Following was the Balance Sheet of A and B who were sharing profits in the ratio of 2 : 1 as at 31st March, 2023:

Following was the Balance Sheet of A and B who were sharing profits in the ratio of 2 : 1 as at 31st March, 2023:

| Liabilities | ₹ | Assets | ₹ |

| Capital A/cs:

A B Sundry Creditors |

15,000 10,000 32,950 |

Building

Plant and Machinery Stock Sundry Debtors Cash in Hand |

25,000 17,500 10,000 4,850 600 |

| 57950 | 57950 |

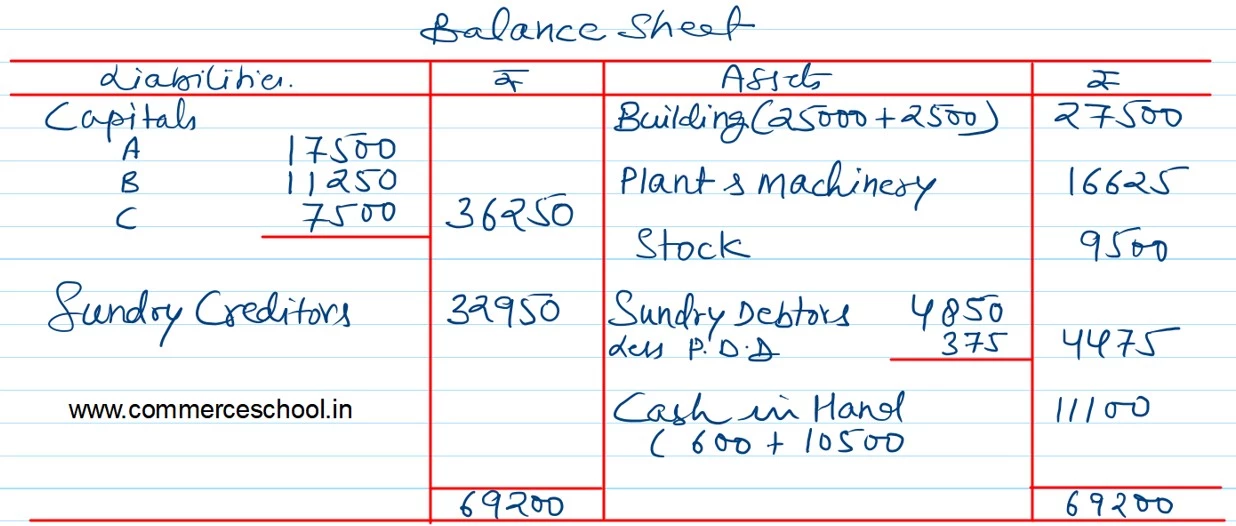

They admit C into partnership on 1st April, 2023 on the following terms:

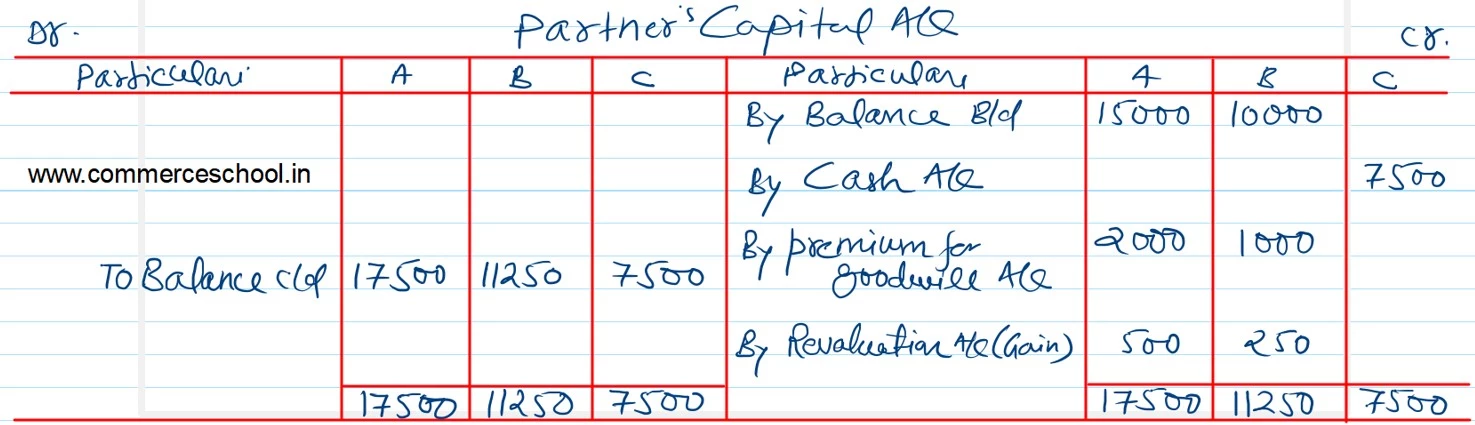

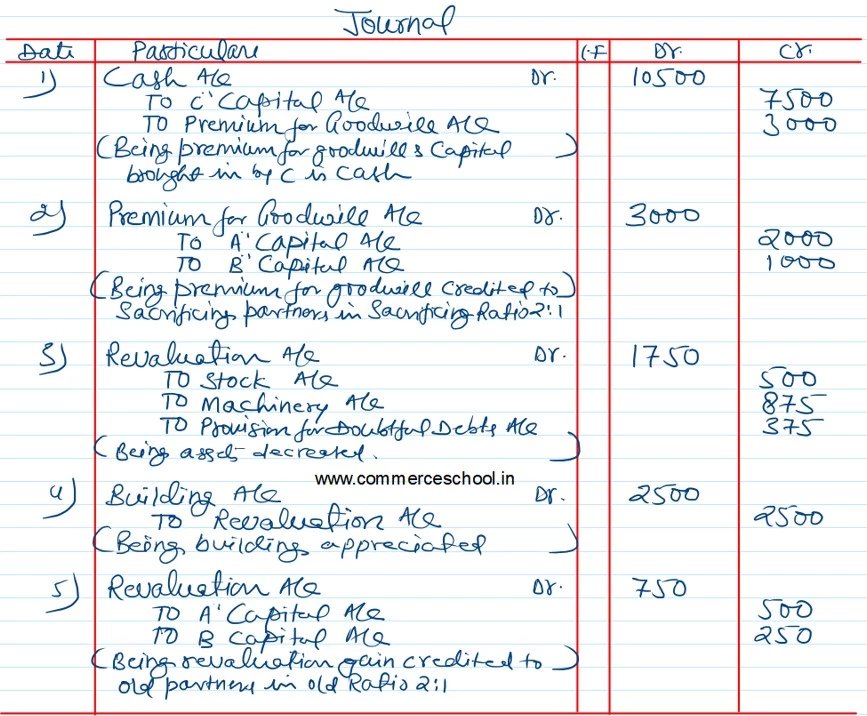

a) C was to bring ₹ 7,500 as his capital and ₹ 3,000 as goodwill for 1/4th share in the firm.

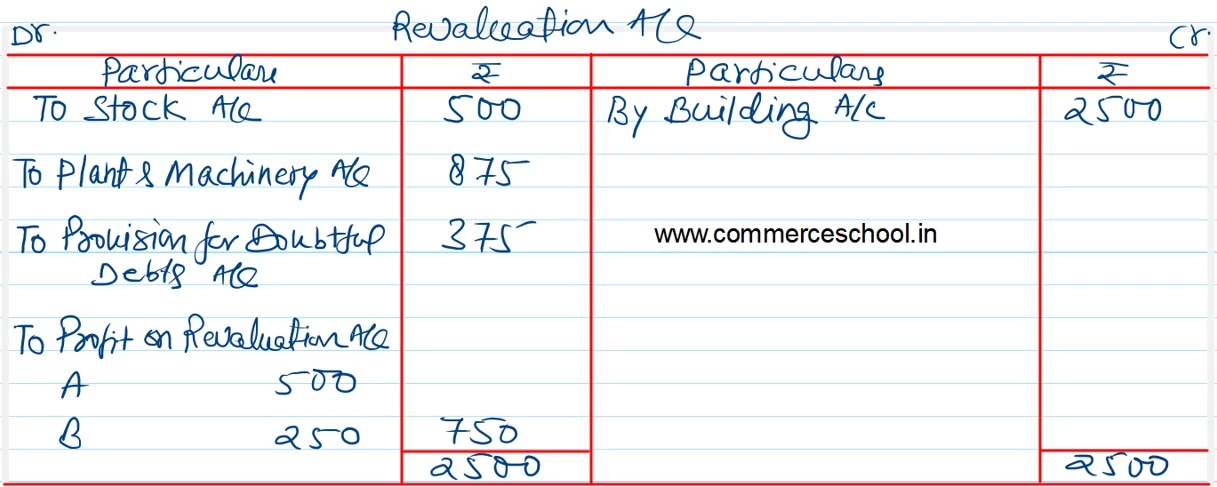

b) Values to the stock and Plant and Machinery were to be reduced by 5%.

c) A Provision for Doubtful Debts was to be created in respect of Sundry Debtors ₹ 375.

d) Building was to be appreciated by 10%

Pass necessary Journal entries to give effect to the arrangements. Prepare Profit & Loss Adjustment Account (or Revaluation Account) Partner’s Capital Accounts and Balance Sheet of the new firm.