E, F and G were partners in a firm sharing profits in the ratio of 3 : 2 : After division of the profits for the year ended 31.3.2024 their capitals were: E ₹ 2,95,000; F ₹ 3,30,000; and G ₹ 3,35,000

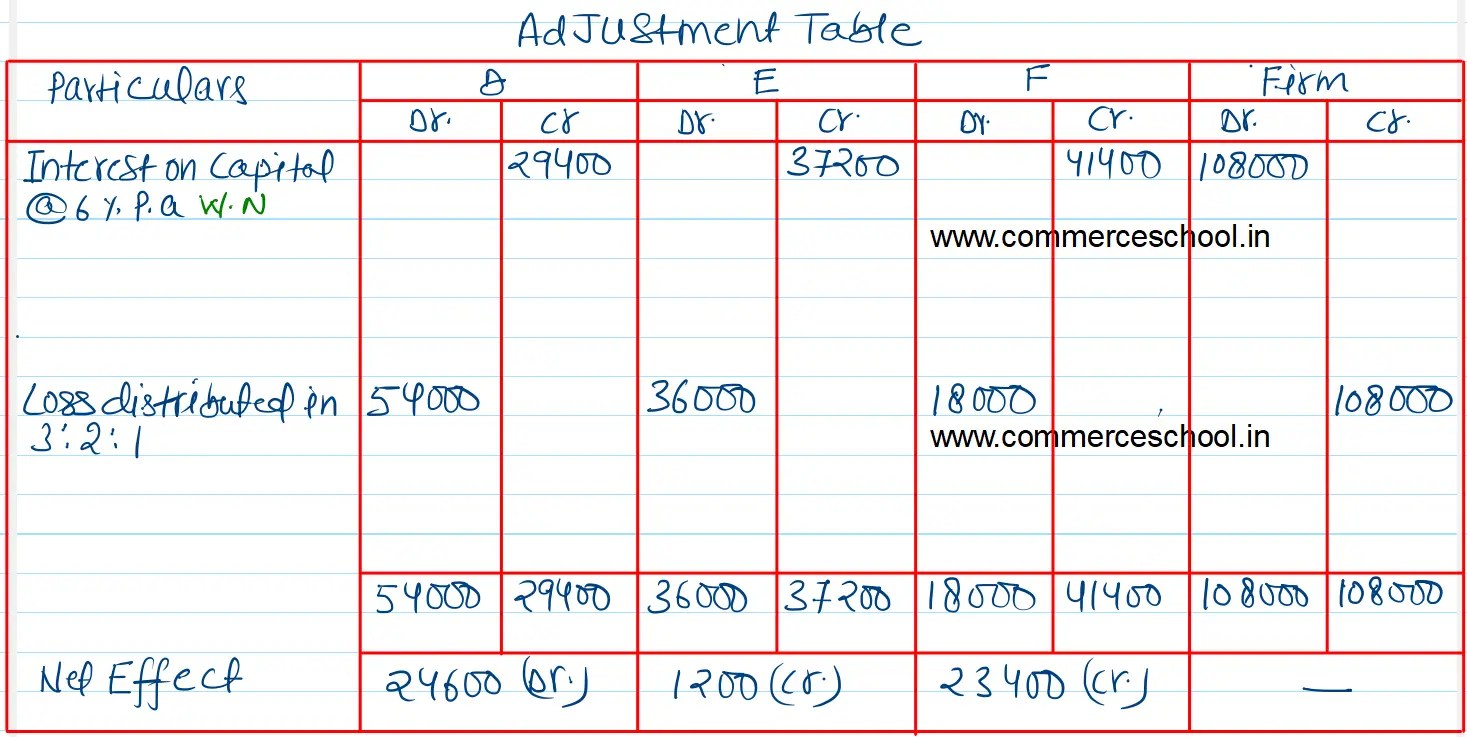

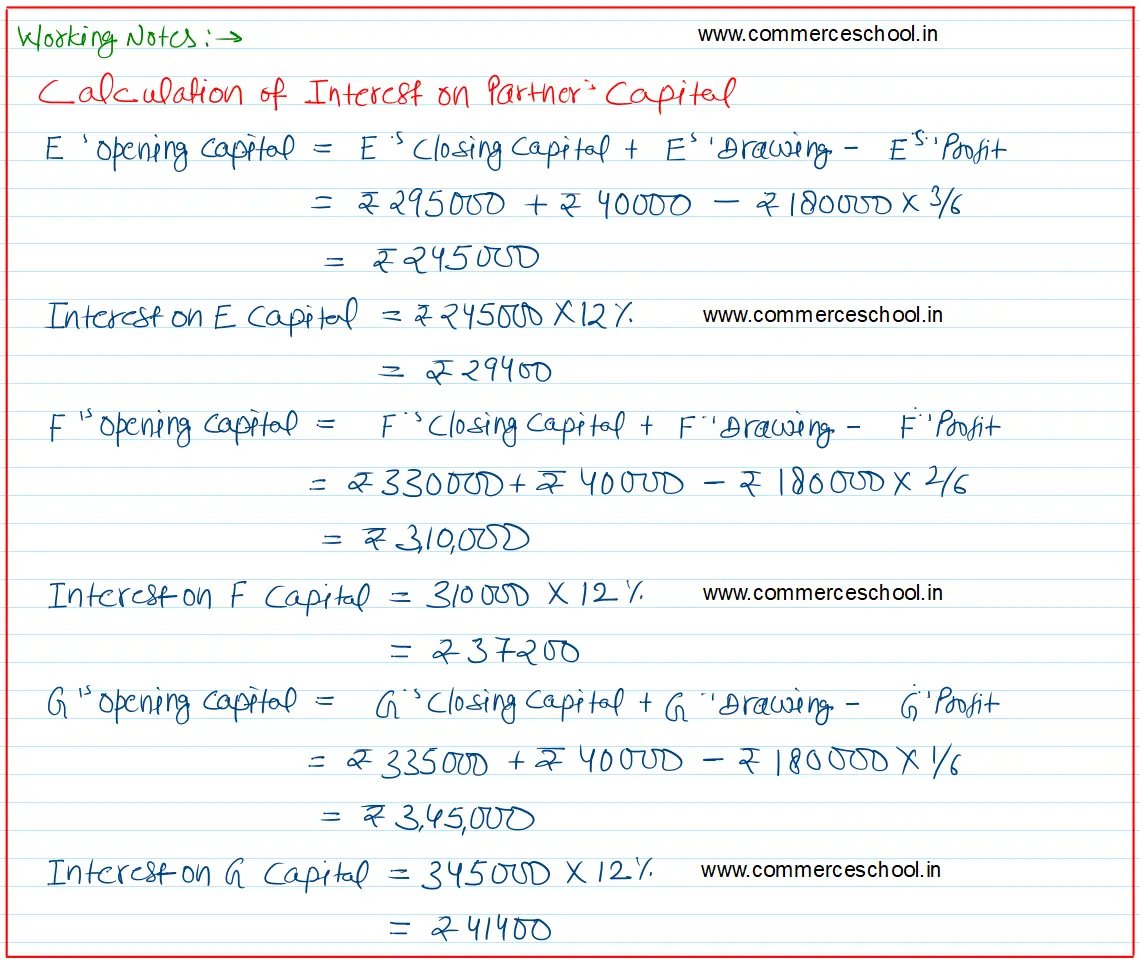

E, F and G were partners in a firm sharing profits in the ratio of 3 : 2 : After division of the profits for the year ended 31.3.2024 their capitals were: E ₹ 2,95,000; F ₹ 3,30,000; and G ₹ 3,35,000. During the year they withdrew ₹ 40,000 each. The profit of the year was ₹ 1,80,000. The partnership deed provided that interest on capital will be allowed @ 12% p.a. While preparing the final accounts, interest on partner’s capital was not allowed.

You are required to calculate the capital of E, F and G as on 1-4-2023 and pass the necessary adjustment entry for providing interest on capital. Show your workings clearly.

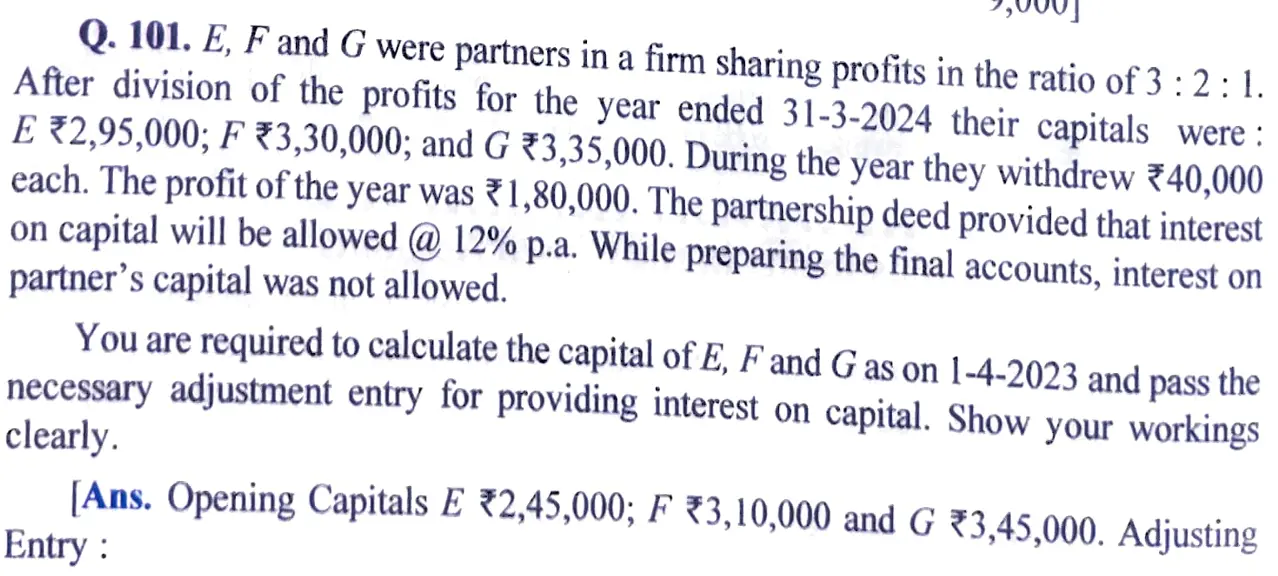

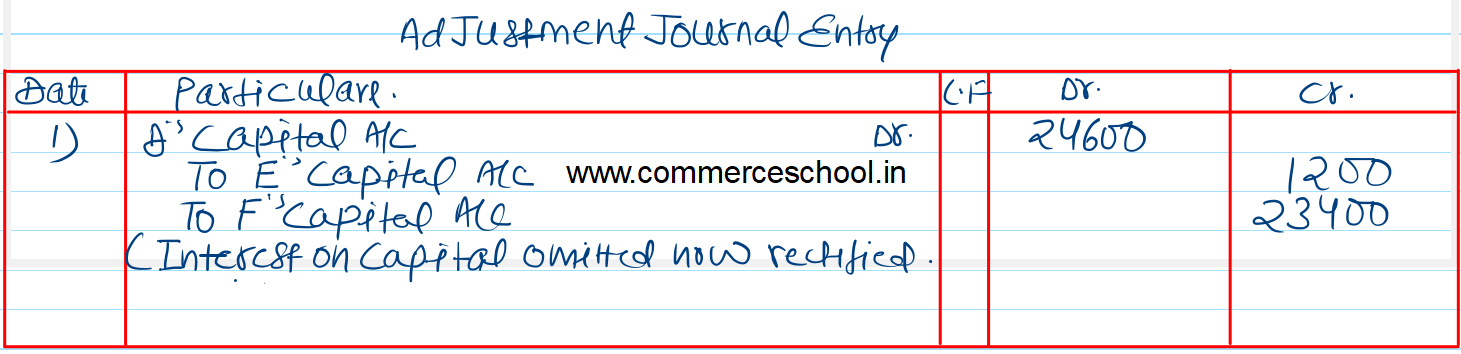

[Ans. Opening Capitals E ₹ 2,45,000; F ₹ 3,10,000 and G ₹ 3,45,000. Adjusting Entry:

E’s Capital A/c Dr. 24,600

To F’s Capital A/c 1,200

To G’s Capital A/c 23,400