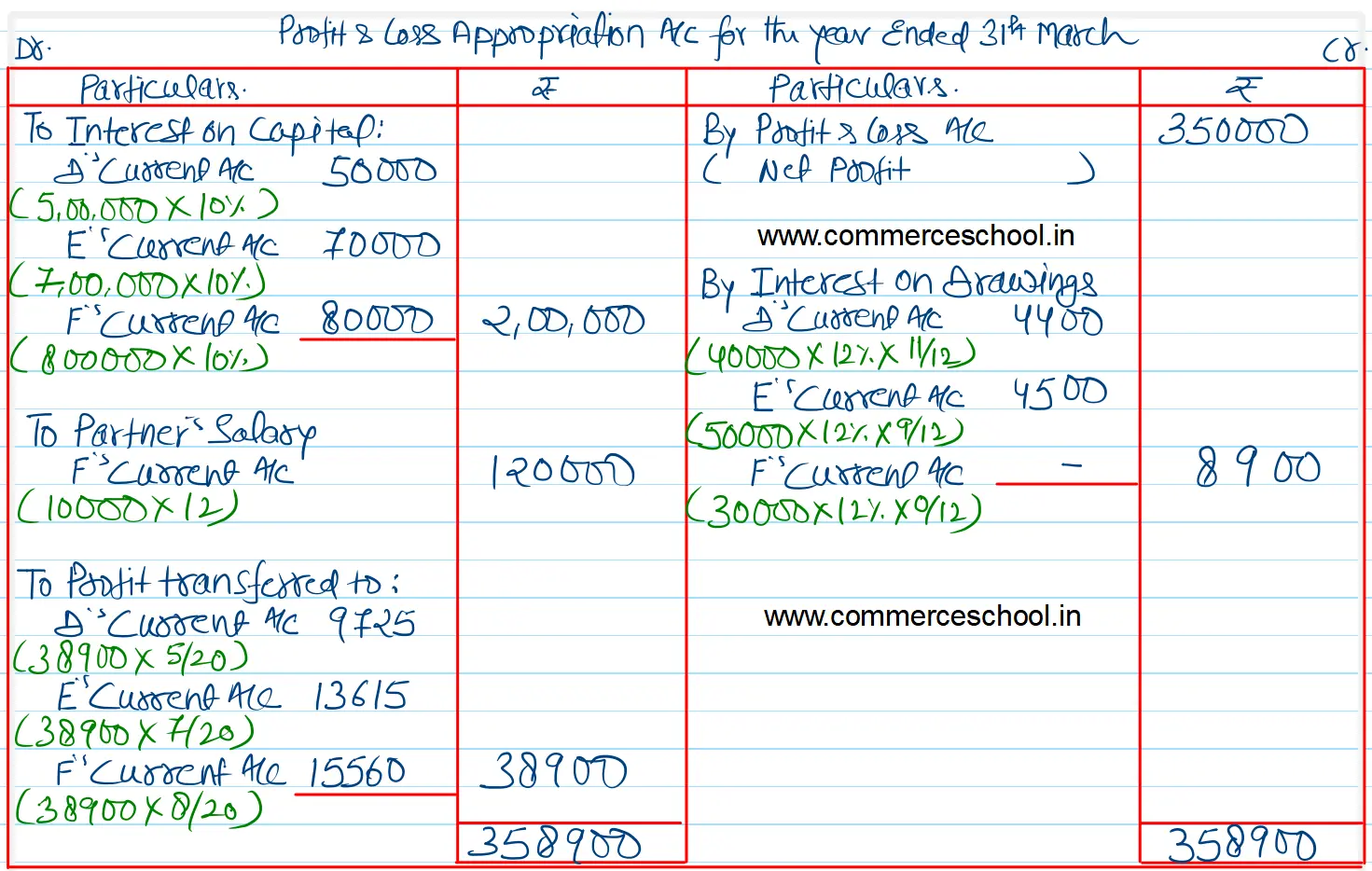

D, E and F were partners in a firm sharing profits in the ratio of 5 : 7 : 8. Their fixed capitals on 1st April, 2023 were D ₹ 5,00,000, E ₹ 7,00,000 and F ₹ 8,00,000

D, E and F were partners in a firm sharing profits in the ratio of 5 : 7 : 8. Their fixed capitals on 1st April, 2023 were D ₹ 5,00,000, E ₹ 7,00,000 and F ₹ 8,00,000. Their partnership Deed provided for the following:

(i) Interest on capital @ 10% p.a.

(ii) Salary of ₹ 10,000 per month to F.

(iii) Interest on drawings @ 12% p.a.

D withdrew ₹ 40,000 on 30th April, 2023; E withdrew ₹ 50,000 on 30th June 2023 and F withdrew ₹ 30,000 on 31st March, 2024.

During the year ended 31st March, 2024 the firm earned a profit of ₹ 3,50,000.

Prepare the Profit and Loss Appropriation Account for the year ended 31st March, 2024.

[Ans. Share of Profit D ₹ 9,725; E ₹ 13,615 and F ₹ 15,560.]

Anurag Pathak Answered question