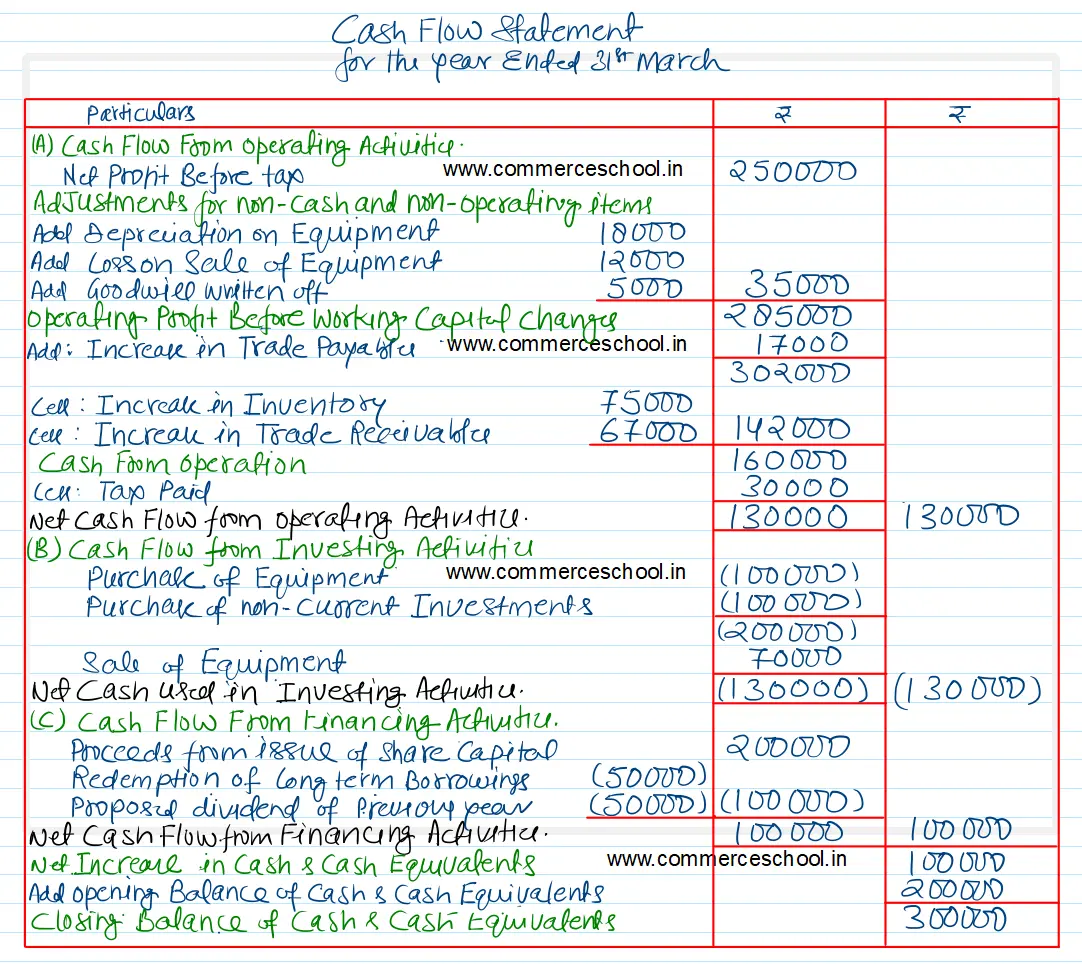

From the following Balance Sheets of B.C.R Ltd. as at 31.3.2023 and 31.3.2022 prepare a Cash Flow Statement:

From the following Balance Sheets of B.C.R Ltd. as at 31.3.2023 and 31.3.2022 prepare a Cash Flow Statement:

| Particulars | Note. No. | 31st March, 2023 | 31st March, 2022 |

| I. EQUITY AND LIABILITIES: | |||

|

(1) Shareholder’s Funds: (a) Share Capital (b) Reserves & Surplus |

7,00,000 3,50,000 |

5,00,000 2,00,000 |

|

|

(2) Non-Current Liabilities Long-term Borrowings |

50,000 | 1,00,000 | |

|

(2) Current Liabilities: (a) Trade Payables (b) Short-term Provisions (Provision for Tax) |

1,22,000 50,000 |

1,05,000 30,000 |

|

| Total | 12,72,000 | 9,35,000 | |

| II. ASSETS: | |||

|

(1) Non-Current Assets: (a) Property, Plant and Equipment and Intangible Assets (i) Property, Plant and Equipment (ii)Intangible Assets (b) Non-Current Investments |

5,00,000 95,000 1,00,000 |

5,00,000 1,00,000 — |

|

|

(2) Current Assets: (a) Inventory (b) Trade Receivables (c) Cash & Cash Equivalents |

1,30,000 1,47,000 3,00,000 |

55,000 80,000 2,00,000 |

|

| Total | 12,72,000 | 9,35,000 |

Notes to Accounts:-

| 31.3.2023 | 31.3.2022 | |

|

Property, Plant and Equipment: Equipment |

5,00,000 | 5,00,000 |

|

Intangible Assets: Goodwill |

95,000 | 1,00,000 |

Additional Information:

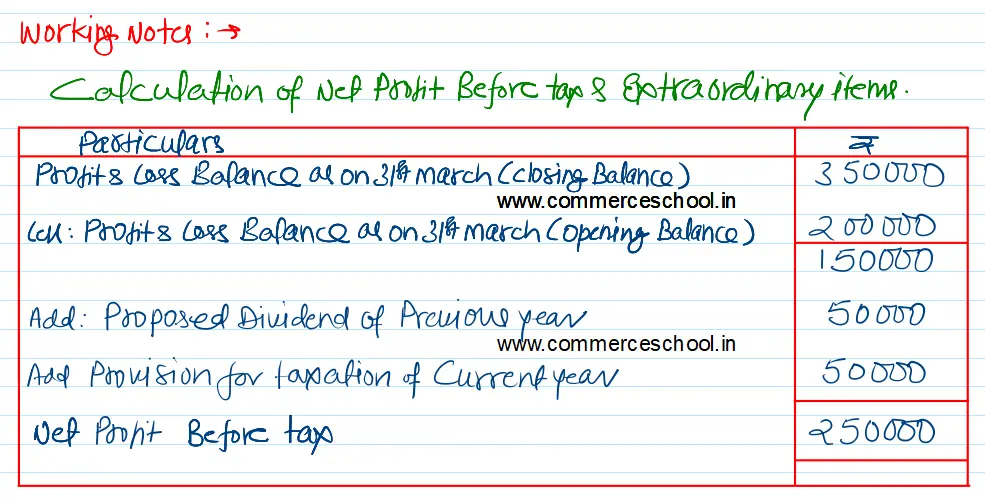

(i) Proposed Dividend for the year ended 31st March 2023 was 12% and for the year ended 31st March, 2022 was 10%.

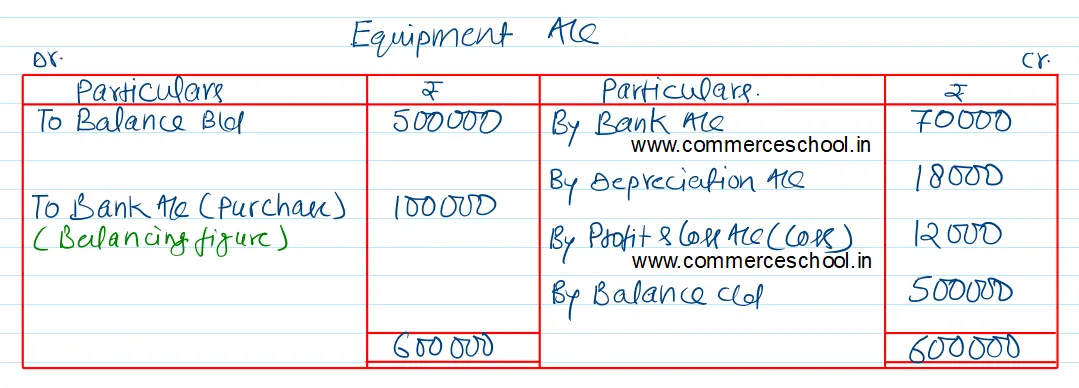

(ii) During the year Equipment costing ₹ 1,00,000 was purchased. Loss on sale of Equipment amounted to ₹ 12,000. ₹ 18,000 depreciation was charged on Equipment.

[Ans. Cash from Operating Activities ₹ 1,30,000; Cash used in Investing Activities ₹ 1,30,000; Cash from Financing Activities ₹ 1,00,000.]