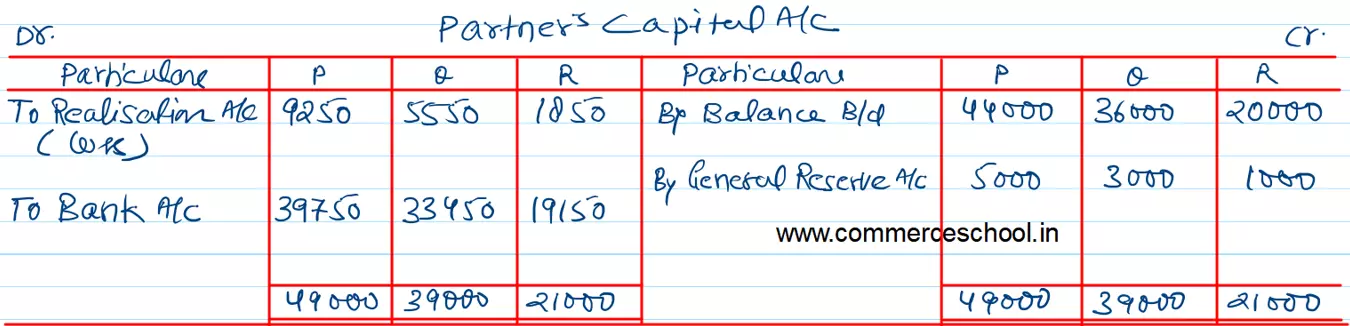

Balance Sheet of P, Q and R as at 31st March, 2023, who were sharing profits in the ratio of 5 : 3 : 1, was:

Balance Sheet of P, Q and R as at 31st March, 2023, who were sharing profits in the ratio of 5 : 3 : 1, was:

| Liabilities | ₹ | Assets | ₹ | |

| Bills Payable

Loan from Bank General Reserve Capital A/cs: P Q R |

40,000 30,000 9,000 44,000 36,000 20,000 |

Cash at Bank

Stock Sundry Debtors Building Plant and Machinery |

42,000

|

40,000 19,000 40,000 40,000 40,000 |

| 1,79,000 | 1,79,000 |

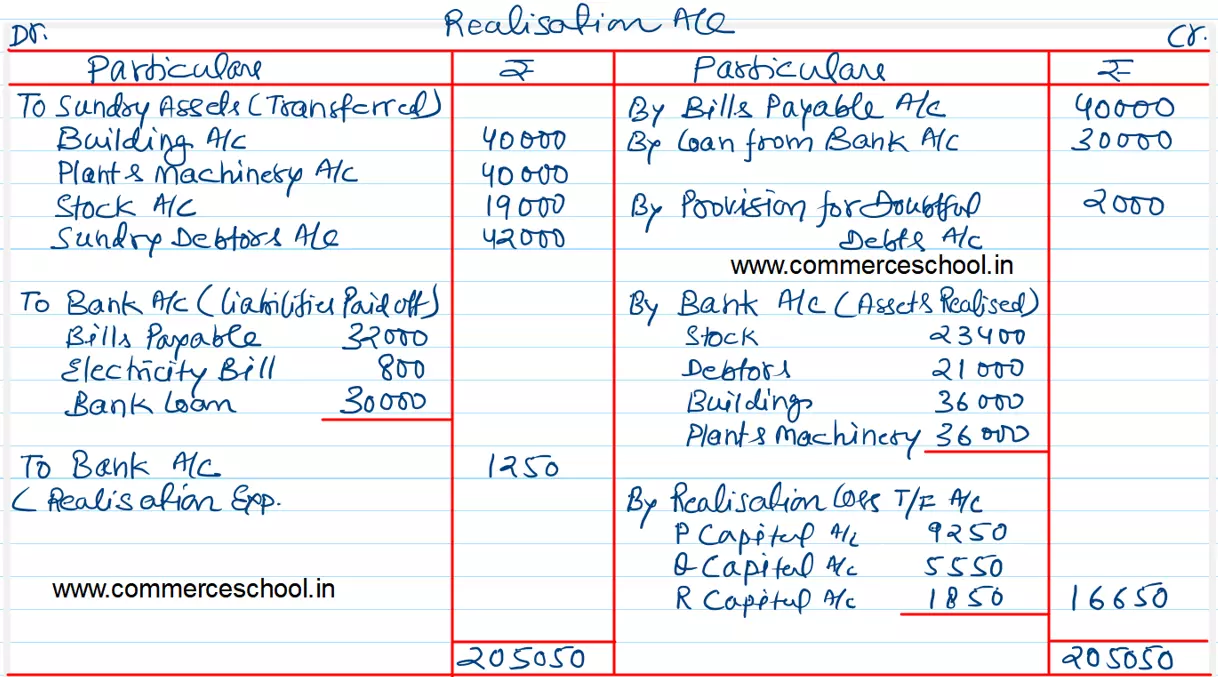

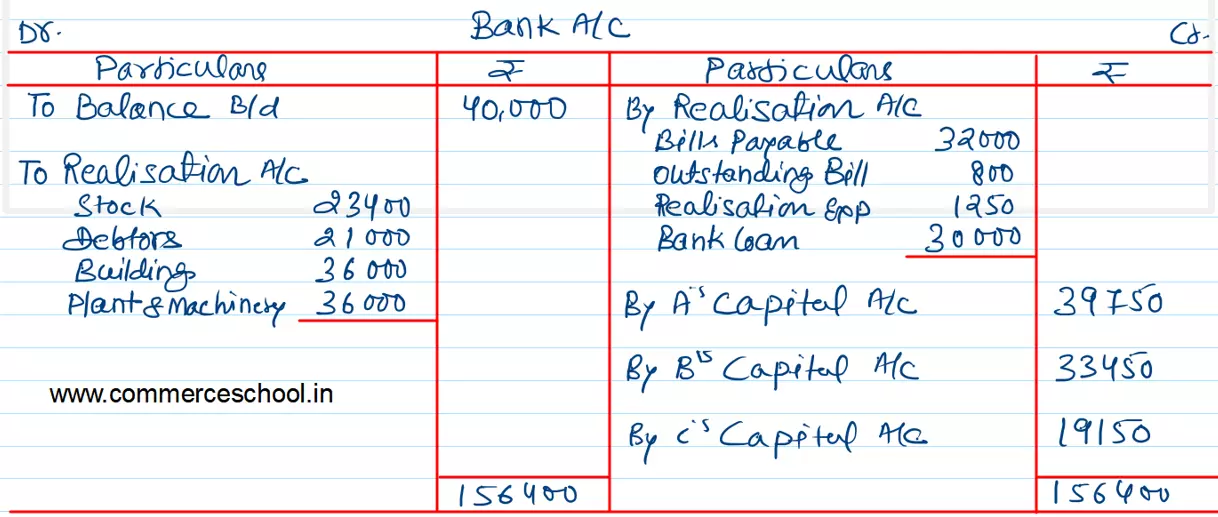

The partners dissolved the business. Asset realised – Stock ₹ 23,400; Debtors 50%; Building and Plant and Machinery 10% less than their book value. Bills payable were settled for ₹ 32,000. There was an outstanding Bill of electricity ₹ 800 which was paid. Realisation expenses ₹ 1,250 were also paid.

Prepare Realisation Account, Partner’s Capital Accounts and Bank Account.

[Ans.: Loss on Realisation – ₹ 16,650; Amount Payable to P – ₹ 39,750; Q – ₹ 33,450; R – ₹ 19,150; Total of Bank Account – ₹ 1,56,400.]