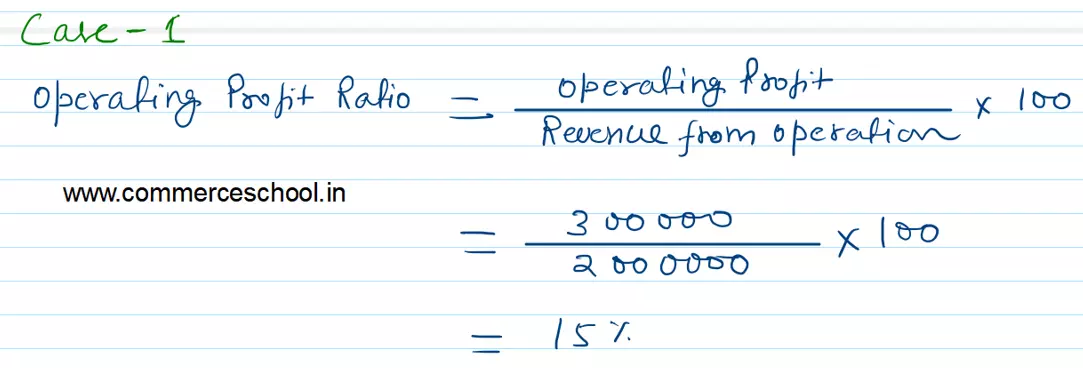

Calculate Operating Profit Ratio in each of the following alternative cases: Case 1: Revenue from Operations (Net Sales) ₹ 20,00,000; Operating Profit ₹ 3,00,000.

Calculate Operating Profit Ratio in each of the following alternative cases:

Case 1: Revenue from Operations (Net Sales) ₹ 20,00,000; Operating Profit ₹ 3,00,000.

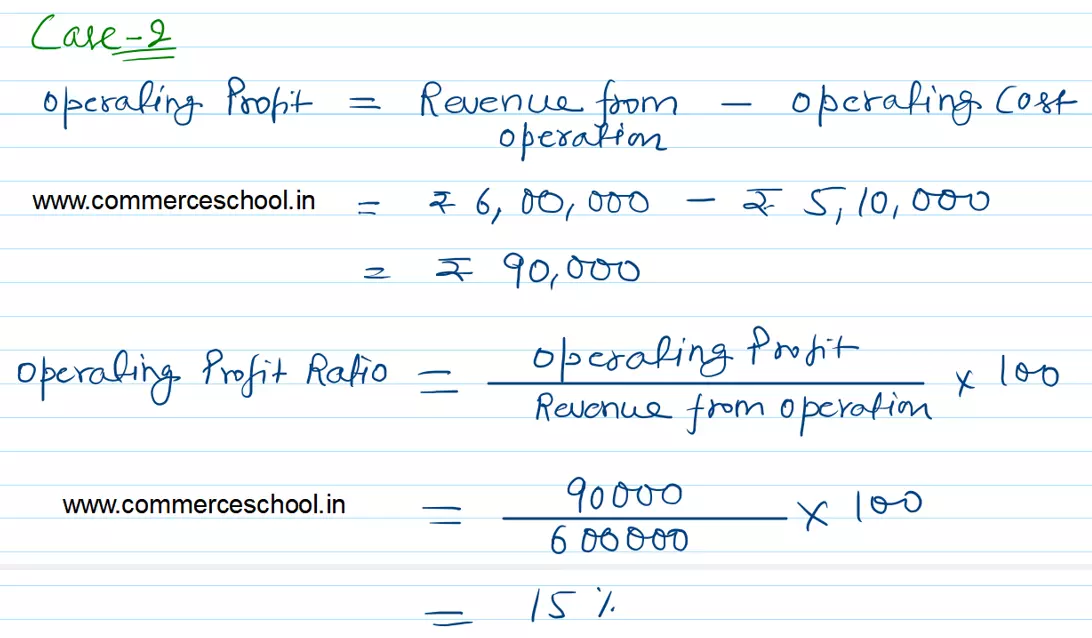

Case 2: Revenue from Operations (Net Sales) ₹ 6,00,000; Operating Cost ₹ 5,10,000.

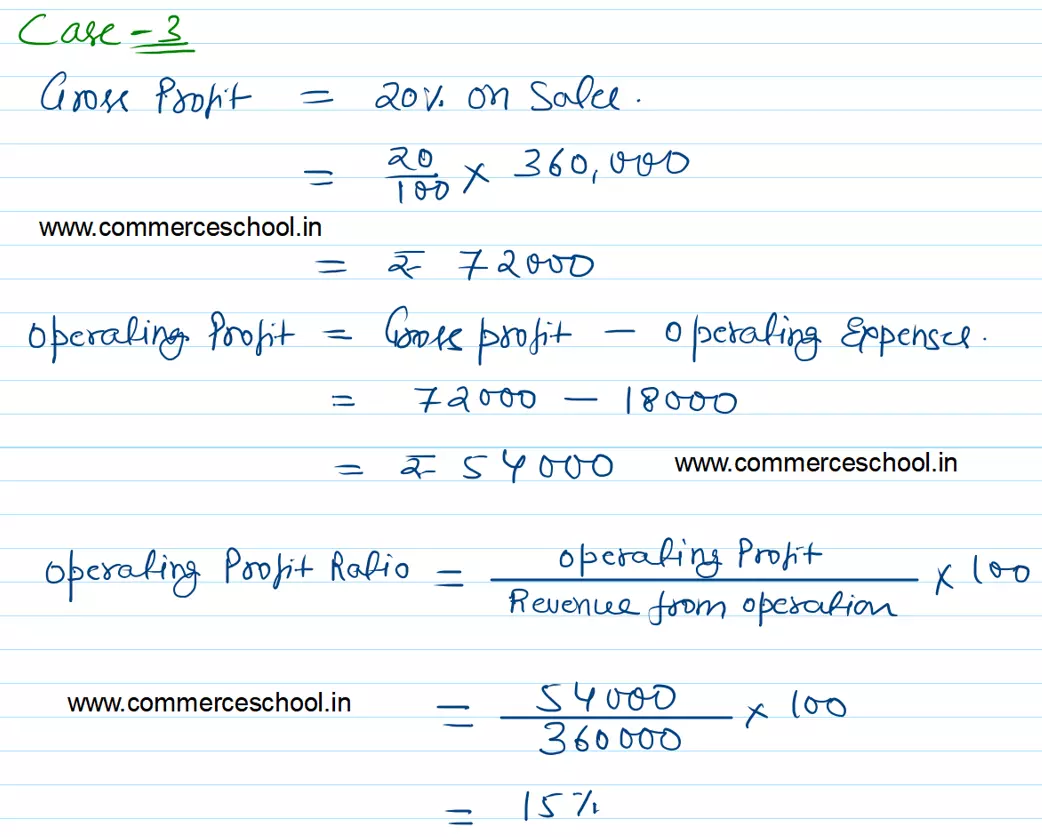

Case 3: Revenue from Operations (Net Sales) ₹ 3,60,000; Gross Profit 20% on Sales; Operating Expenses ₹ 18,000.

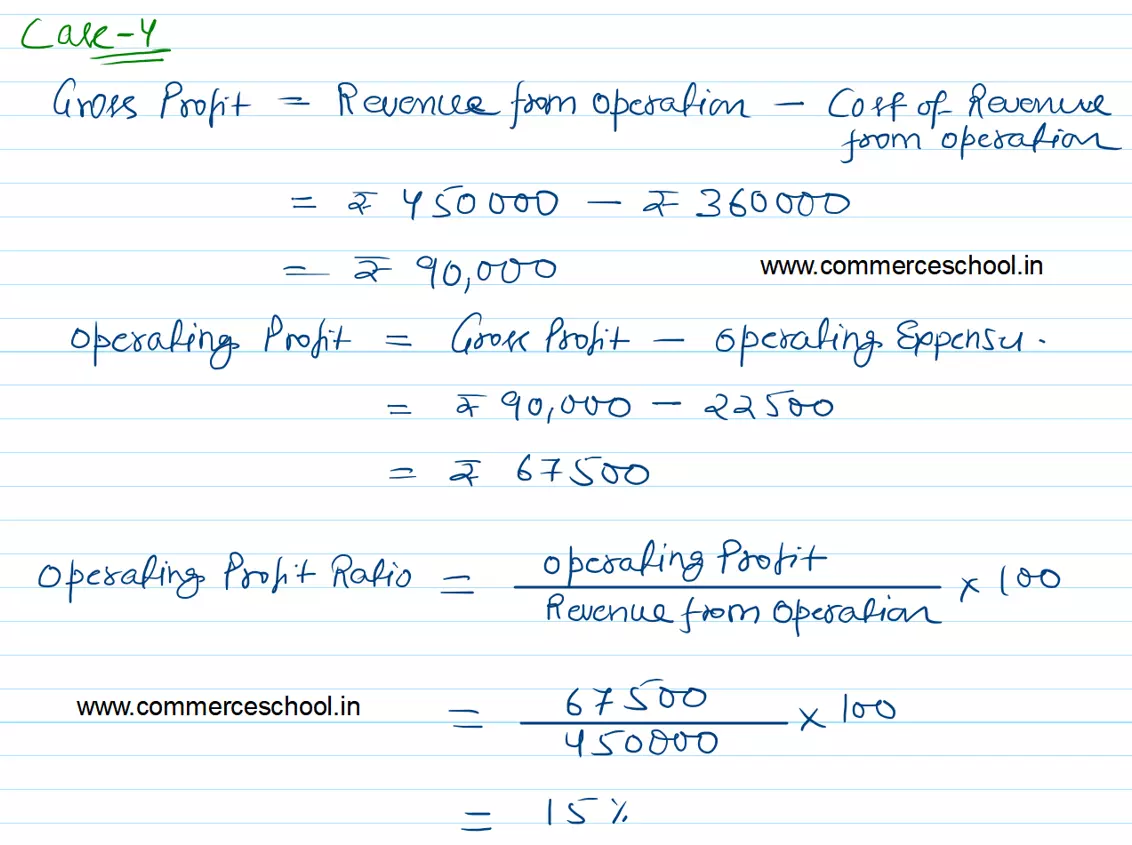

Case 4: Revenue from Operations (Net Sales) ₹ 4,50,000; Cost of Revenue from Operations ₹ 3,60,000; Operating Expenses ₹ 22,500.

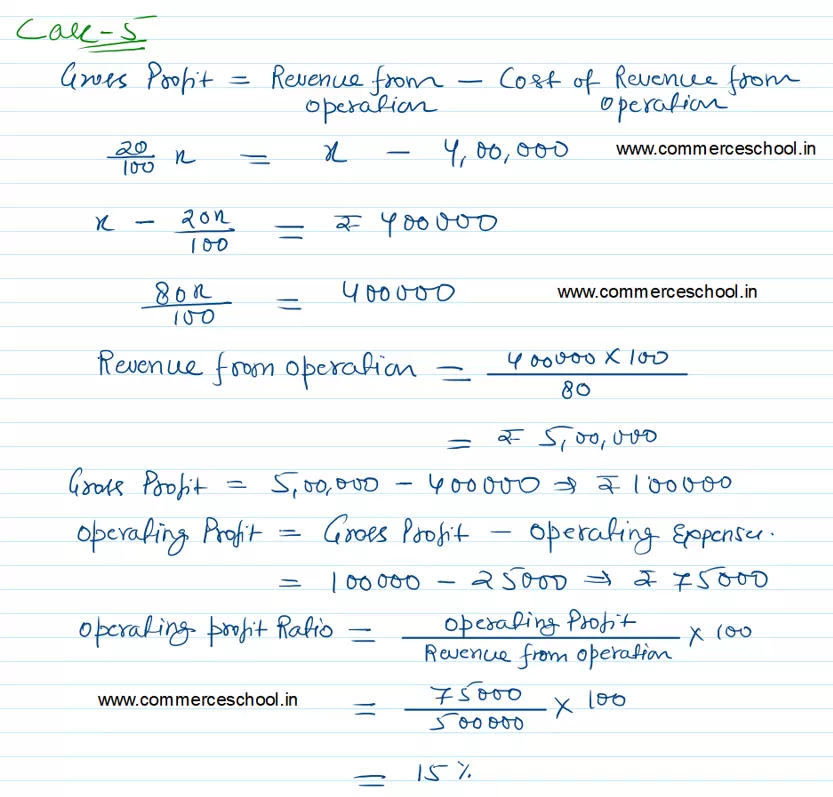

Case 5: Cost of Goods Sold, i.e., Cost of Revenue from Operations ₹ 4,00,000; Gross Profit 20% on Sales; Operating Expenses ₹ 25,000.

[Ans.: Case 1 = 15%; Case 2 = 15%; Case 3 = 15%; Case 4 = 15%; Case 5 = 15%.]

Anurag Pathak Changed status to publish