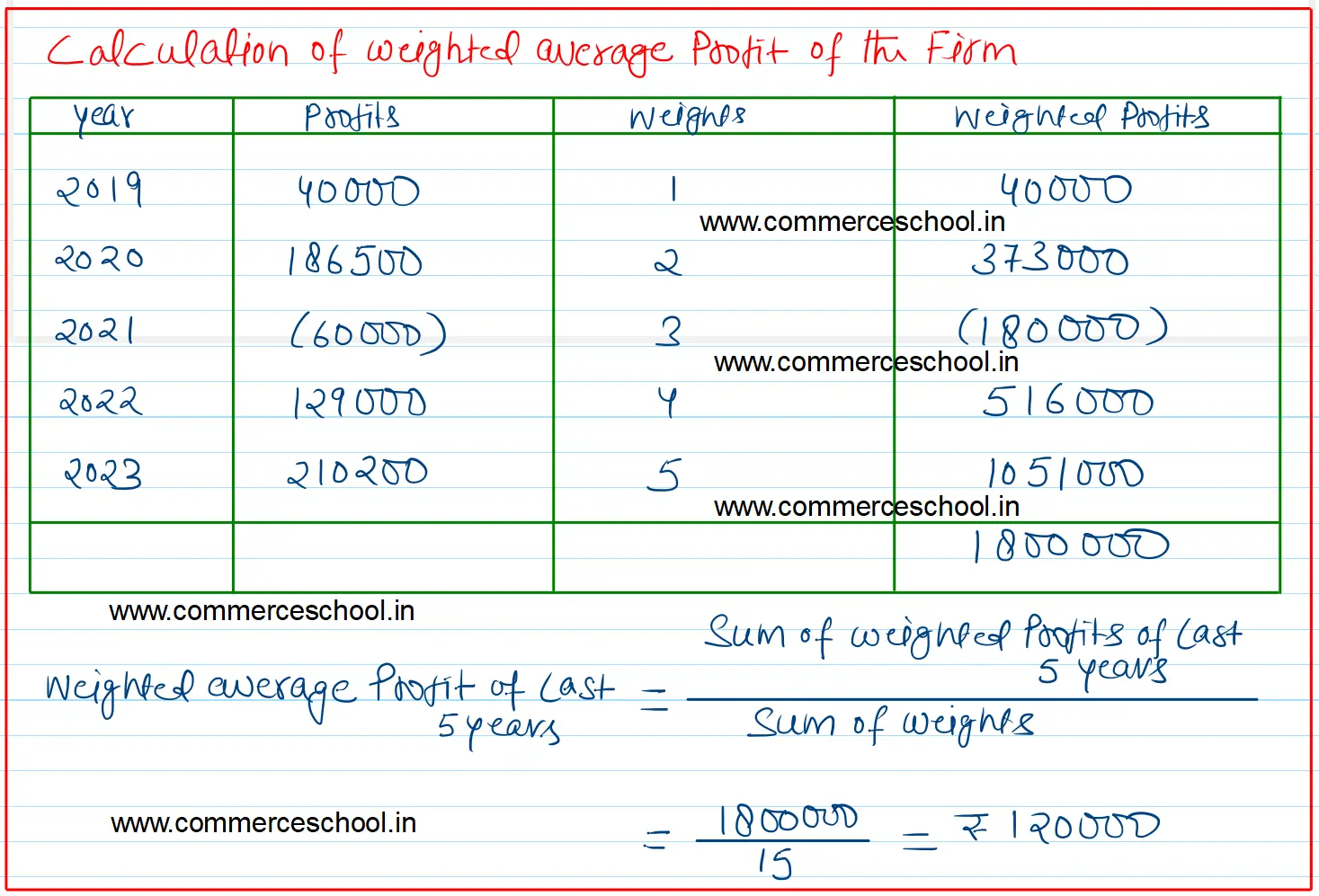

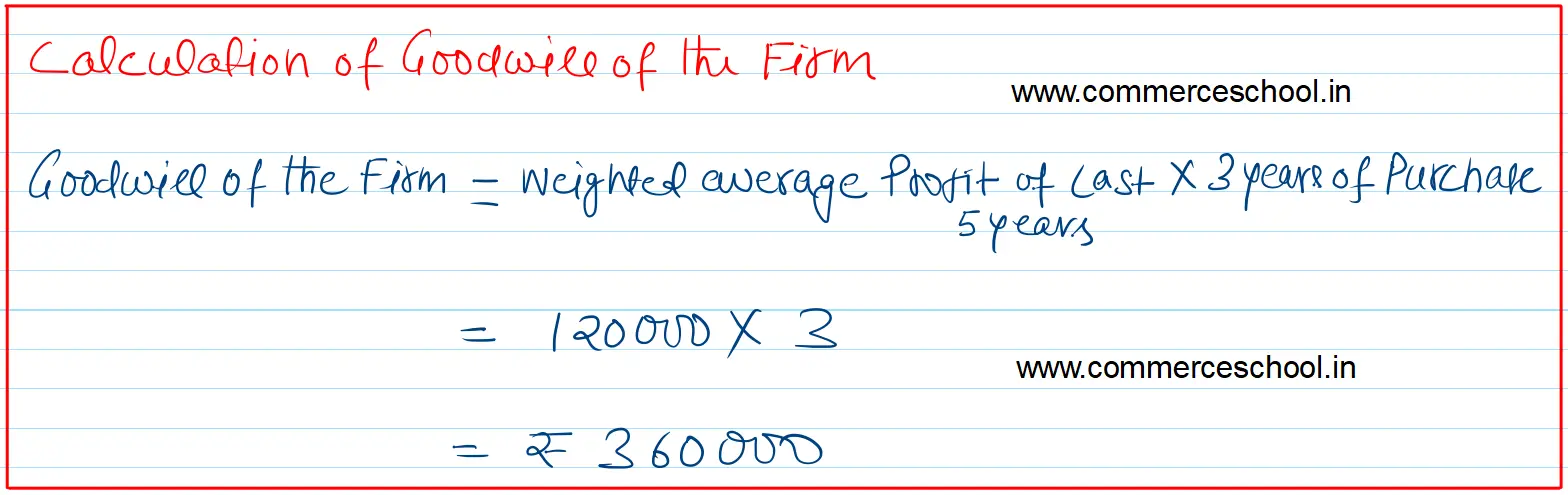

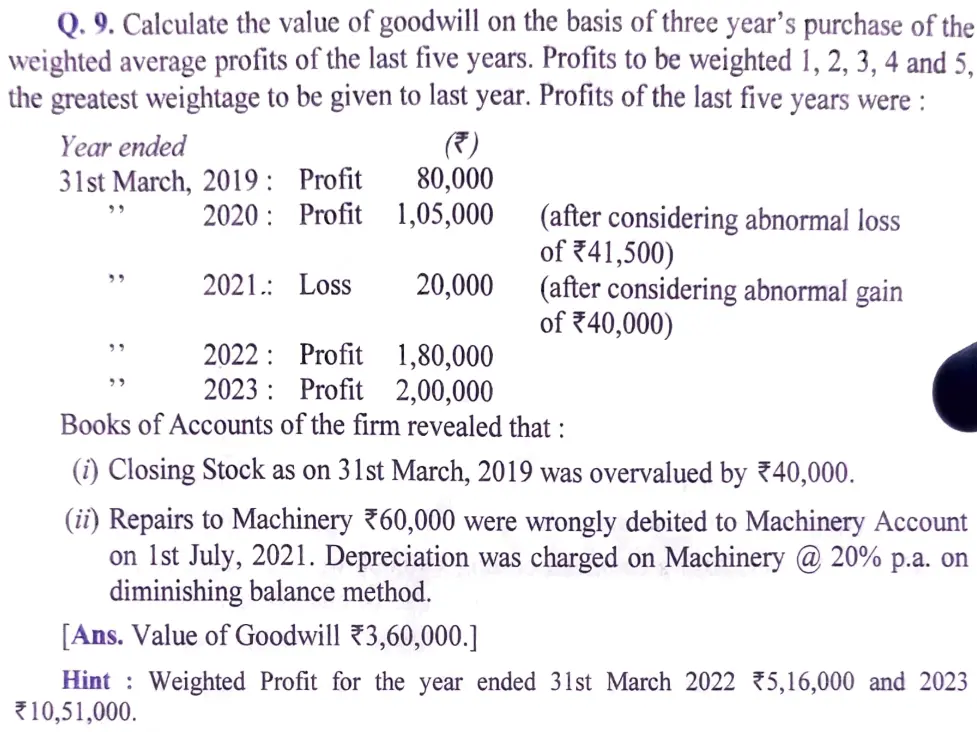

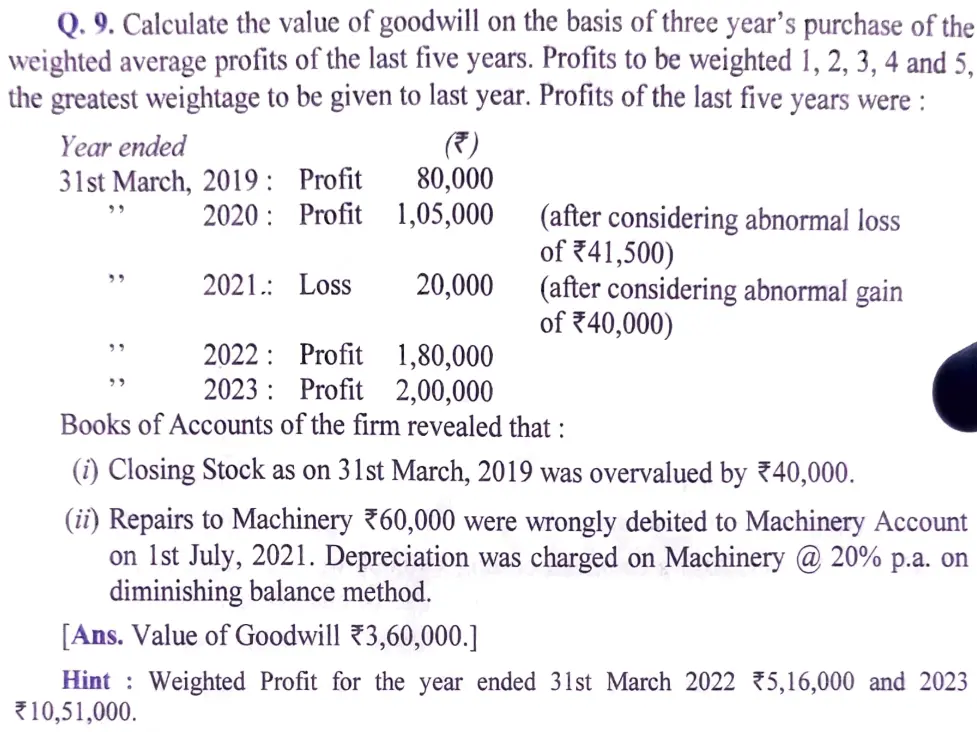

Calculate the value of goodwill on the basis of three year’s purchase of the weighted average profits of the last five years. Profits to be weighted 1, 2, 3, 4 and 5, the greatest weightage to be given to last year. Profits of the last five years were

Calculate the value of goodwill on the basis of three year’s purchase of the weighted average profits of the last five years. Profits to be weighted 1, 2, 3, 4 and 5, the greatest weightage to be given to last year. Profits of the last five years were :

Books of Accounts of the firm revealed that:

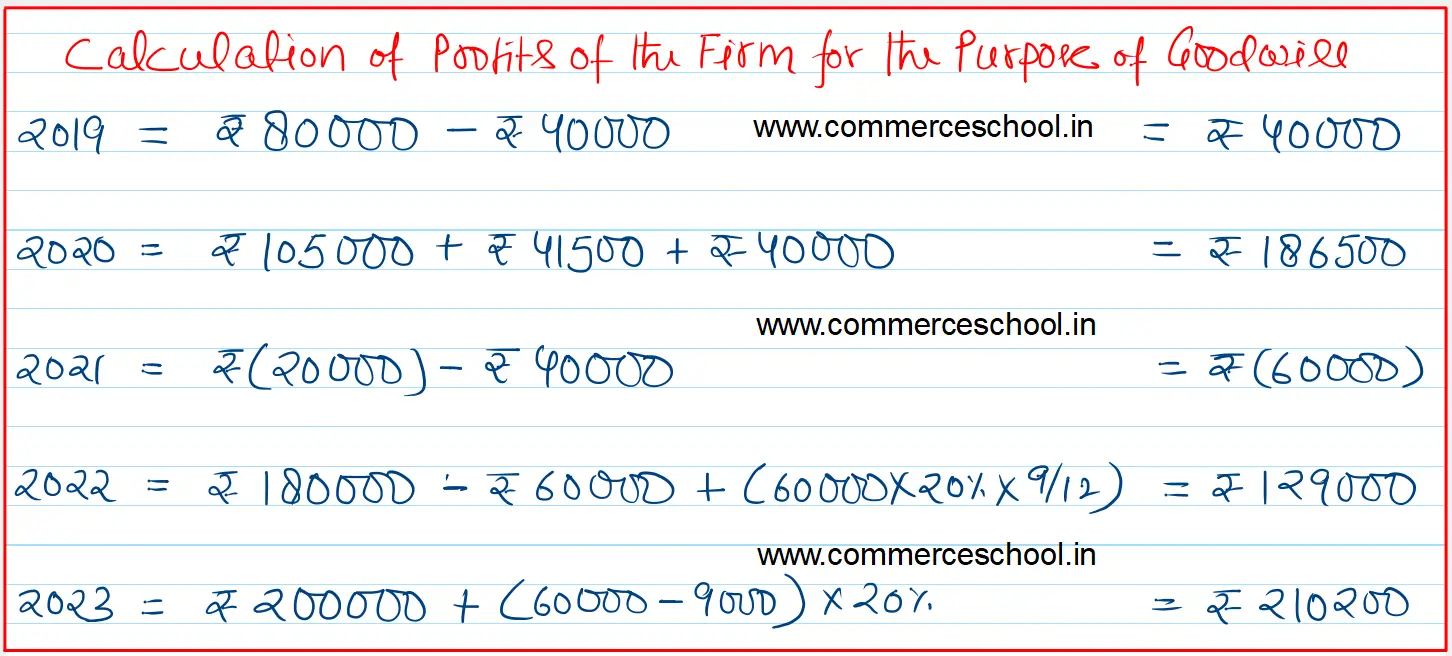

(I) Closing stock as on 31st March, 2019 was overvalued by ₹ 40,000.

(ii) Repairs to Machinery ₹ 60,000 were wrongly debited to Machinery Account on 1st July, 2021. Depreciation was charged on Machinery @ 20% p.a. on diminishing balance method.

[Ans. Value of Goodwill ₹ 3,60,000.]

| Year | Profits | |

| 2019 | 80,000 | |

| 2020 | 1,05,000 | (after considering abnormal loss of ₹ 41,500) |

| 2021 | (20,000) | (after considering abnormal gain of ₹ 40,000) |

| 2022 | 1,80,000 | |

| 2023 | 2,00,000 |

Anurag Pathak Answered question