Dell Ltd. forfeited 2,000 Equity Shares of ₹ 50 each issued at 10% premium on which allotment money of ₹ 15 per equity share (including premium) and first call of ₹ 15 per share were not received, the second and final call of ₹ 10 per equity share was not yet called

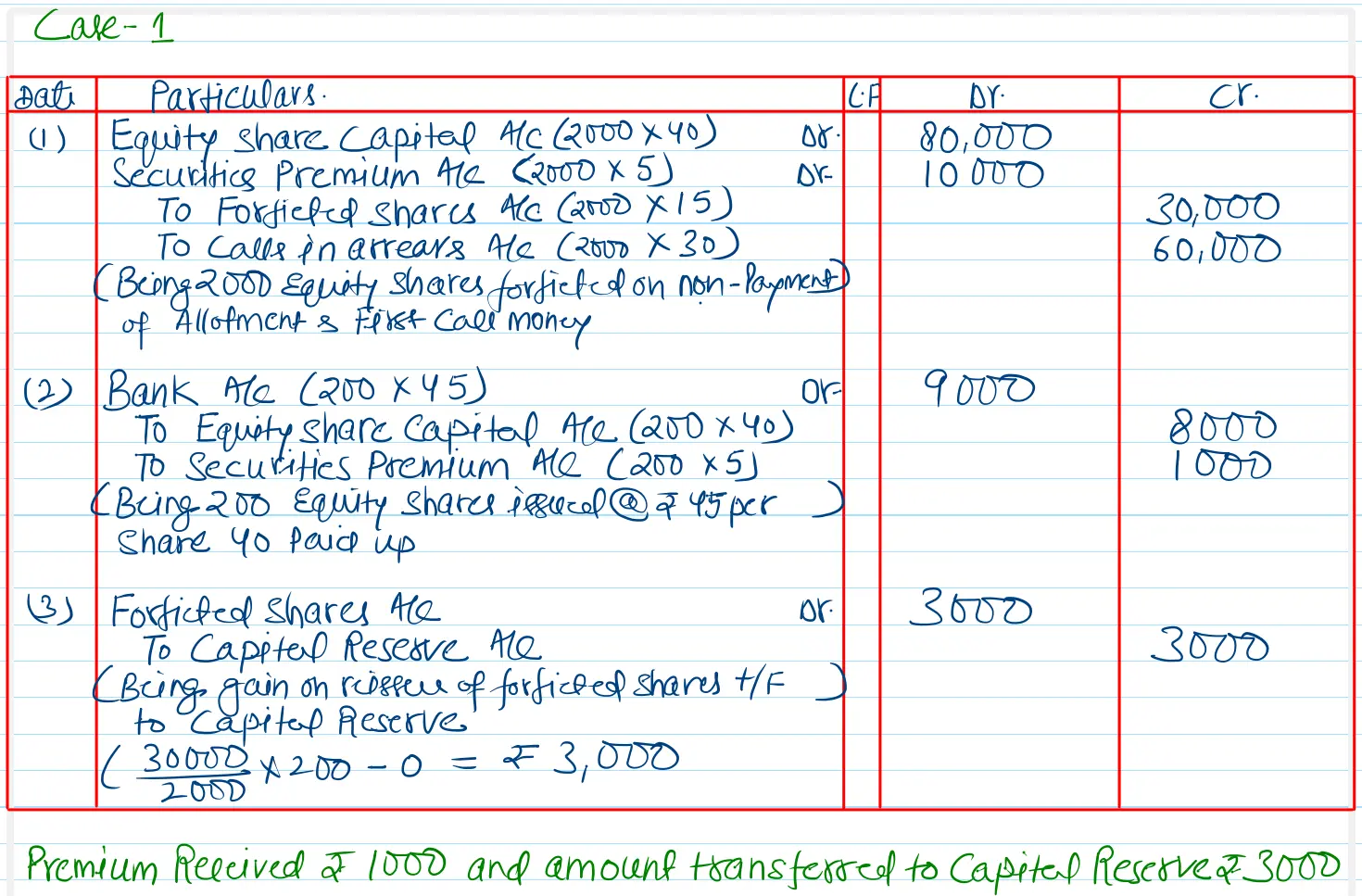

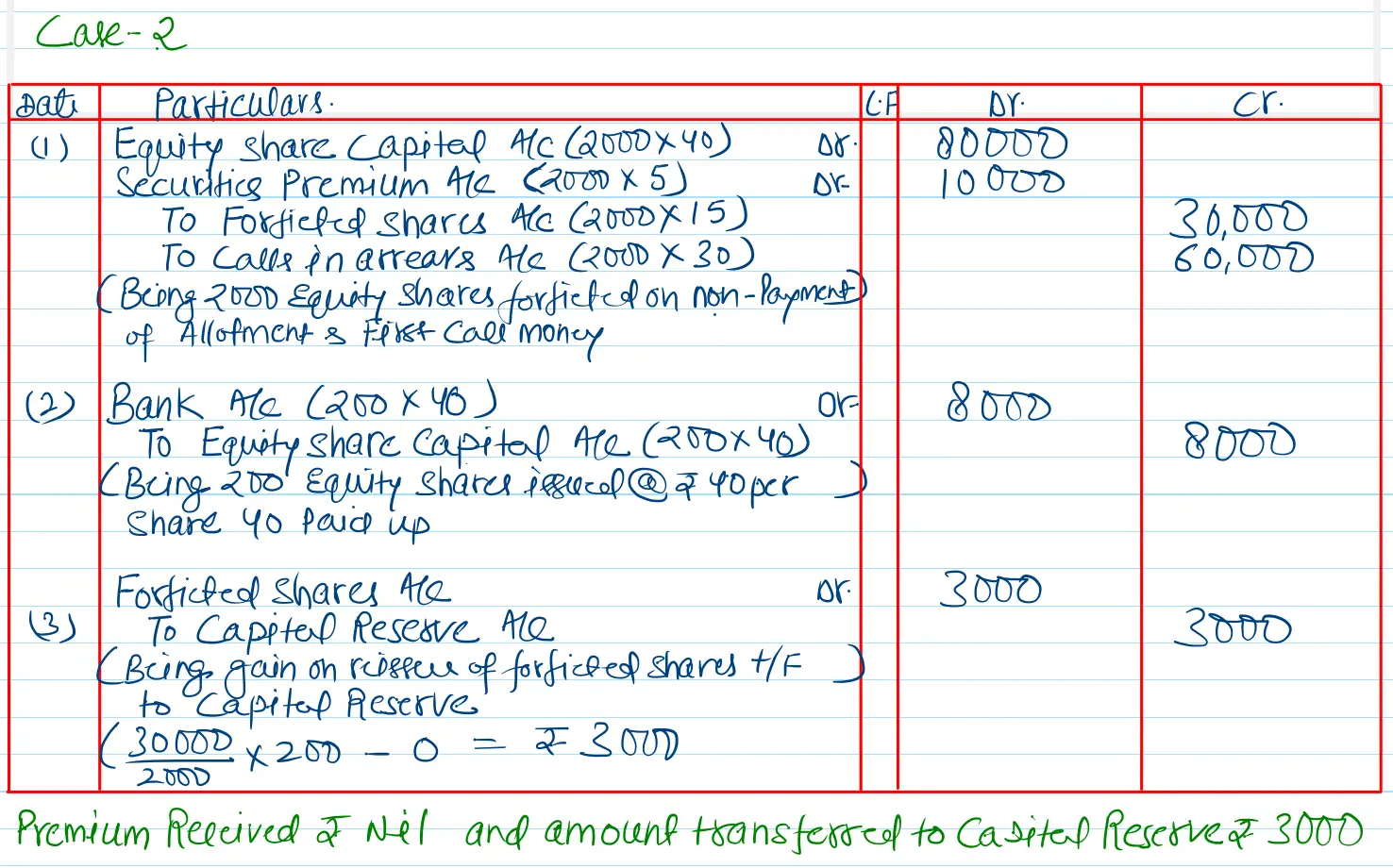

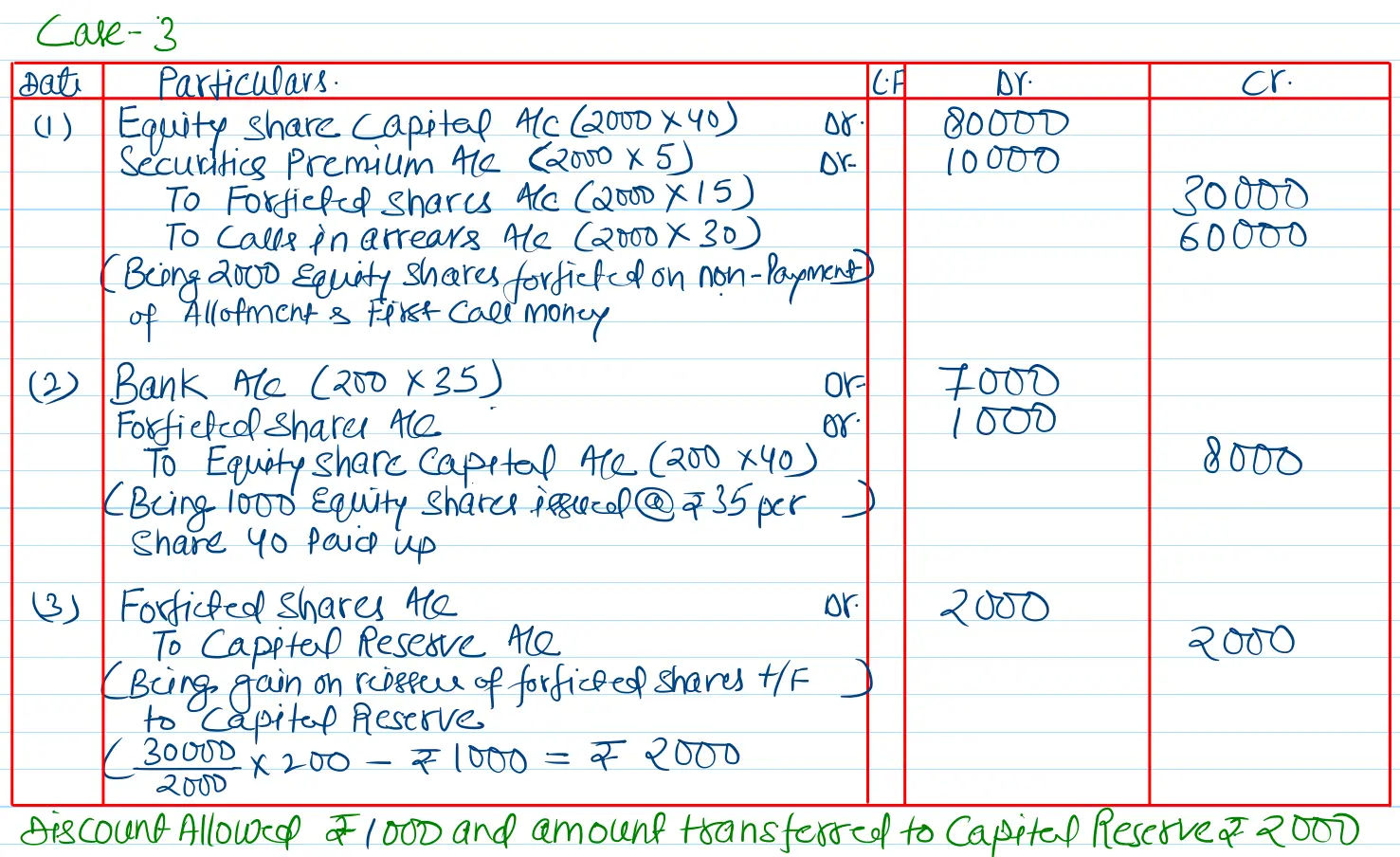

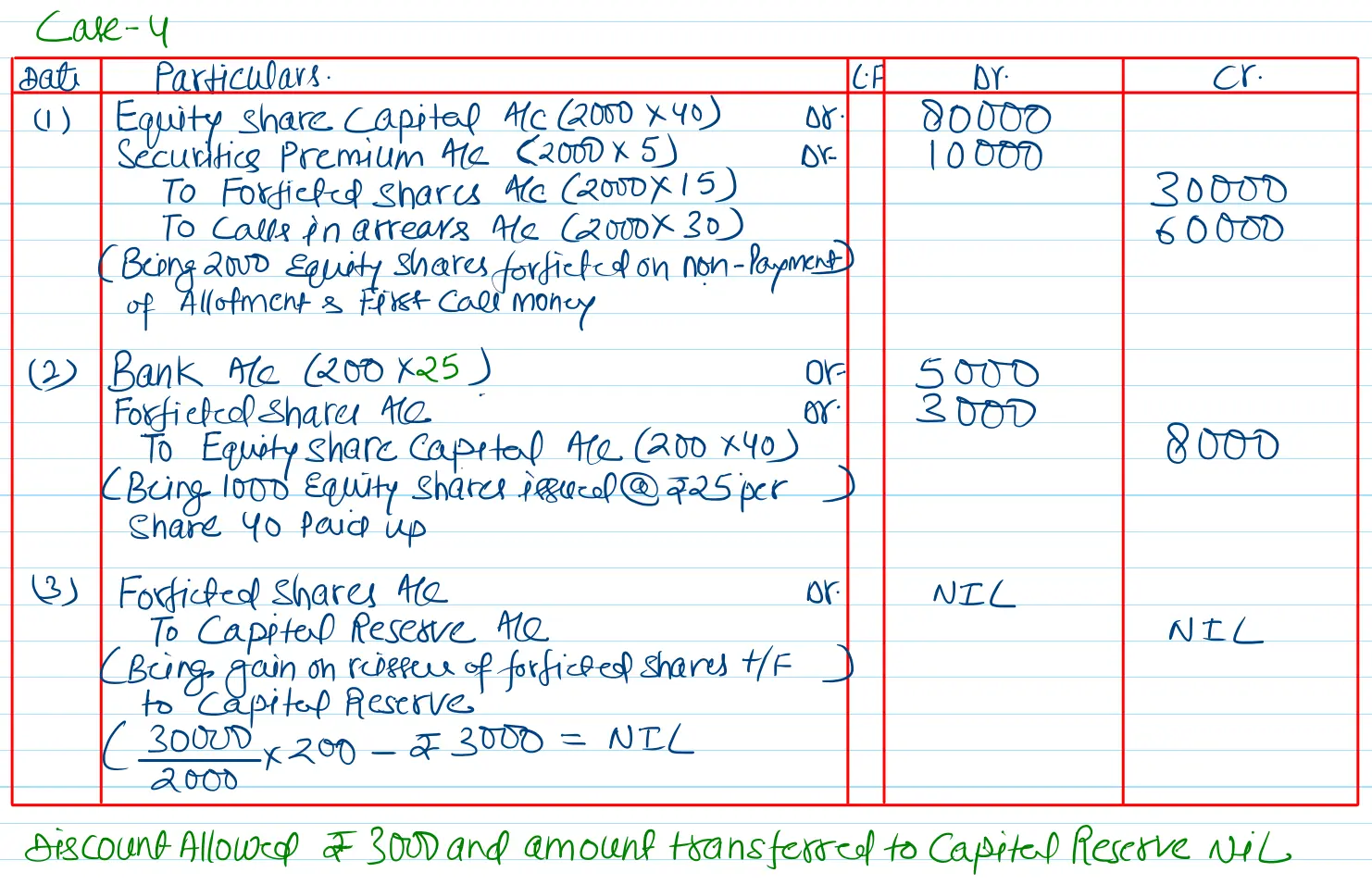

Dell Ltd. forfeited 2,000 Equity Shares of ₹ 50 each issued at 10% premium on which allotment money of ₹ 15 per equity share (including premium) and first call of ₹ 15 per share were not received, the second and final call of ₹ 10 per equity share was not yet called.

Calculate ‘Discount Allowed or Premium Received’ and ‘Amount transferred to Capital Reserve on reissue of shares as fully paid up in each of the following cases:

Case 1. If 200 of these shares were reissued as ₹ 40 paid up for ₹ 45 per share.

Case 2. If 200 of these shares were reissued as ₹ 40 paid up for ₹ 40 per share.

Case 3. If 200 of these shares were reissued as ₹ 40 paid up for ₹ 35 per share.

Case 4. If 200 of these shares were reissued as ₹ 40 paid up for ₹ 25 per share.

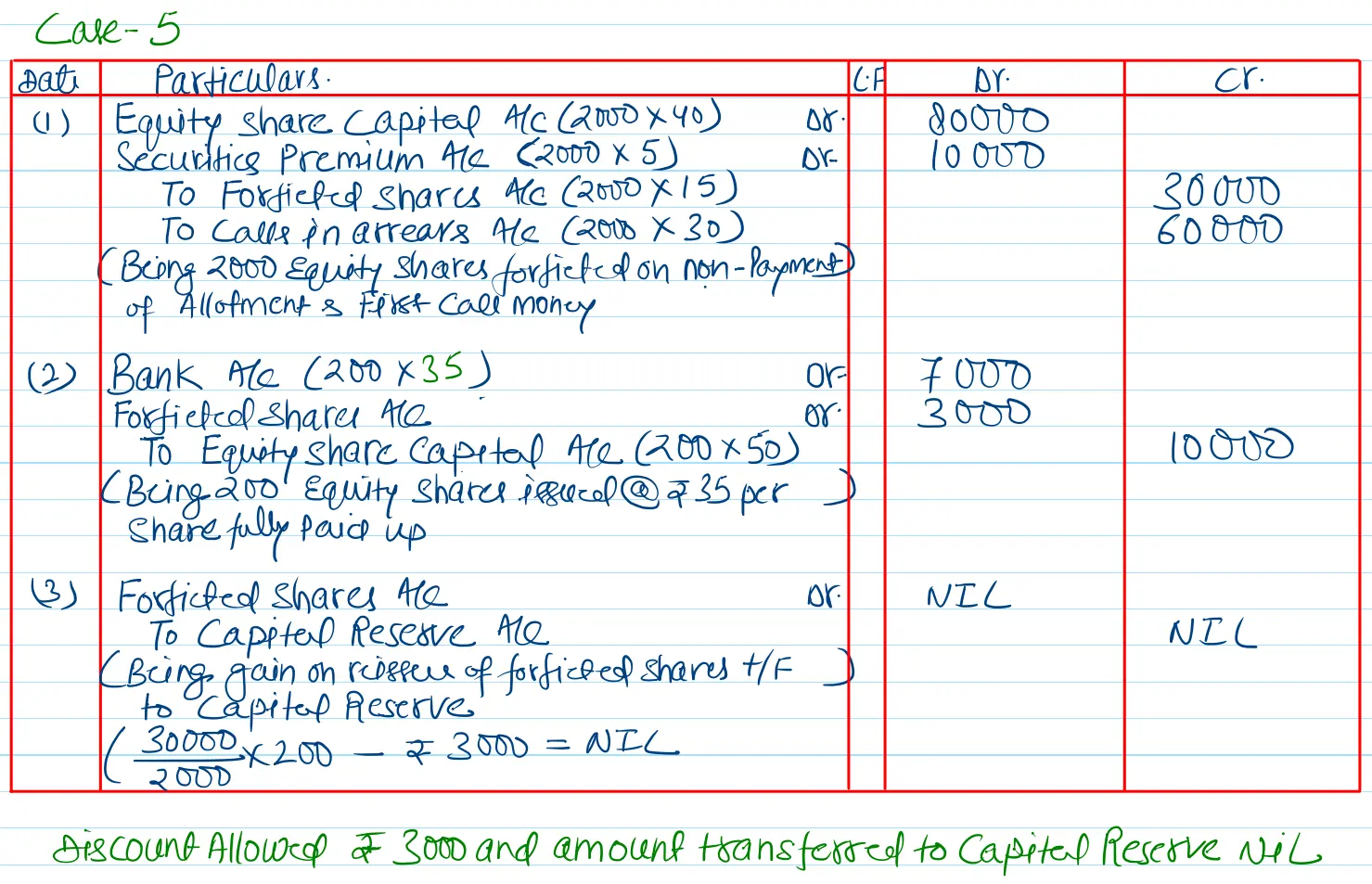

Case 5. If 200 of these shares were reissued as ₹ 35 per share as fully paid-up.

[Ans.:

Case 1: Premium Received – ₹ 1,000 and Amount transferred to Capital Reserve – ₹ 3,000.

Case 2: Discount or Premium – ₹ Nil and Amount transferred to Capital Reserve ₹ 3,000

Case 3: Discount Allowed – ₹ 1,000 and Amount transferred to Capital Reserve – ₹ 2,000;

Case 4: Discount Allowed – ₹ 3,000 and Amount transferred to Capital Reserve – ₹ NiL;

Case – 5: Discount Allowed – ₹ 3,000 and Amount transferred to Capital Reserve – ₹ NiL.]