Balance Sheet of X, Y and Z who shared profits in the ratio of 5 : 3 : 2, as on 31st March, 2023 was as follows:

Balance Sheet of X, Y and Z who shared profits in the ratio of 5 : 3 : 2, as on 31st March, 2023 was as follows:

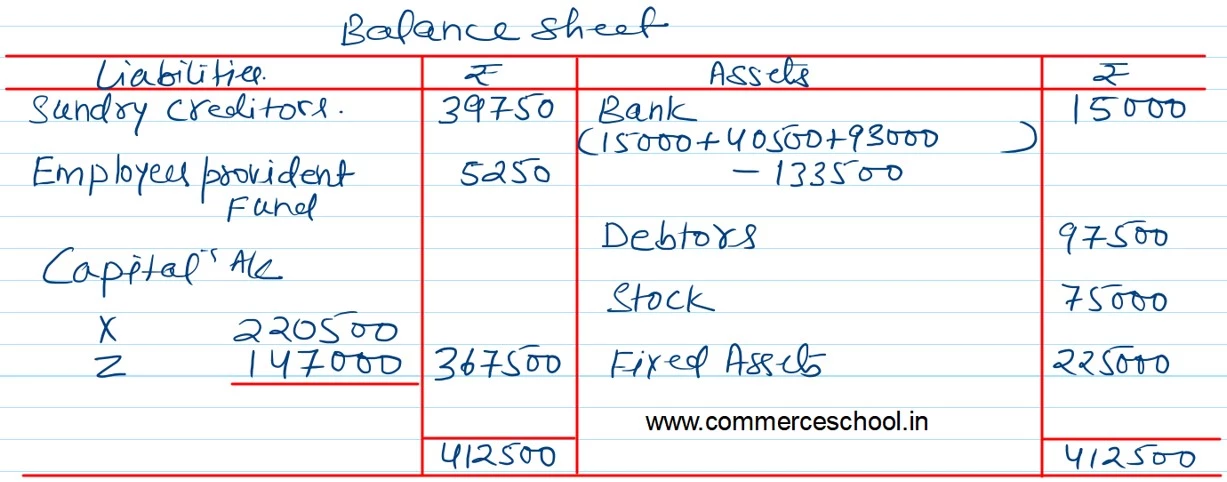

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors

Employee’s Provident Fund Workmen Compensation Reserve Capital A/cs: X Y Z |

39,750 5,250 22,500 1,65,000 84,000 66,000 |

Bank (Minimum Balance)

Debtors Stock Fixed Assets |

15,000 97,500 82,500 1,87,500 |

| 3,82,500 | 3,82,500 |

Y retired on 1st April, 2023 and it was agreed that:

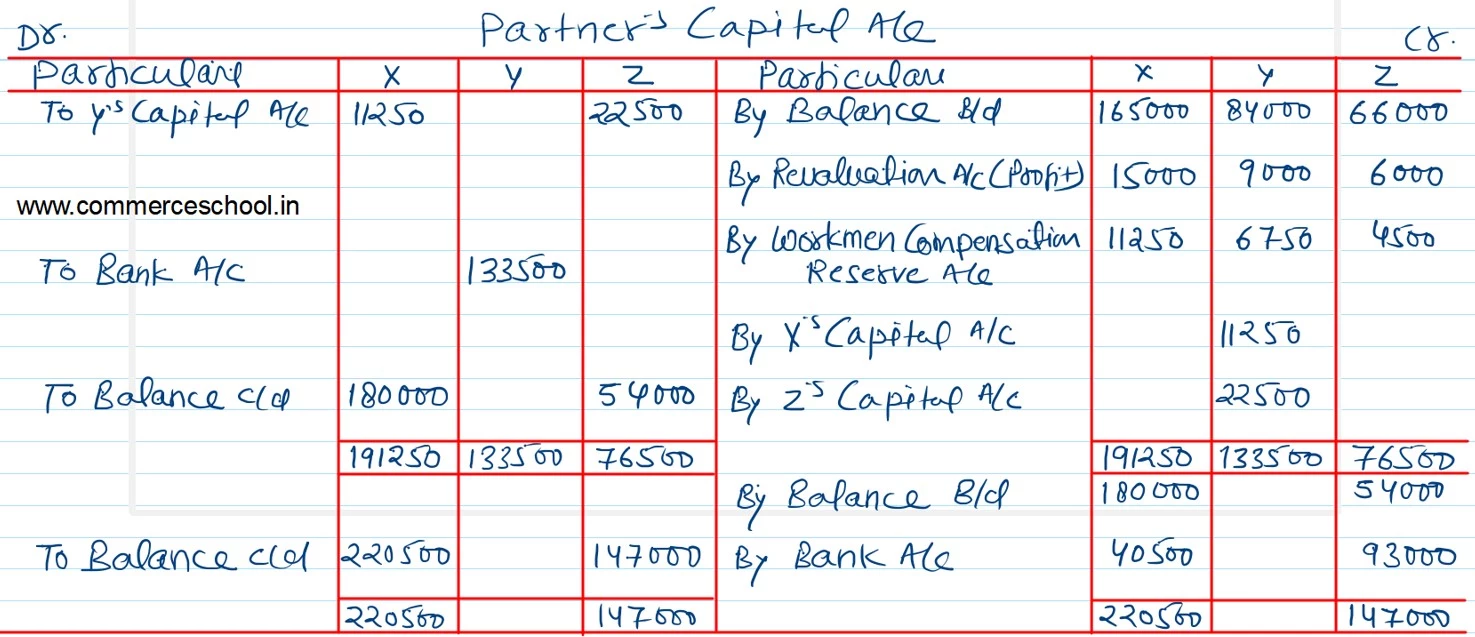

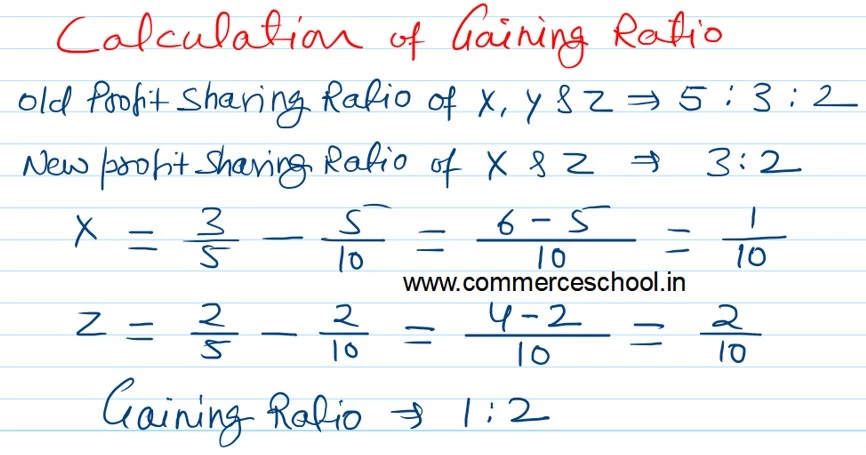

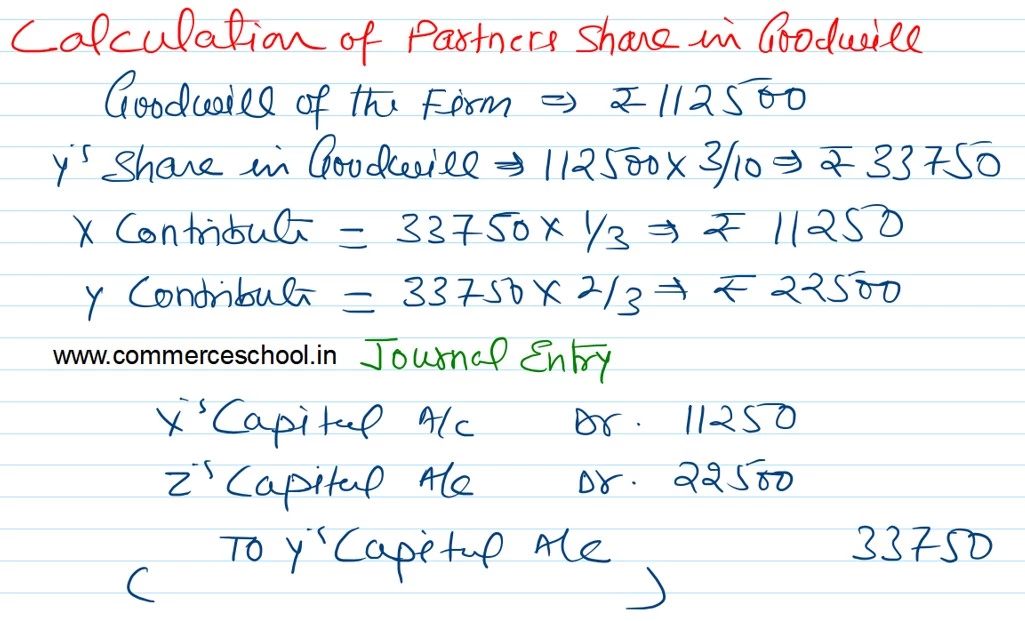

i) Goodwill of the firm is valued at ₹ 1,12,500 and Y’s share of it be adjusted into the Capital Accounts of X and X who are going to share future profits in the ratio of 3 : 2.

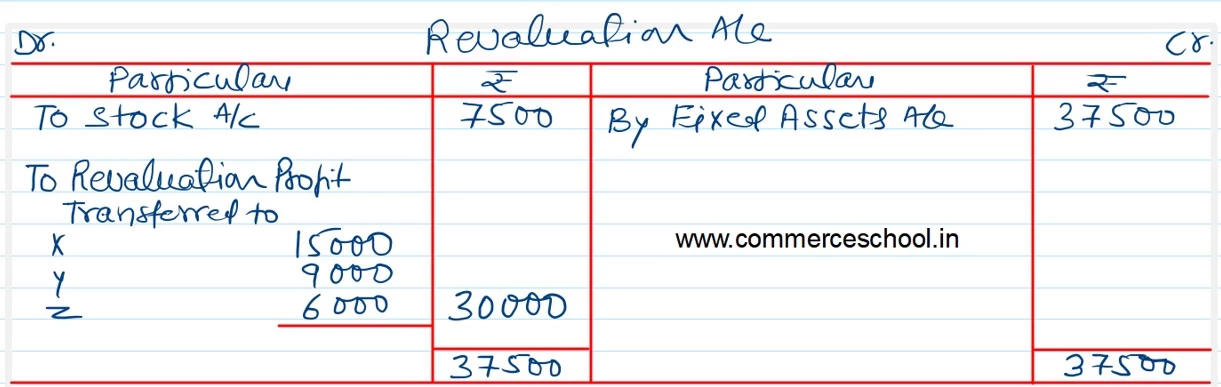

ii) Fixed Assets be appreciated by 20%.

iii) Stock be reduced to ₹ 75,000.

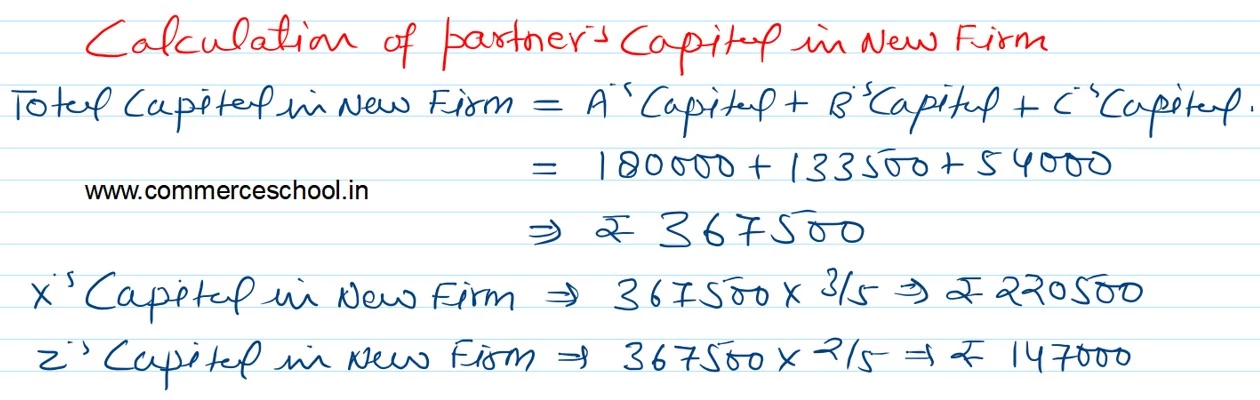

iv) Y be paid amount brought by X and Z so as to make their capitals proportionate to their new profit sharing ratio.

Prepare Revaluation Account, Capital Accounts of all partners and the Balance Sheet of the new Firm.

[Ans.: Gain (profit) on Revaluation – ₹ 30,000; Capital Accounts: X – ₹ 2,20,500; Z – ₹ 1,47,000; Amount Paid to Y – ₹ 1,33,500; Balance Sheet Total – ₹ 4,12,500; Gaining Ratio – 1 : 2; X pays – ₹ 40,000; Z pays – ₹ 93,000.]