Calculate the amount of subscription which will be treated as income for the year 2022 – 23, for each of the following cases:

Calculate the amount of subscription which will be treated as income for the year 2022 – 23, for each of the following cases:

| Case | Particulars | ₹ |

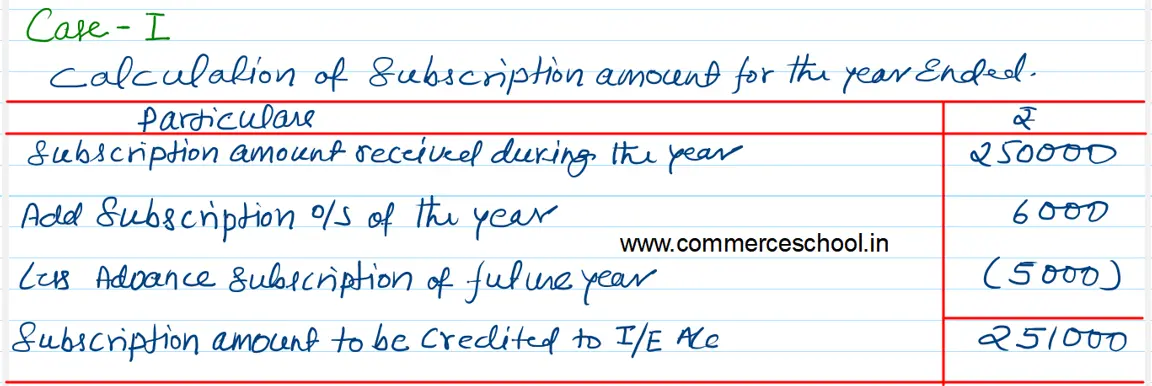

| 1. | (i) Subscriptions collected during the year 2022-23 (ii) Subscription in arrear for the year 2022-3 (iii) Subscription received in advance for the year 2023-24 | 2,50,000 6,000 5,000 |

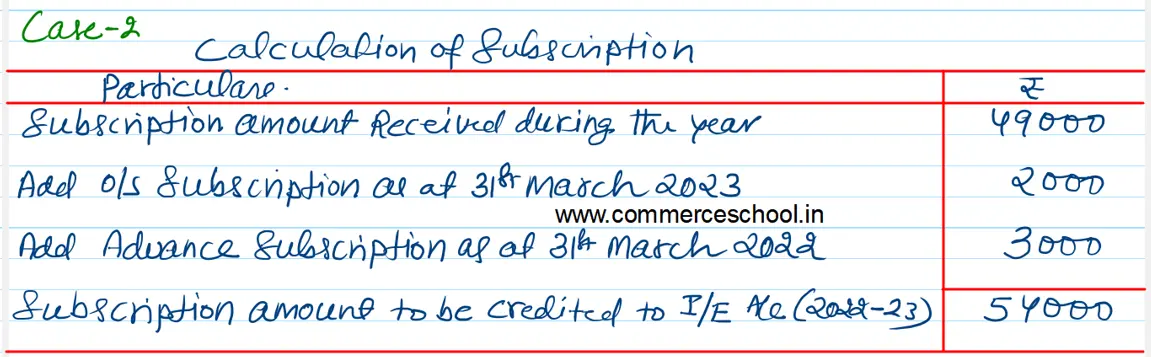

| 2 | (i) Subscriptions collected during the year 2022-23 (ii) Subscriptions for the year 2022-23 collected in 2021-22 (iii) Subscriptions unpaid for the year 2022-23 | 49,000 3,000 2,000 |

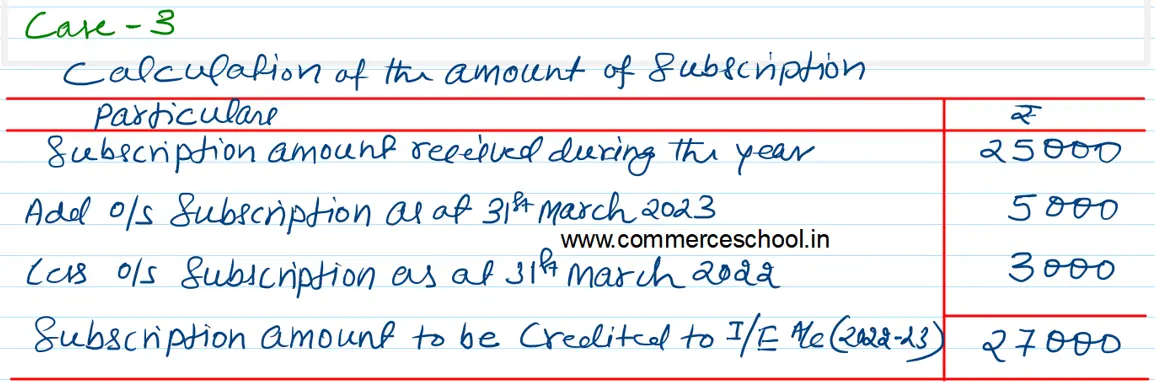

| 3 | (i) Subscription received during the year 2022-23 (ii) Subscriptions outstanding in the beginning of 2022-23 (iii) Subscriptions not yet collected for 2022-23 | 25,000 3,000 5,000 |

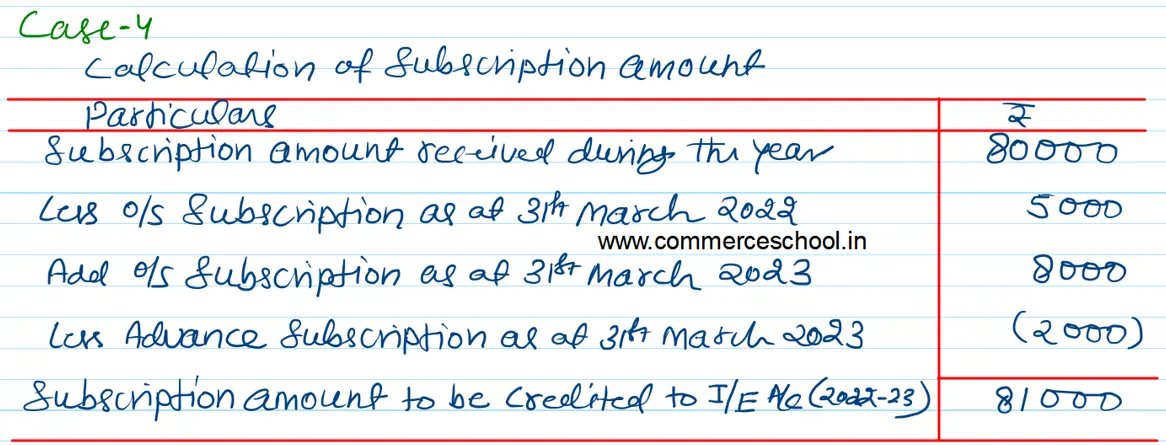

| 4 | (i) Subscriptions received during the year 2022-23 (ii) Subscriptions outstanding in the beginning of 2022-23 (iii) Subscriptions not yet collected for 2022-23 (iv) Subscriptions for 2023-24 received in advance. | 80,000 5,000 8,000 2,000 |

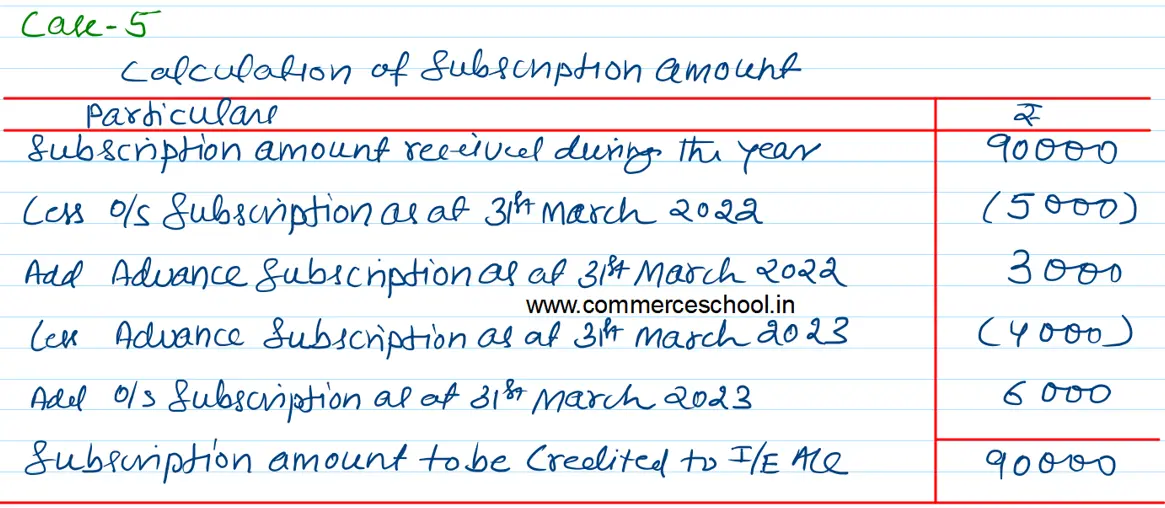

| 5 | (i) Subscriptions received during the year 2022-23 (ii) Subscriptions outstanding at the end of 2021-22 (iii) Subscriptions received in advance on 31st March, 2022 (iv) Subscriptions received in advance on 31st March, 2023 (v) Subscriptions not yet collected for 2022-23 | 90,000 5,000 3,000 4,000 6,000 |

Anurag Pathak Changed status to publish