Balance Sheet as at 31st March, 2024 of Ramesh, Kumar and Pappu who were sharing profits and losses in the ratio of 2 : 3 : 5.

Balance Sheet as at 31st March, 2024 of Ramesh, Kumar and Pappu who were sharing profits and losses in the ratio of 2 : 3 : 5.

| Liabilities | ₹ | Assets | ₹ |

|

Capitals: Ramesh kumar Pappu |

36,000 44,000 52,000 |

Cash | 18,000 |

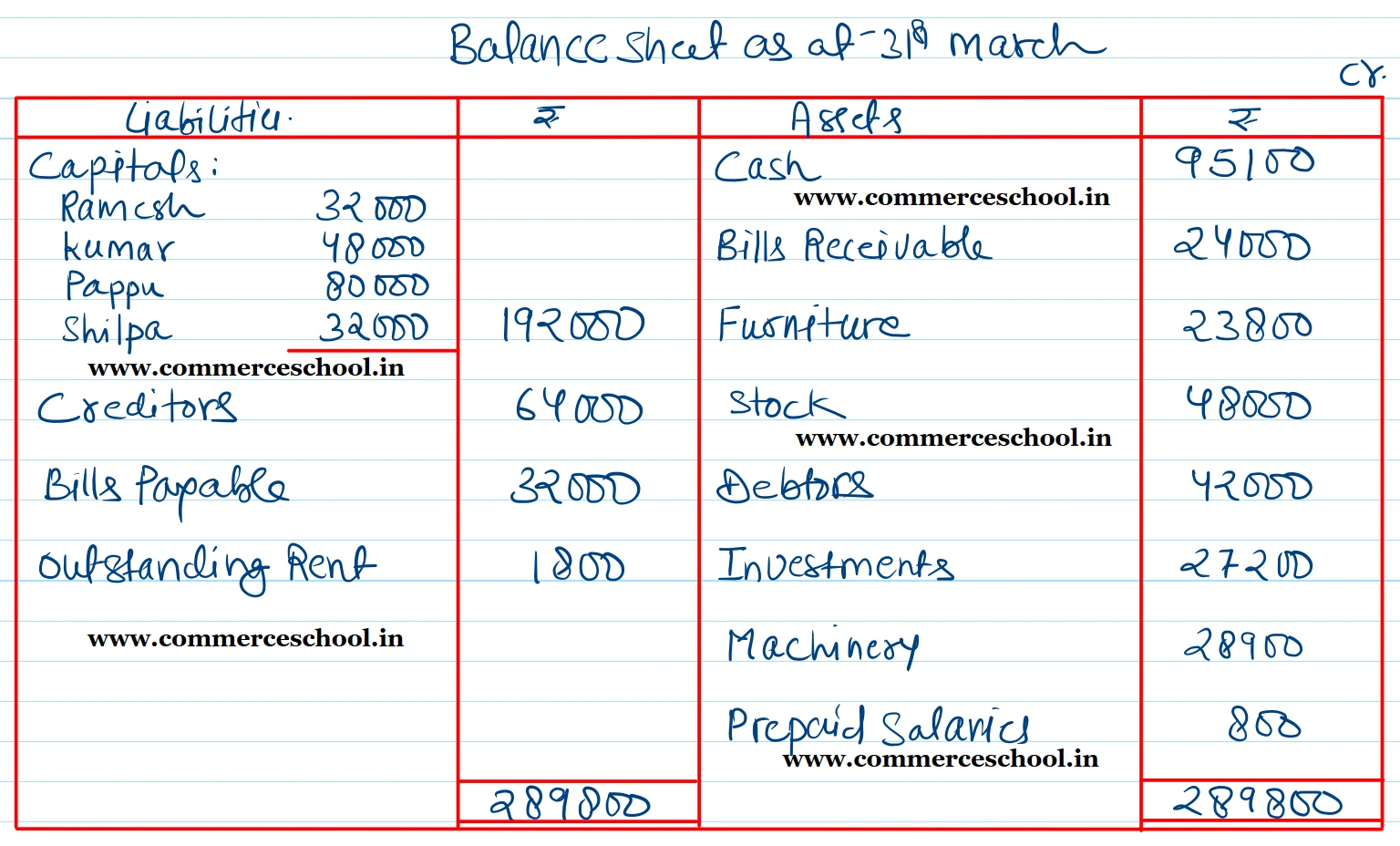

| Creditors | 64,000 | Bills Receivable | 24,000 |

| Bills Payable | 32,000 | Furniture | 28,000 |

| Profit & Loss A/c | 14,000 | Stock | 44,000 |

| Debtors | 42,000 | ||

| Investments | 32,000 | ||

| Machinery | 34,000 | ||

| Goodwill | 20,000 | ||

| 2,42,000 | 2,42,000 |

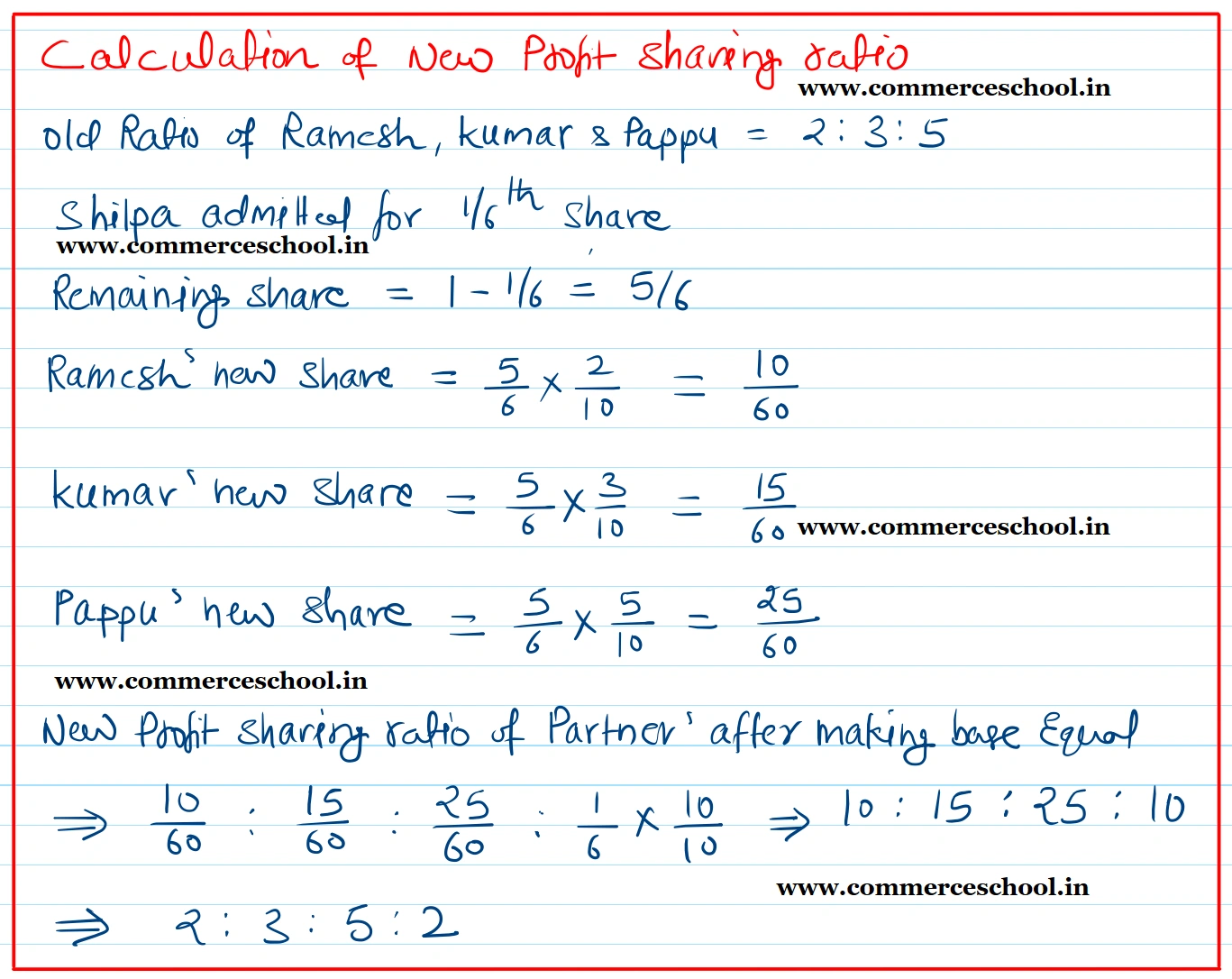

On 1st April, 2024 they admit Shilpa into partnership on the following terms:

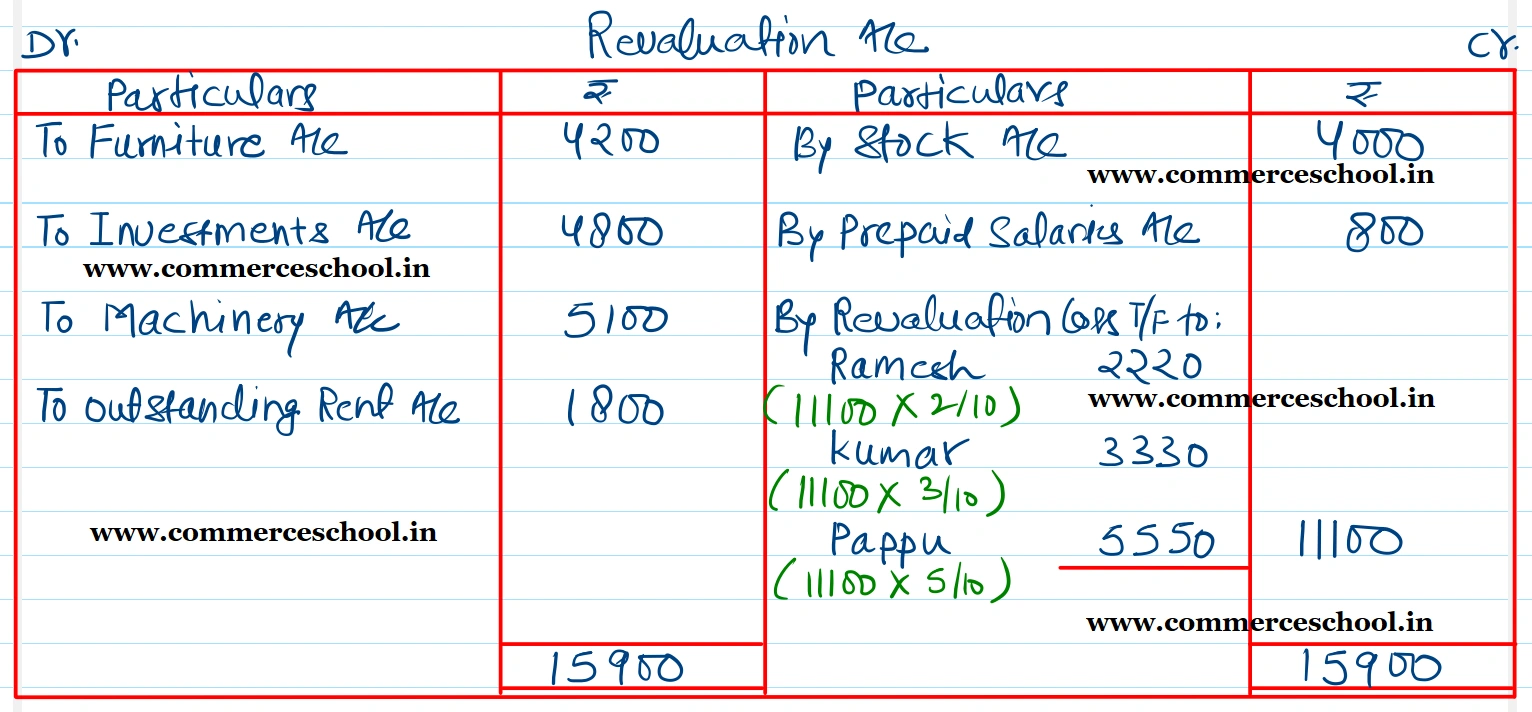

(1). Furniture, Investments and Machinery to be reduced by 15%.

(2) The value of stock to be taken at ₹ 48,000.

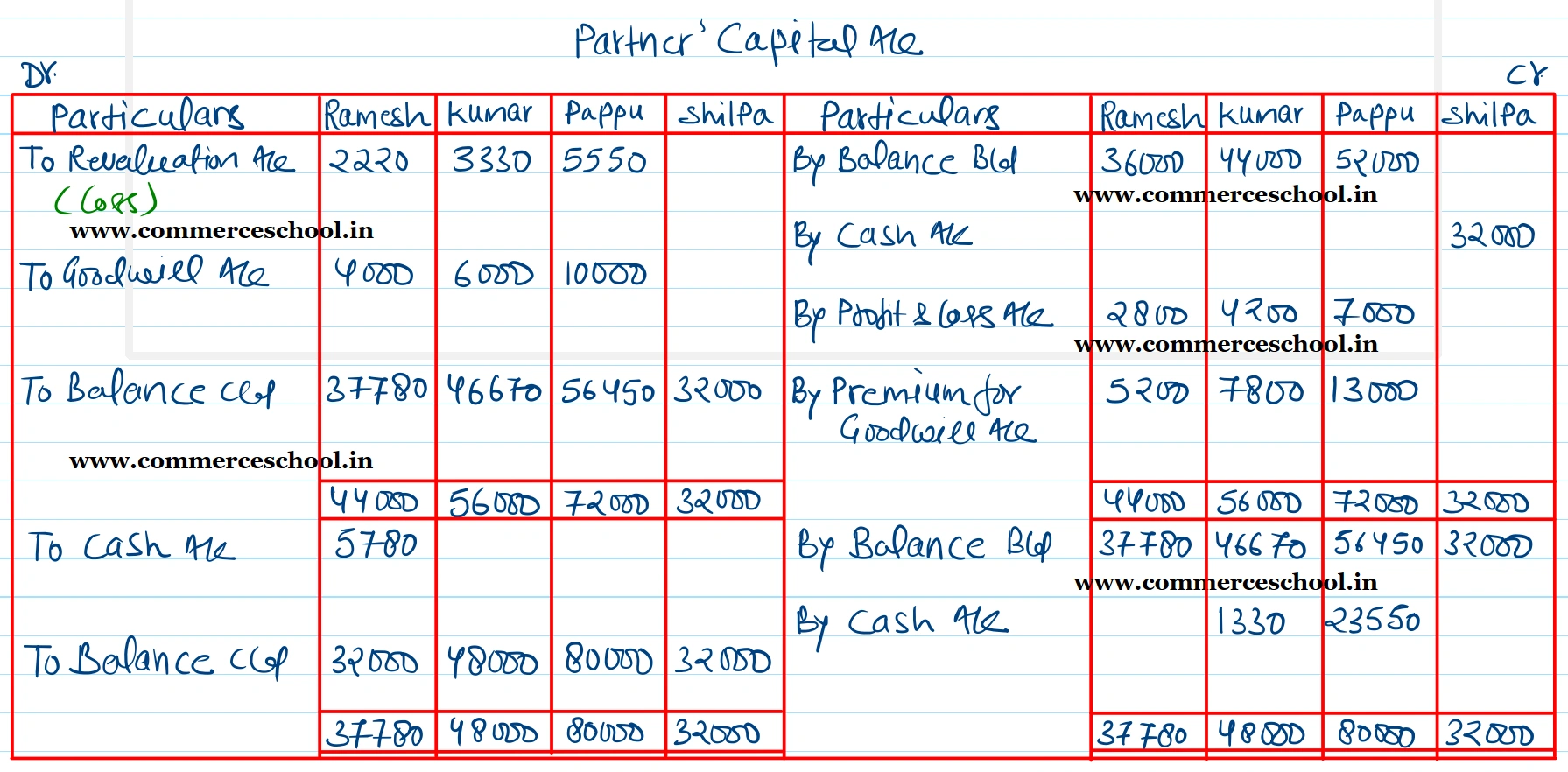

(3) Shilpa will bring in ₹ 26,000 as her share of goodwill.

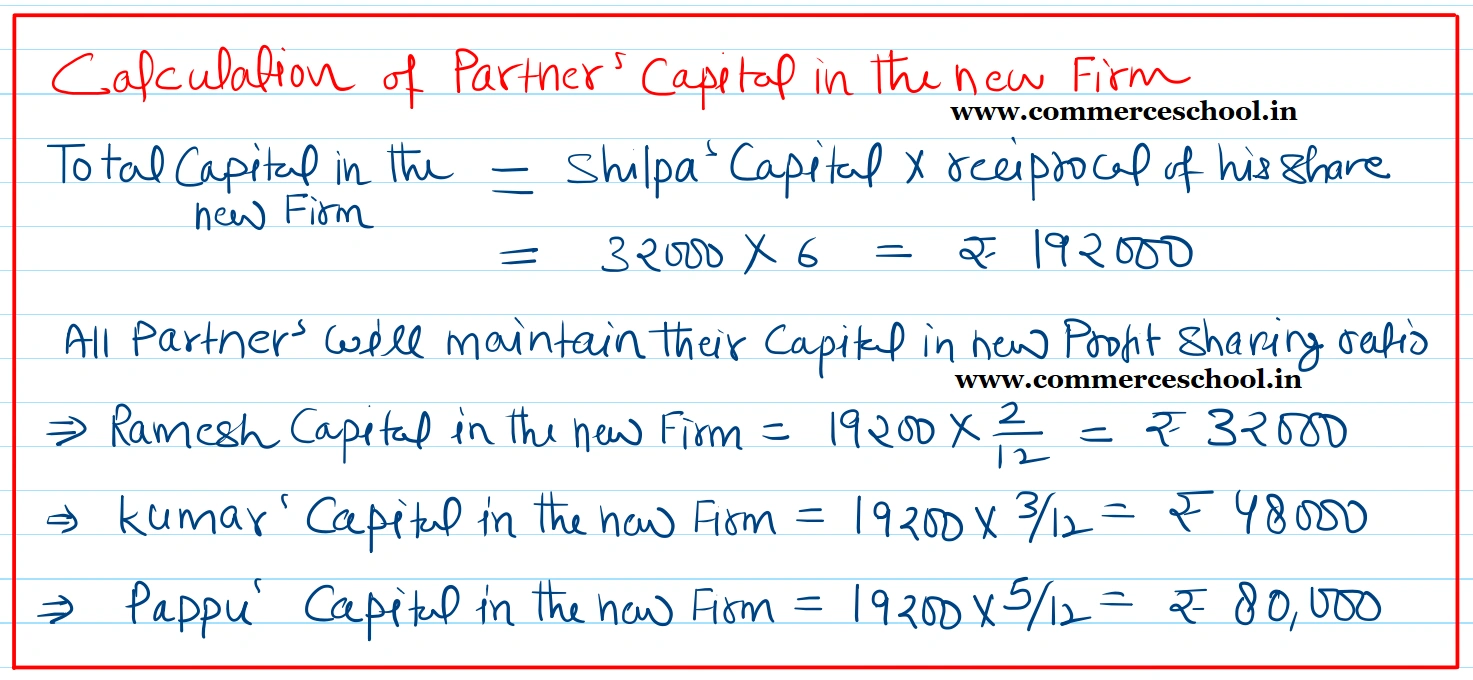

(4) Shilpa to bring ₹ 32,000 towards capital for 1/6th share and old partners to adjust their capitals accordingly.

(5) Outstanding rent amounted to ₹ 1,800.

(6) Prepaid salaries ₹ 800.

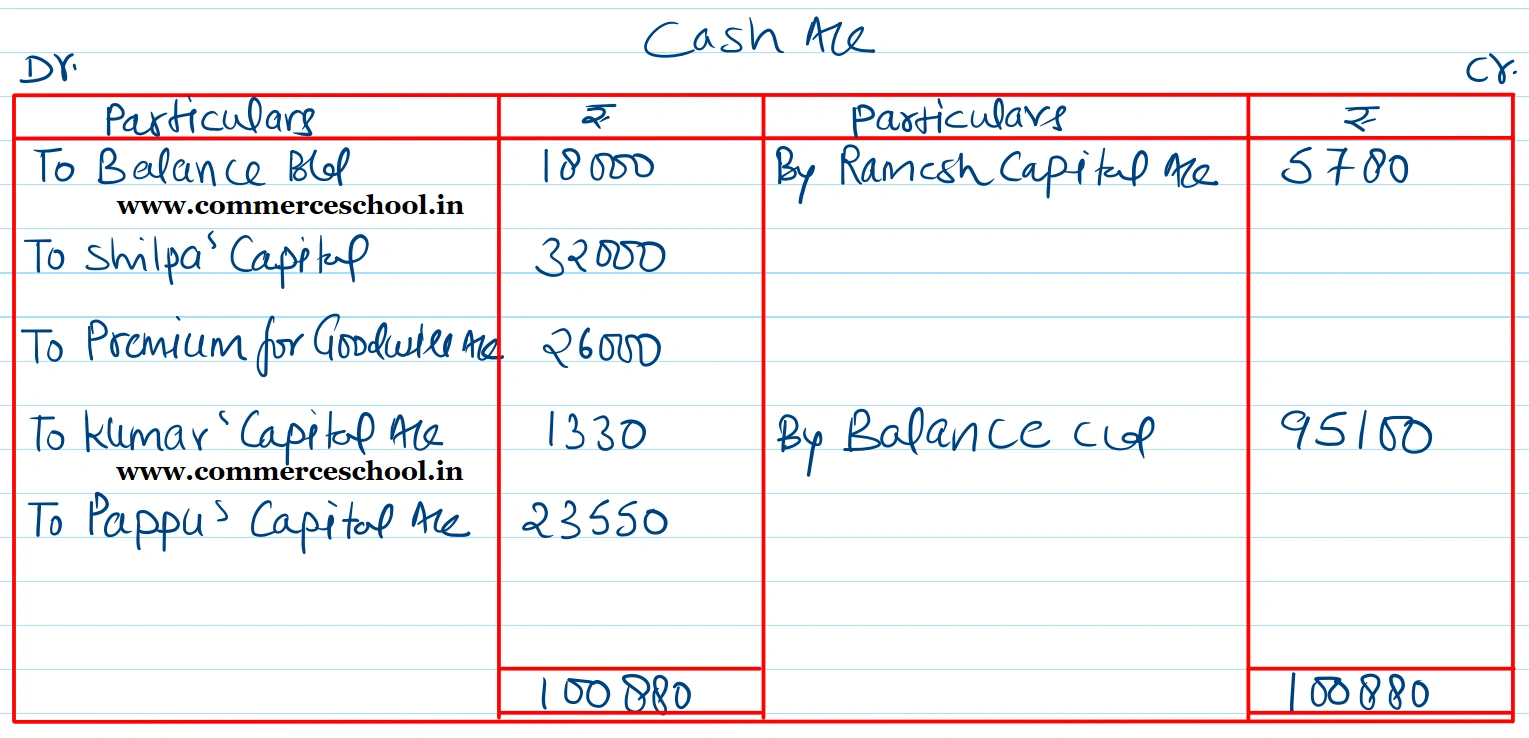

(7) Adjustments of capitals to be made by cash.

Prepare Revalutaion Account, Capital Accounts, Cash Account and the Balance Sheet of the new firm.

[Ans. Loss on Revaluation ₹ 11,100; Capital Accounts : Ramesh ₹ 32,000; Kumar ₹ 48,000; Pappu ₹ 80,000 and Shilpa ₹ 32,000; Cash Balance ₹ 95,100; B/S Total ₹ 2,89,800; Ramesh withdraws ₹ 5,780; Kumar brings in ₹ 1,330 and Pappu brings in ₹ 23,550.]