Balance Sheet of X and Y, who share profits and losses as 5 : 3, as at 1st April, 2022 is:

Balance Sheet of X and Y, who share profits and losses as 5 : 3, as at 1st April 2022 is:

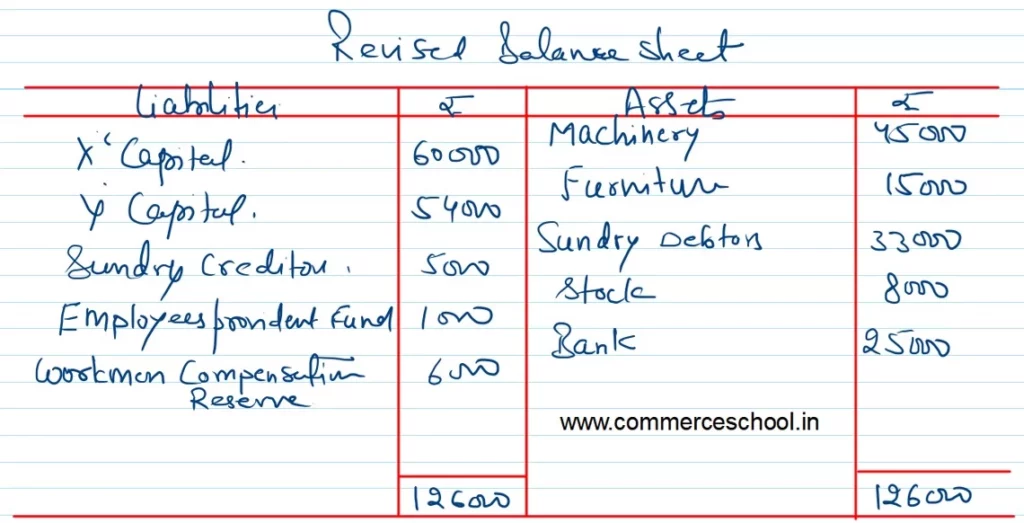

| Liabilities | ₹ | Assets | ₹ |

| X’s Capital

Y’s Capital General Reserve Workmen Compensation Reserve Employee’s Provident Fund Sundry Creditors |

52,000 54,000 4,800 10,000 1,000 5,000 |

Goodwill

Machinery Furniture Sundry Debtors Stock Bank Advertisement Suspense A/c |

8,000 38,000 15,000 33,000 7,000 25,000 800 |

| 1,26,800 | 1,26,800 |

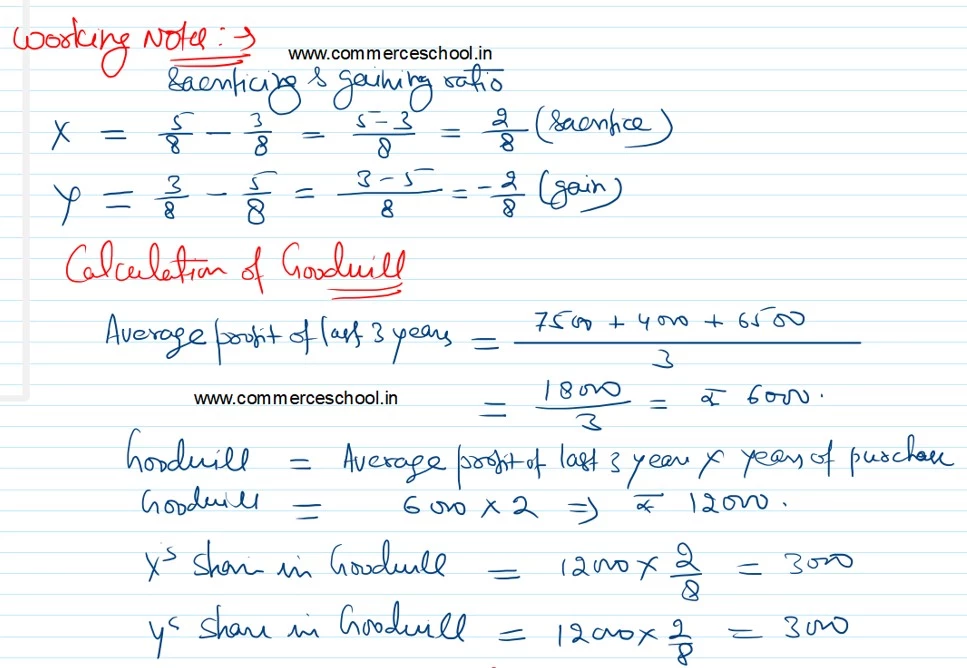

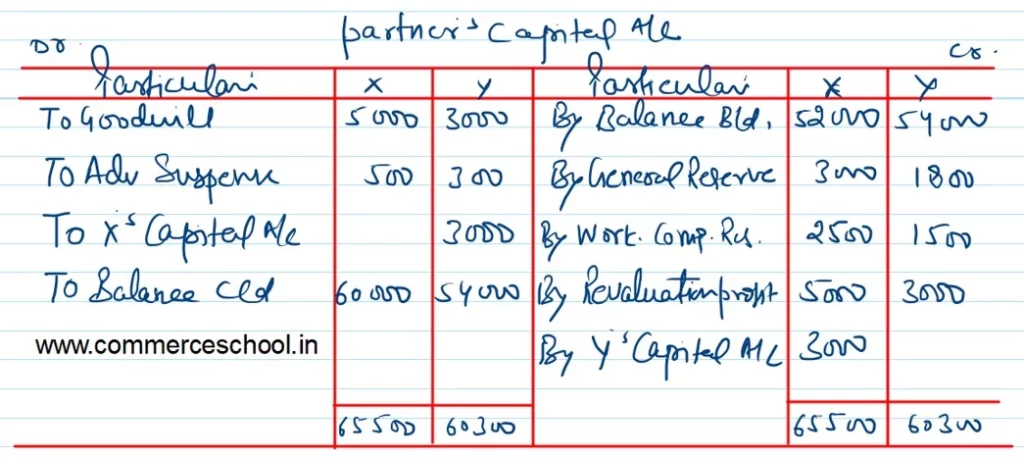

On the above date, they decided to change their profit-sharing ratio to 3 : 5 and agreed upon the following:

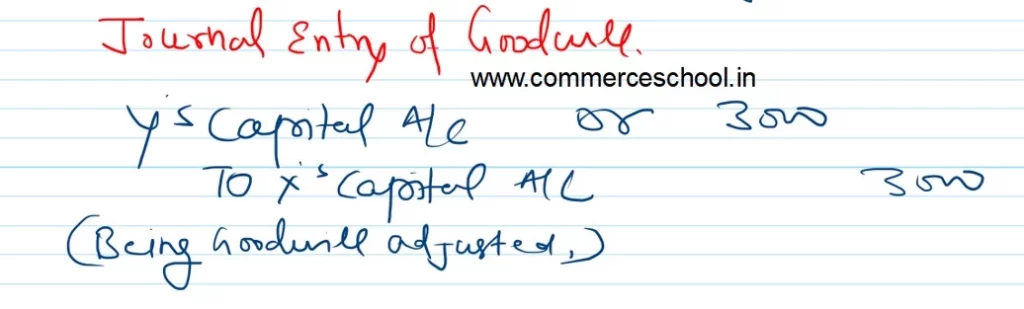

a) Goodwill be valued on the basis of two years’ purchase of the average profit of the last three years. Profits for the years ended 31st March are 2020 – ₹ 7,500; 2021 – ₹ 4,000; 2022 – ₹ 6,500.

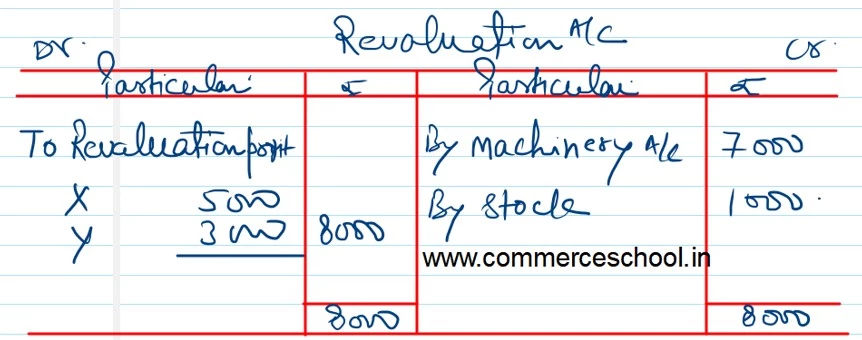

b) Machinery and stock be revalued at ₹ 45,000 and ₹ 8,000 respectively.

c) Claim on account of workmen’s compensation is ₹ 6,000.

Prepare the Revaluation Account, Partner’s Capital Accounts, and the Balance Sheet of the new firm.