Expenses of realisation ₹ 8,000, Expenses of realisation ₹ 10,000 were paid by a partner

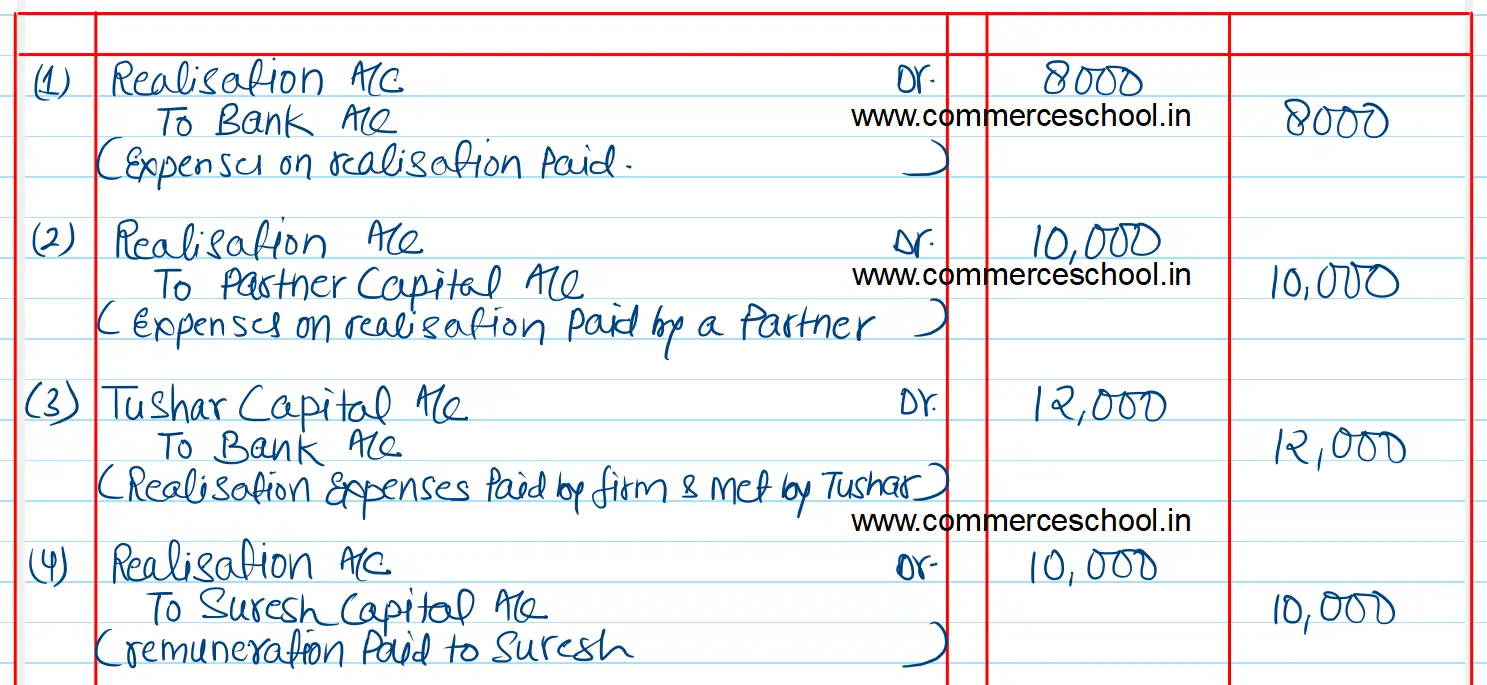

(i) Expenses of realisation ₹ 8,000.

(ii) Expenses of realisation ₹ 10,000 were paid by a partner.

(iii) Realisation expenses of ₹ 12,000 were to be met by Tushar, a partner, but were paid by the firm.

(iv) Suresh, a partner, was paid remuneration of ₹ 10,000 and he was to meet all expenses.

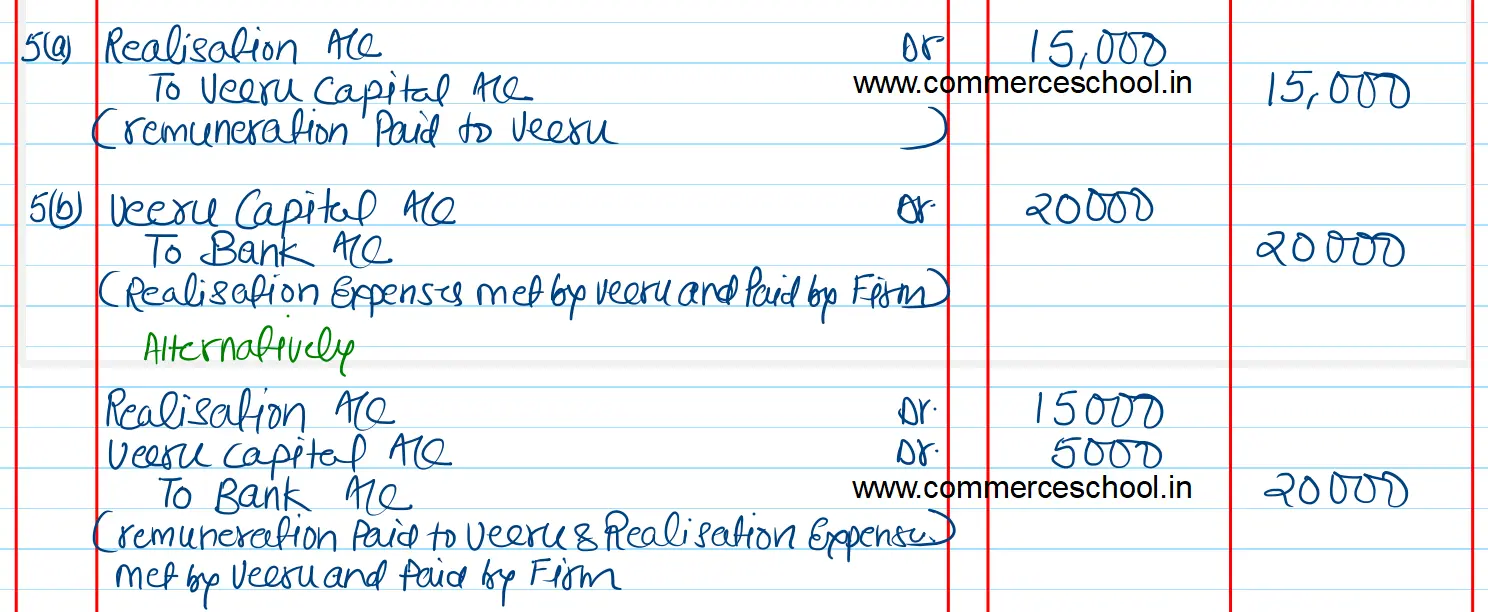

(v) Viru, a partner, was paid remuneration of ₹ 15,000 and he was to meet all expenses. Actual Expenses amounted to ₹ 20,000 which were paid by the firm.

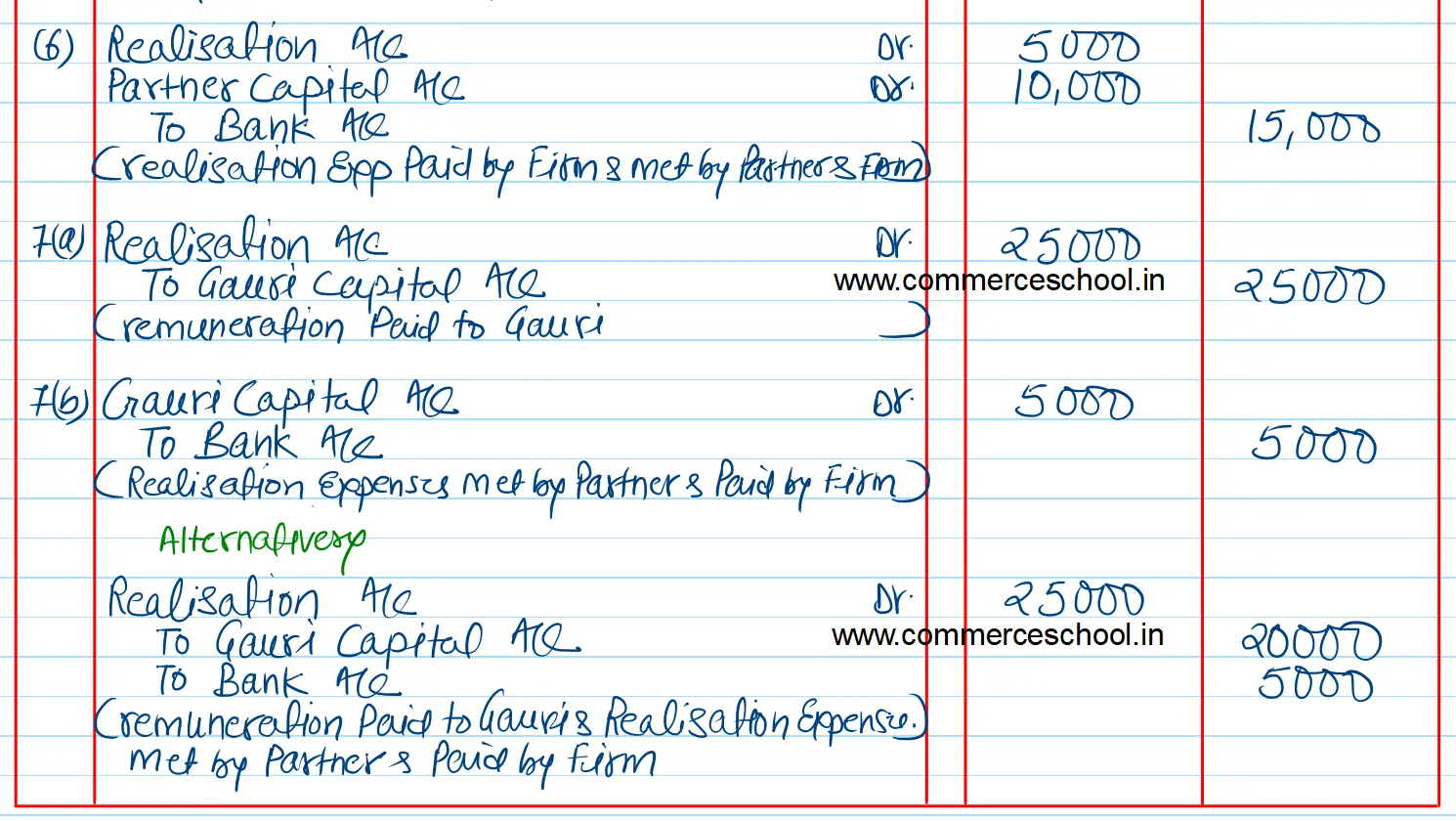

(vi) Realisation expenses amounting to ₹ 15,000 were paid by the firm. ₹ 10,000 were to be borne by a partner and the balance by the firm.\

(vii) Gauri, a partner, was allowed a remuneration of ₹ 25,000 and he was to meet all expenses. Firm paid an expense of ₹ 5,000.

Anurag Pathak Answered question