From the following Balance Sheet of KBC Ltd. as at 31st March, 2023 and additional information, calculate Operating Profit before Working Capital Changes:

From the following Balance Sheet of KBC Ltd. as at 31st March, 2023 and additional information, calculate Operating Profit before Working Capital Changes:

| Particulars | Note. No. | 31st March, 2023 |

31st March, 2022 |

| I. EQUITY AND LIABILITIES | |||

| 1. Shareholder’s Funds (a) Share Capital (b) Reserves and Surplus |

5,00,000 6,70,000 |

5,00,000 5,00,000 |

|

| 2. Current Liabilities (a) Trade Payables (b) other Current Liabilities (outstanding Expenses) (c) Short-term Provisions (Provision for Tax) |

60,000 20,000 1,00,000 |

50,000 15,000 90,000 |

|

| Total | 13,50,000 | 11,55,000 | |

| II. Assets | |||

| 1. Non-Current Assets (a) Property, Plant and Equipment and Intangible Assets: – Property, Plant and Equipment (b) Non-Current Investments |

7,50,000 2,50,000 |

7,30,000 3,00,000 |

|

| 2. Current Assets | 3,50,000 | 1,25,000 | |

| Total | 13,50,000 | 11,55,000 |

Notes to Accounts

| Particulars | 31st March, 2023 |

31st March, 2023 |

| 1. Reserves and Surplus General Reserve Surplus, i.e., Balance in Statement of Profit & Loss |

5,00,000 1,70,000 |

4,00,000 1,00,000 |

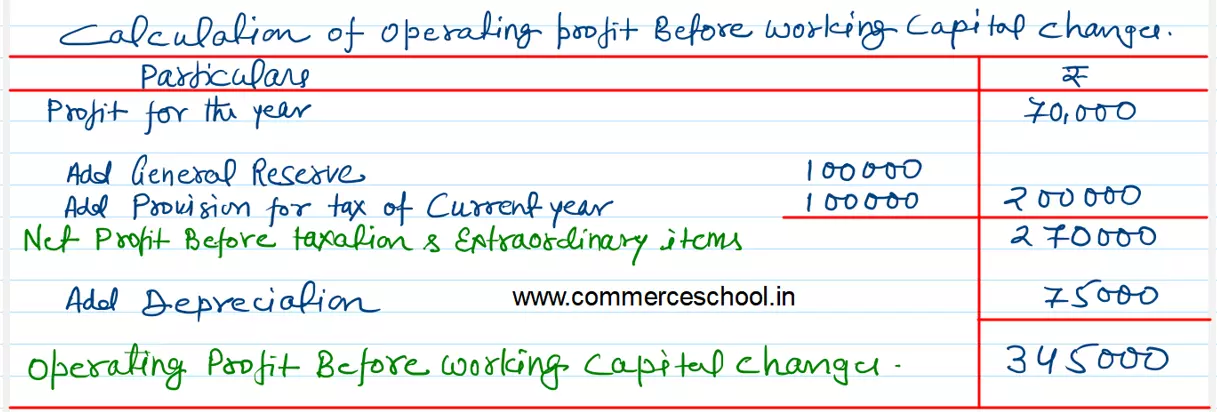

Additional Information: Depreciation for the year was ₹ 75,000.

[Ans.: Operating Profit before Working Capital Changes = ₹ 3,45,000.]

Anurag Pathak Changed status to publish