Bale and yale are equal partners of a firm. They decide to dissolve their partnership on 31st March, 2023 at which date their Balance sheet stood as:

Bale and yale are equal partners of a firm. They decide to dissolve their partnership on 31st March, 2023 at which date their Balance sheet stood as:

| Liabilities | ₹ | Assets | ₹ |

| Capital A/cs:

Bale Yale General Reserve Loan by Bale Creditors |

50,000 40,000 8,000 3,000 14,000 |

Building

Machinery Furniture Debtors Stock Bank |

45,000 15,000 12,000 8,000 24,000 11,000 |

| 1,15,000 | 1,15,000 |

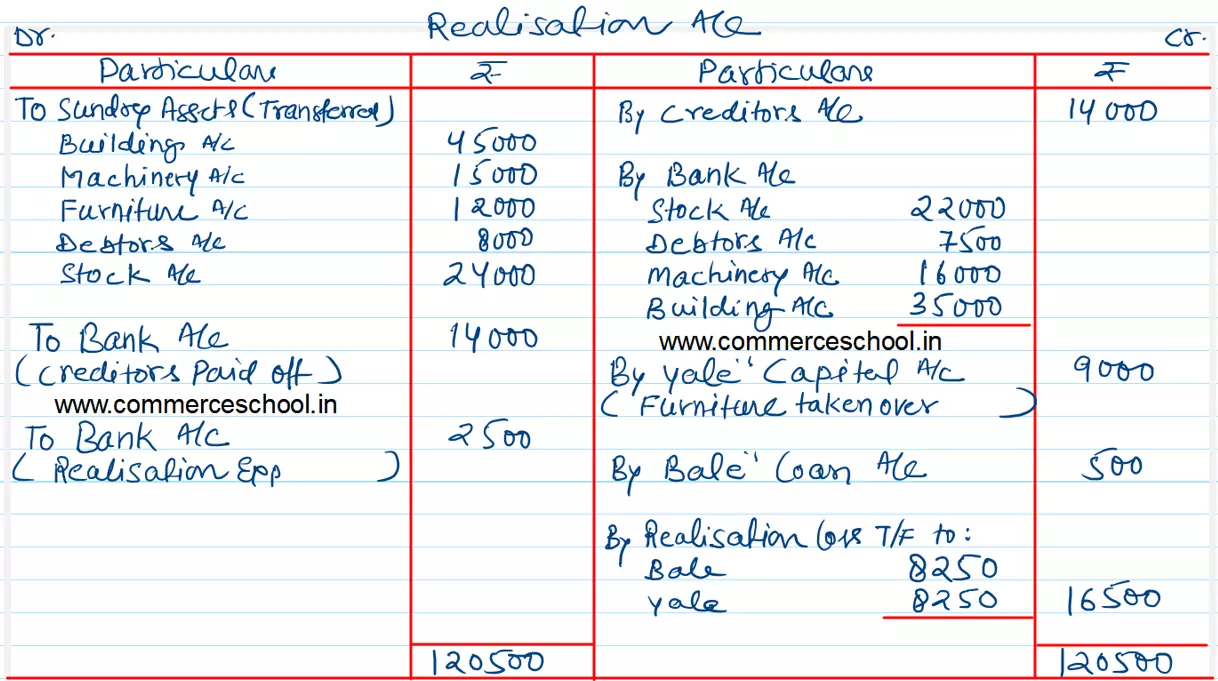

(a) The assets realised were:

Stock ₹ 22,000; Debtors ₹ 7,500; Machinery ₹ 16,000; Building ₹ 35,000.

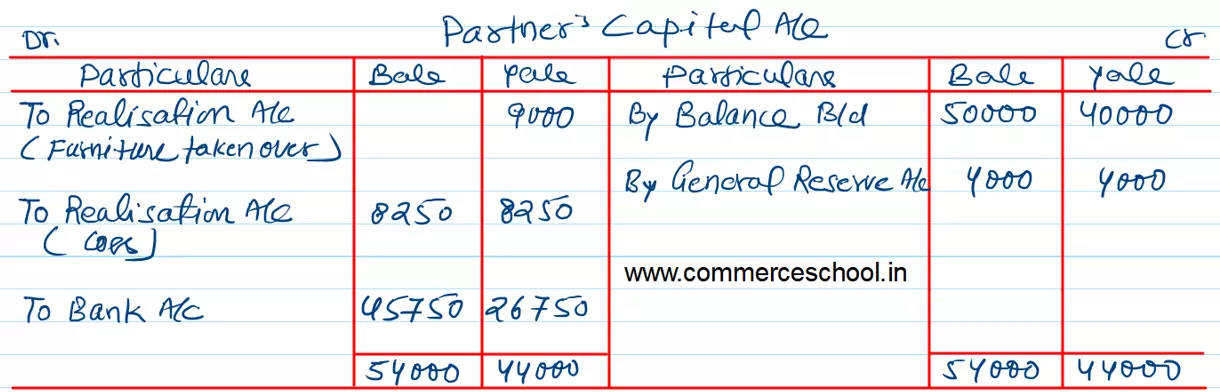

(b) Yale took furniture at ₹ 9,000.

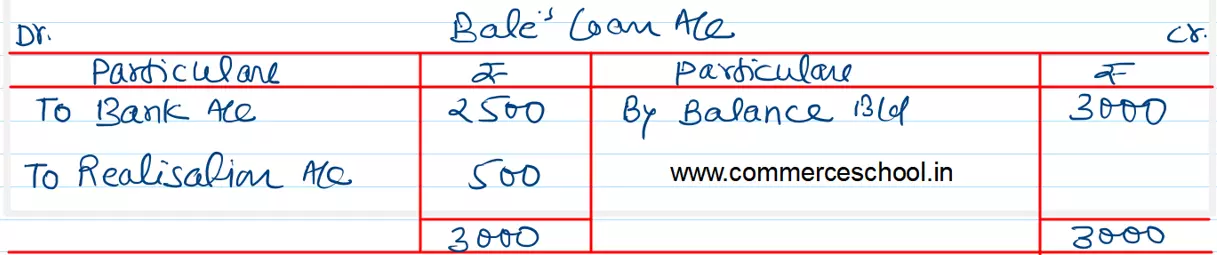

(c) Bale agreed to accept ₹ 2,500 in settlement of his loan account.

(d) Dissolution Expenses were ₹ 2,500.

Prepare the:

(i) Realisation Account;

(ii) Capital Accounts of Parnters

(iii) Loan by Bale Account;

(iv) Bank Account

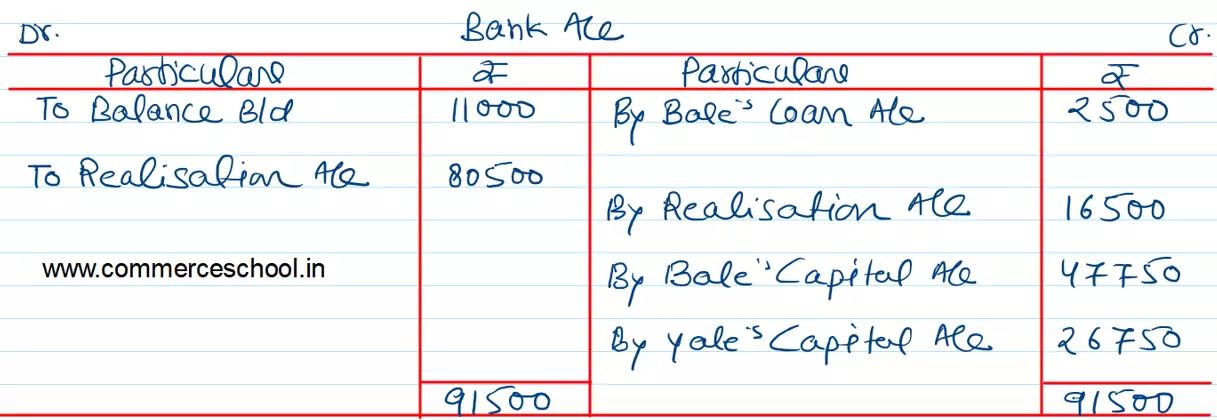

[Ans.: Loss on Realisation – ₹ 16,500; Amount paid to Bale – ₹ 45,750; Yale – ₹ 26,750; Total of Bank Account – ₹ 91,500.]