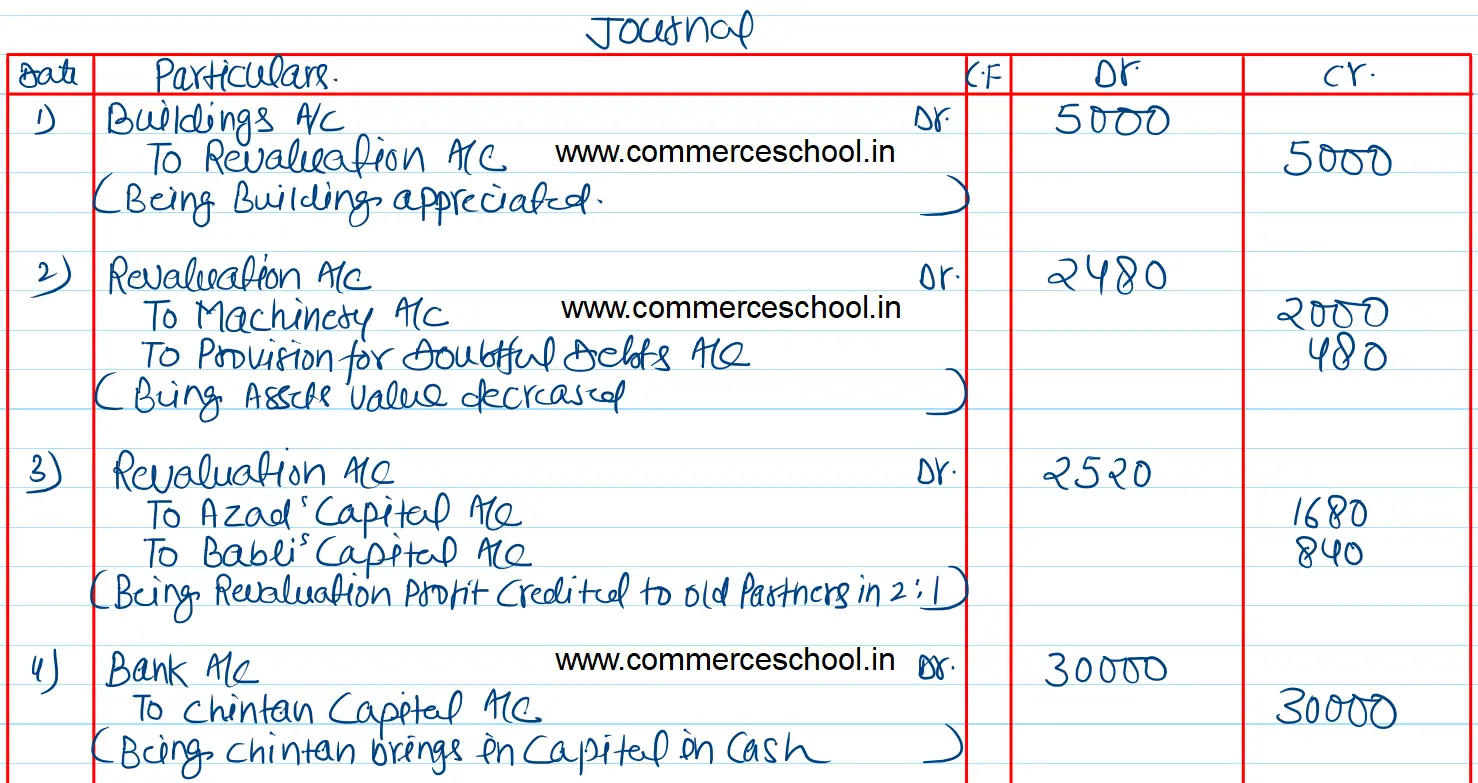

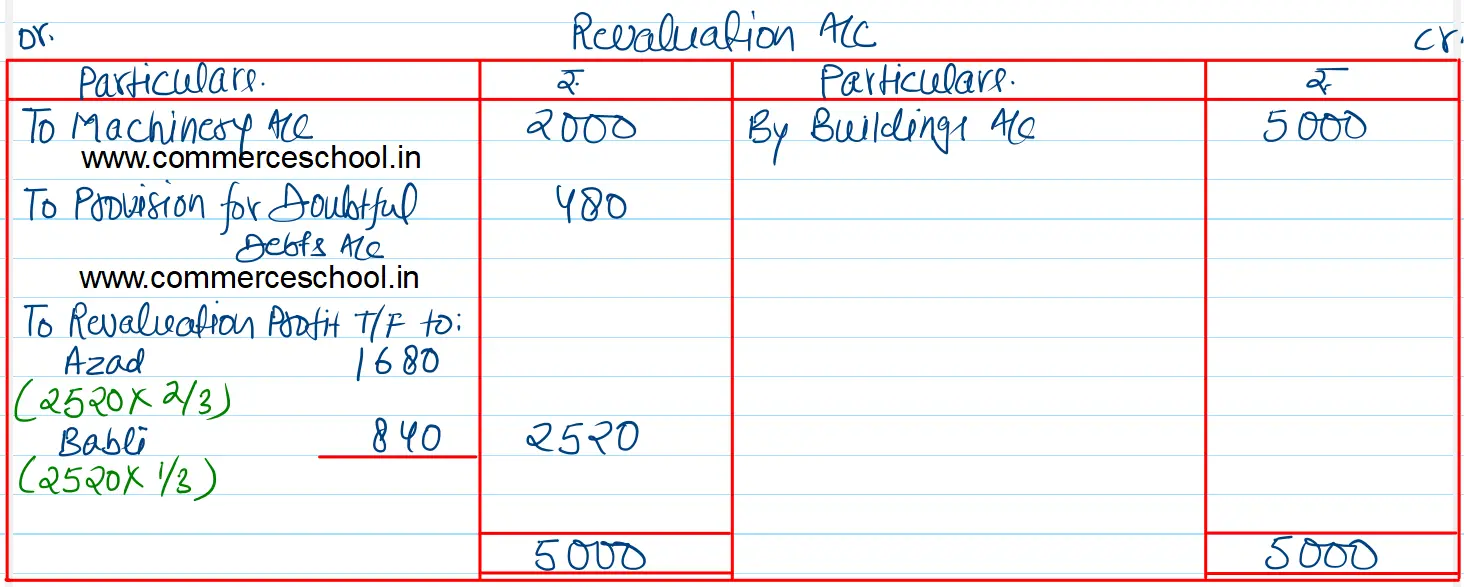

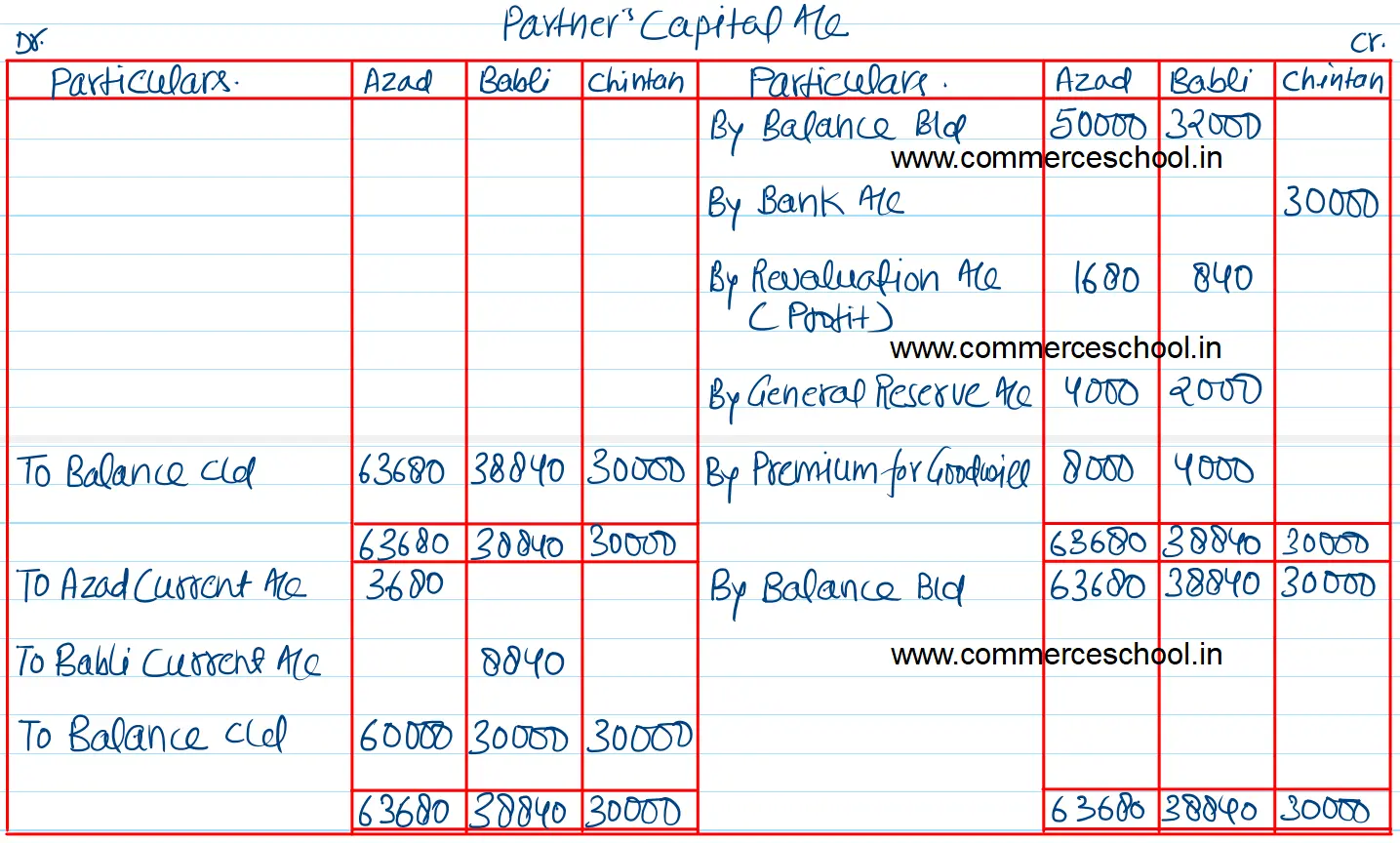

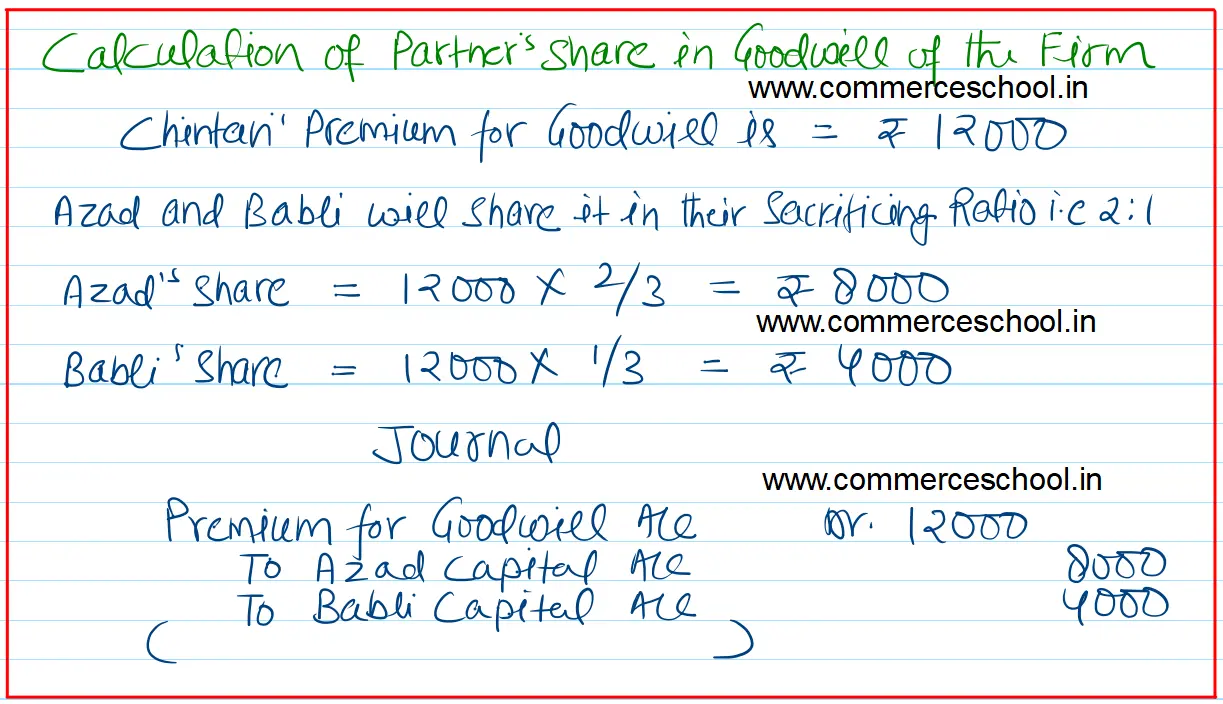

It was agreed that: I) Chintan will bring in Rs. 12,000 as his share of goodwill premium. ii) Buildings were valued at Rs. 45,000 and Machinery at Rs. 23,000. iii) A provision for doubtful debts is to be created @ 6% on debtors. iv) The capital accounts of Azad and Babli are to be adjusted by opening current accounts. Record necessary journal entries, show necessary ledger accounts and prepare the Balance Sheet after admission. [Ans: Gain on Revaluation Rs. 2,520. Balance Sheet Rs. 1,44,520]