Badal and Bijli were partners in a firm sharing profits in the ratio of 3 : 2. Their Balance Sheet as at 31st March, 2019 was as follows:

Badal and Bijli were partners in a firm sharing profits in the ratio of 3 : 2. Their Balance Sheet as at 31st March, 2019 was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Capital A//cs:

Badal Bijli Badal’s Current A/c Investment Fluctuation Reserve Bills Payable Creditors |

1,50,000 90,000 12,000 24,000 8,000 26,000 |

Building

Investments Stock Debtors Cash Bijli’s Current A/c |

1,50,000 73,000 43,000 20,000 22,000 2,000 |

| 3,10,000 | 3,10,000 |

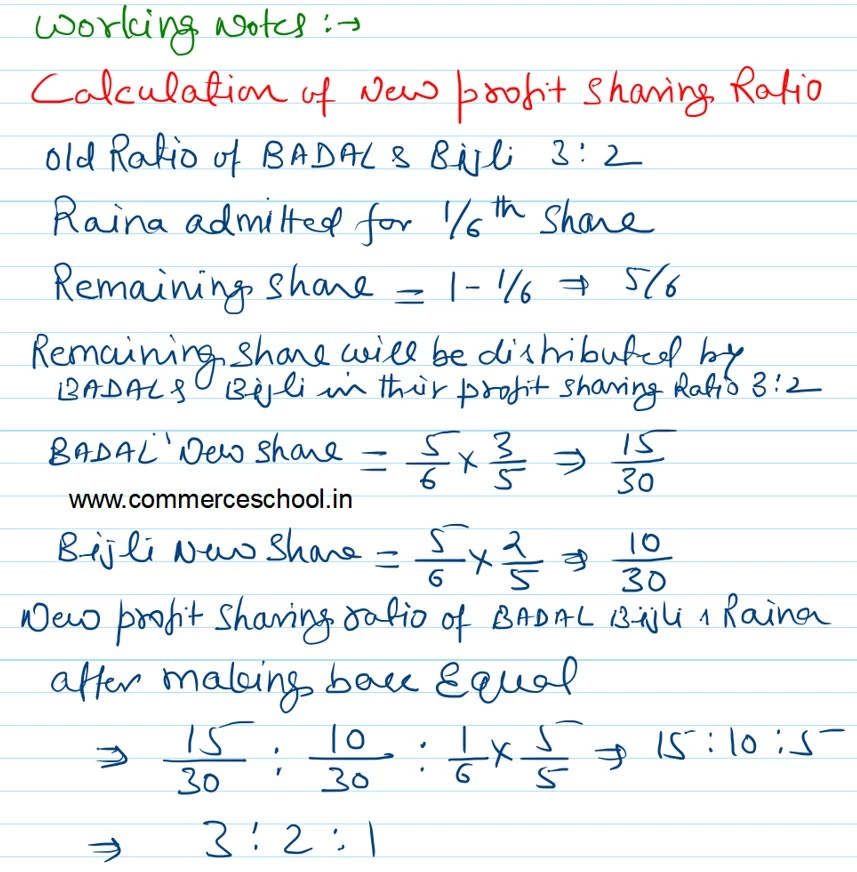

Raina was admitted on the above date as a new partner for 1/6th share in the profits of the firm. The terms of agreement were as follows:

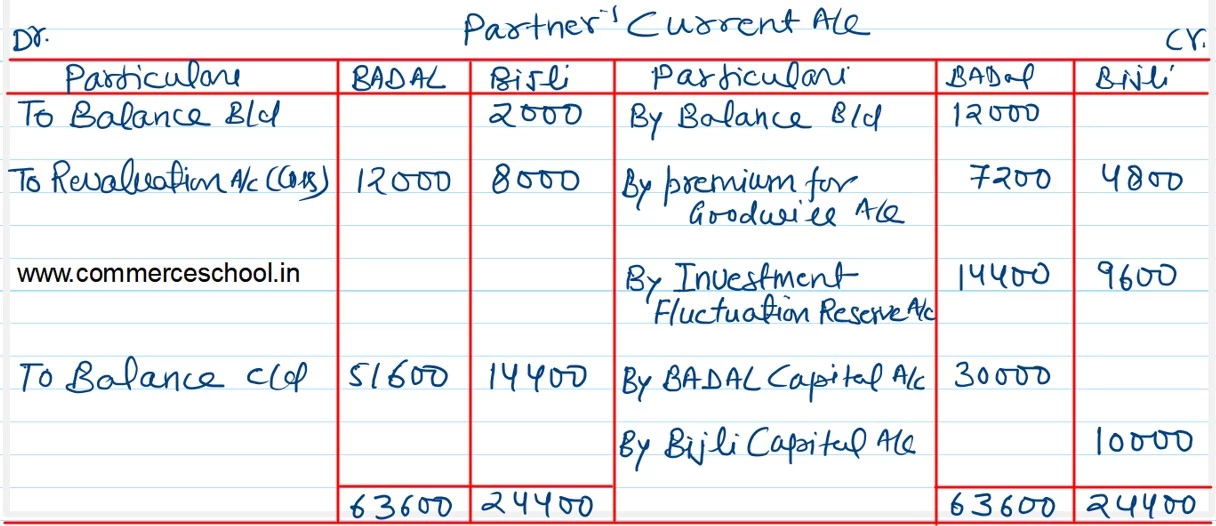

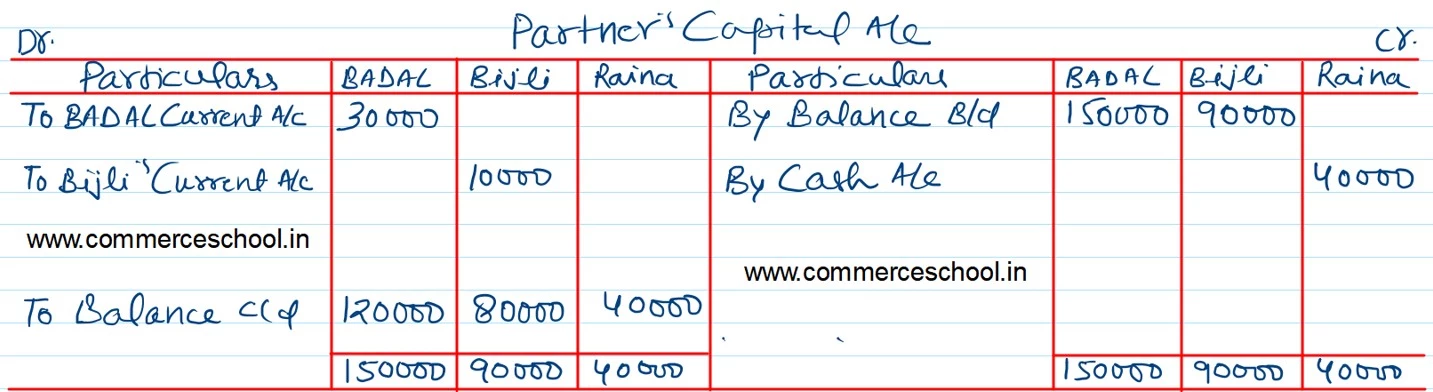

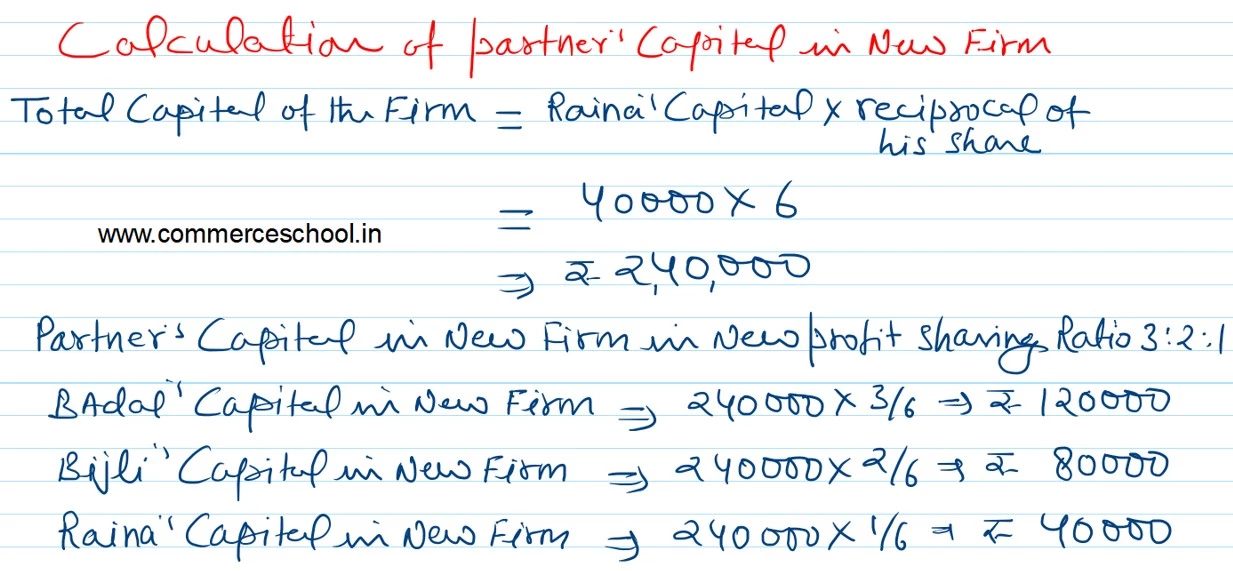

i) Raina will bring ₹ 40,000 as her capital and capitals of Badal and Bijli will be adjusted on the basis of Raina’s Capital by opening Current Accounts.

ii) Raina will bring her share of goodwill premium for ₹ 12,000 in cash.

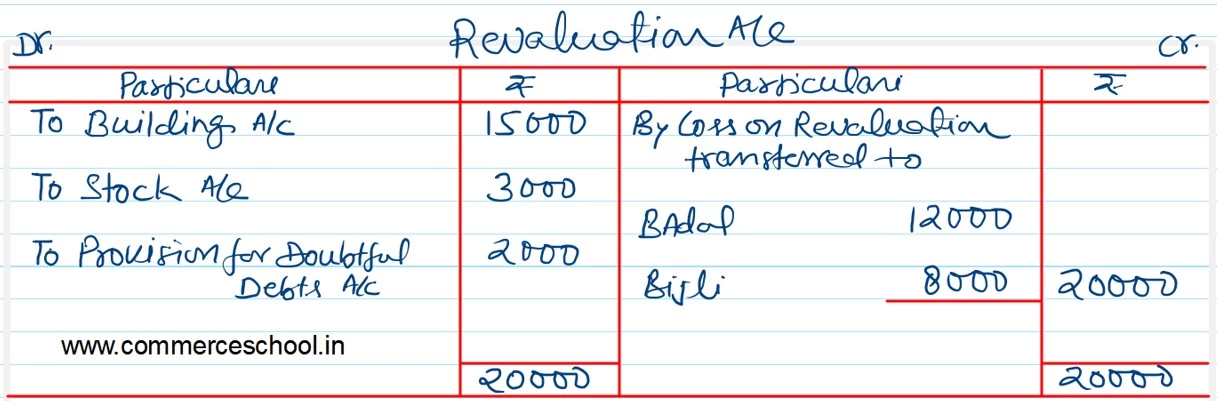

iii) The building was overvalued by ₹ 15,000 and stock by ₹ 3,000.

iv) A provision of 10% was to be created on debtors for bad debts.

Prepare the Revaluation Account and Current and Capital Accounts of Badal, Bijli and Raina.

[Ans.: Loss on Revaluation – ₹ 20,000; partner’s Capital A/cs: Badal – ₹ 1,20,000; Bijli – ₹ 80,000 and Raina – ₹ 40,000; Partner’s Current A/cs: Badal – ₹ 51,600 (cr.); Bijli – ₹ 14,400 (cr.).]