Following was the Balance Sheet of X and Y who were sharing profit 2/3rd and 1/3rd as at 31st March, 2023:

Following was the Balance Sheet of X and Y who were sharing profit 2/3rd and 1/3rd as at 31st March, 2023:

| Liabilities | ₹ | Assets | ₹ |

| Capital A/cs:

X Y Sundry Creditors |

1,50,000 1,50,000 3,29,500 |

Building

Plant and Machinery Stock Sundry Debtors Cash in Hand |

2,50,000 1,75,000 1,00,000 48,500 6,000 |

| 5,79,500 | 5,79,500 |

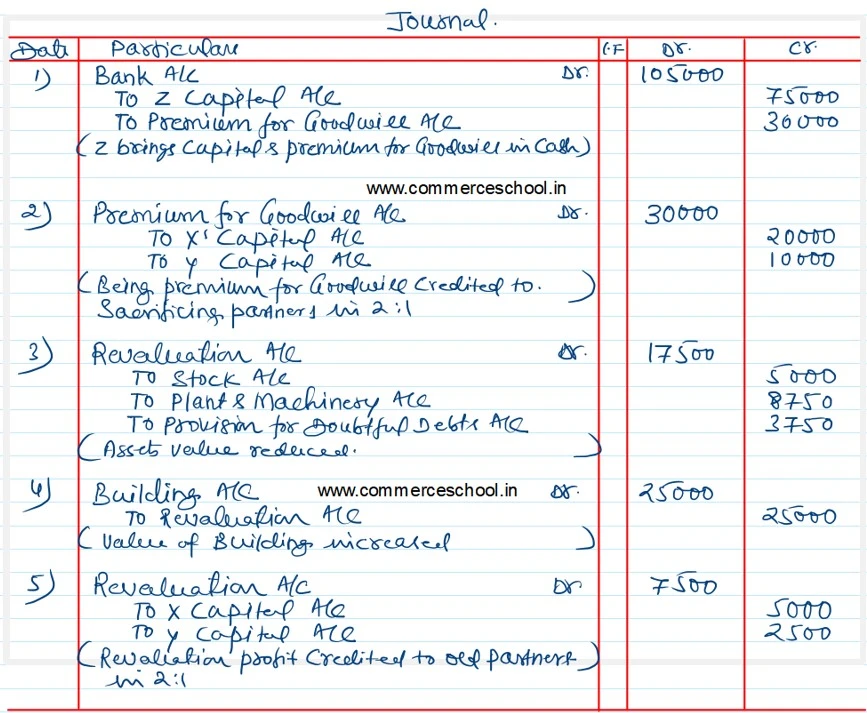

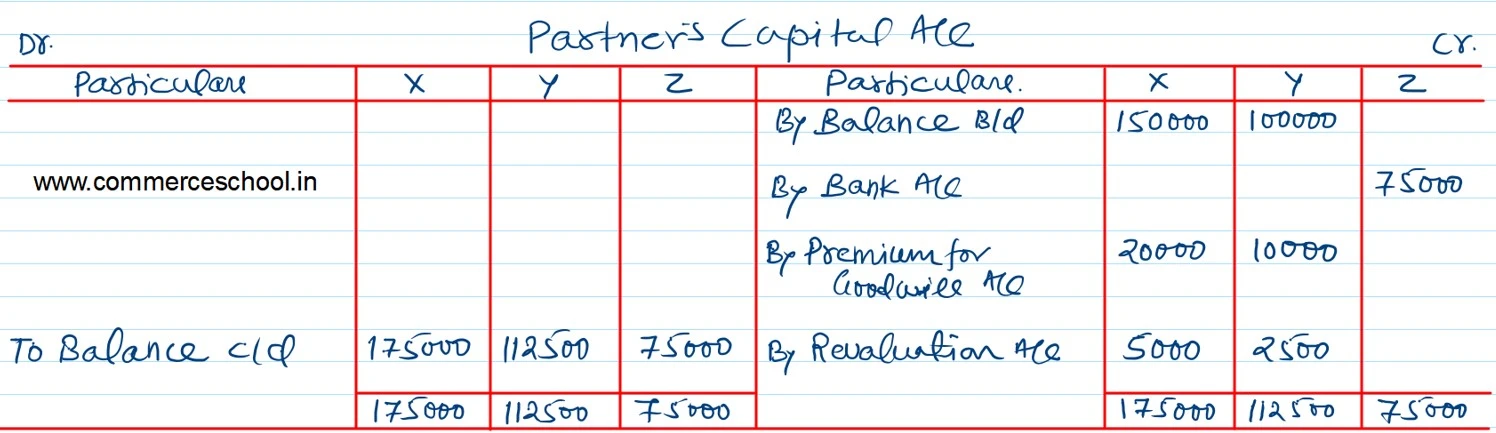

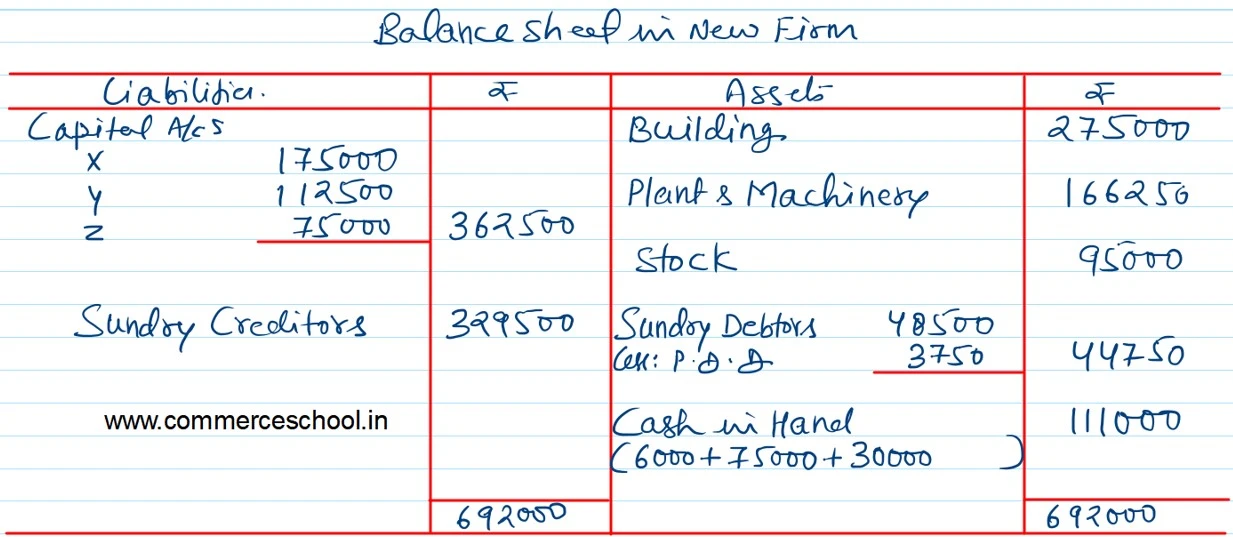

On 1st April 2023, they admit Z into the partnership on the following terms:

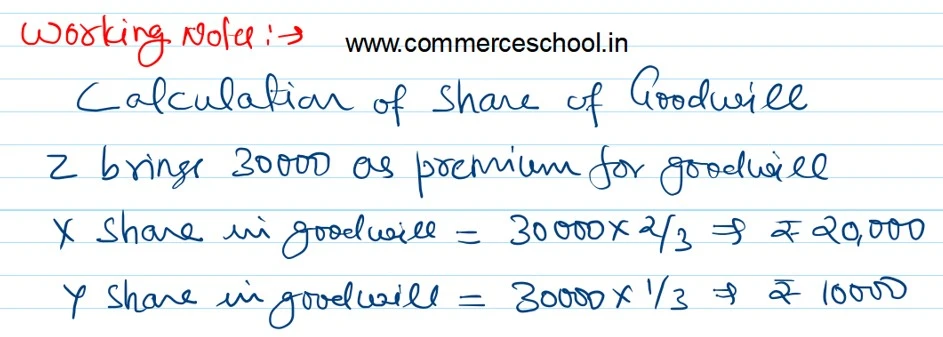

(i) Z was to bring ₹ 75,000 as his capital and ₹ 30,000 as Goodwill for 1/4th share in the firm.

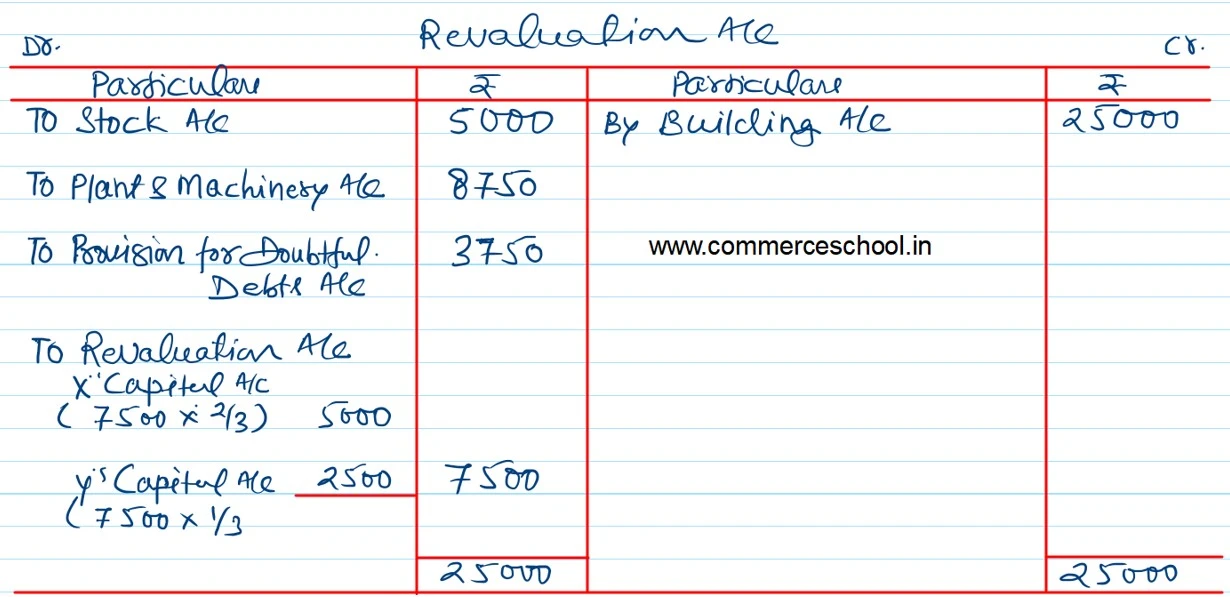

(ii) Values of the Stock and Plant and Machinery were to be reduced by 5%.

(iii) Provision for Doubtful Debts of ₹ 3,750 was to be created on Sundry Debtors.

(iv) the Building was to be appreciated by 10%.

Pass necessary Journal entries to give effect to the arrangements, prepare Revaluation Account, partner’s Capital Accounts and Balance Sheet of the new firm.