From the following Balance Sheets of Godrej Ltd. You are required to prepare Cash-Flow Statement

From the following Balance Sheets of Godrej Ltd. You are required to prepare Cash-Flow Statement.

| Particulars | Note. No. | 31st March, 2023 | 31st March, 2022 |

| I. EQUITY AND LIABILITIES: | |||

|

(1) Shareholder’s Funds: (a) Share Capital (b) Reserves & Surplus |

3,30,000 25,000 |

3,00,000 30,000 |

|

|

(2) Non-Current Liabilities Long-term Borrowings |

25,000 | 40,000 | |

|

(2) Current Liabilities: (a) Short-term Borrowings (b) Trade Payables (c) Short-term Provisions |

5,000 97,000 30,000 |

— 1,24,000 24,000 |

|

| Total | 5,12,000 | 5,18,000 | |

| II. ASSETS: | |||

|

(1) Non-Current Assets: (a) Property, Plant and Equipment and Intangible Assets (i) Property, Plant and Equipment (Machinery) (ii) Intangible Assets (b) Non-Current Investments |

2,60,000 7,500 64,000 |

2,00,000 60,000 50,000 |

|

|

(2) Current Assets: (b) Inventory (c) Trade Receivables (d) Cash & Cash Equivalents |

62,500 98,000 20,000 |

70,000 1,30,000 8,000 |

|

| Total | 5,12,000 | 5,18,000 |

Notes to Accounts:-

| 31.3.2023 | 31.3.2022 | |

|

(1) Short-term Borrowings: Bank Overdraft |

5,000 | — |

|

(2) Short-term Provision: Taxation Provision |

30,000 | 24,000 |

|

(3) Intangible Assets: Goodwill Patents |

— 7,500 |

50,000 10,000 |

| 7,500 | 60,000 |

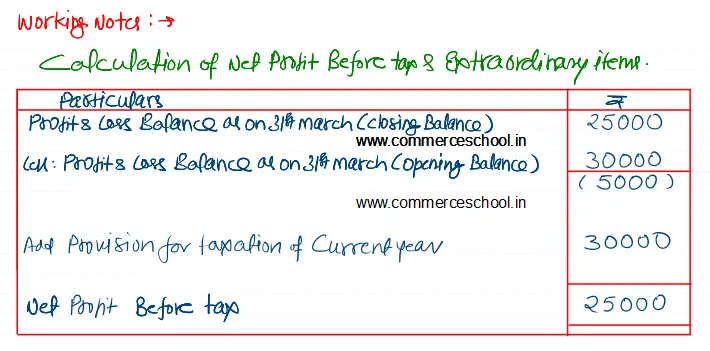

Additional Information:-

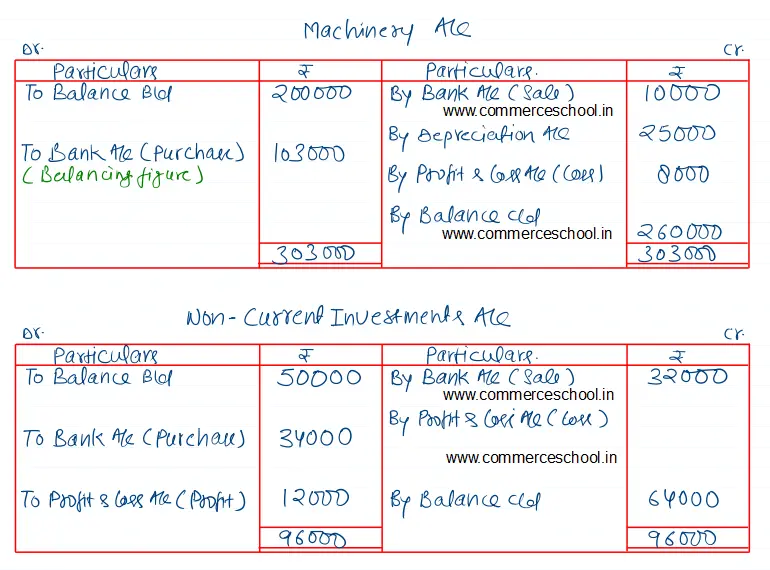

(I) Machinery whose original cost was ₹ 50,000k (accumulated depreciation thereon being ₹ 32,000) was sold for ₹ 10,000.

(II) Depreciation on Machinery charged during the year was ₹ 25,000.

(III) Non-Current Investments costing ₹ 20,000 were sold for ₹ 32,000 during the year.

(IV) Interest paid on long-term borrowings amounted to ₹ 3,000.

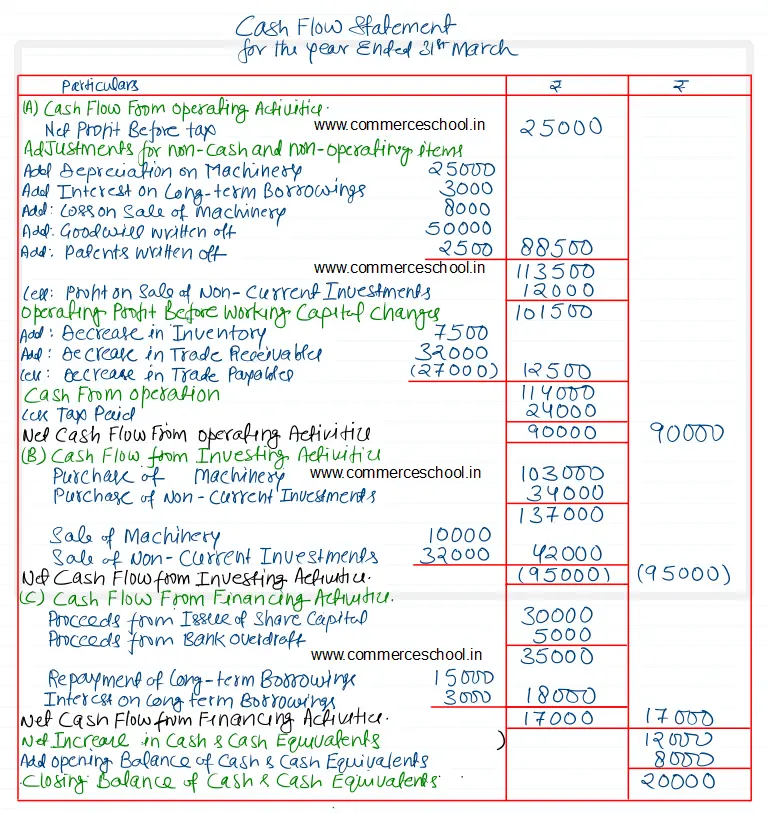

[Ans. Cash from Operating activities ₹ 90,000; Cash used in investing activities ₹ 95,000; Cash from financing activities ₹ 17,000. Purchase of Machinery ₹ 1,03,000.