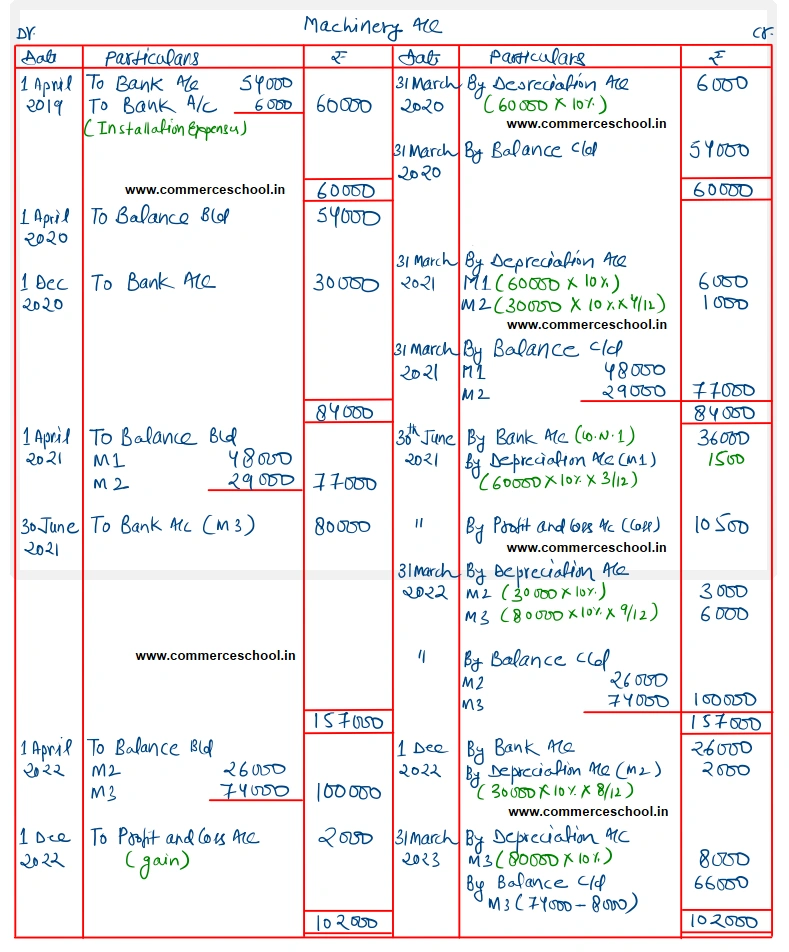

Bhushan & Company purchased a Machinery on 1st April, 2019, for ₹ 54,000 and spent ₹ 6,000 on its installation. On 1st December, 2020, it purchased another machine for ₹ 30,000.

Bhushan & Company purchased a Machinery on 1st April, 2019, for ₹ 54,000 and spent ₹ 6,000 on its installation. On 1st December, 2020, it purchased another machine for ₹ 30,000.

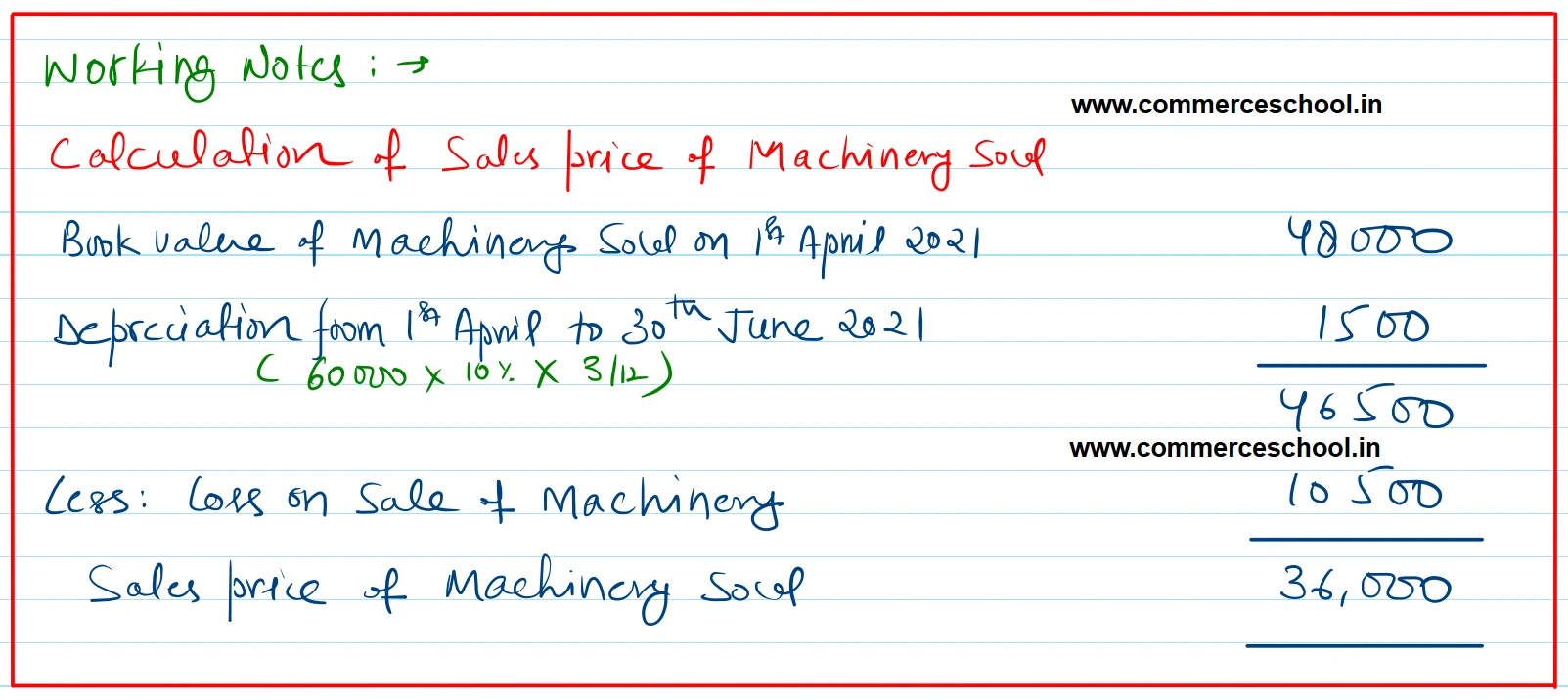

On 30th June 2021, the first machine purchased on 1st April, 2019, is sold at a loss of ₹ 10,500 and on the same date it purchased a new machinery for ₹ 80,000.

On December 1, 2022, the second machine (purchased on December 1, 2020) was also sold off for ₹ 26,000.

Depreciation was provided on machinery @ 10% p.a. on Original Cost Method annually on 31st March. Give the machinery account for four years.

[Ans. Sale Value of First Machine ₹ 36,000; Gain on sale of Second Machine ₹ 2,000, Balance of Machine A/c on 31st March, 2023, ₹ 66,000.]