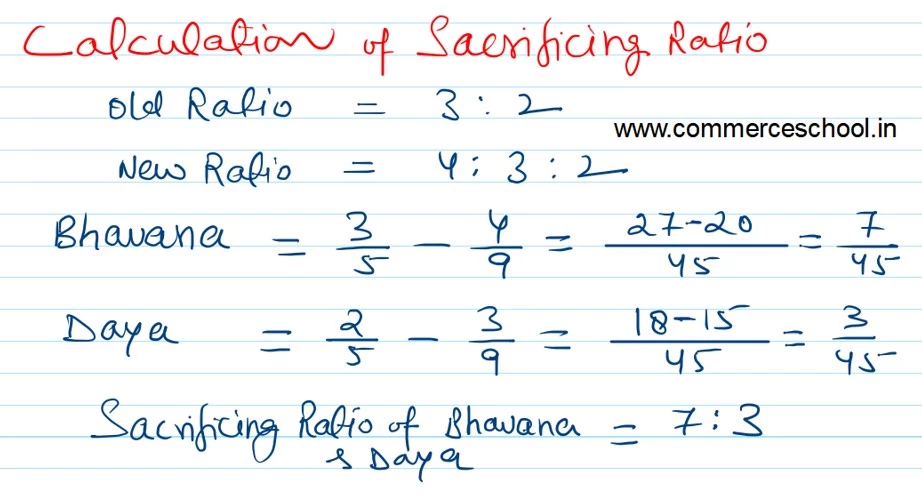

Bhavna and Daya sharing profits in the ratio of 3 : 2 had following Balance Sheet as at 31st March, 2023:

Bhavna and Daya sharing profits in the ratio of 3 : 2 had following Balance Sheet as at 31st March, 2023:

| Liabilities | ₹ | Assets | ₹ |

| Creditors

General Reserve Capital A/cs: Bhavna Daya Current A/cs: Bhavna Daya |

15,000 12,000 1,54,000 1,36,000 10,000 2,000 |

Cash in Hand

Cash at Bank Debtors Patents Investments Machinery Goodwill |

25,000 1,80,000 19,200 14,800 8,000 72,000 10,000 |

| 3,29,000 | 3,29,000 |

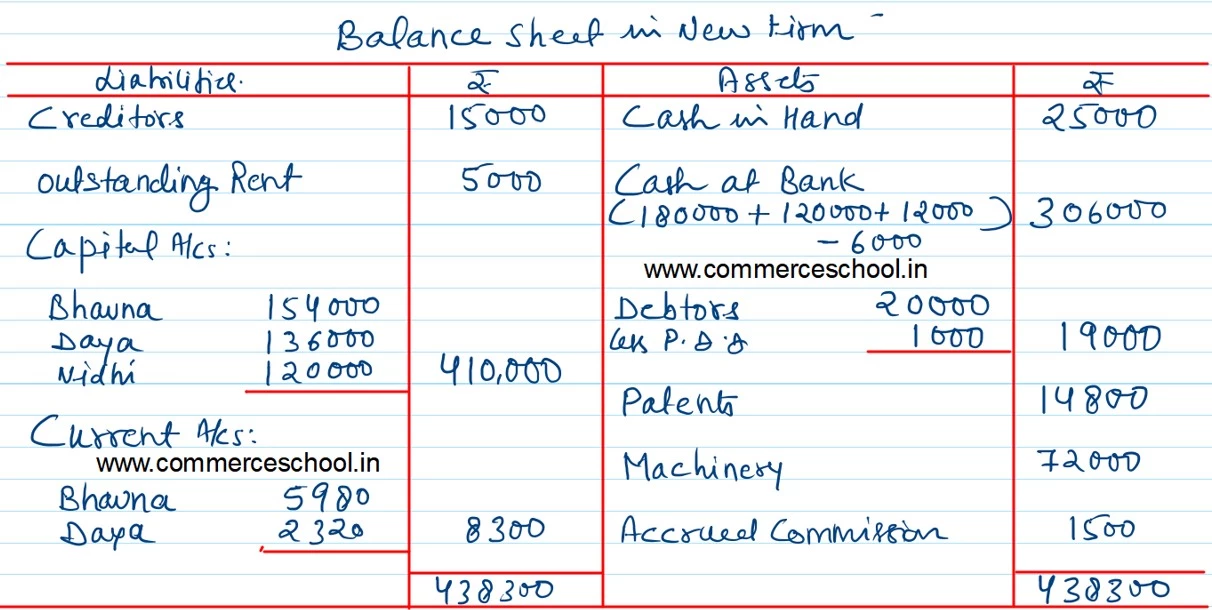

On 1st April, 2023, they admit Nidhi into partnership on the following terms:

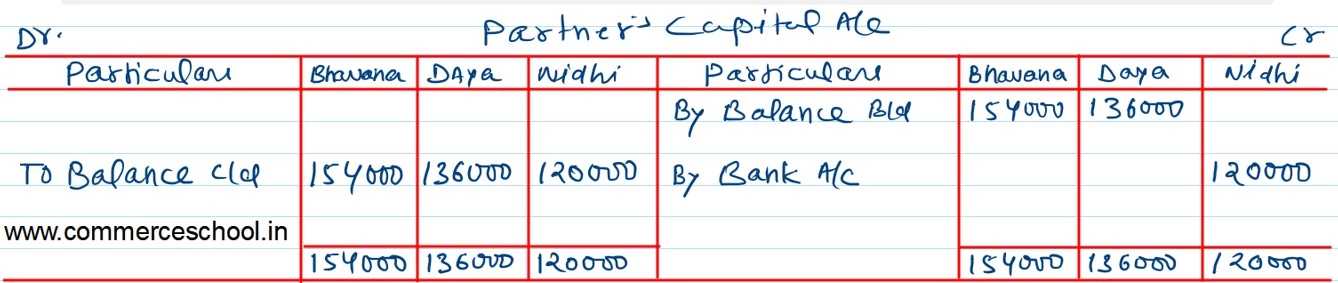

(i) Nidhi will bring in ₹ 1,20,000 as her capital.

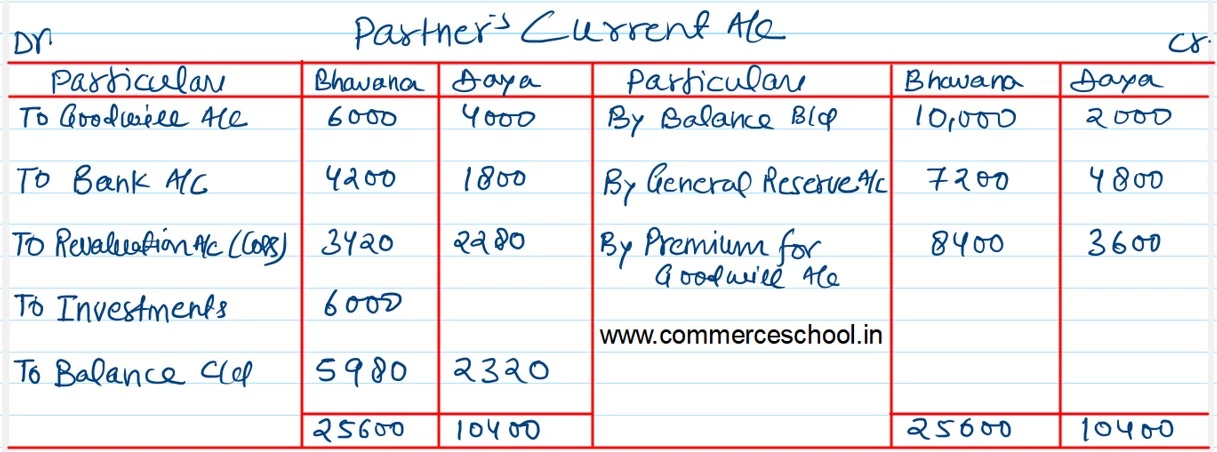

(ii) Nidhi is to pay in cash an amount equal to her share in firm’s goodwill valued at twice the average profit of the last 3 years which were ₹ 25,000: ₹ 26,000 and ₹ 30,000 respectively.

(iii) Half the amount of goodwill is withdrawn by old partners.

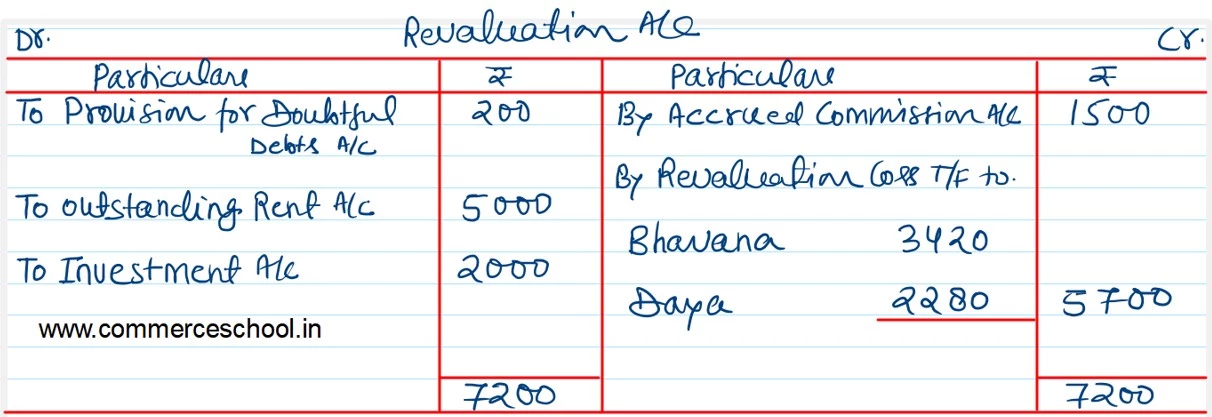

(iv) Provision for Doubtful Debts is to be maintained at 5% on Debtors.

(v) Accrued commission of ₹ 1,500 does not appear in the books and ₹ 5,000 are outstanding for rent.

(vi) Present market value of investments is ₹ 6,000. Bhavna takes the investments at its market value.

(vii) New Profit sharing ratio of partners will be 4 : 3 : 2.

Prepare Revaluation Account, Partner’s Capital Accounts, Partner’s Current Accounts and opening Balance Sheet of the new firm.