Calculate ‘Cash Flows from Operating Activities’ for the year ended 31st March, 2021 from the following Balance Sheet of Raman Ltd. as at 31st March, 2021

Calculate ‘Cash Flows from Operating Activities’ for the year ended 31st March, 2021 from the following Balance Sheet of Raman Ltd. as at 31st March, 2021:

Balance Sheet of Raman Ltd. as at 31st March, 2021

| Particulars | Note. No. | 31st March, 2021 | 31st March, 2020 |

| I. EQUITY AND LIABILITIES: | |||

|

(1) Shareholder’s Funds: (a) Share Capital (b) Reserve and Surplus |

7,50,000 1,25,000 | 7,00,000 55,000 | |

|

(2) Non-Current Liabilities: Long-term Borrowings |

1,00,000 | 62,500 | |

|

(3) Current Liabilities (a) Short term Borrowings (b) Trade Payables (c) Short term Provisions |

6,000 7,500 9,000 | 5,000 41,500 5,500 | |

| Total | 9,97,500 | 8,69,500 | |

| II. ASSETS: | |||

|

(1) Non-Current Assets: (a) Property, Plant and Equipment and Intangible Assets (i) Property, Plant and Equipment (b) Intangible Assets |

9,30,000 25,000 | 8,05,000 15,000 | |

|

(2) Current Assets: (a) Current Investments (b) Inventories (c) Trade Receivables (d) Cash at Bank |

4,000 18,500 13,000 7,000 | 2,500 29,500 11,500 6,000 | |

| Total | 9,97,500 | 8,69,500 |

Notes to Accounts:-

| 31.3.2023 | 31.3.2022 | |

|

Reserves and Surplus: Surplus (Balance in Statement of Profit and Loss) |

1,25,000 | 55,000 |

|

Short term Borrwingss Bank Overdraft |

6,000 | 5,000 |

|

Short term Provisions Provision for Tax |

9,000 | 5,500 |

|

Property, Plant and Equipment Machinery Accumulated Depreciation |

10,00,000 (70,000) |

8,50,000 (45,000) |

| 9,30,000 | 8,05,000 | |

|

Intangible Assets Patents |

25,000 | 15,000 |

Additional Information:

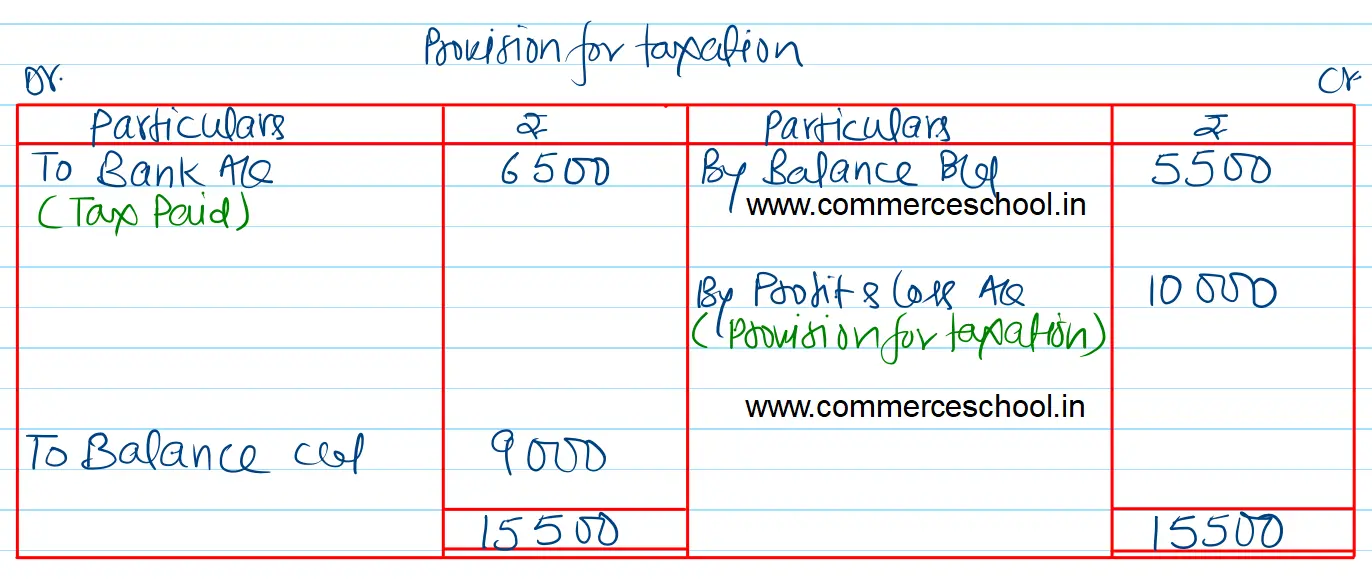

Tax Paid during the year amounted to ₹ 6,500.

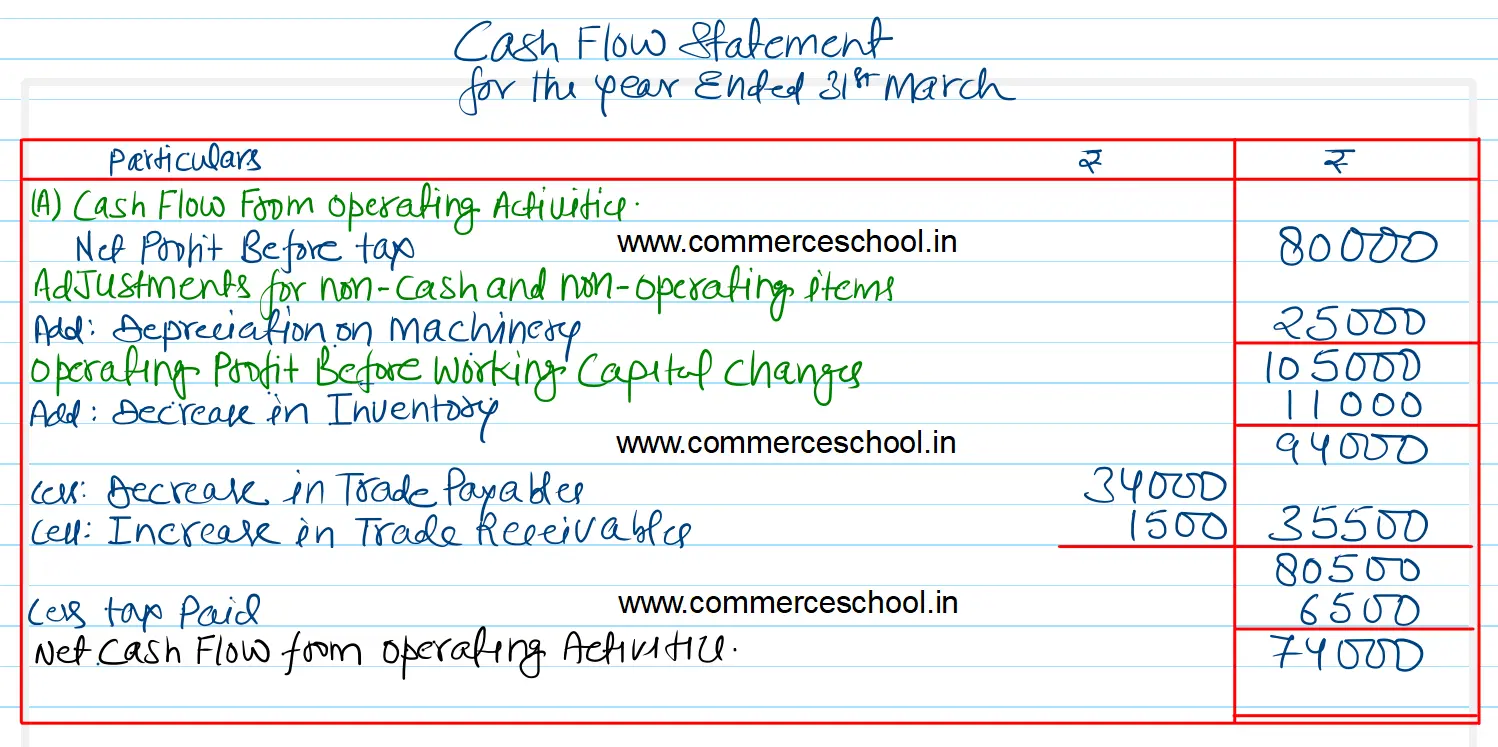

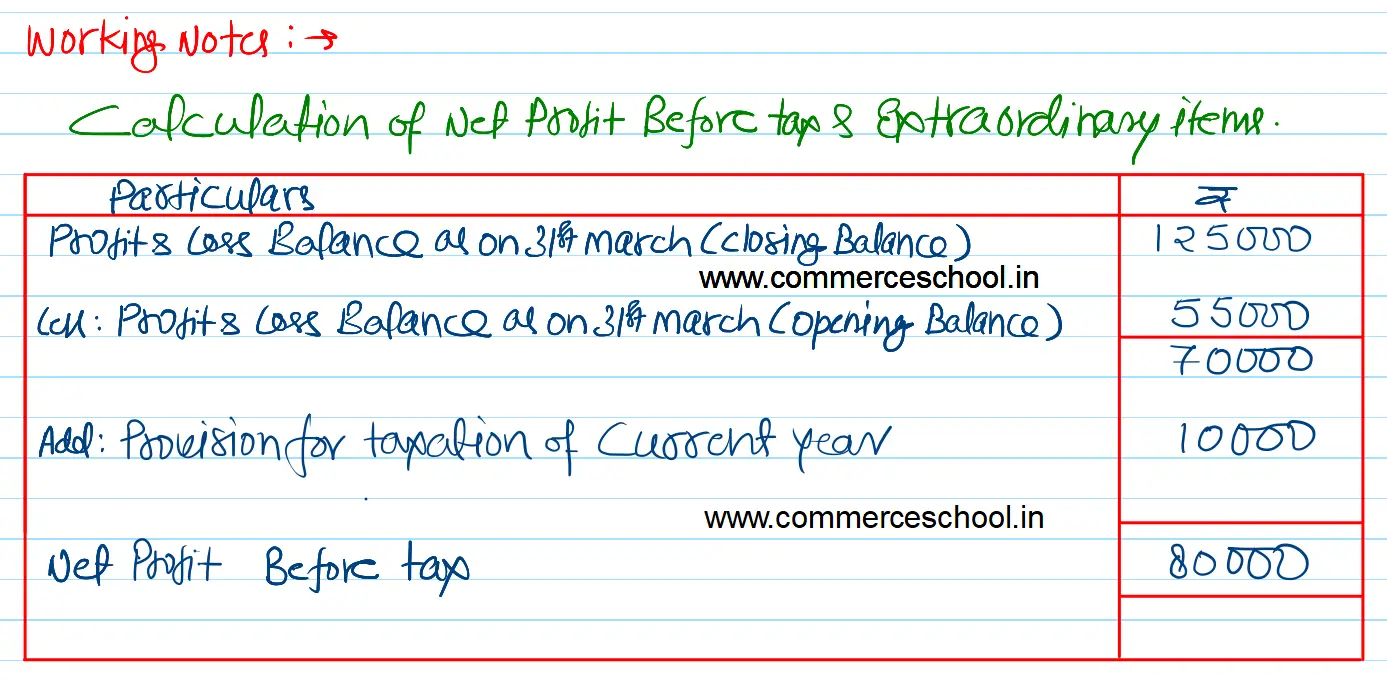

[Ans. Profit before tax ₹ 80,000; Cash Flow from Operating Activities ₹ 74,000.]