Below is given the Trial Balance of Mr. Ram as at 31st December, 2022. You are required to prepare Trading and Profit & Loss Account and Balance Sheet as at that date.

Below is given the Trial Balance of Mr. Ram as at 31st December, 2022. You are required to prepare Trading and Profit & Loss Account and Balance Sheet as at that date.

Adjustments:-

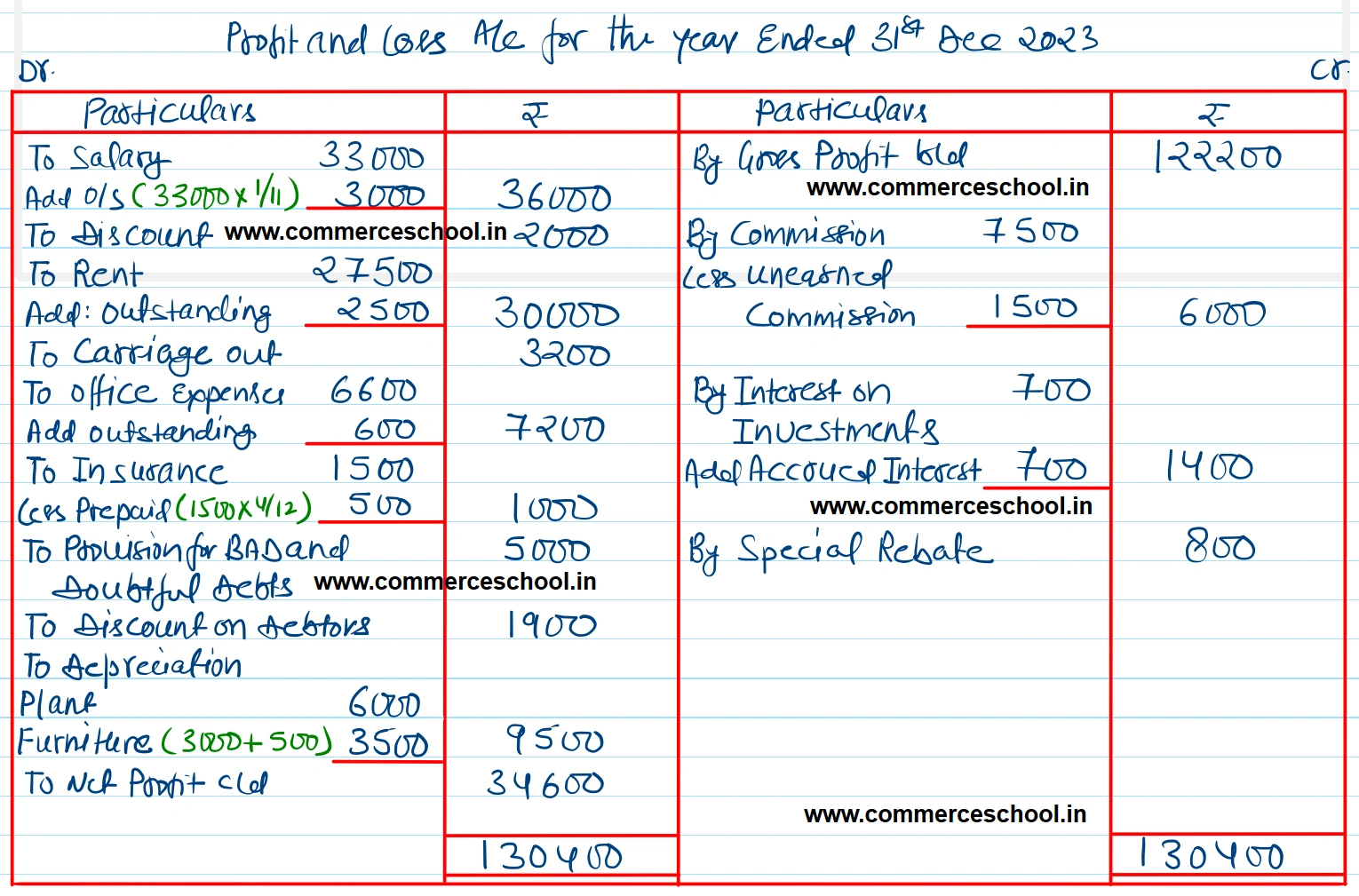

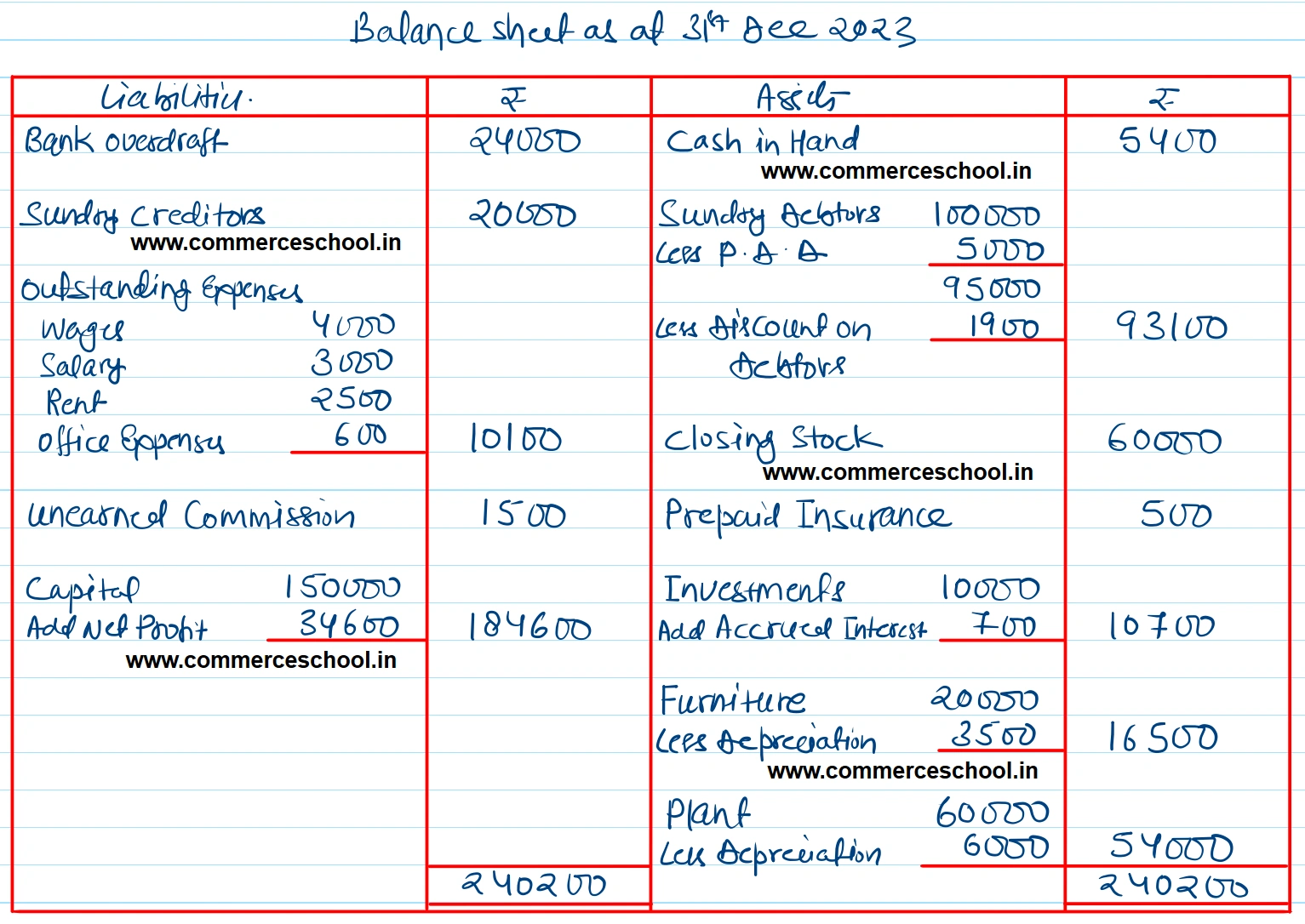

(1) Create a provision for Doubtful Debts @ 5% on Debtors and 2% for discount on Debtors.

(2) Provide up-to-date interest on Investments.

(3) Expenses for rent, wages, salaries and office expenses are uniform throughout the year and those for December, 2022 have not bee paid.

(4) Depreciate Plant by 10% p.a. and Furniture by 20% p.a.

(5) Unearned Commission ₹ 1,500.

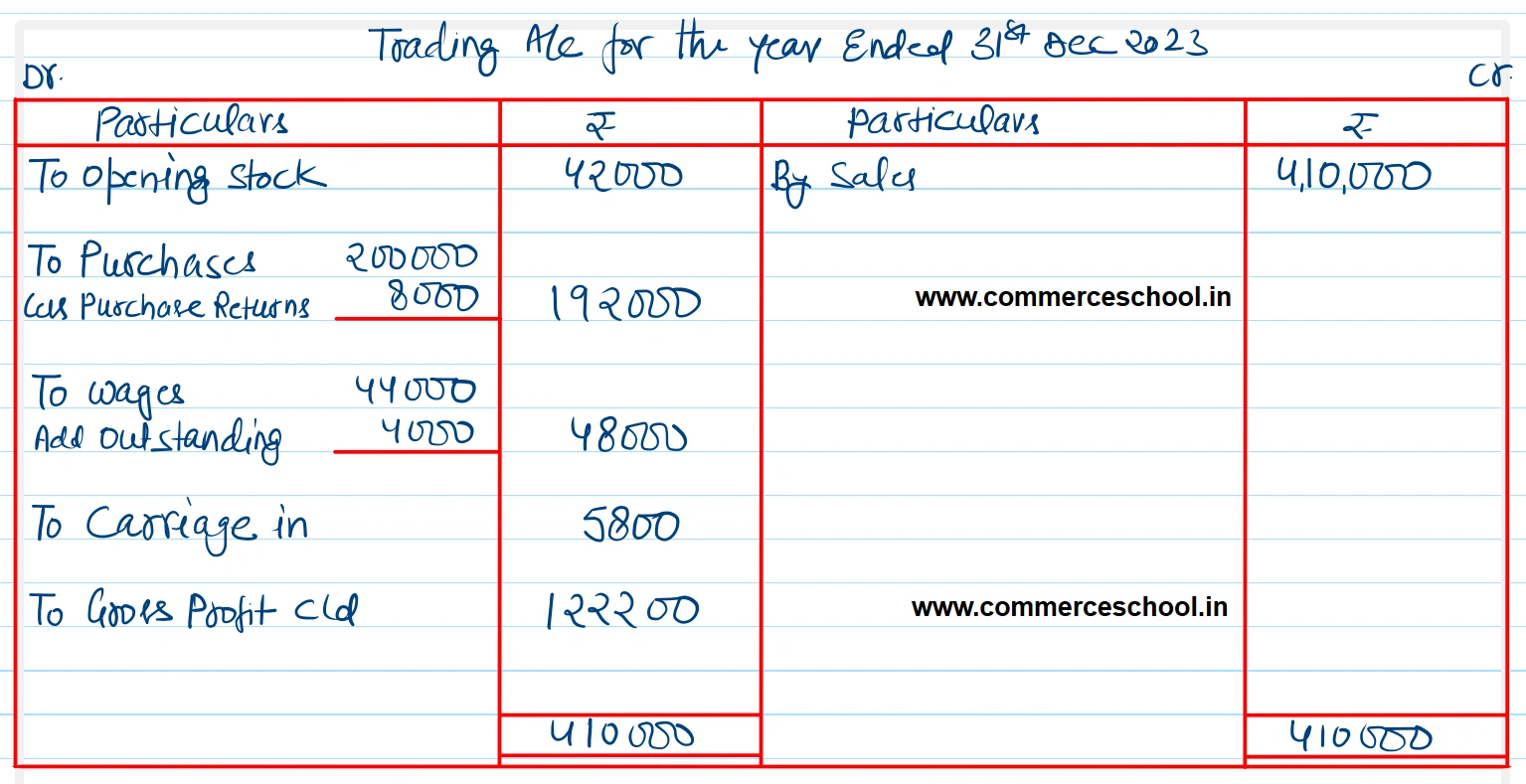

[Ans. G.P. ₹ 1,22,200; N.P. ₹ 34,600; B/S Total ₹ 2,40,200.]

Solution:-

| Dr. Balances | ₹ | Cr. Balances | ₹ |

| Opening Stock | 42,000 | Sales | 4,10,000 |

| Purchases | 2,00,000 | Sundry Creditors | 20,000 |

| Plant | 60,000 | Purchases Return | 8,000 |

| Salary | 33,000 | Commission | 7,500 |

| Wages | 44,000 | Bank | 24,000 |

| Discount | 2,000 | Capital | 1,50,000 |

| Rent | 27,500 | Interest on Investments | 700 |

| Furniture (Including Furniture of ₹ 5,000 purchased on 1st July, 2022) | 20,000 | Special Rebate | 800 |

| Carriage in | 5,800 | ||

| Carriage out | 3,200 | ||

| Sundry Debtors | 1,00,000 | ||

| Office Expenses | 6,600 | ||

| Cash in Hand | 5,400 | ||

| Investments at 14% p.a. | 10,000 | ||

| Insurance (Paid to 30th April, 2023) | 1,500 | ||

| Stock on 31st December, 2022 | 60,000 | ||

| 6,21,000 | 6,21,000 |

Anurag Pathak Answered question