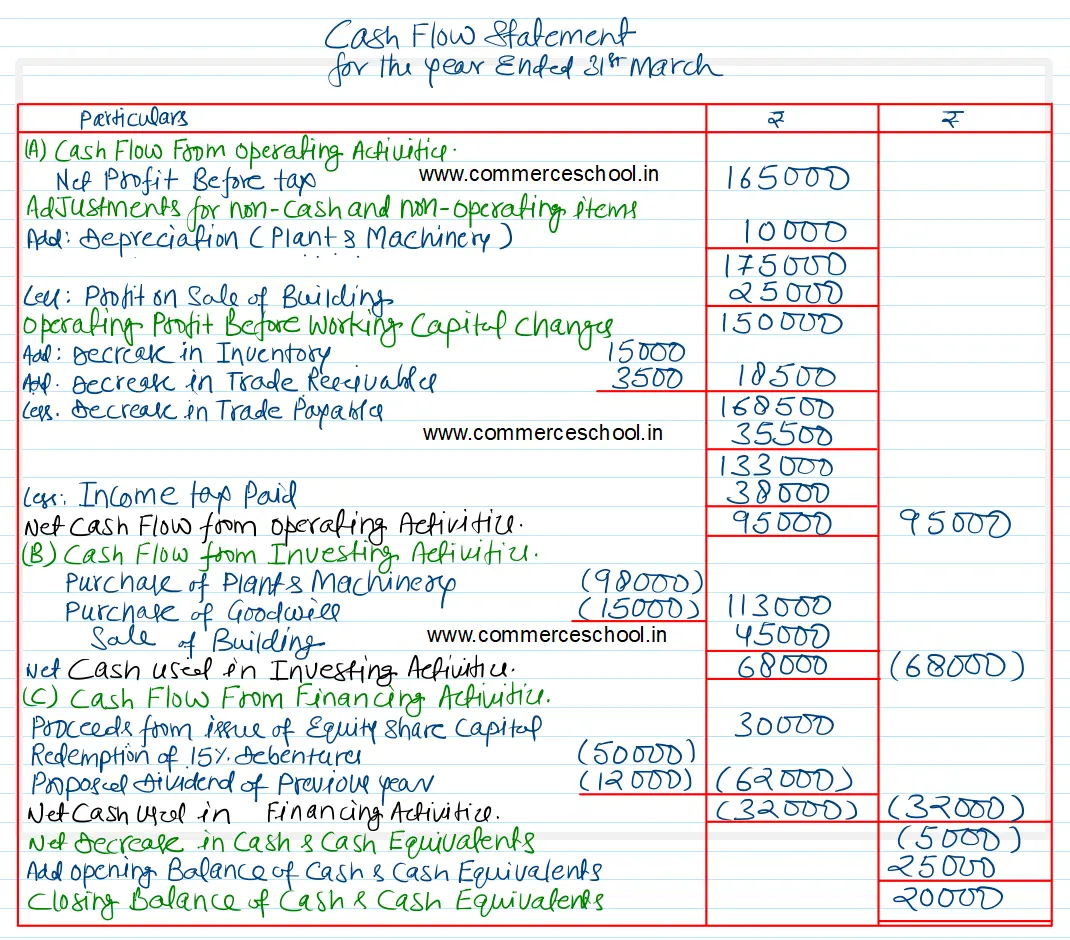

From the following Balance Sheets of Tarun Fashions Ltd., prepare a cash flow statement Share Capital ₹ 1,50,000

From the following Balance Sheets of Tarun Fashions Ltd., prepare a cash flow statement:-

| Particulars | Note. No. | 31st March, 2022 | 31st March, 2021 |

| I. EQUITY AND LIABILITIES: | |||

|

(1) Shareholder’s Funds: (a) Share Capital (b) Reserve and Surplus |

1,50,000 1,78,000 |

1,20,000 75,000 |

|

|

(2) Non-Current Liabilities: Long-term Borrowings |

– | 50,000 | |

|

(3) Current Liabilities (a) Trade Payables (b) Short-term Provision (Provision for Tax) |

31,500 42,000 |

67,000 30,000 |

|

| Total | 4,01,500 | 3,42,000 | |

| II. ASSETS: | |||

|

(1) Non-Current Assets: (a) Property, Plant and Equipment and Intangible Assets (i) Property, Plant and Equipment (2) Intangible Assets |

2,08,000 35,000 |

1,40,000 20,000 |

|

|

(2) Current Assets: (a) Inventories (b) Trade Receivables (c) Cash and Cash Equivalents |

1,05,000 33,500 20,000 |

1,20,000 37,000 25,000 |

|

| Total | 4,01,500 | 3,42,000 |

Notes to Accounts:-

| 31.3.2022 (₹) | 31.3.2021 (₹) | |

|

(1) Long-term Borrwings: 15% Debentures |

__ | 50,000 |

|

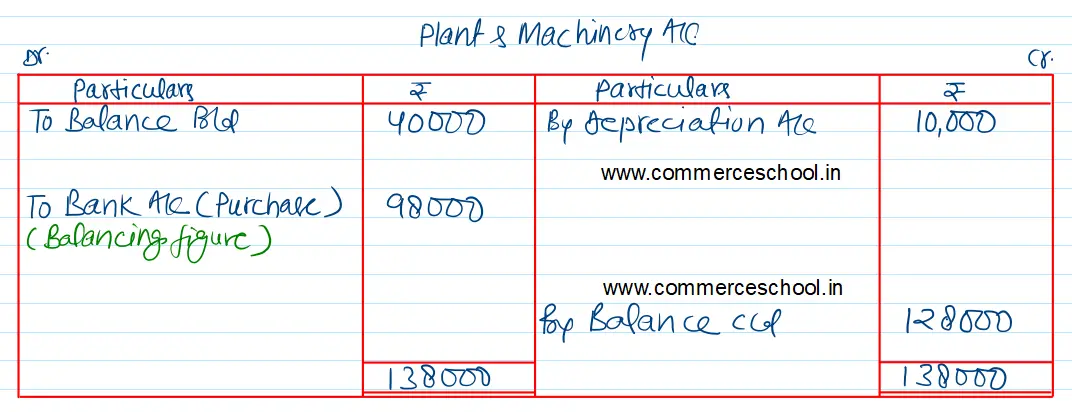

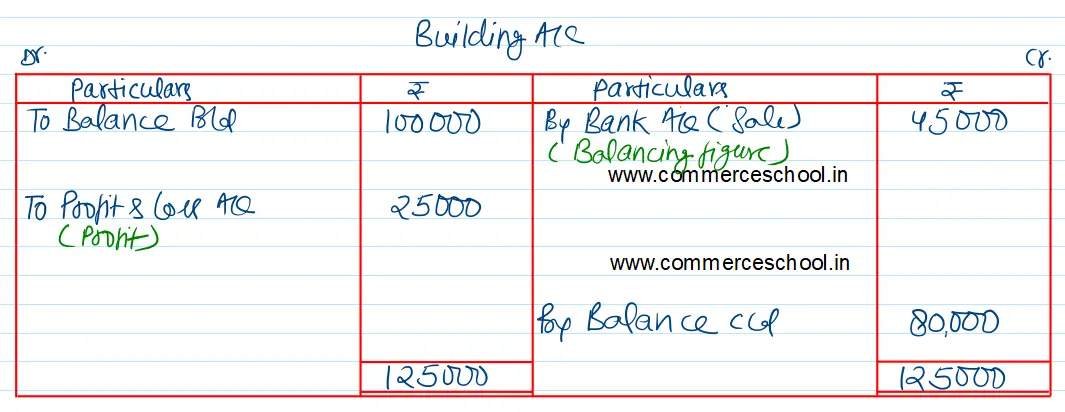

(2) Property, Plant and Equipment: Building Plant & Machinery |

80,000 1,28,000 |

1,00,000 40,000 |

| 2,08,000 | 1,40,000 | |

|

(3) Intangible Assets: Goodwill |

35,000 | 20,000 |

Additional Information:-

(I)

| Contingent Liabilities | 31.03.2022 | 31.03.2021 |

| Proposed Dividend | 15,000 | 12,000 |

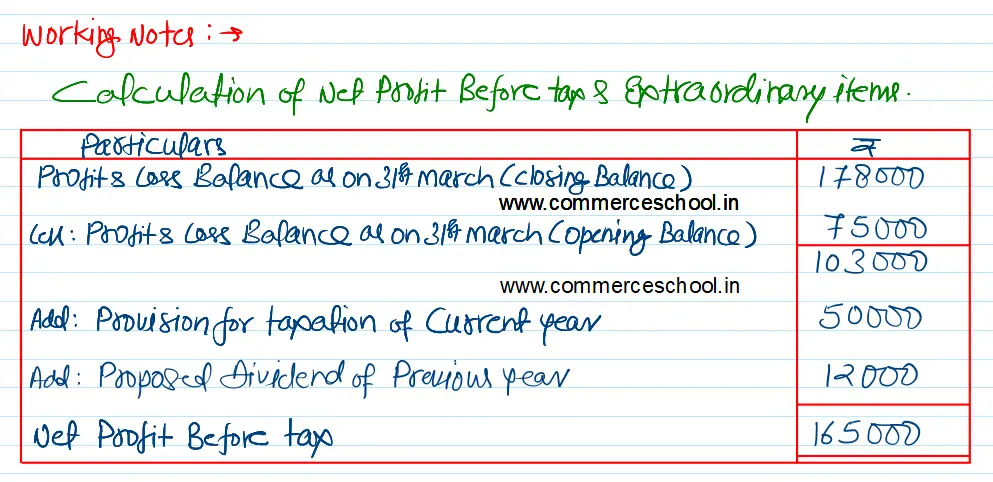

(II) Depreciation of ₹ 10,000 was provided on Plant & Machinery.

(III) Gain on sale of a part of Building ₹ 25,000.

(IV) Debentures were redeemed on 1st April, 2021.

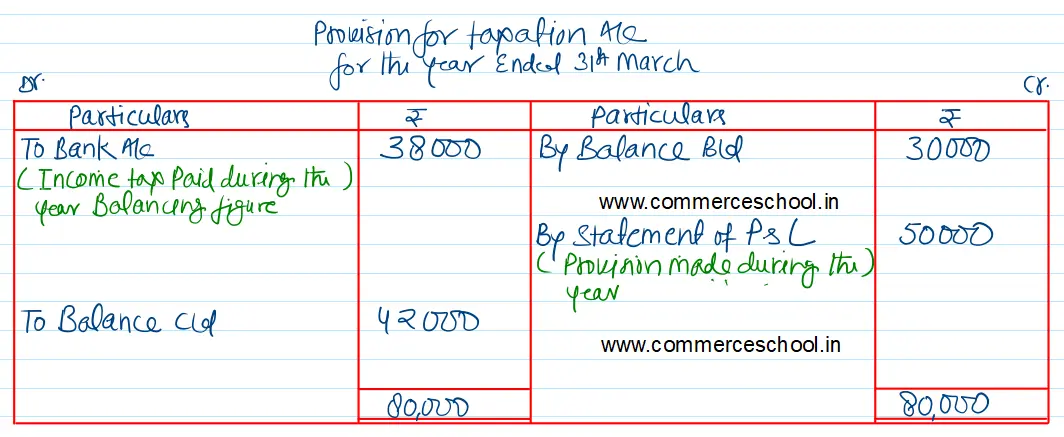

(V) Provision for Tax made during the year ₹ 50,000.

[Ans. Cash from Operating Activities ₹ 95,000; Cash used in investing activities ₹ 68,000; Cash used in financing activities ₹ 32,000.]