David and Bimal are partners sharing profits and losses in the ratio of 3 : 2. Their Balance Sheet as at 31st March 2023, was as follows:

David and Bimal are partners sharing profits and losses in the ratio of 3 : 2. Their Balance Sheet as at 31st March 2023, was as follows:

Balance Sheet as at 31st March, 2023

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 8,20,000 | Cash | 3,20,000 |

| General Reserve | 30,000 | Stock | 1,50,000 |

|

Capital A/cs: David Bimal |

1,80,000 1,20,000 |

Debtors 94,000 Less: Provision 4,000 |

90,000 |

| Building | 5,50,000 | ||

| Furniture | 40,000 | ||

| 11,50,000 | 11,50,000 |

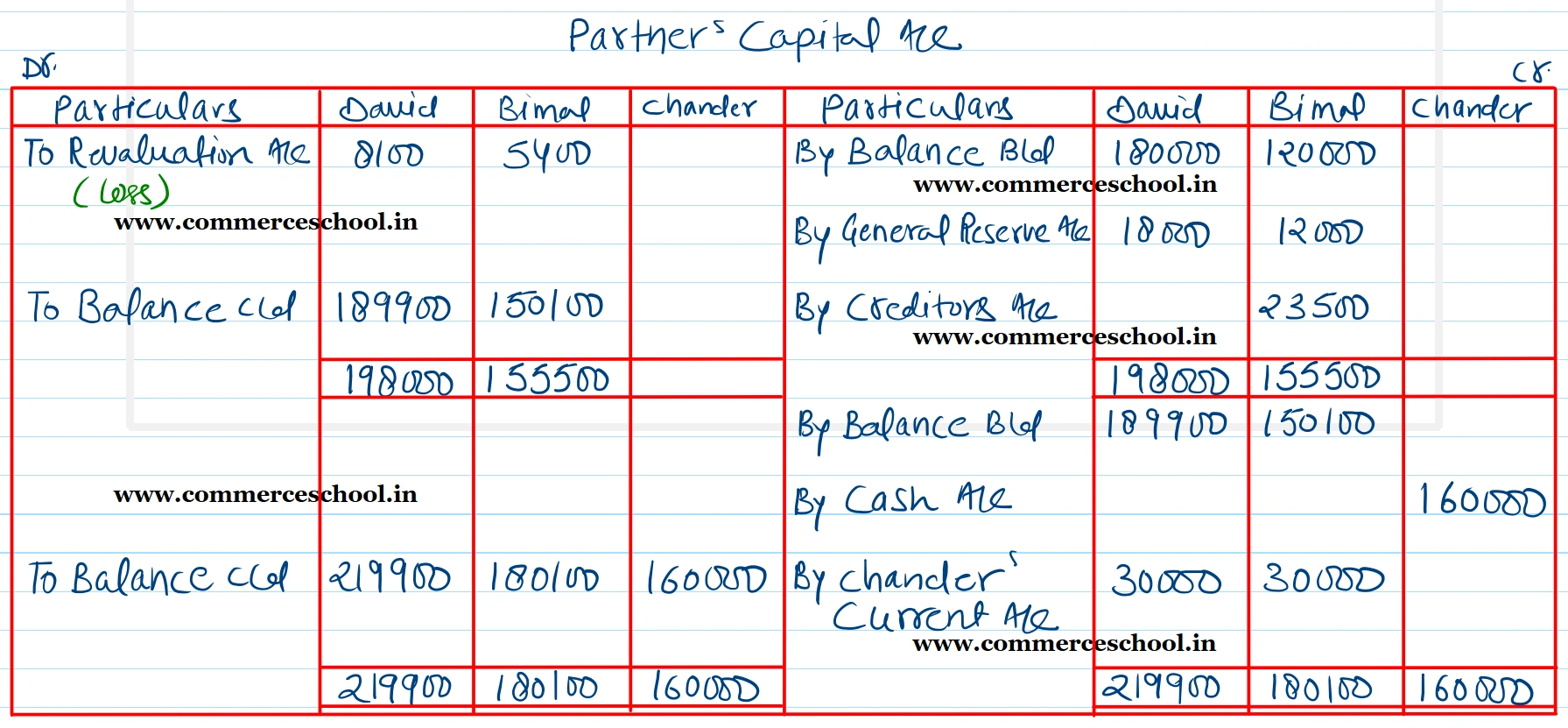

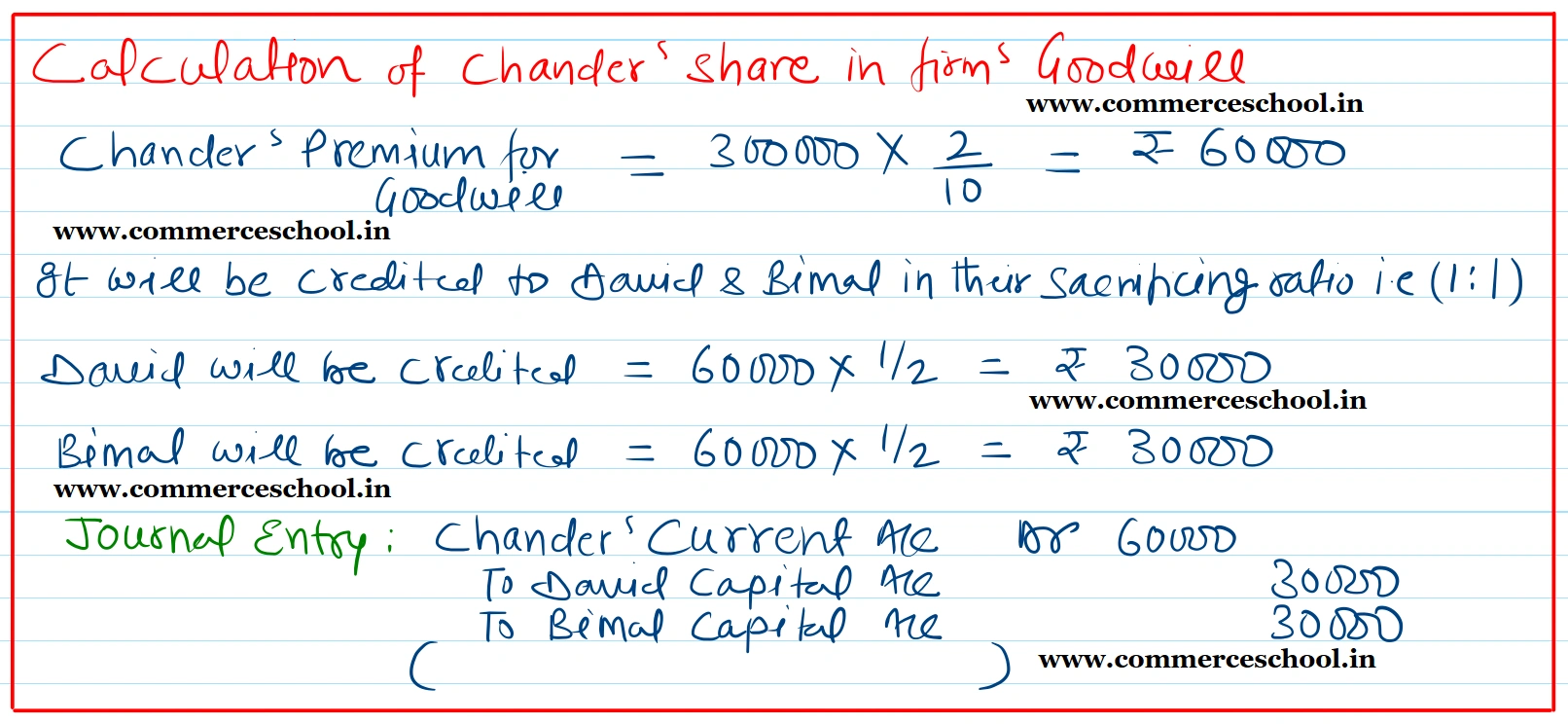

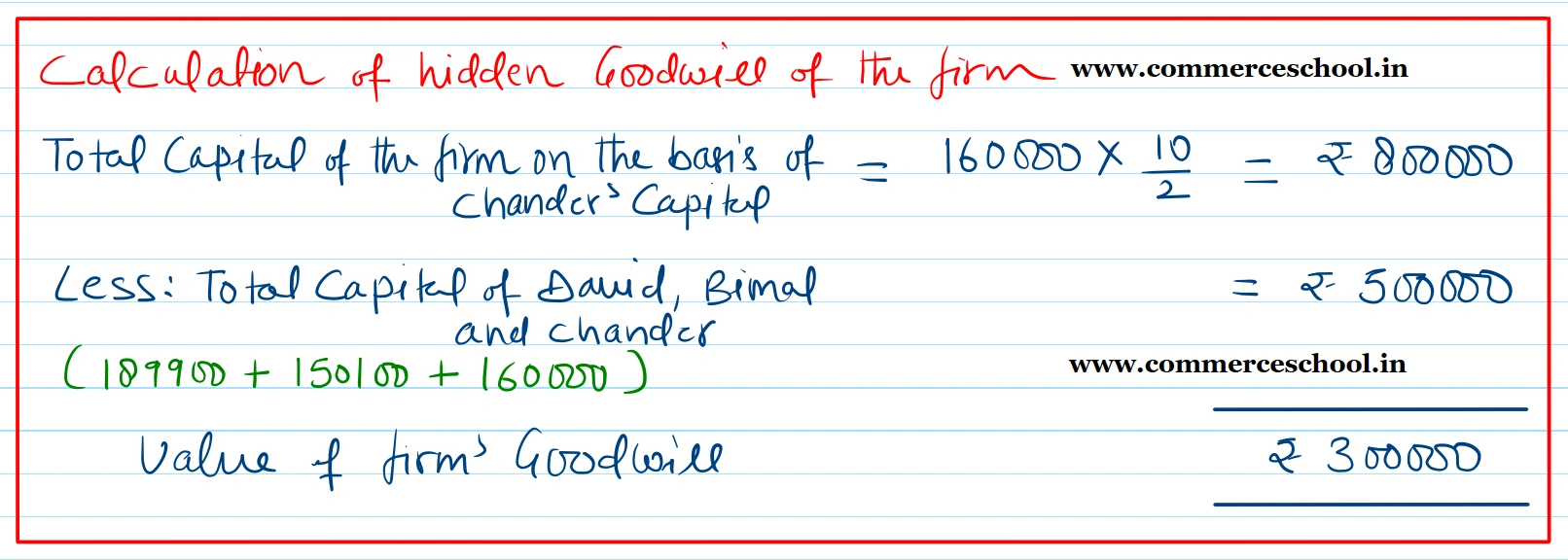

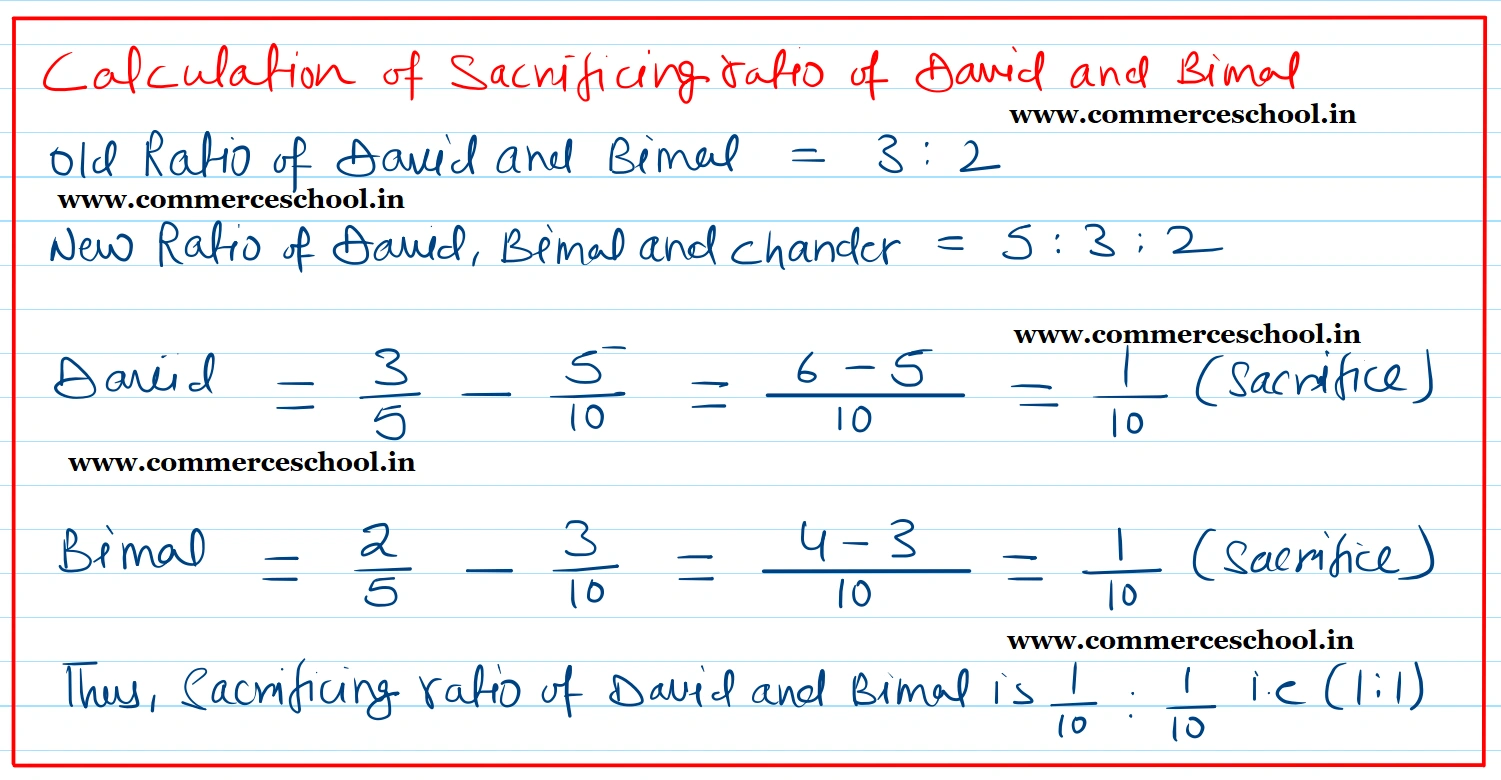

They admitted Chander as a new partner on 1.4.2023 and the new profit sharing ratio became 5 : 3 : 2. Chander introduced a capital of ₹ 1,60,000. Chander was unable to bring any cash for goodwill and so it was decided to value the goodwill on the basis of his share in the profits and the capital contributed by him. Adjustment for the same should be made through a current account opened in the name of Chander. The following revaluations were made at the time of Chander’s admission:

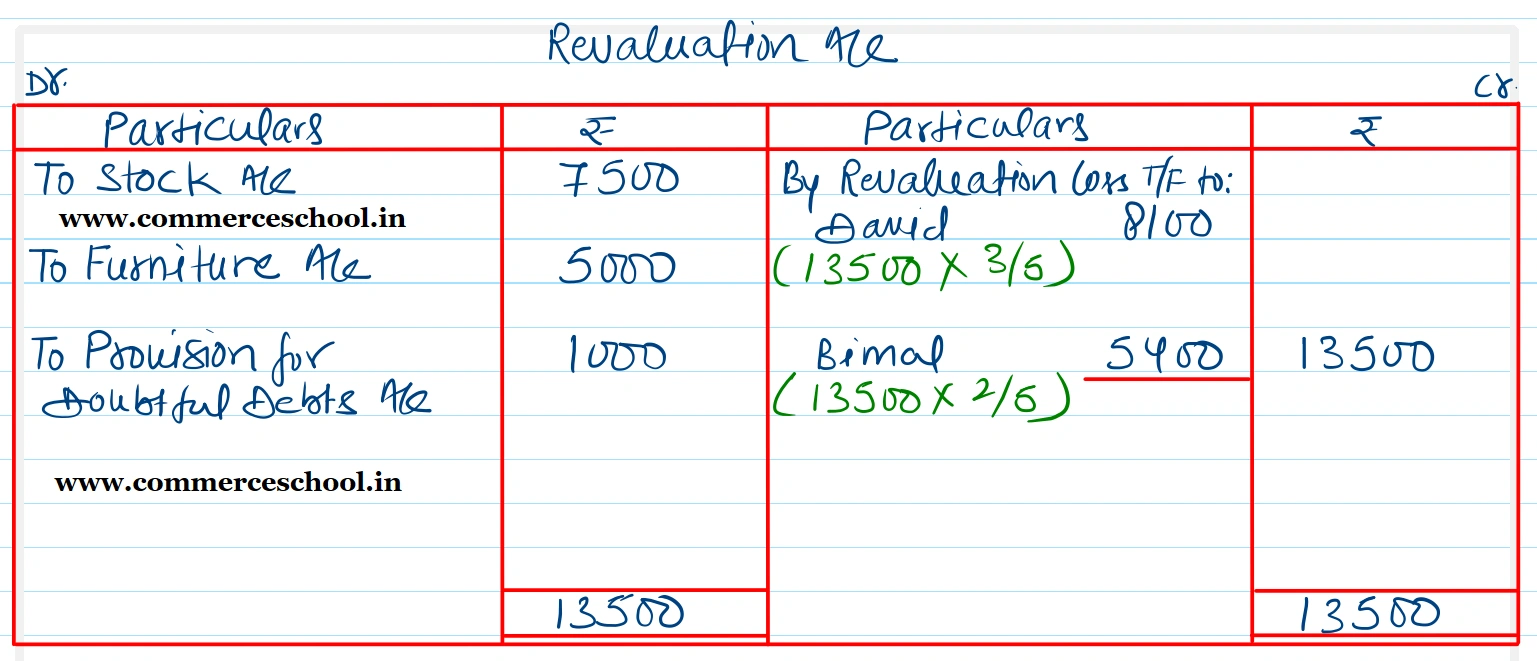

(i) Stock had been overvaued by ₹ 7,500 and furniture by ₹ 5,000.

(ii) Provision for doubtful debts to be increased by ₹ 1,000.

(iii) A creditor for ₹ 23,500 was paid off by Bimal privately for which no entry was passed in the books of the firm.

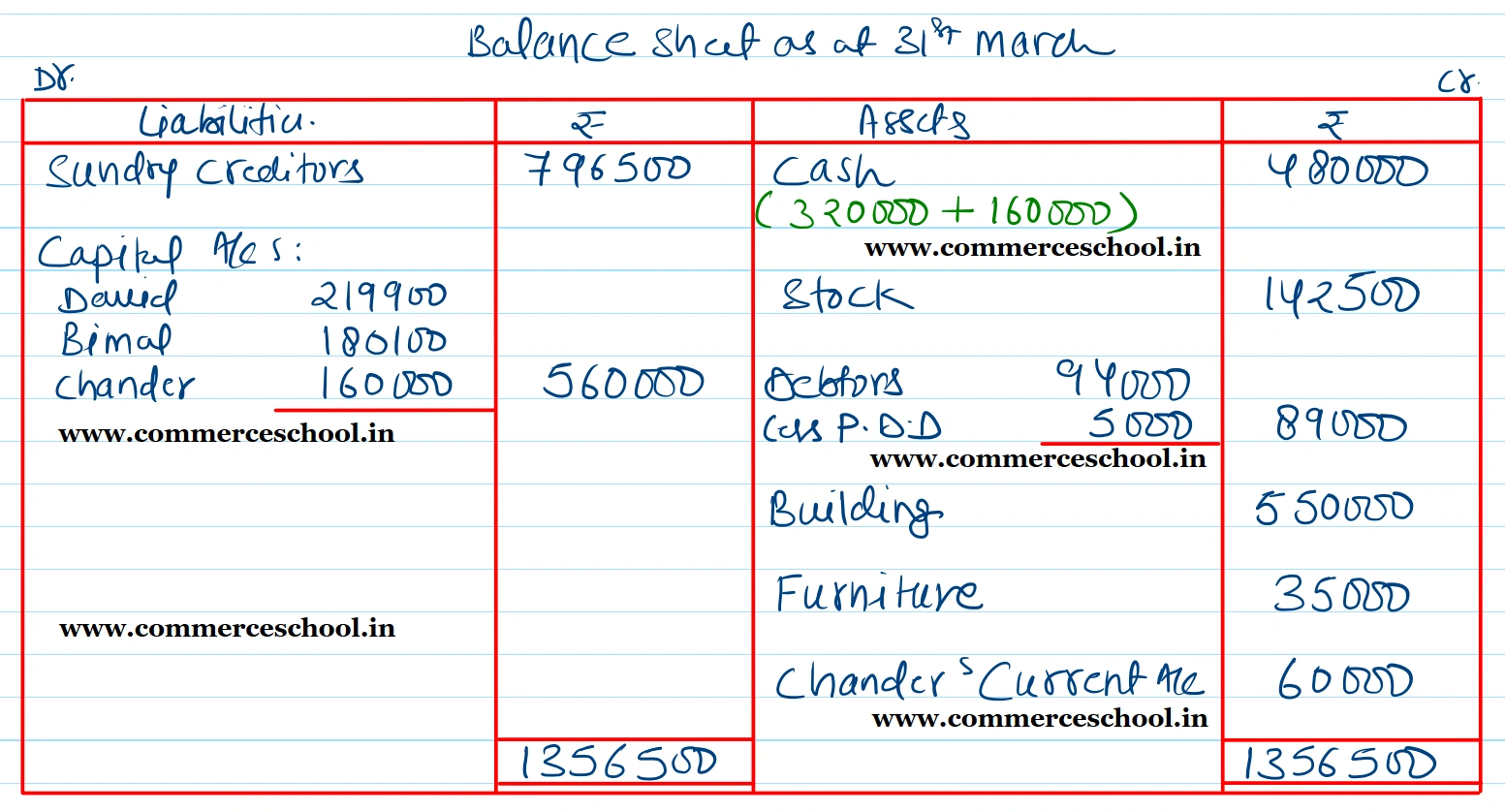

Prepare the Revaluation Account, Partner’s Capital Accounts and a Balance Sheet of the new firm on the date of Chander’s admission. Show your workings clearly.

[Ans. Loss on Revaluation ₹ 13,500; Chander’s Current A/c (Dr.) ₹ 60,000; Capital Accounts: David ₹ 2,19,900; Bimal ₹ 1,80,100 and Chander ₹ 1,60,000; B/S total ₹ 13,56,500.]