From the following Balance Sheets of X Ltd., you are required to prepare Cash Flow Statement Share Capital ₹ 8,00,000 Reserve and Surplus ₹ 1,70,000

From the following Balance Sheets of X Ltd., you are required to prepare Cash Flow Statement.

| Particulars | Note. No. | 31st March, 2022 | 31st March, 2021 |

| I. EQUITY AND LIABILITIES: | |||

|

(1) Shareholder’s Funds: (a) Share Capital (b) Reserve and Surplus |

8,00,000 1,70,000 |

6,75,000 91,000 |

|

|

(3) Current Liabilities (a) Short-term Borrowings (b) Trade Payables (c) Short-term Provision |

88,000 1,00,000 34,000 |

66,000 70,000 26,000 |

|

| Total | 11,92,000 | 9,28,000 | |

| II. ASSETS: | |||

|

(1) Non-Current Assets: (a) Property, Plant and Equipment and Intangible Assets (i) Property, Plant and Equipment |

3,75,000 | 5,00,000 | |

|

(2) Current Assets: (a) Inventories (b) Trade Receivables (c) Cash & Cash Equivalents (d) Other Current Assets |

4,00,000 3,82,000 10,000 25,000 |

2,50,000 1,55,000 3,000 20,000 |

|

| Total | 11,92,000 | 9,28,000 |

Notes to Accounts:-

| 31.3.2022 (₹) | 31.3.2021 (₹) | |

|

(1) Short-term Borrowings:- Bank Overdraft |

88,000 | 66,000 |

|

(2) Short term Provision: Taxation Provision |

34,000 | 26,000 |

|

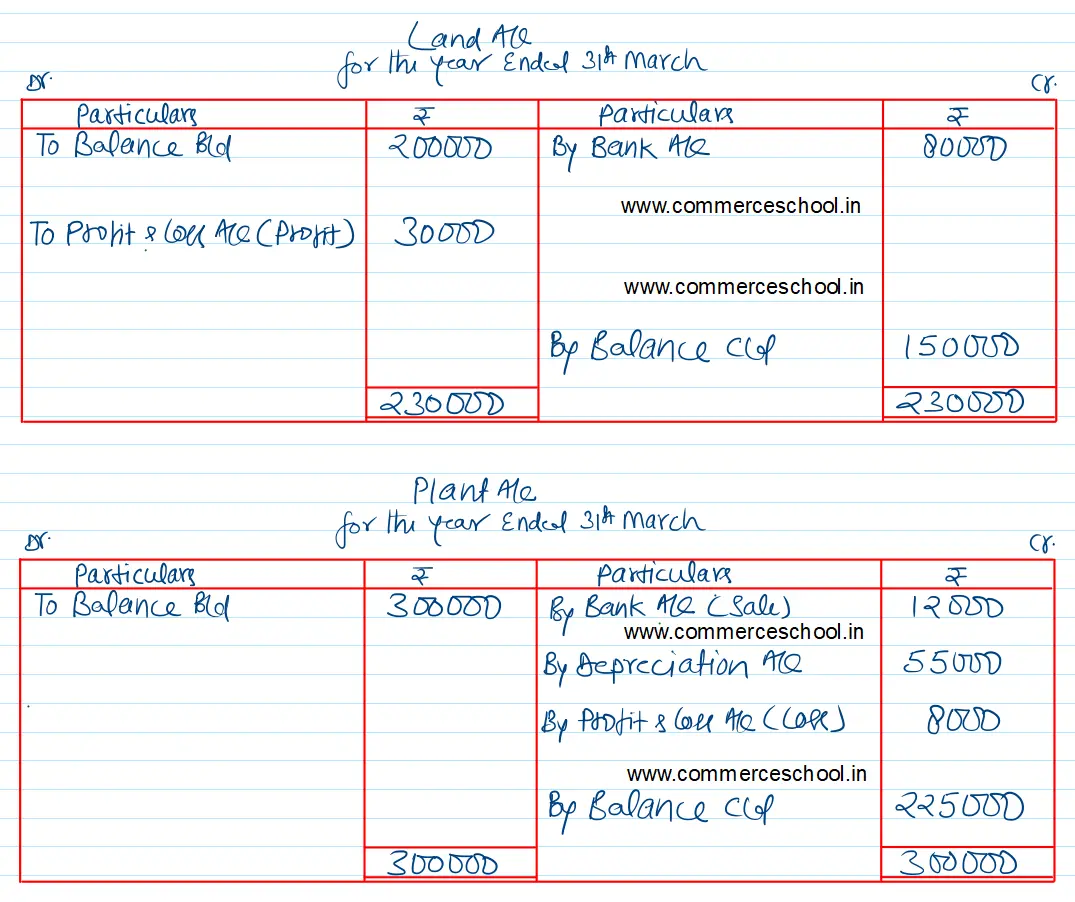

(2) Property, Plant and Equipment Land Plant |

1,50,000 2,25,000 |

2,00,000 3,00,000 |

| 3,75,000 | 5,00,000 |

Additional Information:-

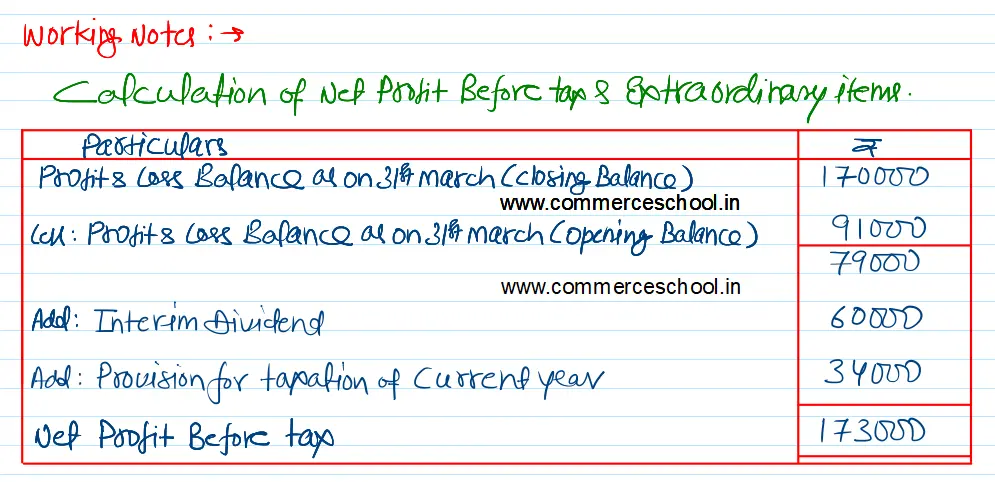

(1) Interim Dividend paid during the year ₹ 60,000.

(2) Land was sold at a gain of ₹ 30,000.

(3) Plant of the book value of ₹ 20,000 was sold during the year at a loss of ₹ 8,000.

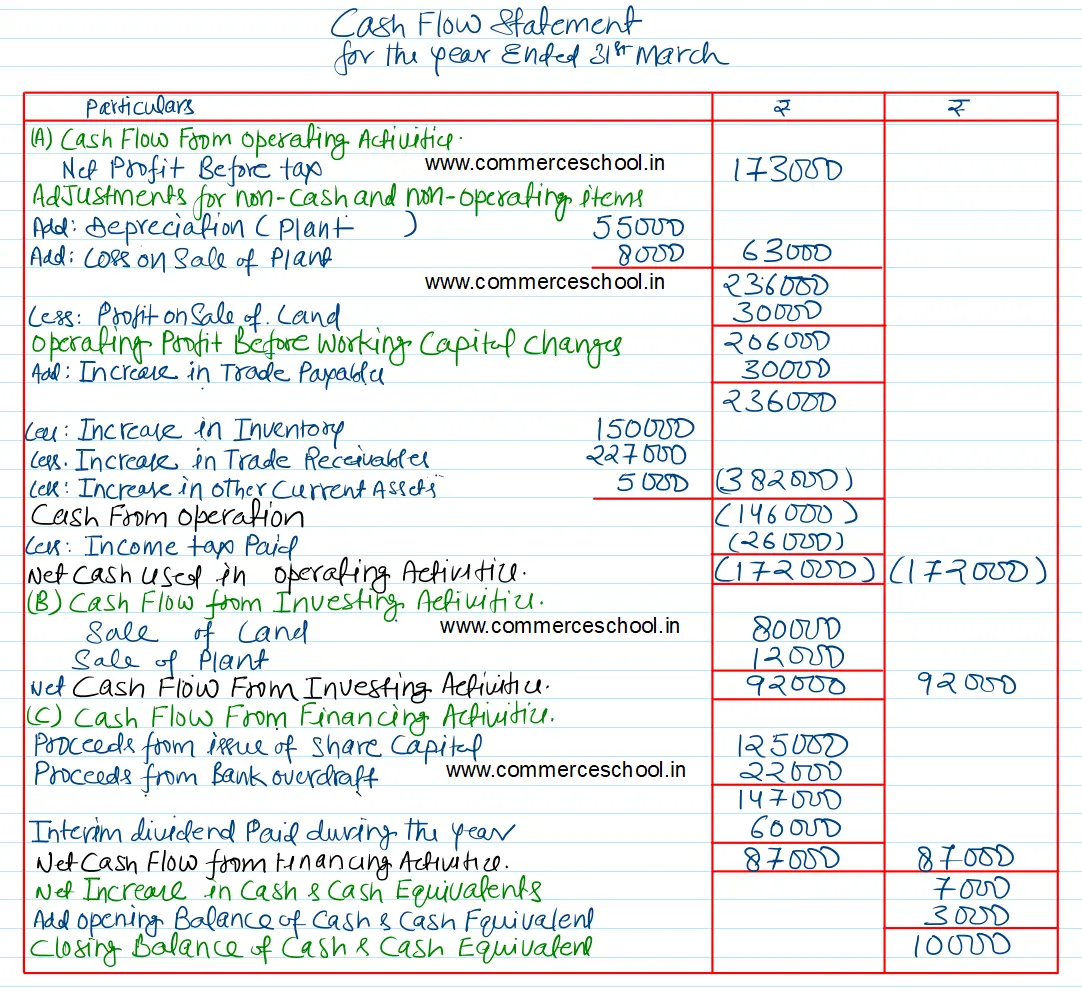

[Ans. Cash used in operating activities ₹ 1,72,000; Cash from Investing activities ₹ 92,000; and Cash from financing activities ₹ 87,000.]