Charu, Dhwani, Iknoor and Paavni were partners in a firm. They had entered into partnership firm last year only, through a verbal agreement.

Charu, Dhwani, Iknoor and Paavni were partners in a firm. They had entered into partnership firm last year only, through a verbal agreement. They contributed Capitals in the firm and to meet other financial requirement, few partners also provided loan to the firm. Within a year, their conflicts arisen due to certain disagreements and they decided to dissolve the firm. The firm had appointed Mr. Kavya, who is a financial advisor and legal consultant, to carry on the dissolution process. In the firm instance, Mr. kavya had transferred various assets and external liabilities to Realisation Account. Due to her busy schedule; Ms. Kavya has delegated this assignment to you, being an intern in her firm. On the date of dissolution, you have observed the following transactions:

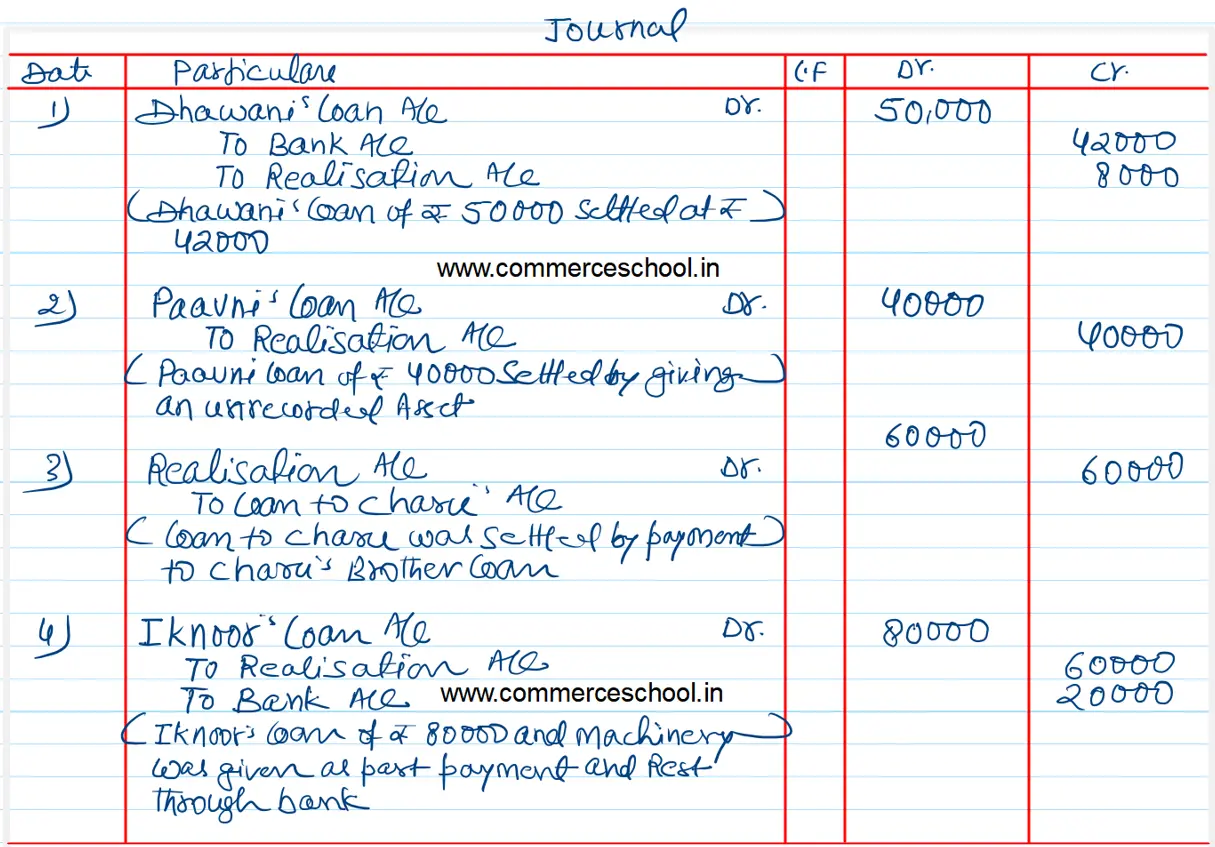

(i) Dhwani’s Loan of ₹ 50,000 to the firm was settled by paying ₹ 42,000.

(ii) Paavni’s Loan of ₹ 40,000 was settled by giving an unrecorded asset of ₹ 45,000.

(iii) Loan to Charu of ₹ 60,000 was settled by payment to Charu’s brother loan of the same amount.

(iv) Iknoor’s Loan of ₹ 80,000 to the firm and she took over Machinery of ₹ 60,000 as part payment.

You are required to pass necessary entries for all the above-mentioned transactions.