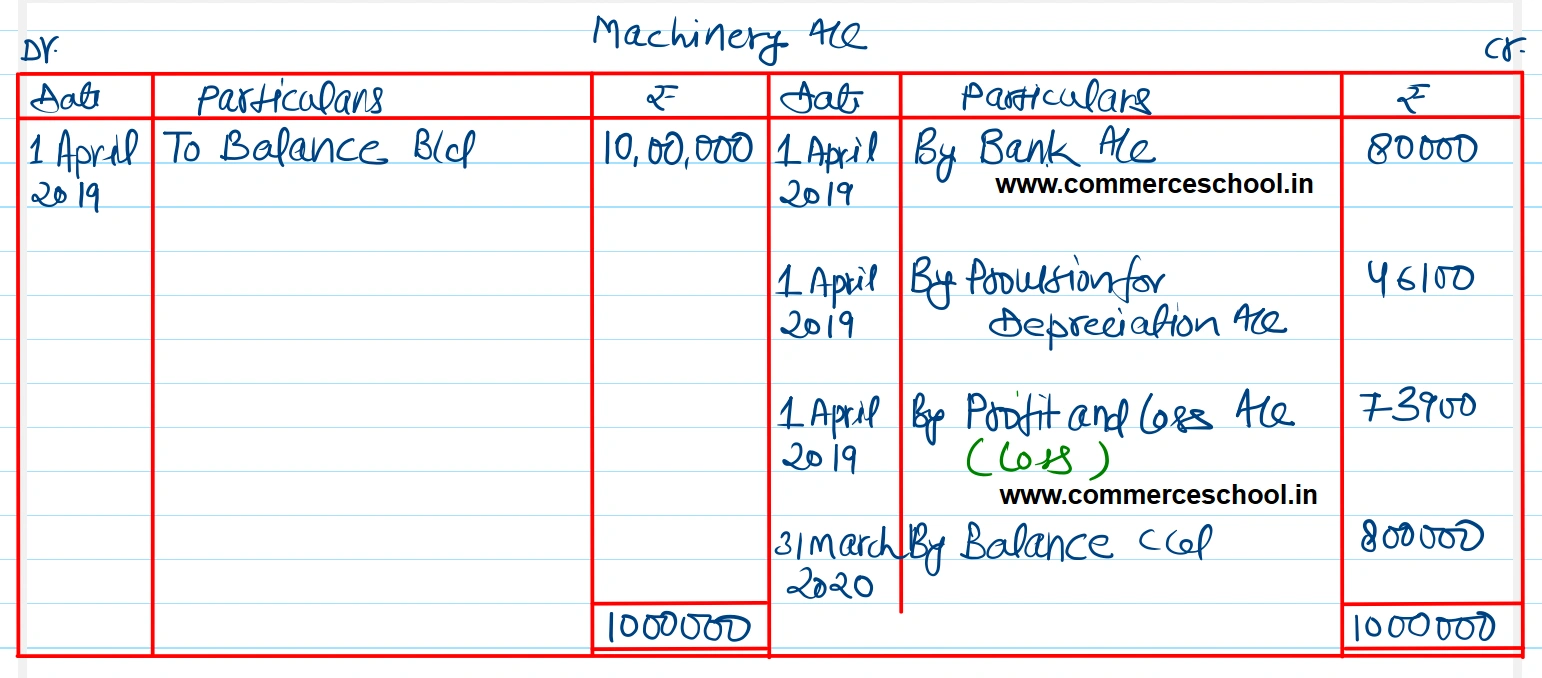

Books of Mumbai Chemicals Ltd. showed the following balances on 1st April, 2019: Machinery A/c ₹ 10,00,000 ₹ Provision for Depreciation A/c ₹ 4,05,000

Books of Mumbai Chemicals Ltd. showed the following balances on 1st April, 2019:

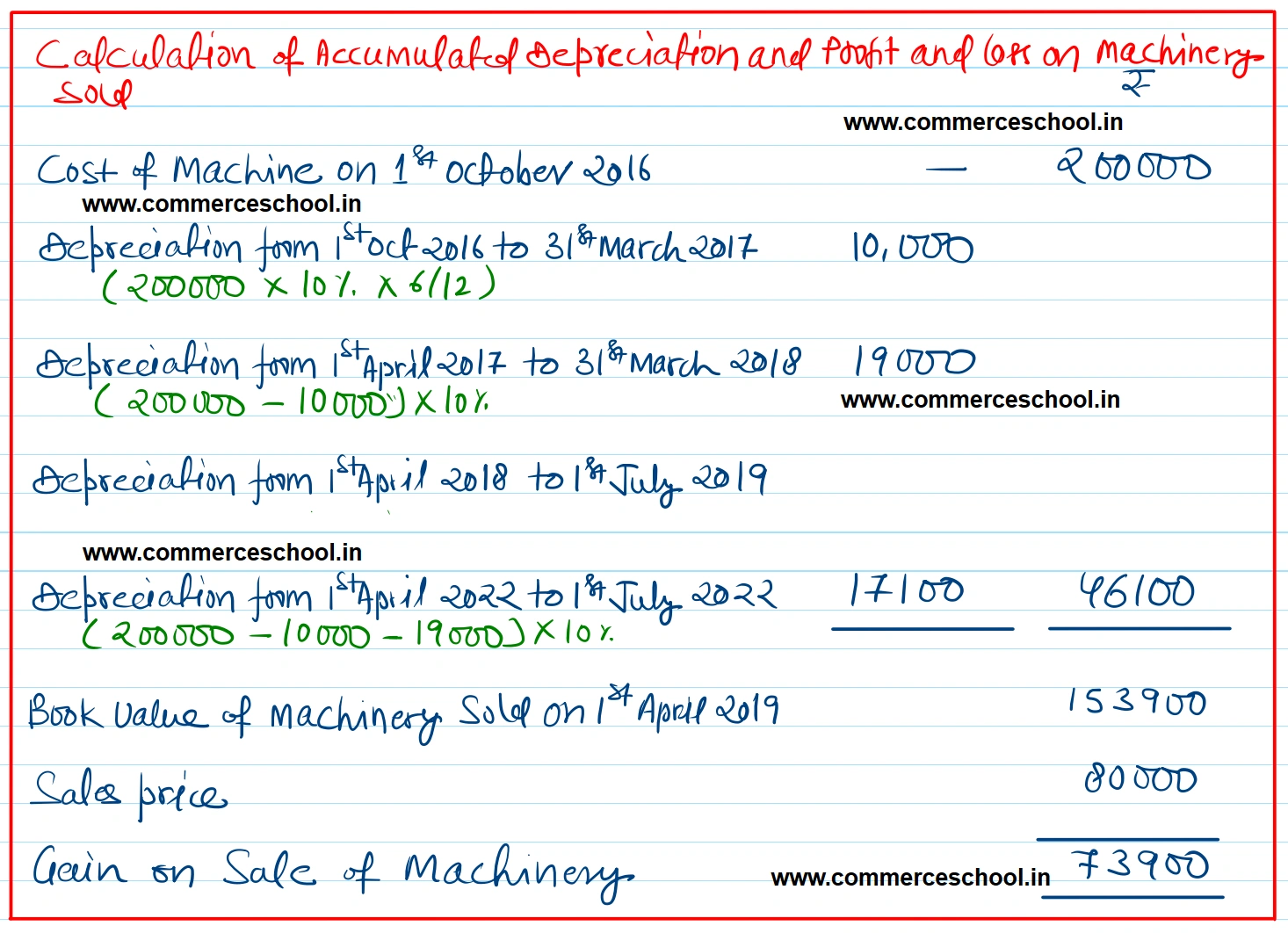

On 1st April, 2019, a machine which had a cost of ₹ 2,00,000 on 1st October, 2016 was sold for ₹ 80,000. The firm writes off depreciation @ 10% p.a. under the Reducing Balance Method and its accounts are made up on 31st March each year. You are required to prepare the Machinery A/c and Provision for Depreciation A/c for the year ending 31st March, 2020.

[Ans. Balance of Machinery A/c on 31st March, 2020 ₹ 8,00,000. Balance of Provision for Depreciation A/c on 31st March, 2020 ₹ 4,03,010; Loss on sale of Machinery ₹ 73,900.]

| ₹ | |

| Machinery A/c | 10,00,000 |

| Provision for Depreciation A/c | 4,05,000 |

Anurag Pathak Answered question