Following Trial Balance has been extracted from the books of Prasad as on 31st March, 2023: Machinery 2,40,000 Cash at Bank 1,00,000

Following Trial Balance has been extracted from the books of Prasad as on 31st March, 2023:

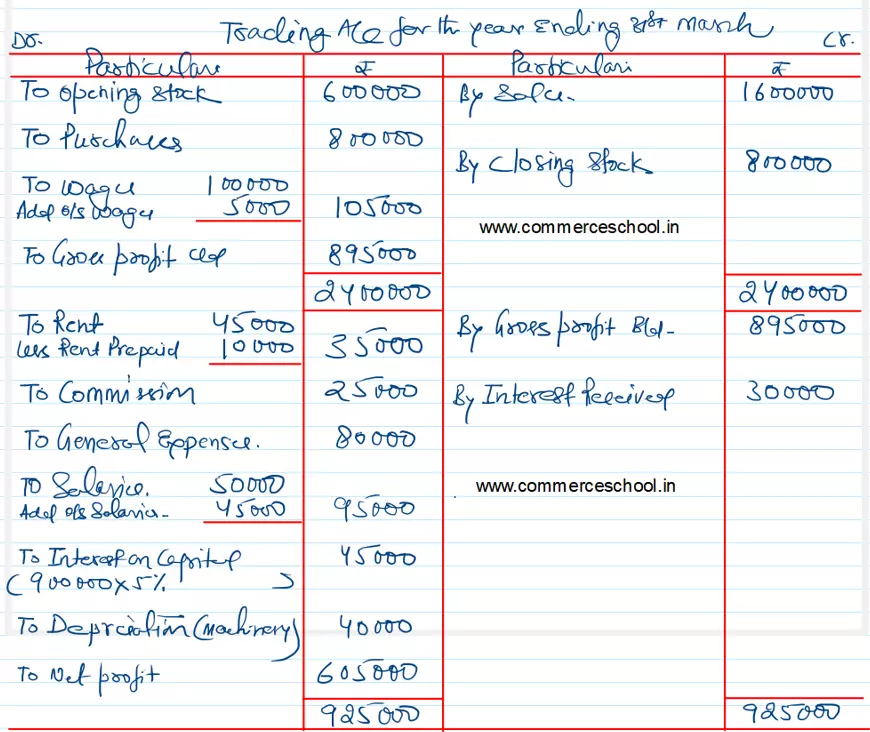

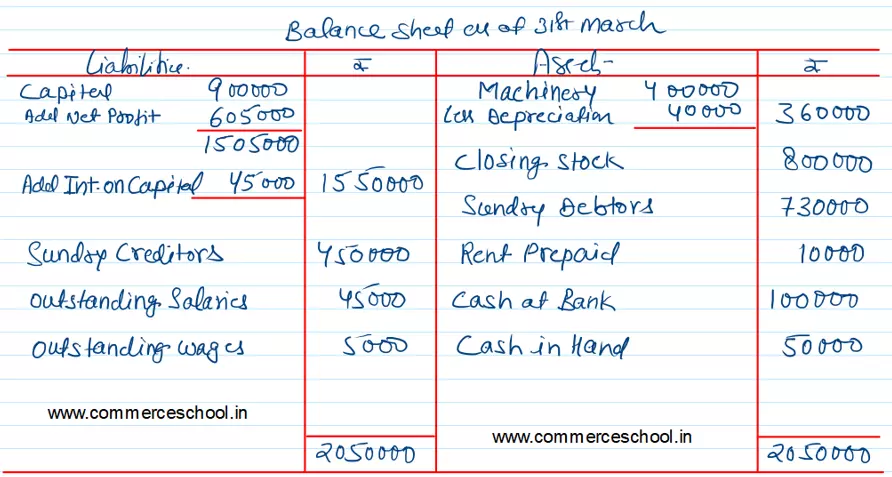

| Particulars | Dr. (₹) | Particulars | Cr. (₹) |

|

Machinery Cash at Bank Cash in Hand Wages Purchases Stock on 1st April, 2021 Sundry Debtors Rent Commission General Expenses Salaries |

4,00,000 1,00,000 50,000 1,00,000 8,00,000 6,00,000 7,30,000 45,000 25,000 80,000 50,000 |

Capital Sales Sundry Creditors Interest Received |

9,00,000 16,00,000 4,50,000 30,000 |

| 29,80,000 | 29,80,000 |

Additional Information:

(i) Outstanding Salaries were ₹ 45,000.

(ii) Depreciate Machinery at 10%.

(iii) Wages outstanding were 5,000.

(iv) Rent prepaid ₹ 10,000.

(v) Provide for interest on capital @ 5% per annum.

(vi) Stock on 31st March, 2022 ₹ 8,00,000.

Prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as at that date.

[Gross Profit – ₹ 8,95,000; Net Profit – ₹ 6,05,000; Balance sheet Total – ₹ 20,50,000.]

Good morning sir

Sir machine is for rs. 2,40,000

And you take this as 4,00,000

Also your answer is worng sir

Corrected, Machinery is of ₹ 4,00,000 and net profit is also correct it is 6,05,000. It was a clerical mistake in the question. Answer is correct.

Corrected

Machinery value is 240000 only and depreciation is at 10% then why in p&l it is showed rs. 40000 as depreciation… Its only 24000..