Following is the Balance Sheet of Amit and Vidya as at 31st March, 2024: Creditors ₹ 26,000 Employees Provident Fund ₹ 16,000

Following is the Balance Sheet of Amit and Vidya as at 31st March, 2024:

| Liabilities | ₹ | Assets | ₹ |

|

Creditors Employees Provident Fund Workmen’s Compensation Reserve Capital A/cs: Amit Vidya |

26,000 16,000 30,000 1,10,000 60,000 |

Bank Stock Debtors 44,000 Less Provision for Bad Debts 2,000 Plant and Machinery Goodwill Profit and Loss Account |

20,000 30,000 42,000 1,20,000 20,000 10,000 |

| 2,42,000 | 2,42,000 |

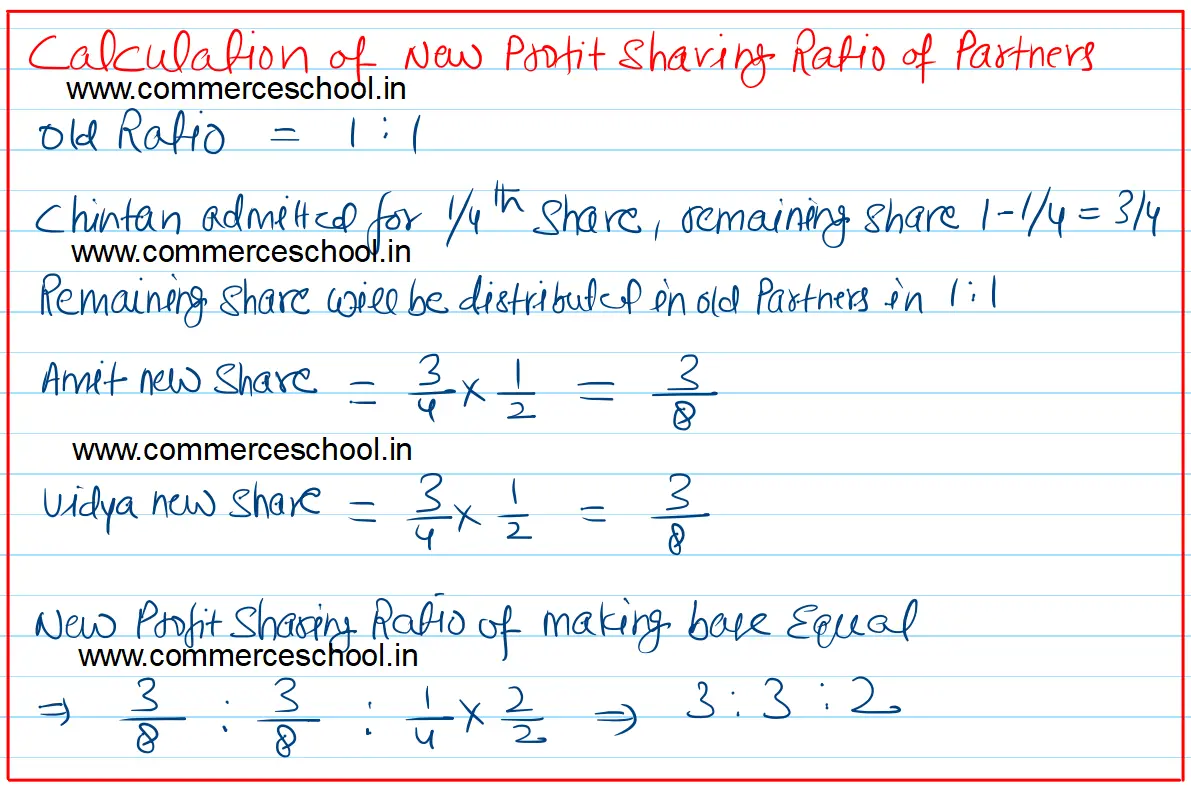

On the above date, Chintan was admitted as a partner for 1/4th share in the profits of the firm with the following terms:

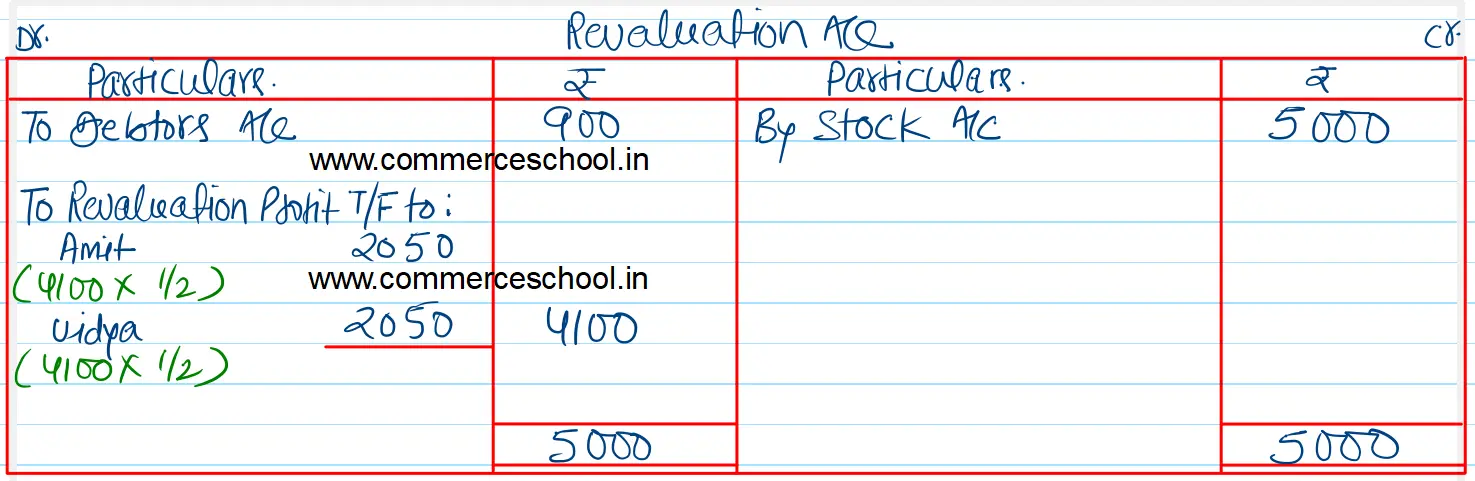

(a) ₹ 2,900 will be written off as Bad Debts.

(b) Stock was taken over by Vidya at ₹ 35,000.

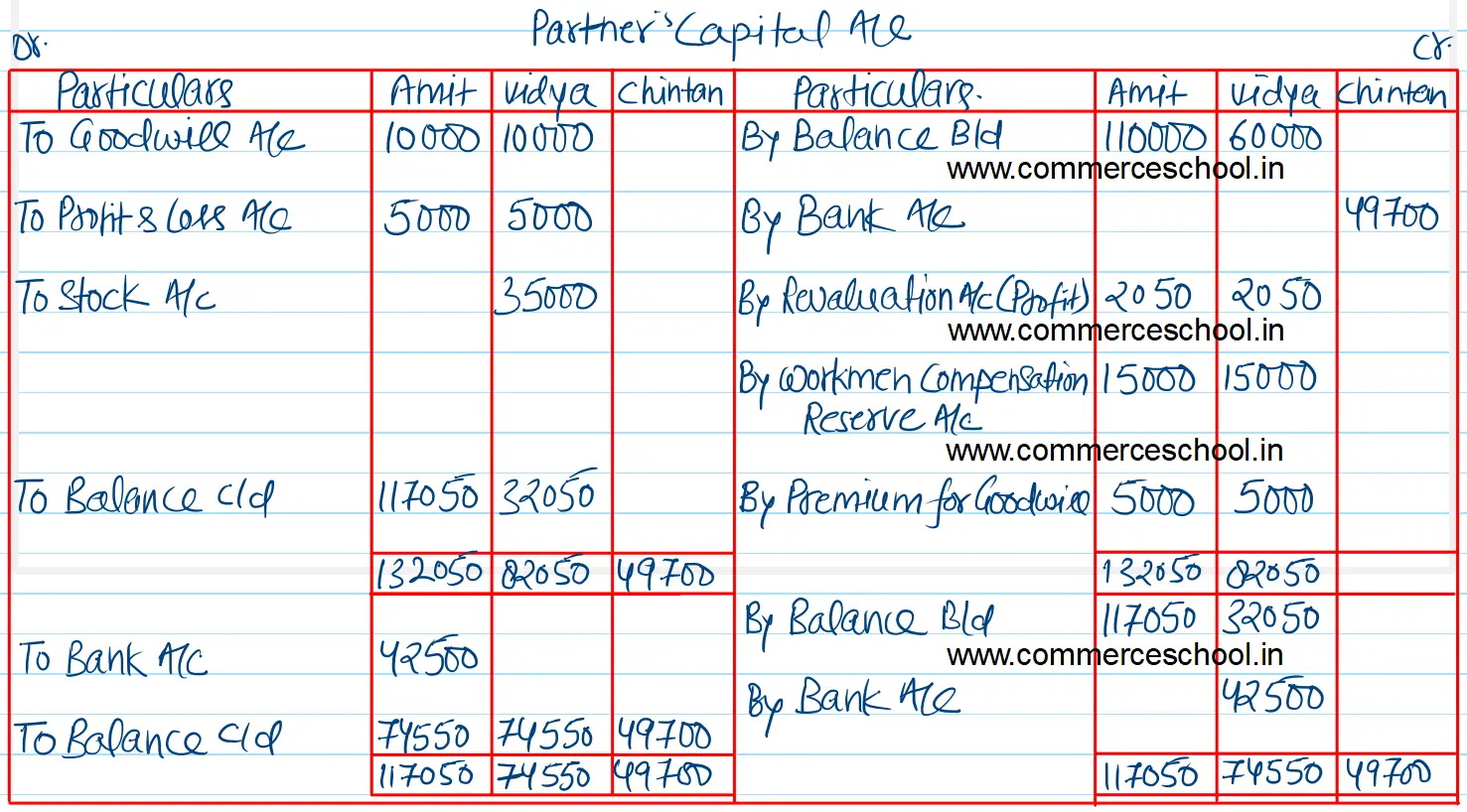

(c) Goodwill of the firm was valued at ₹ 40,000. Chintan brought his share of goodwill premium in cash.

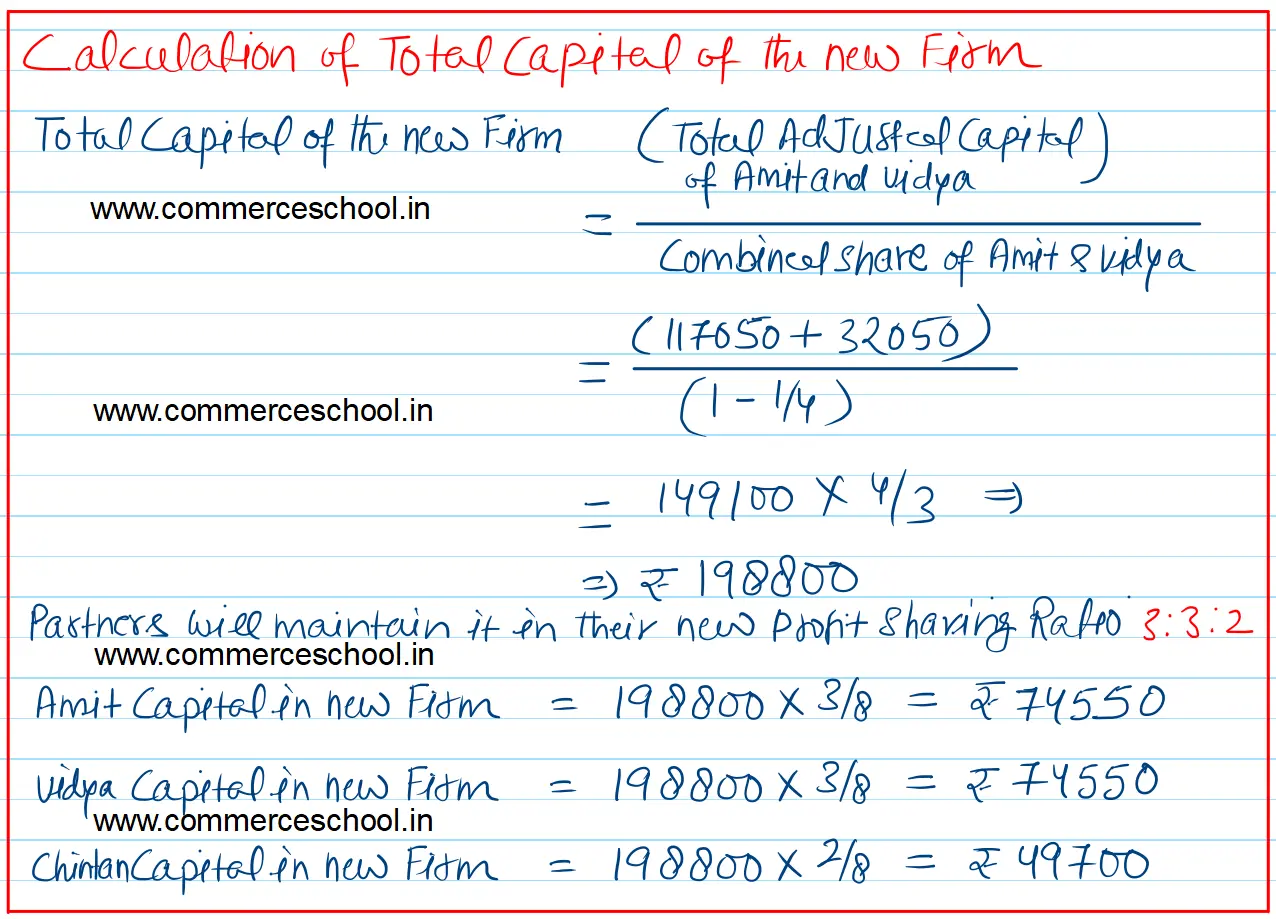

(d) Chintan brought proportionate capital and the capitals of the other partners were adjusted on the basis of Chintan’s Capital. For this necessary cash was to be brought in or paid off to the partners as the case may be.

Prepare Revaluation Account and Partner’s Capital Accounts.

[Ans. Gain on Revaluation ₹ 4,100; Capital Accounts : Amit ₹ 74,550, Vidya ₹ 74,550 and Chintan ₹ 49,700; Amit withdraws ₹ 42,500 and Vidya brings in ₹ 42,500.]